Get the free LSM NON-QM SUBMISSION FORM. LoanStream Mortgage

Get, Create, Make and Sign lsm non-qm submission form

Editing lsm non-qm submission form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lsm non-qm submission form

How to fill out lsm non-qm submission form

Who needs lsm non-qm submission form?

Comprehensive Guide to the LSM Non-QM Submission Form

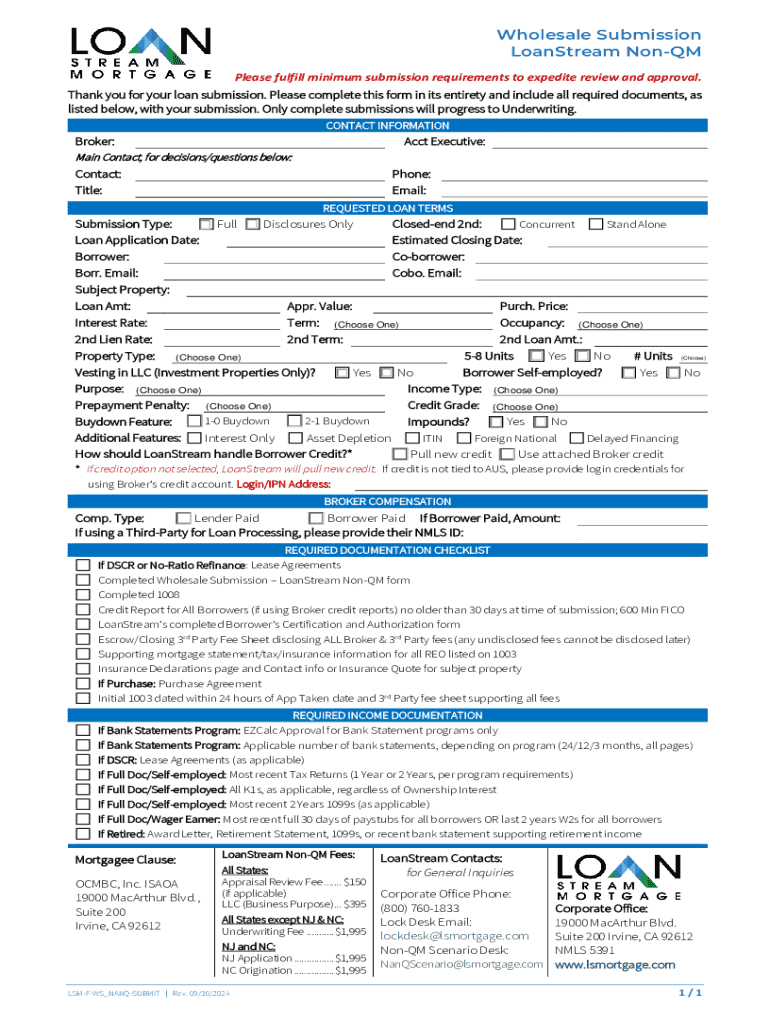

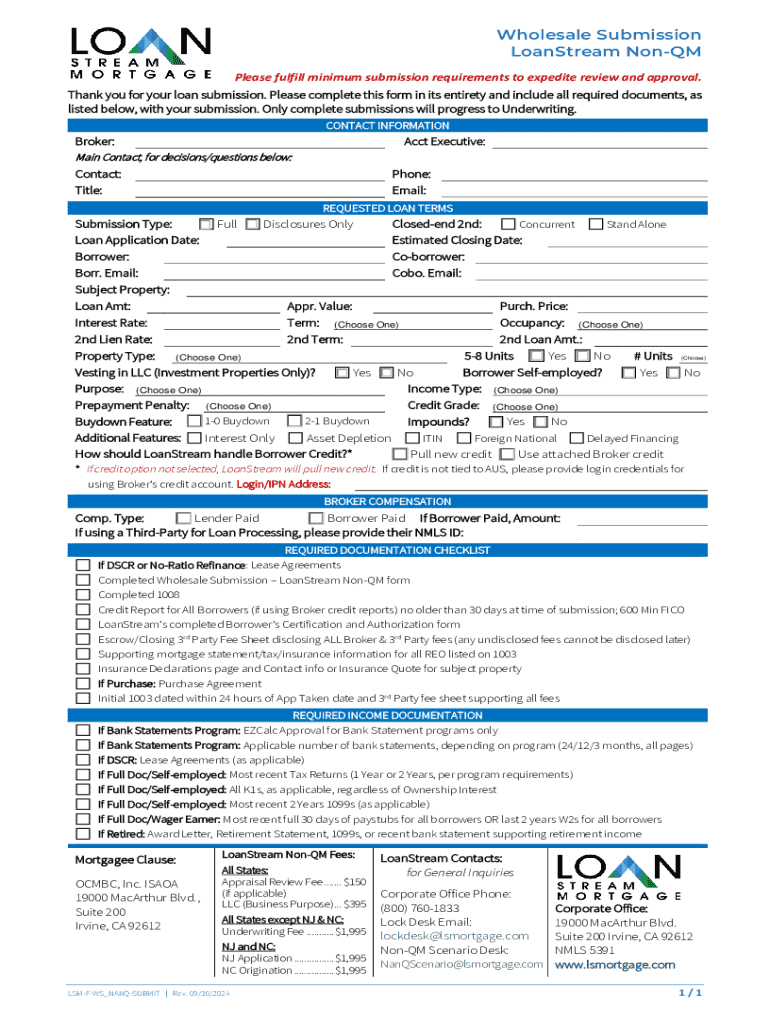

Overview of the LSM Non-QM Submission Form

The LSM non-QM submission form serves as a crucial tool for consumers and professionals seeking non-qualified mortgage (non-QM) loans. It encapsulates essential information needed for lenders to evaluate an application that doesn't fit traditional lending standards. Non-QM loans are designed for borrowers with unique financial situations, and this form plays a pivotal role in streamlining the submission process.

Key features of the LSM non-QM submission form include its structured sections that ensure thorough capture of personal, financial, and property information. This organized approach not only helps to prevent miscommunication but also increases the likelihood of securing a loan by presenting a well-rounded view of the borrower’s qualifications.

Incorporating the LSM non-QM submission form into your document management process enhances efficiency. With the right tools, such as pdfFiller, users can leverage technology to manage their documents effectively, ensuring swift completion and submission.

Preparing to use the LSM non-QM submission form

Before diving into filling out the LSM non-QM submission form, it's essential to gather and understand the required information. Primarily, you'll need to provide comprehensive personal information, which includes your full name, contact details, and Social Security number.

