Get the free KENTUCKY UNITARY COMBINED CORPORATION INCOME ...

Get, Create, Make and Sign kentucky unitary combined corporation

Editing kentucky unitary combined corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kentucky unitary combined corporation

How to fill out kentucky unitary combined corporation

Who needs kentucky unitary combined corporation?

A Comprehensive Guide to the Kentucky Unitary Combined Corporation Form

Understanding the Kentucky unitary combined corporation form

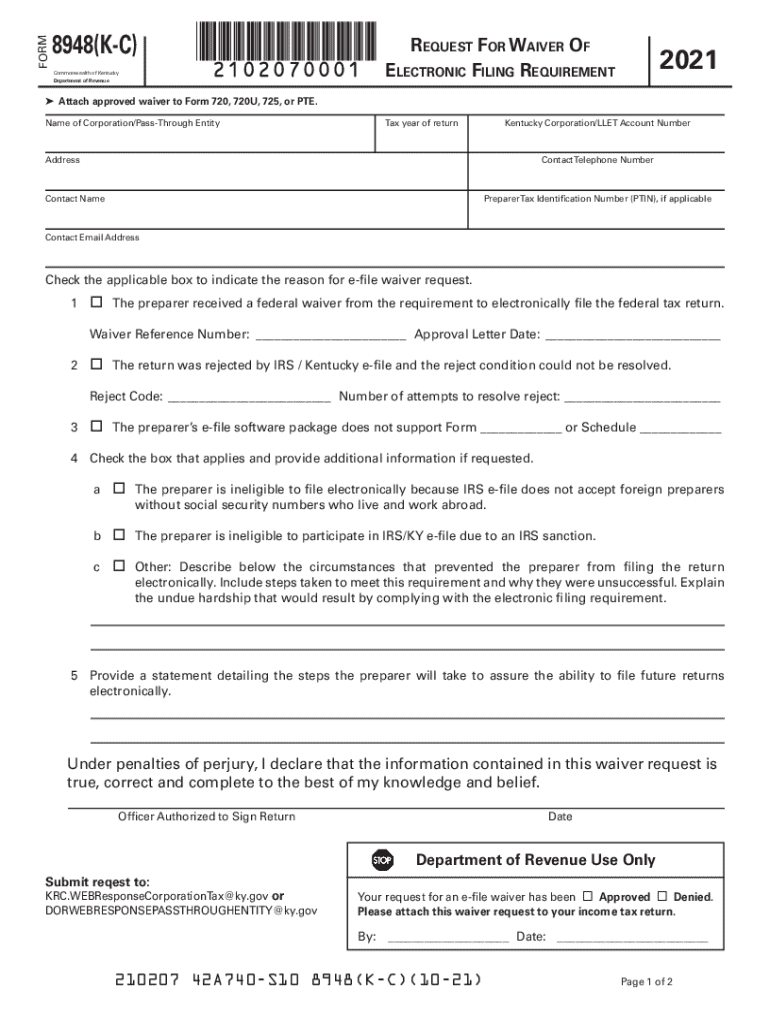

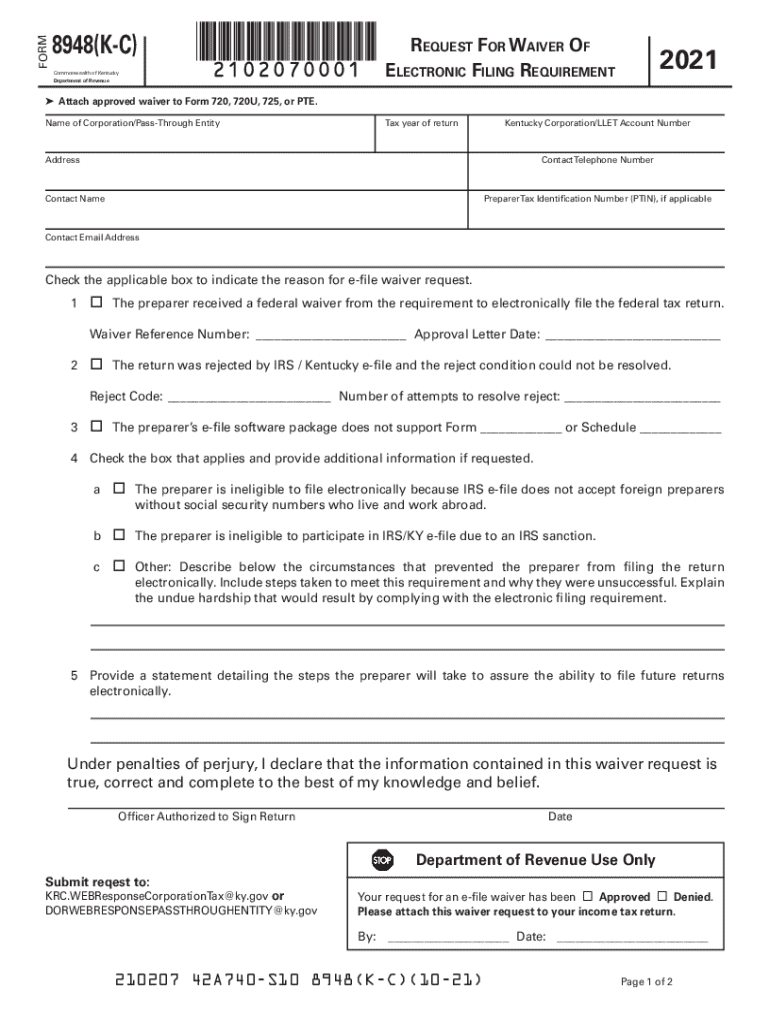

The Kentucky unitary combined corporation form is a specialized tax document used by corporations operating within Kentucky. This form allows businesses that are part of a unitary group to file consolidated income tax returns, thereby reflecting the true economic enterprise of the group. Unlike separate entity filings, the unitary combined approach offers a more accurate depiction of the overall financial performance, particularly for corporations engaged in multi-faceted operations across different sectors.

For companies, understanding and utilizing the Kentucky unitary combined corporation form is essential for ensuring compliance with state tax regulations. It enables corporations to allocate income fairly among group members, which can lead to significant tax efficiencies and support strategic financial planning. Missing out on this option can leave corporations vulnerable to increased tax liabilities and penalties.

Who needs to file the Kentucky unitary combined corporation form?

Filing the Kentucky unitary combined corporation form is mandatory for specific groups of businesses. Primarily, corporations that are part of a unitary group—where at least one entity is engaged in business within Kentucky—must file this form. The criteria encompass various types of entities, such as C-corporations, S-corporations, and limited liability companies (LLCs) that elect to be treated as corporations.

