Get the free Official Documents- Loan Agreement for Loan 9143-GE

Get, Create, Make and Sign official documents- loan agreement

Editing official documents- loan agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official documents- loan agreement

How to fill out official documents- loan agreement

Who needs official documents- loan agreement?

Official Documents: Loan Agreement Form How-To Guide

Understanding loan agreements

A loan agreement is a formal document outlining the terms between a borrower and a lender. This agreement serves as a legal contract that specifies the amount borrowed, the repayment terms, and both parties' obligations. Understanding its purpose and importance is pivotal for successful financial transactions. A well-crafted loan agreement protects both parties by clearly defining expectations and mitigating any potential disputes.

Financial transactions, especially those involving loans, are susceptible to misunderstandings and conflicts. By having a comprehensive loan agreement in place, borrowers are ensured the funds needed for personal or business growth. Conversely, lenders solidify their right to receive repayment, providing a layer of reassurance in their investment.

Types of loan agreements

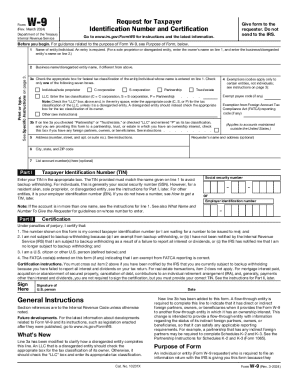

Key components of a loan agreement form

A well-structured loan agreement form comprises several critical components to ensure clarity and functionality. The first component involves detailing the parties involved, where the borrower and lender are clearly defined. This sets the stage for who is responsible for repayment and who is extending credit, minimizing ambiguity from the outset.

Another essential component is the loan amount and terms, such as the principal amount borrowed, the interest rate (which can be either fixed or variable), and the repayment schedule. By outlining these details, both parties understand what is owed and the timeline for repayment. Further, conditions and covenants specify how funds can be used, insurance requirements, and reporting responsibilities which keep both parties accountable.

The lending process simplified

The lending process can seem overwhelming, yet breaking it down into manageable steps can ease the experience. The first step is to assess your financial needs, which involves determining how much to borrow and evaluating your repayment capacity. This crucial step ensures you ask for a realistic amount in line with your financial situation.

Following this, it's essential to shop for lenders. Comparing interest rates and checking lender reviews can help you make informed decisions. Once you've selected a lender, the application process begins, requiring necessary documentation such as income statements and credit histories. Finally, understanding approval and terms will allow you to know what to expect during the approval process and negotiate terms if necessary.

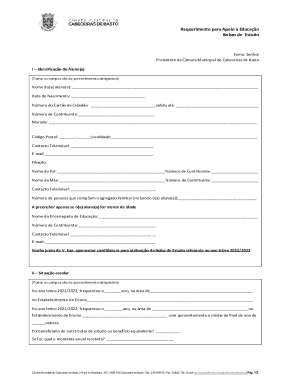

Filling out the loan agreement form

Completing the loan agreement form requires attention to detail. Start by filling in relevant borrower and lender information, ensuring all personal and business details are accurate. Next, specify the loan details, including the principal amount, interest rate, and repayment schedule. Each section of the form must be meticulously completed to avoid complications later on.

Common mistakes include incomplete sections or incorrect personal information, which can negatively affect the transaction. Ensure all parties' signatures are obtained, as this is essential for the agreement's legal validity. Taking the time to double-check the form can prevent potential disputes in the future.

Editing and signing your loan agreement

Once your loan agreement has been drafted, using a tool like pdfFiller can enhance your document management. You can easily upload your loan agreement and utilize the editing tools available to make necessary amendments. The platform provides an intuitive interface, allowing users to add, delete, or modify text with ease.

Electronic signatures are becoming increasingly popular, and pdfFiller offers an efficient way to eSign documents. eSigning provides legal validity and significantly expedites the signing process, allowing all parties to sign from different locations. Following a guided process, you can quickly add your electronic signature, ensuring compliance and security.

Managing your loan agreement post-signing

After signing your loan agreement, managing the document effectively is crucial. Best practices include securely saving and storing your documents in organized digital spaces, such as cloud-based storage solutions. Such practices enhance accessibility, ensuring you can retrieve your agreement whenever necessary.

Monitoring your loan status and repayment involves keeping meticulous records of payment schedules and due dates. This can prevent missed payments and unnecessary penalties. Additionally, being proactive about your financial health opens the door for future refinancing opportunities if your financial status improves, potentially allowing you to secure better loan terms.

Frequently asked questions

Many individuals have questions regarding loan agreements. One of the most common queries is whether loan agreements are legally binding. The answer is yes; once signed, they become enforceable contracts that both parties must abide by. Borrowers often wonder if they can cancel a loan agreement after signing; generally, this is not possible, and it’s crucial to read terms before signing.

Moreover, writing a loan agreement between family members can be a sensitive space. It’s important to approach this with professionalism and detail to avoid damaging relationships. Lastly, some users question whether notarization or a witness is required; this often depends on local laws and the nature of the loan.

Conclusion

Navigating the world of loan agreements can be complex, but with the right information, you can confidently manage your borrowing needs. From understanding different types of loans to filling out the loan agreement form accurately, being informed is your greatest asset. Embracing user-friendly platforms such as pdfFiller can significantly streamline the process, making document management efficient and secure.

Remember, a well-structured loan agreement is not just a piece of paper; it is a critical tool in defining relationships in financial transactions. Equip yourself with knowledge, take advantage of digital solutions, and ensure you’re making the best decisions for your financial future.

Additional forms related to loan agreements

Interactive tools

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in official documents- loan agreement?

How can I edit official documents- loan agreement on a smartphone?

Can I edit official documents- loan agreement on an Android device?

What is official documents- loan agreement?

Who is required to file official documents- loan agreement?

How to fill out official documents- loan agreement?

What is the purpose of official documents- loan agreement?

What information must be reported on official documents- loan agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.