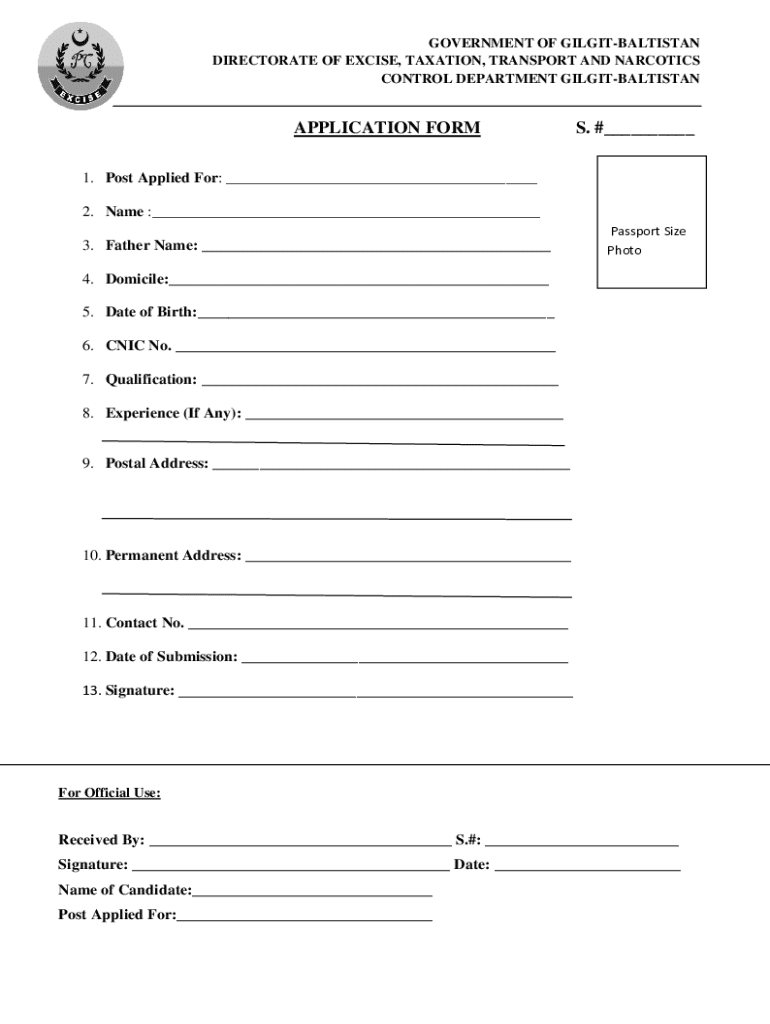

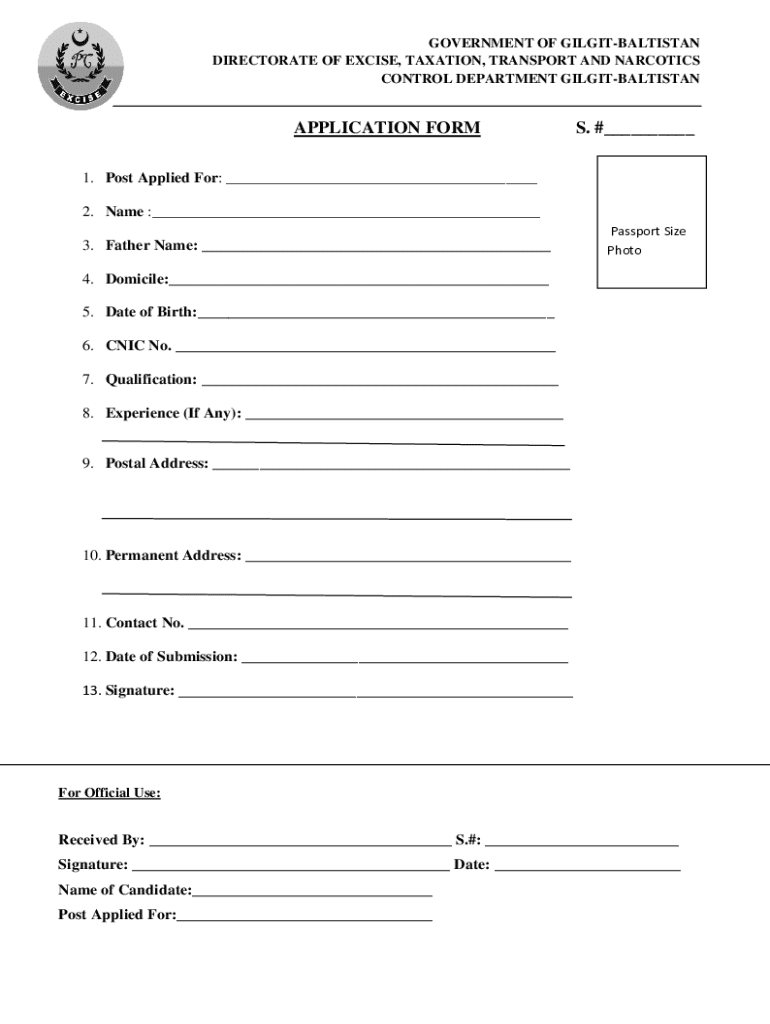

Get the free APPLICATION FORM - Excise and Taxation - gbexcise gov

Get, Create, Make and Sign application form - excise

How to edit application form - excise online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form - excise

How to fill out application form - excise

Who needs application form - excise?

