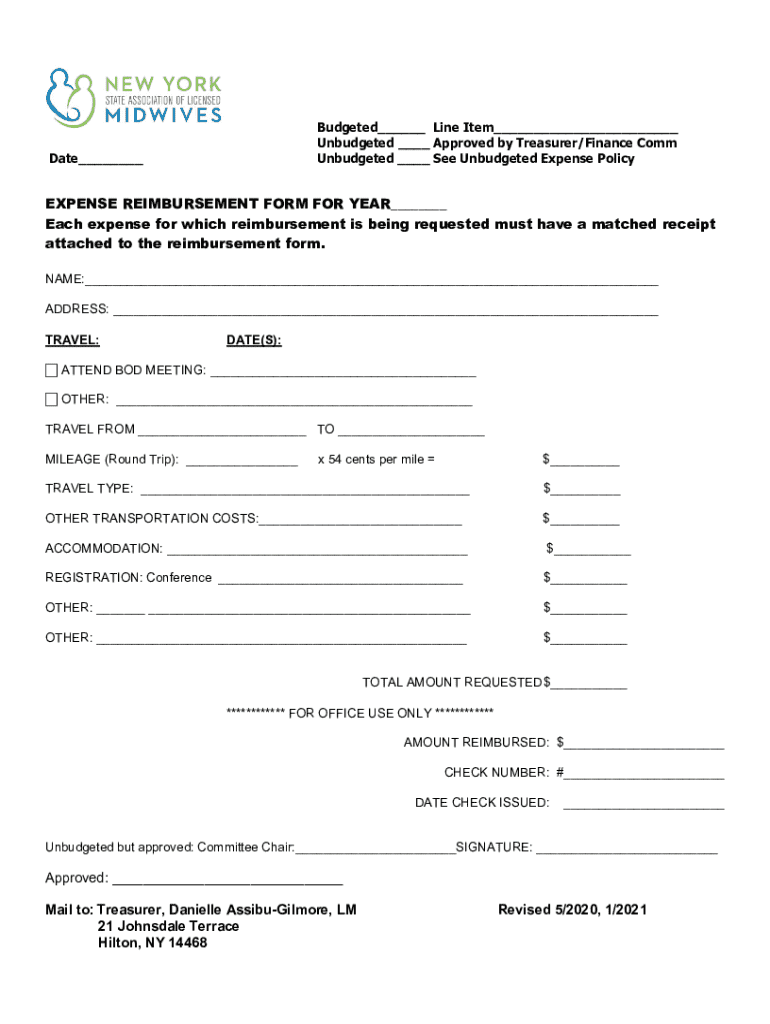

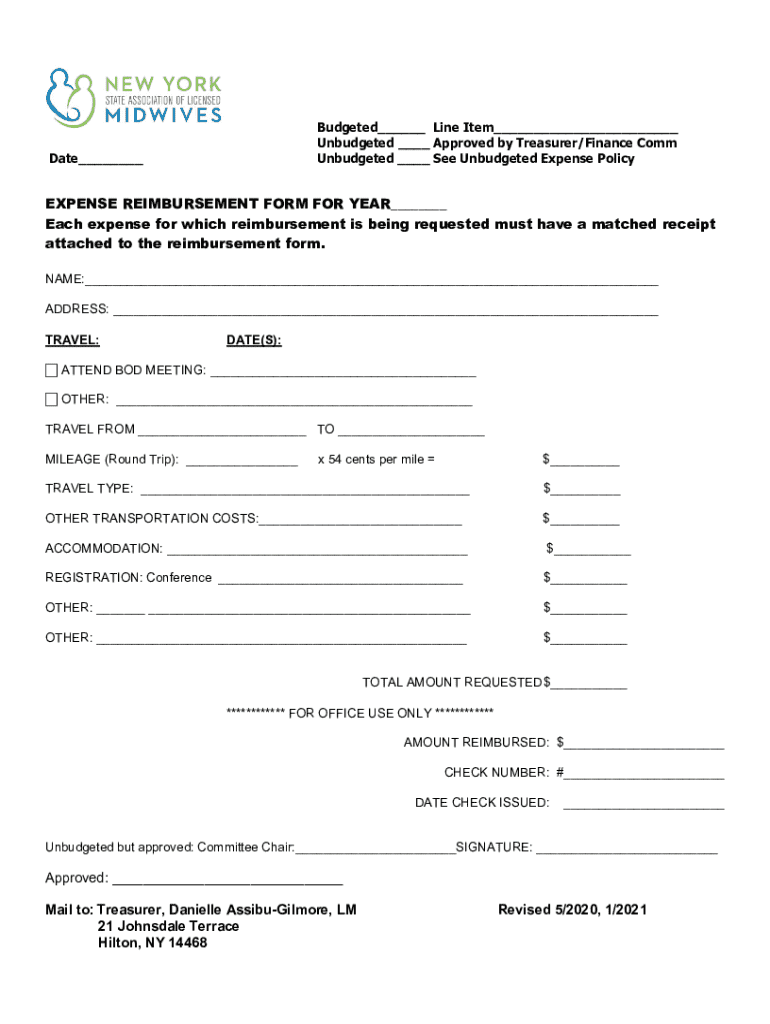

Get the free CLA Policy on Budget Variances

Get, Create, Make and Sign cla policy on budget

Editing cla policy on budget online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cla policy on budget

How to fill out cla policy on budget

Who needs cla policy on budget?

