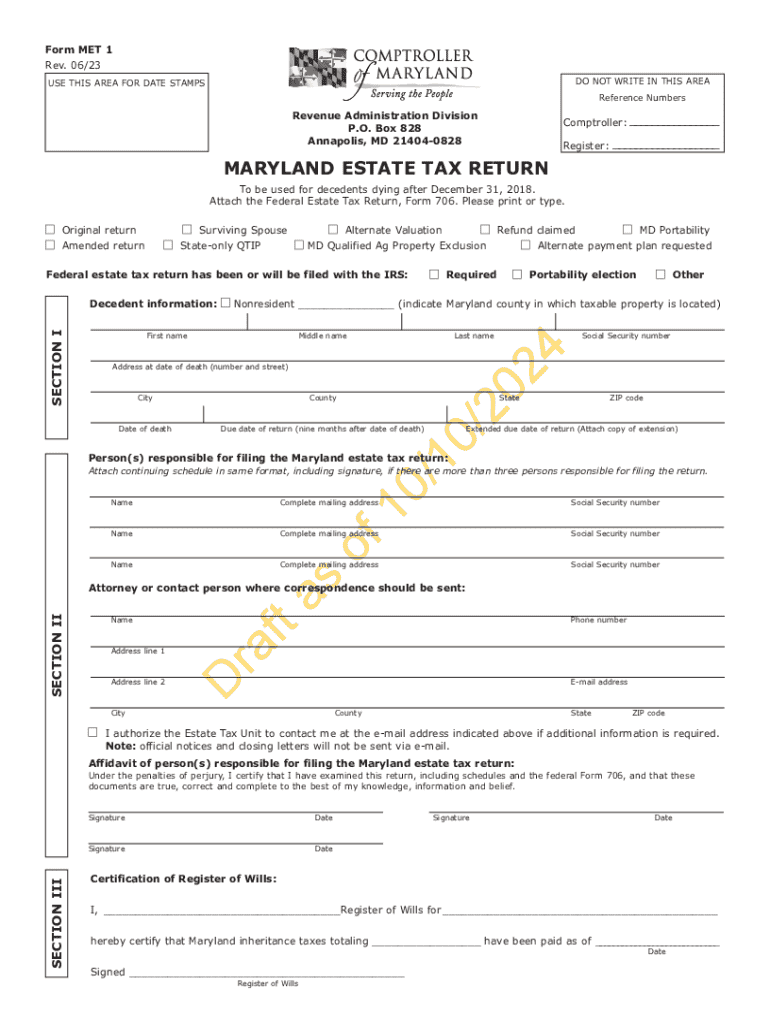

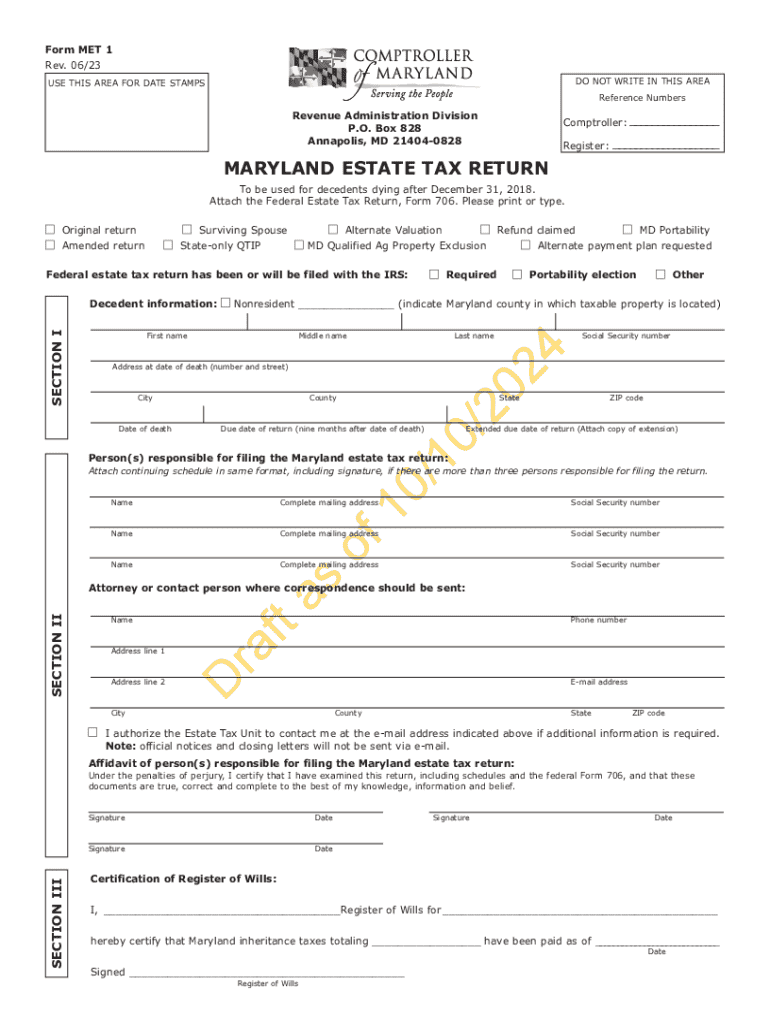

Get the free Tax Year 2023 Form MET 1 Maryland Estate Tax Return

Get, Create, Make and Sign tax year 2023 form

Editing tax year 2023 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax year 2023 form

How to fill out tax year 2023 form

Who needs tax year 2023 form?

