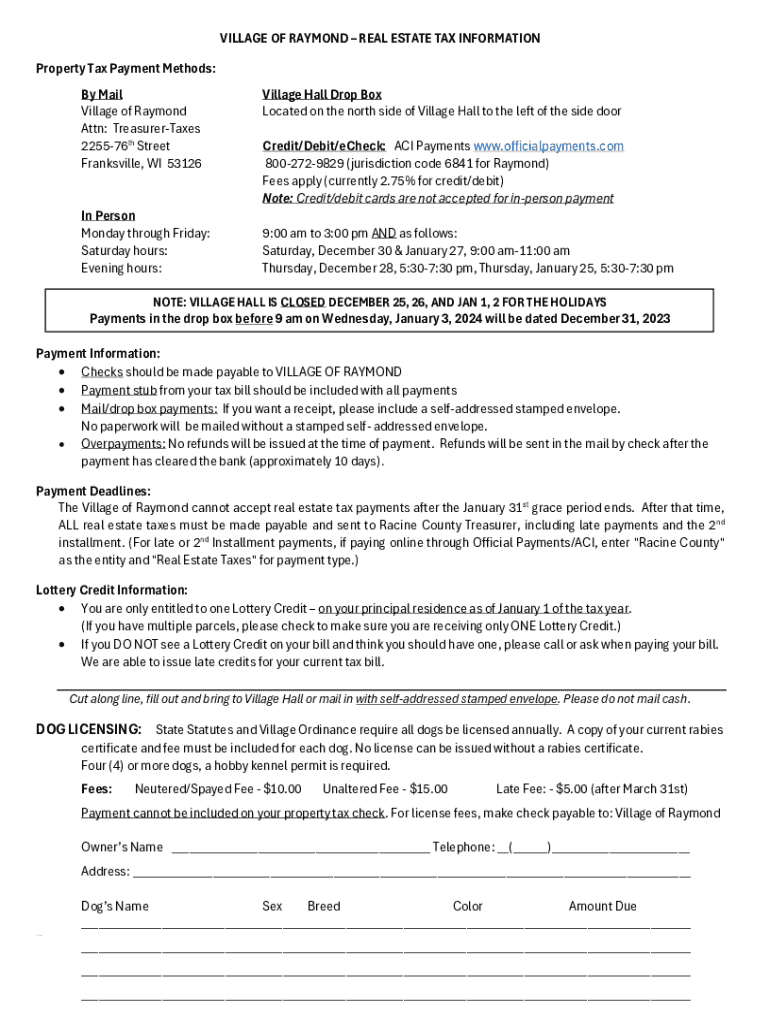

Get the free REAL ESTATE TAX INFORMATION Property Tax Payment ...

Get, Create, Make and Sign real estate tax information

How to edit real estate tax information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out real estate tax information

How to fill out real estate tax information

Who needs real estate tax information?