Understanding the CLA Policy on Budget Form

Understanding the CLA policy on budget form

The CLA policy on budget form is a vital tool for managing financial resources within various organizations. Establishing a comprehensive understanding of this policy is crucial for individuals and teams tasked with budget preparation and management. CLA, or Cost-Limit Analysis, focuses on ensuring compliant and accountable financial practices, and the budget form is designed to reflect this framework.

This policy outlines several relevant aspects such as adherence to financial guidelines, budgeting priority areas, and the need for transparency in financial dealings. By utilizing the budget form, stakeholders can effectively allocate resources, ensuring each expenditure aligns with organizational goals. This becomes even more critical in a competitive environment where resource optimization is key.

Accessing the CLA budget form

Access to the CLA budget form is streamlined via multiple avenues. The most effective method is through online platforms such as pdfFiller, where users can easily navigate to find the necessary forms. Additionally, the option for a printable version ensures that those who prefer paper files are accommodated.

User eligibility and registration requirements may vary, commonly involving a need for organizational affiliation or specific credentials. With pdfFiller, users must create an account for uninterrupted access to all features. Should any access issues arise, users can efficiently troubleshoot through options available on the platform.

Step-by-step instructions for filling out the budget form

Filling out the CLA budget form involves several structured steps, starting with understanding the budget categories assigned in the document. Budget categories typically include fixed and variable expenditures. Fixed expenditures represent costs that remain constant over time, such as lease payments, while variable expenditures can fluctuate, like project-based costs.

Furthermore, it's crucial to distinguish between operational and capital expenditures. Operational costs refer to day-to-day expenses, while capital costs relate to long-term investments in fixed assets. Clarity on these metrics can significantly impact project planning and funding sourcing.

Utilizing tools within pdfFiller for budget management

pdfFiller offers several innovative tools to streamline the management of the budget form. The editing features allow users to modify and save changes easily, ensuring that the latest information is always at hand. Collaboration tools also facilitate team input, making it easier for various stakeholders to contribute their insights effectively.

Another critical aspect is the electronic signature options provided by pdfFiller. To utilize eSignatures, users must meet specific requirements outlined by the platform. The steps to eSign are intuitive, involving just a few clicks to authenticate the document securely. Best practices around document management ensure that budget forms are organized and securely stored, establishing streamlined operational flow.

Monitoring and adjusting your budget

Monitoring your budget effectively requires the establishment of performance metrics, such as key performance indicators (KPIs) tailored to track budget adherence. Regular reviews of these metrics are critical responses to budget variances, allowing for timely adjustments based on observed fiscal performance.

Adapting your budget in real-time is essential for navigating financial challenges or unexpected expenses. Implementing changes as soon as discrepancies arise ensures organizations maintain fiscal health and progress towards their strategic objectives without interruption.

Strategic budgeting in practice

Strategic budgeting allows organizations to align their financial planning with overarching business goals. This begins with clearly defined objectives for effective budgeting that reflect both immediate needs and long-term aspirations. Key budget strategies must identify cost-saving techniques while simultaneously pursuing opportunities for investment that drive future growth.

Using historical data to inform budget decisions is paramount. Past spending patterns and financial performance provide a baseline for forecasting future revenues and expenditures, thus minimizing uncertainty within budget plans. Forecasting itself plays a crucial role in budget development; accurate projections enable businesses to prepare for fluctuation and react proactively.

FAQ and common issues related to the budget form

Like any document, users may encounter errors while completing the CLA budget form. It is vital to remain calm and address any anomalies methodically. Should there be a technical issue, referring to the relevant FAQs can provide immediate resolutions for common hurdles. Understanding budget policy compliance is equally important to avoid any pitfalls arising from misinterpretation.

Important deadlines and submission guidelines are often outlined within the budget form documentation itself. Meeting these timelines is a crucial aspect of maintaining financial order and accountability, ensuring that your submissions are timely and meet organizational standards.

Get support for your budget planning challenges

Submitting a budget form can often come with its challenges, necessitating support. pdfFiller offers various resources for users needing further guidance. The educational materials available on their platform cover a range of topics relevant to budget planning, ensuring users have the knowledge needed to navigate complexities.

For more complex budget scenarios, engaging with external experts can provide additional value. Collaborating with financial advisors or budget specialists can bring tailored insights that enhance the budgeting process, leading to better financial outcomes.

Real-life applications and case studies

Numerous teams have successfully implemented the CLA budget form, leveraging the structure and clarity it provides. These case studies serve as valuable learning opportunities, demonstrating how effective budget management can propel an organization towards achieving its objectives.

Lessons learned from these experiences often reveal common pitfalls and best practices. Understanding what worked well or what could have been improved often leads organizations to refine their budgeting processes further, promoting ongoing efficiency and adaptability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the cla policy on budget electronically in Chrome?

Can I create an electronic signature for signing my cla policy on budget in Gmail?

How can I edit cla policy on budget on a smartphone?

What is cla policy on budget?

Who is required to file cla policy on budget?

How to fill out cla policy on budget?

What is the purpose of cla policy on budget?

What information must be reported on cla policy on budget?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.