Comprehensive Guide to the Application Form - Excise Form

Understanding the Excise Form: An Overview

The excise form is a crucial document used by businesses to report their liability for excise taxes, which are imposed on specific goods such as alcohol, tobacco, and certain fuels. This form serves as an official record of transactions that may be subject to taxation, and filing it accurately is vital for compliance with federal and state regulations.

The importance of the excise form in tax reporting cannot be overstated. It helps government agencies track the production and sale of taxable goods, ensuring that businesses pay their fair share. Moreover, accurately completing this form aids in avoiding costly penalties or audits. Key elements of the excise form typically include taxpayer information, details of the excise tax calculations, and a declaration confirming the accuracy of the provided information.

Preparing to Complete the Excise Form

Before diving into filling out the excise form, it is essential to gather all necessary information. This includes identifying the required documents such as previous tax returns, invoices, and receipts related to the sale or production of excise taxable goods. Additionally, ensure you have the relevant financial data, including sales figures, costs, and any particular deductions or credits you may be claiming.

While preparing, be mindful of common mistakes to avoid. Often, filers overlook crucial sections of the form, leaving out necessary information that can lead to rejection or delays. Additionally, misunderstanding tax requirements can result in errors that may have financial implications. Double-checking each section thoroughly can significantly enhance your filing process.

Step-by-Step Instructions for Filling Out the Excise Form

The excise form can appear daunting, but breaking it down into sections simplifies the process. Start with the title section, where you include the name of the form and the reporting period. Ensure that all details are accurate, as discrepancies can cause headaches later.

Special considerations must also be addressed. Be aware of multiple state regulations if you're operating in different jurisdictions, as each state may have unique requirements. Additionally, if you're a non-profit organization, there might be exceptions or additional forms needed for compliance.

Editing and managing your excise form with pdfFiller

pdfFiller provides user-friendly editing tools that streamline the process of completing your excise form. With its capabilities to add or remove fields, users can personalize the form to fit their needs. Furthermore, the platform allows for modifying pre-filled information, ensuring that all details are up-to-date and accurate.

Once completed, you can save and access your excise form in the cloud, providing flexibility and security. This not only safeguards your document but also allows you to store different versions, making it easy to track changes or revert to previous versions if needed.

eSigning your excise form

To eSign your excise form with pdfFiller, simply follow the user-friendly step-by-step guide provided by the platform. Signers can add their electronic signature in just a few clicks, making the process quick and efficient. Additionally, pdfFiller employs robust security features to ensure that electronic signatures are valid and secure.

Understanding the legal validity of eSignatures in excise forms is crucial, as electronic signatures are generally accepted for most tax forms, provided they meet specific criteria established by the IRS and other regulatory bodies. Therefore, using pdfFiller safeguards compliance while streamlining your submission.

Submitting your excise form

Once your excise form is completed and signed, it’s time for submission. Methods of submission may vary depending on your jurisdiction. Many states now provide an online submission process that is designed to be efficient and secure. Be prepared to attach any required supplemental documentation as stated in your state guidelines.

Always verify that your submission has been received, as this can prevent any future issues or misunderstandings. Most platforms, including pdfFiller, provide confirmation options, allowing you to track the status of your submission effectively.

Troubleshooting common issues

Despite careful preparation and attention, forms can occasionally be rejected. Some common reasons for excise form rejections include inaccuracies in your calculations, missing required information, or submission outside the designated timeframe. In such cases, it is essential to know what steps to take.

pdfFiller offers robust customer support options, allowing you to access assistance via live chat or their extensive FAQ section dedicated to excise forms. This resource can provide you with guidance, helping resolve any concerns you may encounter.

Interactive tools and resources

One of the standout features of pdfFiller is its interactive tools, which enhance the user experience when dealing with excise forms. The platform includes built-in calculators and estimators, allowing you to quickly assess your excise tax owed based on the information provided, which streamlines the documentation process.

These integrated tools allow users to experience a comprehensive document management system where they can create, edit, eSign, and store all forms conveniently in one cloud-based location.

Related forms and templates

Aside from the excise form, many other important tax forms and templates are relevant for users, including sales tax forms, income tax returns, and customs declarations. Understanding how to navigate between these forms is vital for ensuring compliance with all tax obligations.

Maintaining an organized approach to these forms enhances efficiency and compliance, aiding in smoother tax reporting and management.

Popular tips from users

Many users of the excise form have shared their best practices for completing forms efficiently. Whether you're new to the excise form or looking to refine your approach, learning from others can provide valuable insights. Keeping forms well-organized and using digital tools like pdfFiller is frequently cited as a best practice.

User testimonials highlight the efficiency of pdfFiller, with many citing its ease of use and comprehensive features that enhance document management.

Frequently asked questions (FAQs)

Commonly asked questions about the excise form often revolve around submission methods, deadlines, and specific requirements. Users may also have inquiries about the features available within pdfFiller and how to maximize the platform's utility for document management.

pdfFiller boasts an extensive library of FAQs specifically designed to address users' uncertainties, making it easier to navigate the application form process.

Contact information for further assistance

For additional support while navigating the excise form, you can reach pdfFiller’s customer support team through various avenues. Whether you're facing technical difficulties or have questions about specific features, their trained staff is ready to help.

With a dedicated support team and a wealth of user-generated insights, pdfFiller is committed to ensuring that your experience with the excise form is seamless and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get application form - excise?

How do I make changes in application form - excise?

How do I make edits in application form - excise without leaving Chrome?

What is application form - excise?

Who is required to file application form - excise?

How to fill out application form - excise?

What is the purpose of application form - excise?

What information must be reported on application form - excise?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.