A comprehensive guide to real estate tax information forms

Understanding real estate tax information

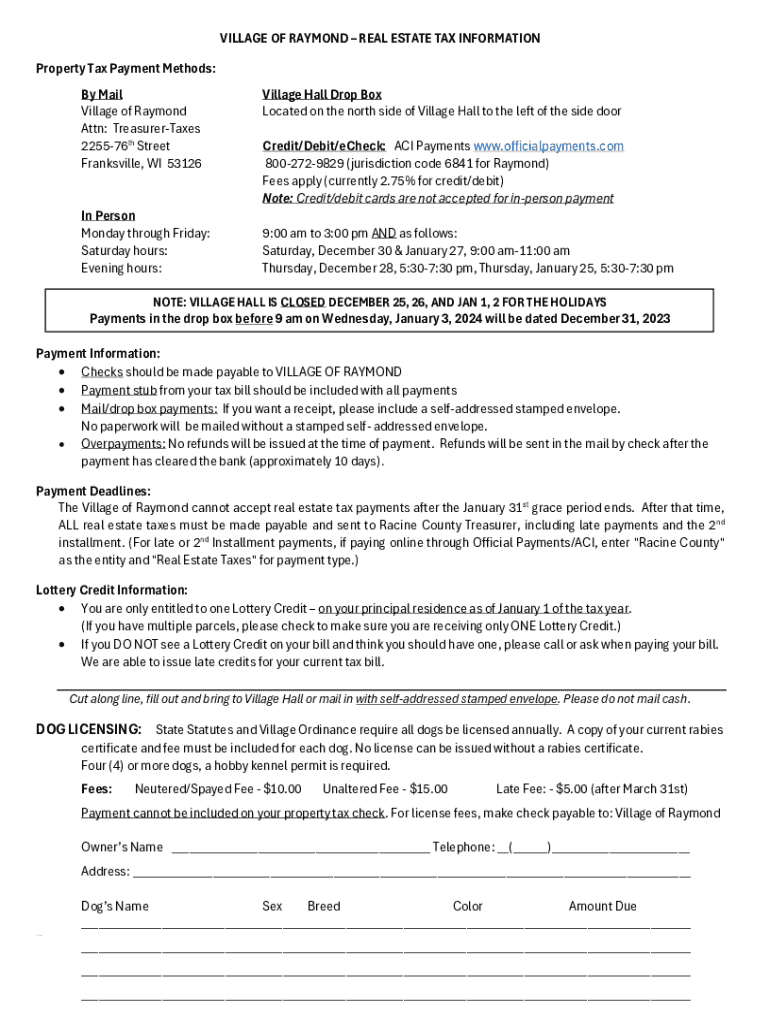

Real estate tax information refers to the detailed documentation and data surrounding the taxation of property. This encompasses various obligations that property owners must fulfill in accordance with state and local regulations. Understanding this information is crucial for property owners as it impacts their financial obligations and potential benefits, such as deductions or exemptions.

Real estate tax obligations vary widely based on property type, ownership structure, and local tax laws. Property owners are primarily responsible for paying property taxes, while government agencies assess these taxes based on property value and usage. Tax professionals often aid in navigating this complex landscape, ensuring individuals and businesses comply with regulations.

Real estate tax information form overview

The real estate tax information form is a crucial document that collects pertinent data regarding property ownership and associated tax liabilities. It serves various purposes, including reporting ownership details, claiming tax benefits, or contesting property assessments that may be deemed excessive.

Anyone involved in property ownership or management typically needs to fill out this form, including individual homeowners, real estate investors, and property management companies. Different types of forms exist, including property tax forms, assessment appeal forms, and exemption applications, catering to specific tax-related needs.

Accessing the real estate tax information form

Accessing the real estate tax information form online is straightforward and typically involves navigating to the relevant governmental tax office website. Most jurisdictions provide downloadable PDF versions that can be filled out digitally or printed for completion.

To find the form, start by visiting your local or state tax authority's website and looking for the 'forms' or 'taxpayer services' section. Specific guidelines may vary based on location, making it essential to identify the proper jurisdiction for accurate forms.

Step-by-step guide to filling out the real estate tax information form

Filling out the real estate tax information form involves several sections, each requiring specific details. The importance of accuracy cannot be overstated, as errors can lead to delays and complications in processing.

Section 1: Personal information

This section requests your name, address, and contact information, ensuring your identity is clearly established. Identification numbers such as your SSN or Tax ID may also be needed depending on local requirements.

Section 2: Property details

Here, detail your property, including the full address, type of property (single-family home, commercial) and size. It's important to specify ownership status, whether it’s held individually, jointly, or as an LLC.

Section 3: Financial information

This section contrasts market value against assessed property value, which is essential for accurate tax calculations. Previous years' property taxes paid may also be requested to establish a historical context.

Section 4: Special circumstances

If you qualify for exemptions or belong to a special assessment area, this information should be detailed. Exemptions can reduce your tax liabilities, so it's crucial to understand and claim them.