Additionally, you'll have to present financial data that reflects your ability to repay the loan. This involves detailing your income sources and amounts, any existing debts, and monthly obligations you might have. Knowing this data beforehand will make the process smoother.

Gathering supporting documents is equally critical. You'll need proof of income, such as pay stubs and bank statements. Identity verification documents, including a government-issued ID, plus your credit history, help establish reliability. Ensuring all these documents are organized and ready for submission can save a significant amount of time and hassle.

Step-by-step instructions for filling out the LSM non-QM submission form

Filling out the LSM non-QM submission form requires attention to detail. The process starts with Section 1: Personal Information. Here, accuracy is crucial. Double-check your name and contact details to avoid any future complications.

Moving on to Section 2: Loan Information, it's essential to include key metrics like the loan amount, interest rate, and loan purpose. Each metric should be clearly stated to avoid any confusion for the lender.

In Section 3: Financial Overview, presenting your financial data is vital. It should include income, assets, and any liabilities. Avoid common pitfalls like estimating figures; use concrete numbers for better credibility.

Section 4 emphasizes Property Information. This is where you provide details regarding property valuation. Include current market value and purchase price to give lenders a clear picture.

Lastly, Section 5 allows for Additional Information. Although optional, adding details such as special circumstances or unique financial situations can strengthen your submission.

Editing and customizing the LSM non-QM submission form

Editing the LSM non-QM submission form is straightforward with pdfFiller. To access the form, simply navigate to pdfFiller's website and locate the template. From there, users can utilize various editing tools to customize the form according to their specifications.

