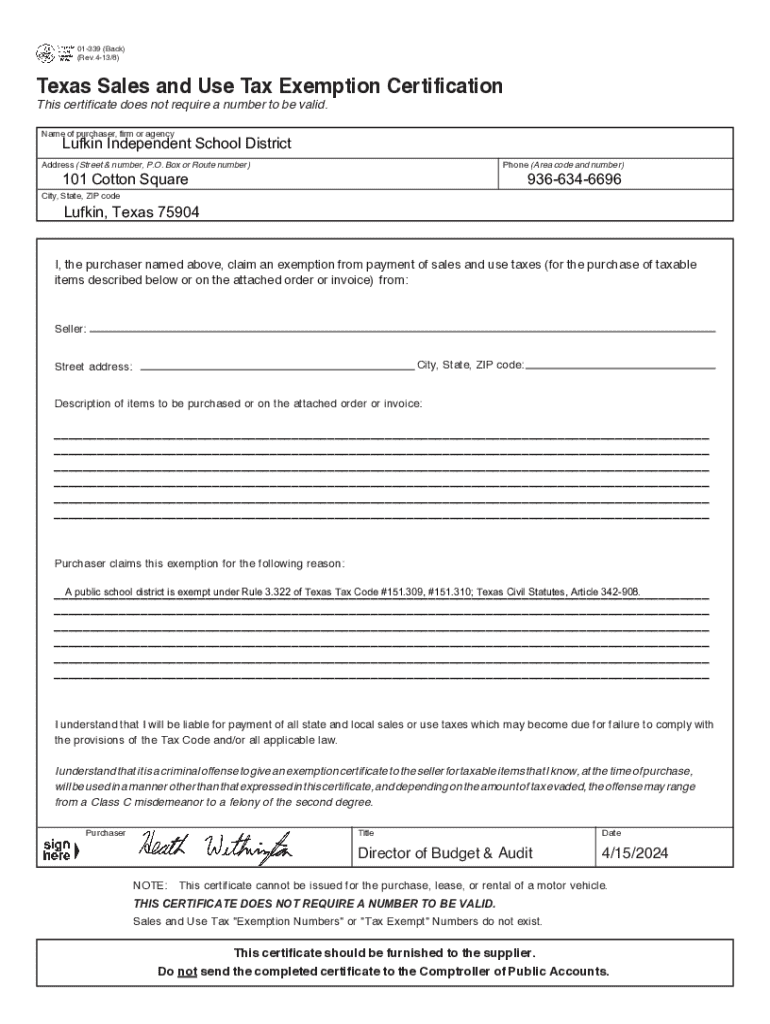

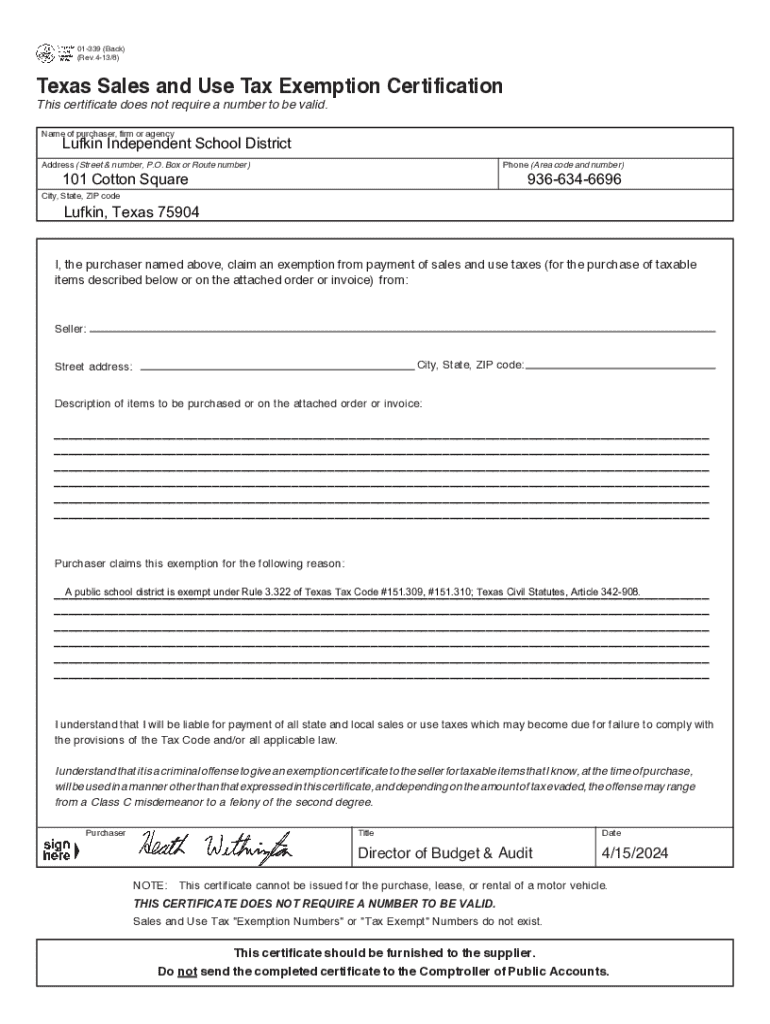

Get the free Tax Exemption Certificate 24. 01-339 Sales and Use Tax Resale Certificate / Exemptio...

