Get the free Maryland 2024 Form 510 Pass Through Entity Income Tax ...

Get, Create, Make and Sign maryland 2024 form 510

Editing maryland 2024 form 510 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland 2024 form 510

How to fill out maryland 2024 form 510

Who needs maryland 2024 form 510?

Maryland 2024 Form 510: Your Comprehensive Guide

Understanding Maryland Form 510: An Overview

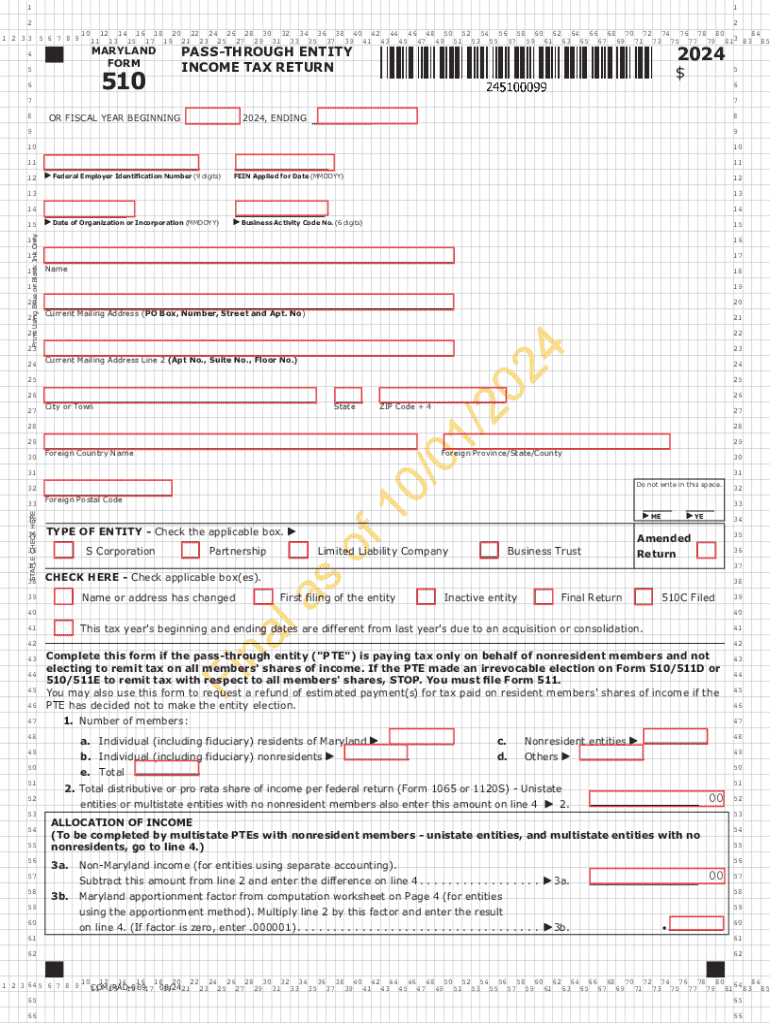

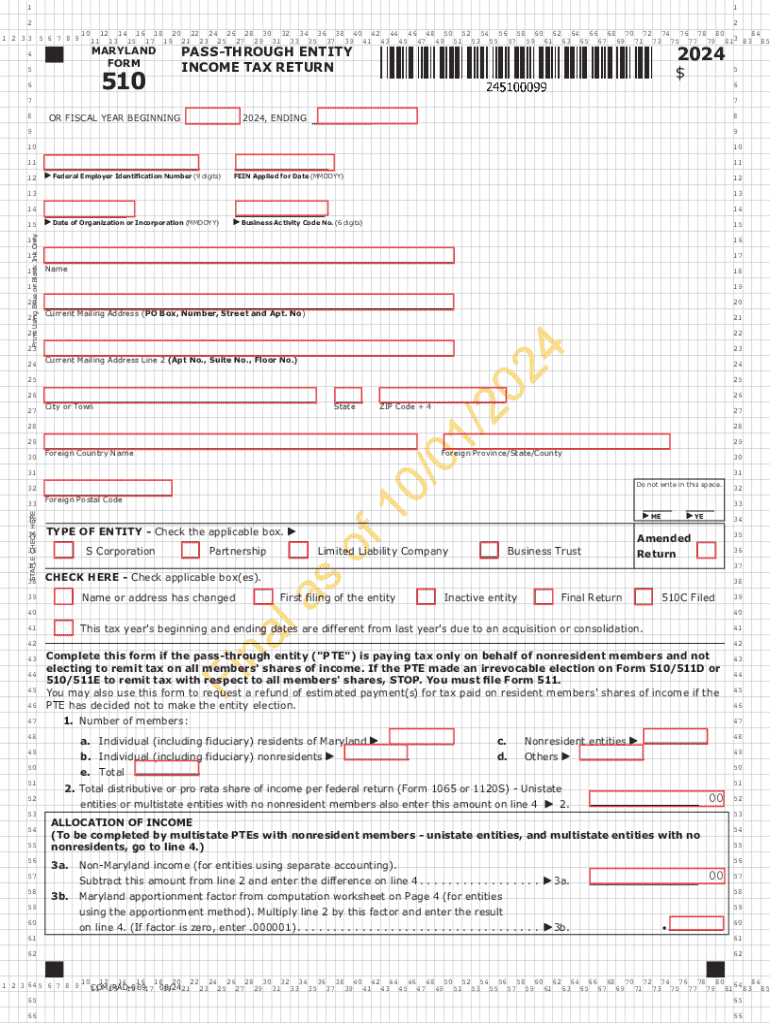

Maryland Form 510 is a crucial document for taxpayers in the state, specifically designed for reporting pass-through entity income and taxes. This form applies predominantly to partnerships and S-corporations, facilitating tax calculations and ensuring compliance with state regulations.

Completing Form 510 accurately is vital for 2024 tax filings to avoid potential penalties and ensure the proper processing of tax obligations. Key features of the 2024 Form 510 include updated rates, additional lines for new tax credits, and enhanced instructions aimed at simplifying the filing process for taxpayers.

Who needs to fill out Maryland Form 510?

Eligibility for filling out Maryland Form 510 primarily includes partnerships and S-corporations conducting business in Maryland. These entities must report their income, deductions, and credits to determine the tax owed at the entity level before passing the responsibility to individual shareholders or partners.

Specific situations that necessitate the use of Form 510 include scenarios where the entity has taxable income in Maryland or when certain deductions apply. For instance, entities with net income exceeding the state’s thresholds must ensure that Form 510 is filed promptly to avoid accruing interest on unpaid taxes.

Steps to access Maryland Form 510

Accessing Maryland Form 510 is straightforward. The official form is available on the Maryland State Comptroller’s website, ensuring it’s kept up to date with the latest tax regulations and filing requirements.

To download Form 510 as a PDF, follow these steps:

Alternatively, pdfFiller users can access Form 510 directly within the platform, which provides built-in tools for editing and completing forms on any device. This feature facilitates a smoother filing experience by allowing easy modifications.

How to fill out Maryland Form 510: Step-by-step instructions

Filling out Maryland Form 510 can seem daunting. However, breaking it down into manageable steps simplifies the process significantly. Below are step-by-step instructions to guide you through the completion of the form.

Editing and customizing Maryland Form 510 with pdfFiller

Using pdfFiller for editing Maryland Form 510 offers numerous advantages. The platform provides intuitive tools for filling in, editing, and customizing the form directly online, thus enhancing user experience.

Moreover, pdfFiller facilitates collaborative features where teams can input and review data collectively, making it easier to handle forms within a group setting. Users can also manage multiple versions of the form and track changes efficiently to ensure that everyone is on the same page.

