Get the free Maryland Sales & Use Resale Certificate

Get, Create, Make and Sign maryland sales amp use

How to edit maryland sales amp use online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland sales amp use

How to fill out maryland sales amp use

Who needs maryland sales amp use?

Mastering the Maryland Sales and Use Form: Your Comprehensive Guide

Understanding the Maryland sales and use tax

The sales and use tax in Maryland is a crucial revenue source for state and local governments, typically applied to the sale of tangible personal property and some services. This tax is levied on the purchase price of goods, and the Maryland Sales and Use Form is the mechanism through which individuals and businesses report and remit this tax. Understanding the nuances of this form is essential for compliance with tax regulations. Key definitions include sales tax, which is a tax paid at the point of sale, and use tax, which is a tax on goods purchased out of state and used in Maryland.

Who needs to file the Maryland sales and use form?

Filing the Maryland Sales and Use Form is mandatory for any individual or business that sells tangible goods or provides taxable services in Maryland. This applies especially to retailers, contractors, and online sellers. Individuals engaged in non-exempt purchases must also file if they owe use tax on goods bought outside the state. Local regulations may add additional layers, such as supplemental local taxes specific to certain jurisdictions, emphasizing the necessity of familiarizing oneself with both state and local tax compliance requirements.

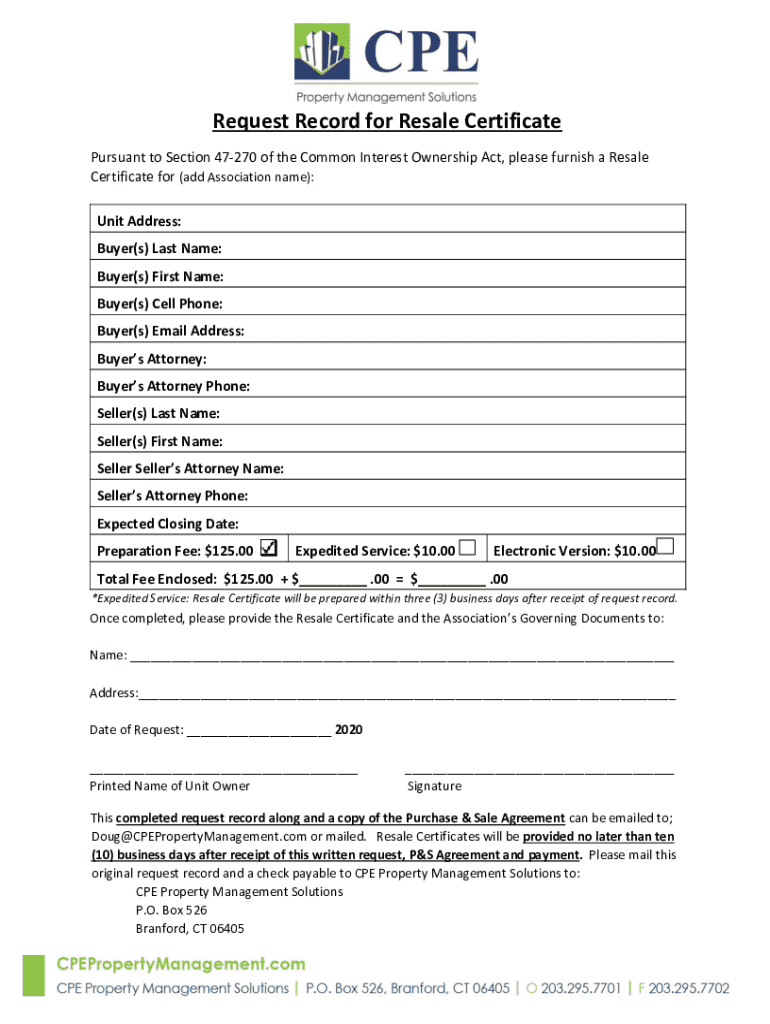

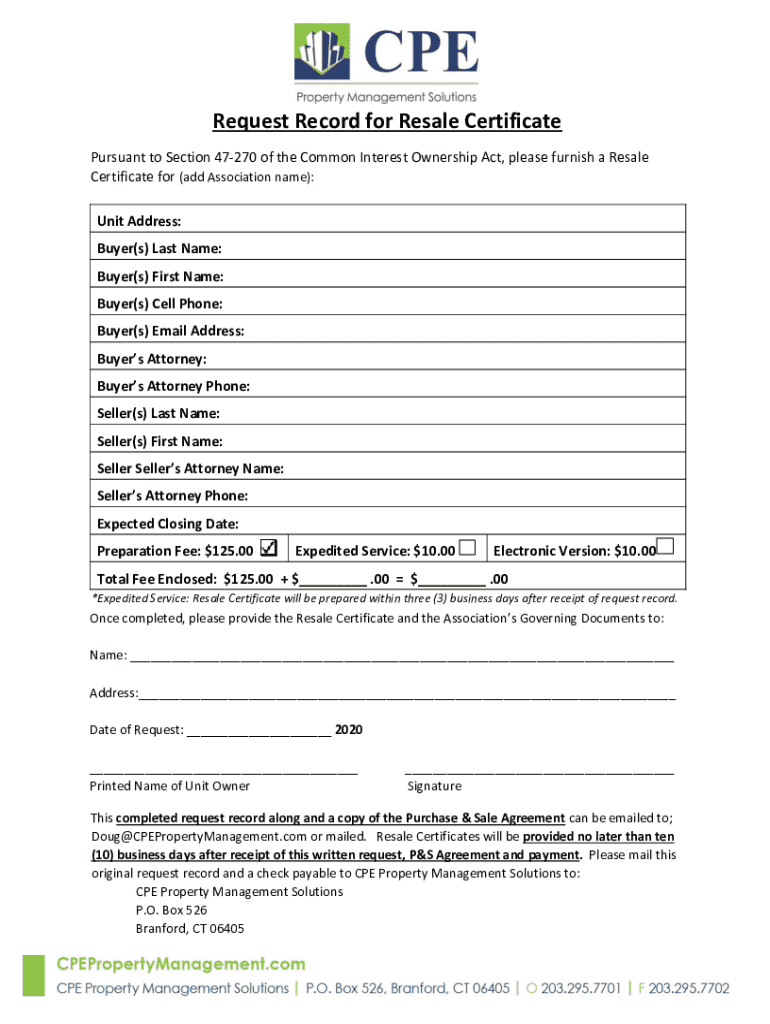

Navigating the Maryland sales and use form

The Maryland Sales and Use Form is structured to ensure clear reporting of sales and use tax obligations. It includes several crucial sections, such as Identifying Information, Tax Calculations, and Deductions and Exemptions. Understanding the layout allows users to fill the form efficiently. For instance, the Identifying Information section typically requires the taxpayer’s name, address, and vendor information, while tax calculation sections break down the taxable sales, exempt sales, and applicable deductions.

To stay organized while filling out the form, create a checklist of required information and prepare all documentation ahead of time.

Step-by-step guide: completing the Maryland sales and use form

Completing the Maryland Sales and Use Form effectively involves several steps, starting with gathering required documentation. This includes sales logs, receipts of purchases, and any previous forms if applicable. Keeping comprehensive records not only simplifies filing but also provides necessary information in case of audits.

Modifying and editing your Maryland sales and use form

Editing PDF documents, especially forms like the Maryland Sales and Use Form, can be seamless when you utilize features such as those offered by pdfFiller. Users can modify existing forms without losing data integrity, which is crucial for maintaining compliance. Collaboration with team members is also streamlined, as these features allow multiple users to add or change information in real-time.

eSigning and securing your Maryland sales and use form