By filing the unitary combined form, corporations can benefit by enhancing their tax efficiency. This method reduces the overall tax burden on the unitary group, as it considers the collective earnings and losses of all group members. Thus, the effective tax rate can be lower compared to separate reporting, allowing businesses to allocate resources better and invest in growth initiatives.

Key components of the Kentucky unitary combined corporation form

The Kentucky unitary combined corporation form comprises several essential components, each crucial for accurate reporting and compliance. The initial requirement is basic entity identification, including the name of the corporation, its address, and a tax identification number. This information anchors the filing process and links it to the appropriate business within Kentucky's tax system.

Financial information is another key section of this form, where businesses must report gross receipts and various apportionment factors. This data is integral as it determines how much of the corporation's income is taxable in Kentucky. Lastly, the ownership structure segment requires detailed documentation for all affiliated entities within the unitary group, ensuring transparency and accurate computation of taxes due.

Step-by-step instructions for completing the form

Preparing to complete the Kentucky unitary combined corporation form involves gathering all necessary documents and data beforehand. These documents typically include financial statements, previous tax returns, and records of related entities. A thorough preparation can significantly streamline the form-filling process and reduce the chances of errors.

When filling out the form, start with entering the corporation's details accurately. This involves inputting essential identification information, followed by careful reporting of financial data, including total gross receipts and applicable deductions. Ensure that all related entities are included in the reporting section, providing necessary identification and financial details for each entity to maintain compliance and transparency.

