Get the free STOCK TRANSFER INTENTION FORM

Get, Create, Make and Sign stock transfer intention form

How to edit stock transfer intention form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stock transfer intention form

How to fill out stock transfer intention form

Who needs stock transfer intention form?

A comprehensive guide to the stock transfer intention form

Understanding the stock transfer intention form

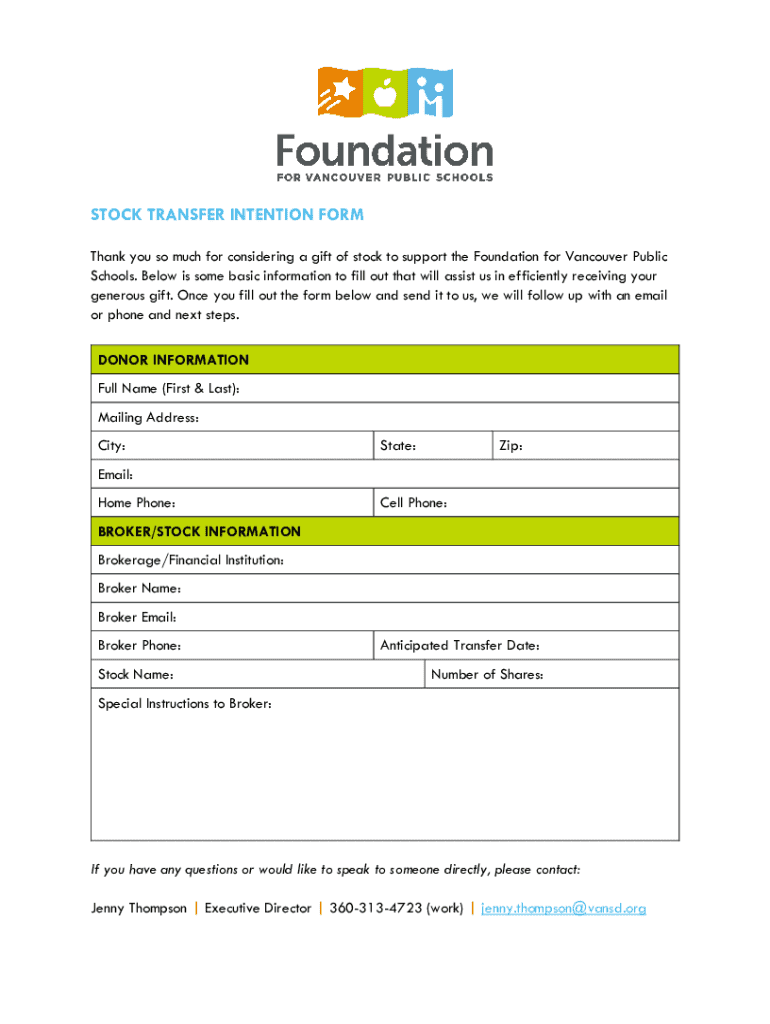

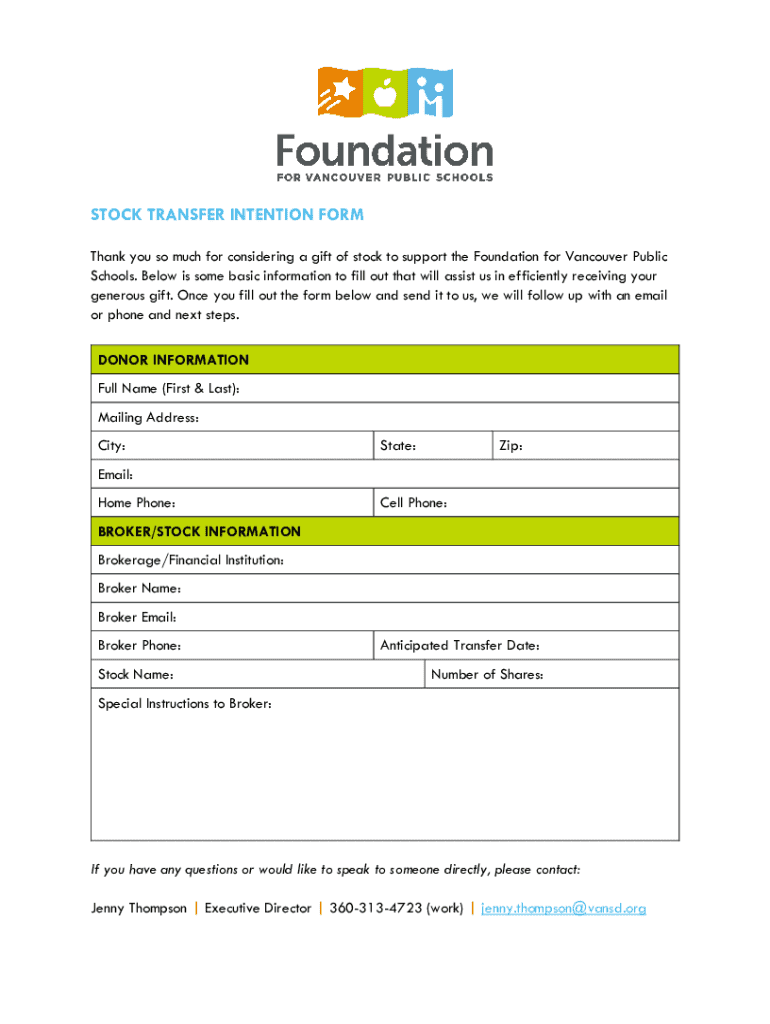

A stock transfer intention form is a crucial document used to facilitate the transfer of ownership of stocks from one individual or entity to another. This form outlines the intent of the current stockholder (the donor) to transfer a specified amount of their stockholdings to a recipient. It serves not only as a formal declaration but also as a legal instrument in the process of transferring stock ownership.