Electronic signatures play a vital role in enhancing the compliance process for the Maryland Sales and Use Form. eSigning not only accelerates the submission process but also ensures that your documents are secure. pdfFiller provides a straightforward method for eSigning that includes a step-by-step guide, allowing users to sign electronically and protect their data during submission.

Common questions about the Maryland sales and use form

It is natural to have questions surrounding the Maryland Sales and Use Form. One common concern is dealing with mistakes made on the form. If you realize a mistake post-submission, it is essential to contact the Maryland Comptroller’s office promptly. Handling audits also requires due diligence; maintaining proper records and understanding the appeals process will mitigate issues with state notices.

Special circumstances: exemptions and special events

Certain exemptions apply to various situations in Maryland that significantly affect sales and use tax obligations. Non-profit organizations often qualify for tax exemptions, while unique circumstances, such as occasional sales or tax holidays, may arise at different times of the year. It is beneficial to recognize these exemptions, as they could substantially reduce tax liabilities.

Interactive features and tools for managing Maryland sales and use tax

Harnessing tools available on platforms like pdfFiller can greatly assist in managing Maryland Sales and Use Tax obligations. Interactive calculators for sales tax help ensure you are accurately assessing tax due, while tracking tools keep you updated on filings and payments. Such features aid in organizing and managing tax documents efficiently, reducing the stress often associated with tax season.

Learning from others: case studies of successful sales tax filing

Successful businesses often share best practices that streamline their sales tax filing processes. For example, a local retailer adopted automated tracking for all transactions, which significantly reduced their error rates. This case demonstrates the value of investing in reliable platforms and keeping organized records as a path to achieving compliance and accuracy.

Further enhancements: tax tools and tips

pdfFiller not only simplifies the Maryland Sales and Use tax process but also offers additional features for document management. Users can leverage these tools to enhance their workflow, from seamless PDF editing to collaborative sharing options, ensuring that all tax documents are managed efficiently. Ongoing education is crucial for keeping up with tax-related topics, and pdfFiller offers resources to help users stay informed about regulations and best practices.

Community engagement: join the discussion

Engaging with others who file the Maryland Sales and Use Form can provide valuable insights and support. Online forums and community discussions can be great resources for sharing experiences and helping each other navigate complex tax issues. Encouraging feedback from users can enhance the overall experience, leading to improved resources and processes as more people share their strategies and solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify maryland sales amp use without leaving Google Drive?

How can I send maryland sales amp use to be eSigned by others?

How do I edit maryland sales amp use on an iOS device?

What is maryland sales amp use?

Who is required to file maryland sales amp use?

How to fill out maryland sales amp use?

What is the purpose of maryland sales amp use?

What information must be reported on maryland sales amp use?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.