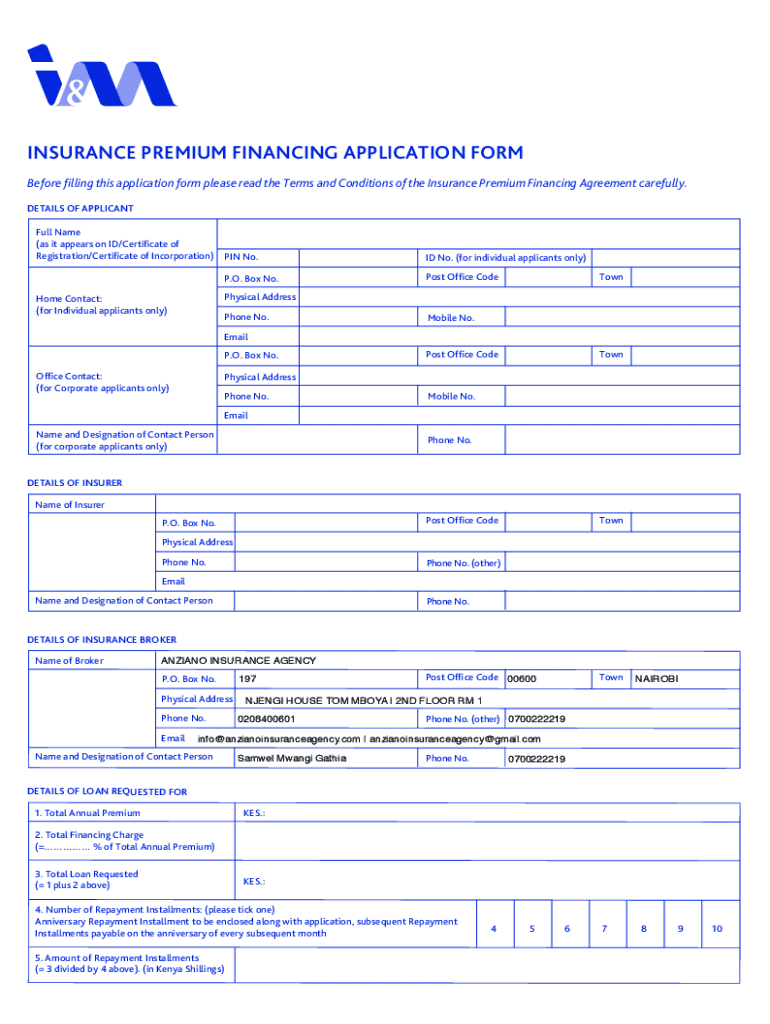

Get the free Targeted Jobs Withholding Tax Credit Application

Get, Create, Make and Sign targeted jobs withholding tax

Editing targeted jobs withholding tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out targeted jobs withholding tax

How to fill out targeted jobs withholding tax

Who needs targeted jobs withholding tax?

Understanding and Managing the Targeted Jobs Withholding Tax Form

Understanding the targeted jobs withholding tax form

The targeted jobs withholding tax form is a key document designed to facilitate tax benefits for individuals and businesses participating in employment programs that target economically disadvantaged regions or specific job creation initiatives. This form allows eligible employers to withhold less tax from workers hired for qualifying jobs, thereby encouraging job creation in areas of high unemployment.

For both individuals seeking jobs and the employers looking for talent, using this form effectively can result in significant financial relief. It serves as an incentive structure established by the government to drive economic growth in targeted communities, promoting a healthy job market.

Who needs to use this form?

The targeted jobs withholding tax form is relevant for three primary audiences: employers, employees, and tax professionals. Employers looking to lower their tax withholding obligations must understand the eligibility criteria and complete the form properly to take full advantage of available tax benefits. On the other hand, employees who are hired for these targeted positions should be aware of how this form can affect their take-home pay.

Tax professionals may also find this form essential, as they guide clients through the intricacies of qualifying jobs and how to manage tax-related decisions effectively. To maximize the benefits of this form, all stakeholders must collaborate and remain informed about their responsibilities.

Eligibility criteria for targeted jobs withholding tax benefits

To qualify for the benefits associated with the targeted jobs withholding tax form, applicants must meet certain general eligibility requirements. These criteria often focus on specific job descriptions and industry standards that typically include positions in sectors that contribute significantly to economic recovery or growth in a particular region. Commonly targeted industries may include manufacturing, technology, healthcare, and renewable energy.

Furthermore, applicants must consider specific conditions, such as the geographic area where the jobs will be created. Areas categorized as economically distressed by government entities are prioritized for these incentives. Municipalities often set workforce development goals that align with the targeted jobs initiative to stimulate regional economic activities.