The importance of the stock transfer intention form in financial transactions cannot be overstated. It helps in documenting the transfer, providing necessary details that assist brokers and the involved parties in executing the transfer smoothly. It protects both the donor and recipient by making the transaction transparent and traceable.

This form is primarily used by individuals or organizations looking to transfer stocks as gifts, for estate planning, or for charitable purposes. If you hold stocks and plan to transfer them to another party, understanding and properly completing this form is essential to ensure a seamless process.

Preparing for the stock transfer

Before filling out the stock transfer intention form, it is vital to assess your current stockholdings. Knowing the specific stocks you own and their current market value will help you determine which stocks you wish to transfer. This step is essential in ensuring that the recipient receives a fair and valuable transfer.

Next, identify the recipient of the stock transfer. This can be a family member, a friend, or a charitable organization. Make sure the recipient is aware of the transfer and agrees to receive the stocks.

Step-by-step instructions for completing the form

Completing the stock transfer intention form accurately is critical for ensuring a successful transfer. The form typically includes several sections, each requiring specific information.

In Section 1, you will provide donor information such as your full name, address, and contact information. Be certain to double-check your details to avoid any errors that could delay the transfer.

Section 2 focuses on broker and stock information. Here, you include your broker's details, including their firm name, address, and contact number. Additionally, provide a description of the stocks being transferred, such as the company name and number of shares.

In Section 3, you will indicate the purpose of the stock transfer, such as whether it is a charitable donation or a private gift. This designation helps specify the context of the transfer.

Finally, Section 4 allows you to add any special instructions to your broker, ensuring clear communication on the specifics of the transfer, such as timing and the preferred method of transfer.

Editing and customizing your form

After filling out the stock transfer intention form, ensuring the content is final and accurate is crucial. You can edit the form online through platforms like pdfFiller, which provide user-friendly tools for document customization.

Using pdfFiller’s interactive tools, you can easily add digital signatures or collaborate with others involved in the transaction, such as the recipient or a legal advisor. This collaborative process ensures that all parties are on the same page regarding the details of the transfer.

eSigning your stock transfer intention form

Signing the stock transfer intention form is a critical step in formalizing the transfer. An electronic signature (eSignature) is legally recognized and provides a secure method of signing documents digitally.

To eSign using pdfFiller, follow the simple steps provided on the platform. You can add your signature electronically with just a few clicks. Keep in mind that an eSignature carries the same legal implications as a traditional handwritten signature, making it important to ensure accuracy and intention when signing.

Submitting your completed form

Once your stock transfer intention form is complete and signed, it’s time to submit it. Best practices involve not only submitting the form but also confirming receipt with your broker. Once submitted, follow up to ensure that the transfer is processed within the expected timeframe.

After submission, keep documentation for your records, including a copy of the completed form and confirmation of receipt. If any issues arise during the transfer process, having these documents readily accessible will aid in resolving any discrepancies efficiently.

Frequently asked questions (FAQs)

It’s natural to have questions regarding stock transfers, particularly if you are unfamiliar with the process. Common concerns include how to correct errors made on the form or what steps to take if the transfer does not go as planned.

For instance, if you encounter errors, promptly reach out to your broker for guidance on rectifications. Additionally, resources such as brokers' customer service, legal advisors, and pdfFiller’s help center can provide the assistance needed to navigate any complexities.

Managing your document

Storing your stock transfer intention form properly is essential for future reference. Consider utilizing cloud storage solutions, like pdfFiller, which enable you to keep important documents securely stored yet easily accessible from anywhere.

The benefits of storing documents in the cloud include convenience, security, and ensuring that you can access your documents whenever necessary. This is especially important for financial documents that may need to be referenced in future transactions or tax planning.

Staying informed on stock transfer regulations

Regulations surrounding stock transfers can vary by jurisdiction and may change over time. Staying informed on these changes is crucial to ensuring compliance and avoiding potential legal issues.

To stay updated on stock transfer regulations, consider subscribing to financial news updates, following IRS guidelines, or consulting with a financial advisor who can provide insights on any new developments that may affect your stock transfer intent.

Exploring more about stock transfers

pdfFiller offers various additional document templates and forms to simplify your financial transactions, particularly when it comes to stock transfers. Exploring these resources can help you understand other essential forms you might need, whether you're managing investments, estate planning, or charitable giving.

By utilizing the resources available on pdfFiller, you can ensure that you have the proper documentation in place for any financial activity, helping you navigate complexities with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit stock transfer intention form in Chrome?

Can I sign the stock transfer intention form electronically in Chrome?

How can I edit stock transfer intention form on a smartphone?

What is stock transfer intention form?

Who is required to file stock transfer intention form?

How to fill out stock transfer intention form?

What is the purpose of stock transfer intention form?

What information must be reported on stock transfer intention form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.