Tax Year 2023 Form: A Comprehensive Guide

Overview of tax year 2023 forms

Tax forms for the year 2023 are crucial for ensuring compliance with federal guidelines and maximizing potential refunds. Every taxpayer must be aware of the specifics that pertain to their financial situation. The forms you file directly affect your tax liabilities and refund amounts, making it essential to select the correct documents. Moreover, being mindful of the deadlines for submission and payment can save you from unnecessary penalties and interest.

Types of tax forms for 2023

The diversity of tax forms available for 2023 caters to different taxpayer needs, ensuring all situations are covered. Understanding which form to use is fundamental in preparing for your filing.

Individual income tax forms

The most commonly used form is Form 1040, which has several variations that cater to various income sources and deductions. Taxpayers can also utilize additional schedules to detail specific deductions or types of income. For seniors aged 65 and older, Form 1040-SR is tailored to accommodate their unique tax circumstances.

Business tax forms

Small business owners will typically file Form 1120 for corporations or Form 1065 for partnerships. Self-employed individuals report their earnings through Schedule C attached to their personal return. Understanding these forms and correctly categorizing your business type will simplify your filing process.

Specialized forms and schedules

Many taxpayers may qualify for education-related deductions or credits owed to energy-efficient home improvements. Familiarizing yourself with forms like Form 8863 for education credits or Form 5695 for residential energy credits can be advantageous.

How to obtain tax year 2023 forms

Accessing the necessary forms for your tax preparation is straightforward. The IRS provides a wealth of resources directly on their website, allowing taxpayers to download the most current forms. Furthermore, don’t overlook the importance of state-specific forms, as they can vary significantly from federal requirements.

For an even more streamlined approach, pdfFiller’s platform offers a user-friendly interface where you can find, manage, and edit all necessary forms without hassle. This ensures that you can keep your documents organized and accessible from anywhere.

Step-by-step instructions for filling out tax year 2023 forms

Completing your tax forms accurately is essential for avoiding audits and maintaining compliance. When filling out your forms, always provide clear, correct information and gather supporting documentation, such as W-2s, 1099s, and other income statements.

General guidelines for completing tax forms

Common mistakes can lead to significant delays in processing or even audits. Double-check your math and verify that all personal information is up to date. Also, don’t forget to sign and date your forms.

Detailed guide for Form 1040

For Form 1040, each line corresponds to specific information regarding your income, adjustments, and deductions. Take note of key lines where you report wages, interest income, and any deductions for student loan interest or retirement contributions. Maximizing deductions requires a keen understanding of what qualifies; maintaining proper documentation throughout the year simplifies this process.

Instructions for additional schedules and forms

Self-employed individuals should be meticulous when filling out Schedule C, as this includes details on income and expenses directly related to their business. When reporting investment income via Schedule D, ensure that you account for any capital gains or losses, as this can significantly impact your taxable income.

Editing and managing your tax forms with pdfFiller

Utilizing pdfFiller offers users customizable tools to manage their tax documents effectively. Whether you need to adjust a form, add signatures, or collaborate with tax professionals, pdfFiller makes it easy from start to finish.

Using interactive tools for form customization

You can edit PDFs online using simple tools. Add in necessary information, use interactive checkboxes, and more. Collaborating with tax advisors through this platform is seamless, enabling real-time updates and discussions, ensuring your document is always accurate.

Saving and organizing your tax documents

Managing your tax documents effectively means implementing a solid organizational system. Use cloud storage options for your forms to ensure they are easily accessible, secure, and properly backed up. This way, you can avoid last-minute scrambles when information is needed.

Filing your tax year 2023 forms

Deciding how to file your forms can affect processing time and refund speed. You have the choice between e-filing and traditional paper filing. eFiling through platforms like pdfFiller is often quicker and includes checks for errors that may prevent rejections.

What to do after filing

Once you've filed your forms, it's essential to track your refund status through the IRS website. An understanding of how to correct any errors is equally important; utilizing Form 1040-X for amendments allows you to rectify mistakes swiftly and avoid complications.

Getting assistance with your tax year 2023 forms

Navigating the complexities of tax forms can be daunting. Seek professional tax help if you're facing unique situations. Many qualified preparers offer assistance, and pdfFiller also provides support for form-related inquiries, streamlining the process of finding solutions.

Utilizing IRS assistance

The IRS offers taxpayer advocate services for those needing support. Engaging with these resources can provide additional guidance tailored to your specific tax circumstances.

Frequently asked questions (FAQs) about tax year 2023 forms

Many taxpayers wonder about changes from the previous tax year. Staying informed about updates in tax regulations helps in understanding new opportunities for deductions and credits. Also addressing concerns around unique scenarios, like handling international income or income from side-gig jobs, is vital.

Navigating tax situations related to recent changes

Tax legislation has evolved significantly, with several new credits and relief measures introduced recently. Understanding how these laws impact your filing, including any pandemic-related provisions, can potentially benefit you financially.

Explore related content

To deepen your understanding of tax year 2023 forms, explore additional resources on the pdfFiller platform. Whether you need tools, guides, or links to relevant publications, the platform serves as a comprehensive hub for all your document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax year 2023 form directly from Gmail?

How can I get tax year 2023 form?

How do I complete tax year 2023 form online?

What is tax year 2023 form?

Who is required to file tax year 2023 form?

How to fill out tax year 2023 form?

What is the purpose of tax year 2023 form?

What information must be reported on tax year 2023 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.