Among the editing tools available are text addition and modification, annotation features, and the ability to integrate images, which can enhance the overall presentation of your submission. These features ensure that you can convey your information effectively and professionally.

When collaborating with team members, pdfFiller offers real-time editing features that allow multiple users to work on the same document simultaneously. This is particularly useful for teams looking to finalize a submission quickly. The sharing and commenting functionalities facilitate efficient communication, ensuring everyone is on the same page.

Signing the LSM non-QM submission form electronically

Understanding eSignatures is crucial in today’s digital environment. They provide a secure and efficient means to sign documents without the need for printing and scanning. When using pdfFiller, signing the LSM non-QM submission form electronically is a simple process.

To sign using pdfFiller, navigate to the signature section of the form. Follow the prompts to create your electronic signature. It can be drawn, typed, or uploaded as an image. Once completed, ensure that you verify your eSignature for legitimacy. This verification step is key to preventing any possible disputes regarding authenticity.

Submitting the LSM non-QM submission form

Once you've completed your LSM non-QM submission form, the next step is to submit it. Various submission channels are available, including direct uploads through pdfFiller or emailing the completed form to your lender. It’s important to choose the channel that best fits your lender's requirements.

Confirmation protocols are crucial to ensuring the lender receives your form. After submission, keep an eye out for confirmation emails or notifications within pdfFiller. These confirmations provide peace of mind and a record that your submission was successful.

After submission, it's wise to be proactive about follow-up actions. This may involve contacting your lender to check the status of your application or asking any questions about the next steps.

Managing your LSM non-QM submission form

Managing your forms after submission is an important aspect of the overall process. With pdfFiller, users can easily access submitted forms through their dashboard, making it simple to keep track of all documentation efforts.

Editing a form post-submission is also possible if any changes arise or if the lender requests additional information. Maintaining the ability to update documents ensures that you can remain flexible and responsive throughout the loan evaluation process.

Staying on top of your document status through pdfFiller enhances your management capabilities. Regularly checking for updates ensures that you're not caught off guard by any requests or changes required by your lender.

Common questions about the LSM non-QM submission form

Addressing common questions about the LSM non-QM submission form can alleviate concerns and enhance understanding. If errors arise during submission, promptly contact customer support through pdfFiller or your lender to resolve these issues quickly.

Additionally, being aware of the specific document requirements can ease the submission process. Familiarize yourself with FAQs provided by your lender to ensure that you have all necessary materials prepared ahead of time.

Troubleshooting submission issues can also be simplified through systematic checks. Ensure all sections of the form are filled accurately, and that supporting documents are attached as required.

Tips for a successful LSM non-QM submission experience

To ensure a successful submission experience for the LSM non-QM submission form, adhering to best practices is essential. This begins with creating and managing your documents in an organized manner. Utilize pdfFiller's capabilities to keep your forms neatly cataloged for easy access.

Leveraging pdfFiller tools for enhanced submission quality can significantly impact your overall experience. Employ features such as document comparison, annotation, and cloud storage to improve clarity in your submissions.

Collaborating with financial advisors during form completion can significantly enhance input quality. Their expertise can guide you in presenting your financial situation more effectively to potential lenders.

Final thoughts on using the LSM non-QM submission form

The efficiency of document management greatly impacts your overall application process. By using the LSM non-QM submission form effectively, you streamline your pathway to obtaining a non-QM loan. The tools and features provided by pdfFiller equip you to edit, sign, collaborate, and manage your documents seamlessly.

Ultimately, harnessing the capabilities of pdfFiller enhances your document needs, giving you the confidence and tools necessary for successful submissions. Whether you're an individual or part of a team, efficient document management can elevate your entire borrowing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get lsm non-qm submission form?

How do I make edits in lsm non-qm submission form without leaving Chrome?

How can I edit lsm non-qm submission form on a smartphone?

What is lsm non-qm submission form?

Who is required to file lsm non-qm submission form?

How to fill out lsm non-qm submission form?

What is the purpose of lsm non-qm submission form?

What information must be reported on lsm non-qm submission form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.