Get, Create, Make and Sign tax exemption certificate 24

Editing tax exemption certificate 24 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax exemption certificate 24

How to fill out tax exemption certificate 24

Who needs tax exemption certificate 24?

Understanding the Tax Exemption Certificate 24 Form: A Comprehensive Guide

Understanding tax exemption certificates

Tax exemption certificates serve as crucial documents that allow certain organizations to purchase goods and services without incurring sales tax. This exemption is predicated on the nature of the purchasing organization’s activities, often aimed at supporting public benefits. The Tax Exemption Certificate 24 Form specifically caters to entities that qualify under specific state regulations, enabling them to streamline their financial transactions and significantly reduce costs associated with taxation.

The Tax Exemption Certificate 24 Form is essential not only for claiming these benefits but also for maintaining compliance with state tax regulations. Entities that utilize this form must clearly demonstrate their eligibility and use it correctly to avoid any potential issues with tax authorities. The importance of understanding the nuances of this particular form cannot be overstated in ensuring that exempt purchases are made seamlessly.

Eligibility for tax exemption

To be eligible for tax exemption through the Tax Exemption Certificate 24 Form, organizations must meet specific criteria set by state authorities. Generally, these criteria focus on the organization's mission, structure, and the nature of its activities. Organizations must demonstrate that their operations contribute positively to the public good, which could encompass various sectors including education, healthcare, and community support initiatives.

Many entities can take advantage of the Tax Exemption Certificate 24 Form, including:

Overview of the tax exemption certificate 24 form

The Tax Exemption Certificate 24 Form consists of various sections designed to capture comprehensive information about the exempt organization. Each field serves a specific purpose and is crucial for validating the exemption claim. A detailed breakdown of the form will help users understand how to complete it accurately.

Key components of the Tax Exemption Certificate 24 Form include:

Common uses for the Tax Exemption Certificate 24 Form involve making purchases of goods and services that qualify for tax exemption, such as educational materials, office supplies, and equipment necessary for operations. Additionally, specific situations may require the submission of the form to ensure compliance with tax regulations.

Step-by-step guide to completing the tax exemption certificate 24 form

Completing the Tax Exemption Certificate 24 Form involves several critical steps. To get started, follow this step-by-step guide to ensure accuracy and compliance.

Step 1: Gather required information.

Step 2: Filling out the form.

Step 3: Reviewing the completed form.

Submitting the tax exemption certificate 24 form

Once the Tax Exemption Certificate 24 Form has been completed and reviewed, the next step is submission. There are several avenues for how to submit the form depending on your organization’s preferences.

Options for submission include:

Additionally, be aware of the required supporting documentation which may need to accompany your form, such as proof of your organization’s tax-exempt status and relevant identification. After submission, confirm that your form was received and follow up as necessary to ensure your exemption claim is processed.

Managing and storing your tax exemption certificate 24 form

Effective document management is essential after submitting your Tax Exemption Certificate 24 Form. Keeping track of expiration dates and required renewals is crucial to maintain your exempt status.

Consider these best practices for managing your tax exemption certificate:

PdfFiller provides excellent tools to help you digitize and store documents efficiently. By employing these best practices, organizations can avoid lapses in their tax-exempt status and seamlessly manage documentation.

Frequently asked questions (FAQs)

Organizations often have several questions regarding the Tax Exemption Certificate 24 Form and its implications. Below are some common inquiries:

Additional considerations for tax exemption

Tax exemption can vary significantly by state, requiring organizations to understand specific regulations that apply to their situation. Awareness of state-specific policies is crucial in maintaining eligibility.

Considerations include:

By regularly reviewing these factors, organizations can safeguard their exempt status and maintain compliance.

Tools and resources available on pdfFiller

PdfFiller offers a range of tools specifically designed to facilitate the document management process, making it easier for organizations to handle their Tax Exemption Certificate 24 Form.

Features include:

Real-world examples of tax exemption certificate use

Several organizations have successfully utilized the Tax Exemption Certificate 24 Form to enhance their operational efficiency and reduce costs associated with sales tax.

Case studies highlight:

Lessons learned from these organizations emphasize the importance of proper documentation and adherence to regulatory standards, showcasing how beneficial the Tax Exemption Certificate 24 Form can be when utilized effectively.

Contact information for assistance

For any inquiries concerning the Tax Exemption Certificate 24 Form, reaching out for assistance is encouraged. Organizations can contact tax professionals or relevant state revenue departments for specific questions about eligibility and compliance.

Additionally, pdfFiller offers support services to assist users with document management, including:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit tax exemption certificate 24 on an iOS device?

Can I edit tax exemption certificate 24 on an Android device?

How do I fill out tax exemption certificate 24 on an Android device?

What is tax exemption certificate 24?

Who is required to file tax exemption certificate 24?

How to fill out tax exemption certificate 24?

What is the purpose of tax exemption certificate 24?

What information must be reported on tax exemption certificate 24?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.