Signing and submitting Maryland Form 510

Once your Maryland Form 510 is completed, signing and submitting it correctly is imperative. pdfFiller offers electronic signature options, allowing you to sign your documents securely online without the need for printing.

To submit Form 510, you can utilize the online submission feature through pdfFiller or opt for traditional methods such as mailing the form to the appropriate tax office in Maryland or delivering it in person.

Common mistakes to avoid when filing Form 510

Filing Maryland Form 510 requires attention to detail, as numerous common mistakes can lead to delays or penalties. Some frequently overlooked areas include incorrect calculations, missing signatures, and failure to include all required attachments.

To ensure completeness and compliance, consider developing a checklist for each section of the form. Resources such as state-specific tax guides can also assist in understanding common pitfalls and their resolutions.

Resources for further assistance

If you need additional help while completing Maryland Form 510, the Maryland Tax Assistance office provides extensive resources and support. They offer contacts and FAQs that can clarify common queries regarding tax obligations.

pdfFiller also provides comprehensive support through tutorials and user guides specifically tailored for navigating tax-related documents and software features.

Future changes: What to anticipate beyond 2024

Looking ahead to 2025, it is essential to stay informed about the upcoming changes in Maryland tax forms. Regularly checking for updates on Maryland tax legislation will enable taxpayers to adapt their filing processes to any modifications on Form 510.

By preparing for these trends and anticipated changes, taxpayers can avoid potential issues later on, ensuring smooth and compliant filings in the future.

Utilizing pdfFiller for all your tax document needs

pdfFiller stands out as a powerful solution for managing tax documents including Maryland Form 510. Users benefit from cloud-based access, robust editing features, and secure signing options, making the process efficient and user-friendly.

Beyond Form 510, pdfFiller can simplify the management and completion of various tax forms, ensuring that users maintain organized and accessible records throughout the tax season. Client testimonials highlight the platform's effectiveness in streamlining document processes, thereby enhancing efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit maryland 2024 form 510 from Google Drive?

How do I make changes in maryland 2024 form 510?

How do I make edits in maryland 2024 form 510 without leaving Chrome?

What is Maryland 2024 Form 510?

Who is required to file Maryland 2024 Form 510?

How to fill out Maryland 2024 Form 510?

What is the purpose of Maryland 2024 Form 510?

What information must be reported on Maryland 2024 Form 510?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.