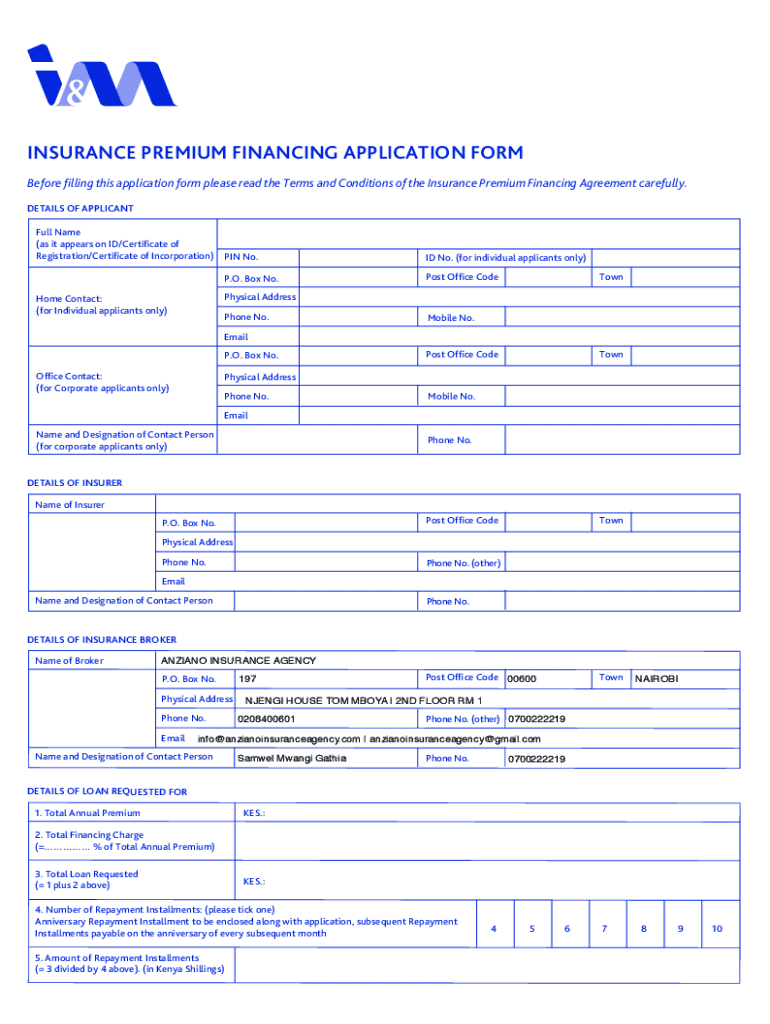

Step-by-step guidance for completing the targeted jobs withholding tax form

Filling out the targeted jobs withholding tax form requires careful attention to detail. The first step involves gathering necessary information, including employee data, job descriptions, and details about the incentive-qualifying program. Make sure to collect documentation such as employee identification numbers, job offer letters, and records of prior tax filings.

Once you have compiled the necessary information, move on to filling out the form. Review each section carefully, ensuring you accurately describe the job and the intended benefits. Common pitfalls include errors in social security numbers, incorrect job descriptions, and incomplete forms, which can delay processing and eligibility verification.

Reviewing and editing the targeted jobs withholding tax form

Before submitting the targeted jobs withholding tax form, thorough review is essential. Key areas to double-check include employee names, job titles, and the specific benefits applied for. Taking the time to verify this information can prevent costly mistakes that may impede tax savings.

Using tools like pdfFiller can significantly simplify the editing process. Its interactive features allow users to make changes easily, ensuring accuracy and compliance before final submission.

Signing and submitting the targeted jobs withholding tax form

The final step in the process involves signing and submitting the targeted jobs withholding tax form. eSigning your form provides several advantages, including convenience and reduced processing time. The step-by-step process of signing using pdfFiller is straightforward and user-friendly, allowing for electronic signatures to be added swiftly.

After signing, understanding submission guidelines is crucial. Be aware of where to send the form and the specific deadlines associated with the targeted jobs initiative type. Some locales may have strict submission deadlines tied to fiscal years or job creation milestones.

Managing your targeted jobs withholding tax submissions

After submission, it's essential to track your application status. Knowing how to monitor submission outcomes can be beneficial for both planning purposes and ensuring you receive due benefits. Many local tax offices provide online tracking systems to check the status of submitted forms.

Should you find any discrepancies after submission, or if circumstances change, be prepared to make amendments. The processes for modifying your form post-filing often vary depending on your local tax authority, so check any available resources or contact your tax professional for guidance.

Frequently asked questions (FAQs)

Many individuals have common inquiries regarding the targeted jobs withholding tax form, particularly around taxable income, deductions, and eligibility requirements. It's vital to clarify how these factors might impact your tax filing. Additionally, understanding state-specific conditions and required additional forms can be complicated, emphasizing the importance of local regulations.

Tax professionals can provide valuable insights into the nuances of your local filing requirements, ensuring compliance and optimizing for potential benefits associated with this tax initiative.

Resources for taxpayers

For those seeking further support regarding the targeted jobs withholding tax form, it’s recommended to reach out to tax advisors who specialize in local and state tax laws. Their personalized guidance can make navigating the complexities of this form much more manageable.

Additionally, utilizing interactive tools on pdfFiller provides easy access to templates and guidance tailored for completing the targeted jobs withholding tax form. Sharing accessible resources enhances successful filed submissions across various users.

Leveraging local and state incentives

In addition to the targeted jobs withholding tax form benefits, exploring other local and state incentives can augment tax savings. These may include specific tax credits or grants aimed at promoting job creation in your locality. Understanding what is available allows employers to maximize the financial impact of their hiring initiatives.

Navigating the application processes for these additional incentives can be labyrinthine, yet it often entails concurrent submissions to relevant agencies. Thorough research and proactive engagement can reveal multiple opportunities for tax benefits.

Conclusion and next steps

Navigating the world of targeted jobs withholding tax forms can seem daunting, but with the right tools and information, it can be manageable. Utilize the seamless document creation and management solutions offered by pdfFiller to edit, sign, and monitor your document processes efficiently.

Embracing these capabilities not only simplifies your workflow but also enhances your chances of successfully leveraging the benefits intended for job creation and economic development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in targeted jobs withholding tax without leaving Chrome?

Can I create an electronic signature for the targeted jobs withholding tax in Chrome?

How can I edit targeted jobs withholding tax on a smartphone?

What is targeted jobs withholding tax?

Who is required to file targeted jobs withholding tax?

How to fill out targeted jobs withholding tax?

What is the purpose of targeted jobs withholding tax?

What information must be reported on targeted jobs withholding tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.