Electronic submission of the Kentucky unitary combined corporation form

Electronic filing (eFiling) of the Kentucky unitary combined corporation form simplifies the submission process and offers numerous advantages. Not only does eFiling provide a quicker method of submission, but it also ensures that filings are accurately logged in the state’s tax system, reducing the chances of losing vital documents. Moreover, eFiling can significantly expedite the review process by the state tax office.

To access the eFiling platform, simply visit the Kentucky Department of Revenue's website, where you can create an account for submission. The platform will guide you through the uploading of necessary documents, from identification to financial statements. Once the information is submitted, users can track their application status easily, which offers peace of mind throughout the filing period.

Editing and managing the form with pdfFiller

Using pdfFiller for managing the Kentucky unitary combined corporation form enhances the filing process by offering a cloud-based platform for editing and collaboration. With features such as document signing and sharing, pdfFiller empowers users to complete their forms efficiently. Its interactive tools facilitate quick edits without needing extensive technical knowledge, making it accessible for all stakeholders involved.

Through pdfFiller, users can also save their documents in varying formats or utilize integrated tools for collaboration. This capability ensures that all relevant parties can contribute to the filing process seamlessly, allowing for a comprehensive review before submission. Furthermore, with the platform's unique features, businesses can maintain all documentation systematically, simplifying future audits or compliance checks.

Common questions and troubleshooting

Many individuals and businesses have questions about the Kentucky unitary combined corporation form. Common inquiries include eligibility criteria and specific filing deadlines. It's crucial for corporations to understand that there are strict deadlines for filing this form, which are aligned with the fiscal year end of the entity. Late filings can attract penalties, making it essential to adhere strictly to timelines.

If a form is rejected, understanding the reasons is critical to avoid future errors. Often, discrepancies in reported financial data or the absence of required documentation can lead to rejections. When this occurs, businesses should review the feedback from the tax office carefully, amend their submissions promptly, and refile to ensure compliance and avoid additional penalties.

Updates and changes to the Kentucky unitary combined corporation filing process

Recent changes in Kentucky tax legislation have impacted the filing process for the unitary combined corporation form. Understanding these updates is vital for corporations to navigate the evolving landscape of state taxes. Changes may relate to new requirements for reporting, adjustments in tax rates, or shifts in eligibility criteria for which corporations qualify to file using the unitary combined format.

For instance, if the state has increased the corporate tax rate or altered criteria for apportionment, businesses need to be proactive in adapting their reporting practices. Keeping abreast of these updates not only ensures compliance but also allows corporations to maximize their opportunities for tax efficiency under the latest regulations.

Additional considerations for corporations operating in Kentucky

Corporations that operate across state lines must navigate unique rules regarding taxation. Multi-state operations can complicate the filing process, as businesses must ensure they comply with tax requirements in multiple jurisdictions while also adhering to Kentucky’s specific regulations. This necessitates a comprehensive understanding of how income is apportioned among states, requiring meticulous record-keeping and documentation strategies.

Best practices for compliance include regularly updating financial records and ensuring that all related entities maintain a transparent and efficient accounting system. By adopting a consistent approach to record-keeping and communication between departments, businesses can mitigate the risk of errors, ensuring smoother tax preparation and filing processes. Collaboration between tax teams and operational units is essential for achieving overall compliance and maximizing financial benefits.

Resources for further assistance

For additional insights into the Kentucky unitary combined corporation form, corporations can connect with key contacts at the state's revenue office. Engaging with professional tax services can provide tailored guidance and support for navigating complex tax regulations. Building relationships with tax advisors can enhance a corporation's understanding of compliance, yielding long-term benefits in financial planning.

Moreover, browsing through authoritative articles and resources dedicated to corporate tax strategies can offer valuable perspectives. Companies looking to refine their tax practices will benefit greatly from staying educated about evolving legislative frameworks and compliance requirements in Kentucky.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit kentucky unitary combined corporation online?

Can I sign the kentucky unitary combined corporation electronically in Chrome?

How do I fill out kentucky unitary combined corporation using my mobile device?

What is kentucky unitary combined corporation?

Who is required to file kentucky unitary combined corporation?

How to fill out kentucky unitary combined corporation?

What is the purpose of kentucky unitary combined corporation?

What information must be reported on kentucky unitary combined corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.