Editing, managing, and signing the real estate tax information form

Using pdfFiller for document editing enhances the efficiency of filling in your real estate tax information form. With interactive tools, pdfFiller allows users to insert information directly into the form, checkboxes, and much more.

Collaboration on the form is also made easy through pdfFiller’s platform, permitting sharing with team members or tax professionals for review. Use the comments and feedback feature to ensure that every detail meets your expectations.

eSigning the form

With pdfFiller, signing the form electronically is simple and secure. eSigning eliminates the need for printing, scanning, or faxing, streamlining the process while ensuring document security. The benefits include increased speed, efficiency, and convenience, especially when meeting strict deadlines.

Submitting the real estate tax information form

Submission methods can vary by jurisdiction. Online submission processes are increasingly common, allowing users to upload their forms directly on tax authority websites. Alternatively, you can choose to submit via email or traditional mail. Understanding the requirements for each method is vital.

When submitting your form, carefully note any deadlines pertinent to your submission and payment. If you miss a deadline, take immediate action to contact your local tax office to determine any potential repercussions and remedial steps.

After submission: What happens next?

Once your real estate tax information form is submitted, you should receive confirmation of receipt from the tax authority. This acknowledgment may come via email or physical mail, confirming that your form has been processed.

Processing timelines vary based on the volume of submissions and the specific office's workload. Understanding the assessment process can help you navigate any subsequent steps, especially when you receive assessment notices indicating potential adjustments in your property tax.

Frequently asked questions (FAQs)

As with any bureaucratic process, questions arise frequently. A common concern is what to do if you make a mistake on your form. Generally, it’s advisable to contact the tax office immediately for guidance on correcting the error before the processing of your form.

Another common query relates to appealing the assessment. This process usually involves submitting a formal appeal to your local tax authority, including evidence supporting your claim for a lower assessment, such as recent comparable property sales.

Local tax resources and contacts

Getting in touch with local tax offices is essential for specific guidance tailored to your area. Many local offices offer resources and contact information on their websites, including phone numbers for inquiries. Building a relationship with these offices can facilitate smoother interactions during tax season.

Additionally, utilizing online tools for tax calculations can help streamline the process. Many tax authorities provide calculators for estimating potential taxes based on assessed values, helping you budget appropriately.

Additional tools for managing real estate taxes

Managing real estate taxes can be simplified with online document management tools like those offered by pdfFiller. The cloud-based platform provides users access to interactive forms and collaboration features, essential for property owners and tax professionals alike. Accessibility and organization become effortless with digital document storage.

Security is also enhanced when managing sensitive tax documents online. Importance lies in knowing that your records are protected within a secure online environment, allowing easy retrieval and sharing with pertinent parties.

Insights and updates on real estate tax trends

Staying informed about current trends in real estate taxation can empower property owners and professionals alike. Legislation changes consistently, affecting property taxes and potential exemptions or deductions. For instance, there has been recent interest in legislation aimed at increasing transparency for property valuations, allowing taxpayers to understand better the rationale behind their assessed values.

Reports and resources are available through local and national real estate organizations, which can provide timely updates on relevant tax reforms. Regularly reviewing these sources will ensure owners are well-prepared for upcoming changes.

Getting help and support

When navigating real estate tax complexities, seeking professional assistance can be invaluable. Tax advisors, accountants, and real estate professionals are essential resources for ensuring compliance and optimizing your tax responsibilities.

Additionally, community resources often exist for tax education, helping individuals understand their obligations and entitlements better. User guides, FAQs, and tutorials offered through platforms like pdfFiller can enhance your understanding and streamline your form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find real estate tax information?

How do I execute real estate tax information online?

Can I create an eSignature for the real estate tax information in Gmail?

What is real estate tax information?

Who is required to file real estate tax information?

How to fill out real estate tax information?

What is the purpose of real estate tax information?

What information must be reported on real estate tax information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.