Get the free HUD 4155.1, Mortgage Credit Analysis for ...

Get, Create, Make and Sign hud 41551 mortgage credit

Editing hud 41551 mortgage credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hud 41551 mortgage credit

How to fill out hud 41551 mortgage credit

Who needs hud 41551 mortgage credit?

HUD 41551 Mortgage Credit Form: A Comprehensive How-to Guide

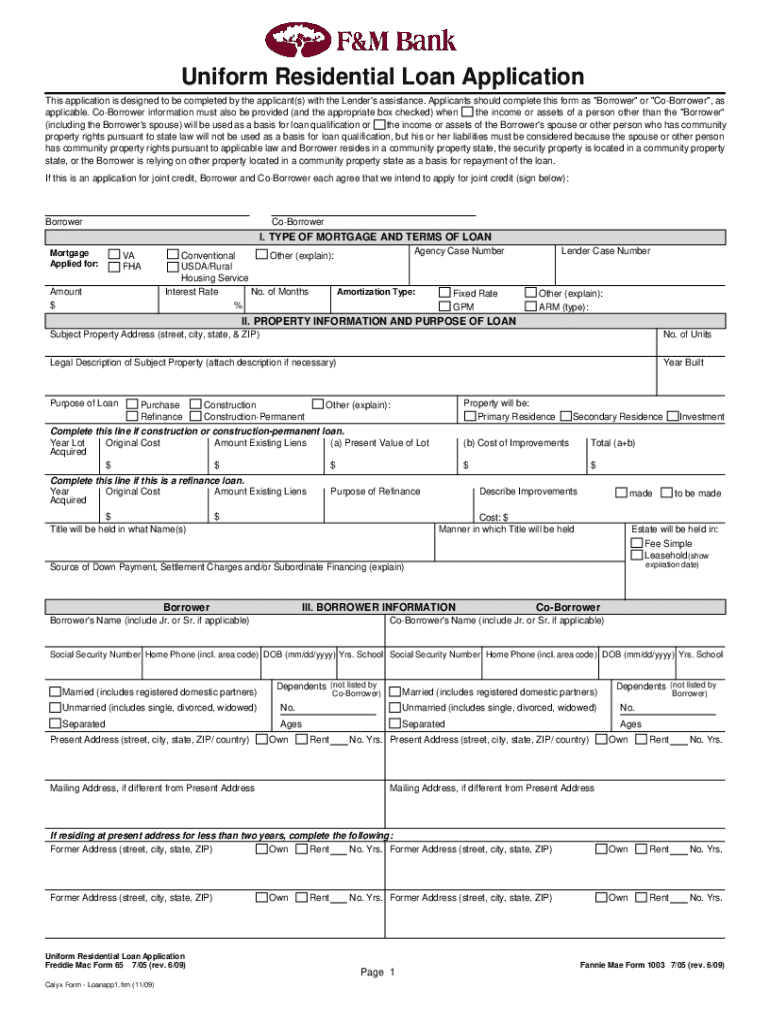

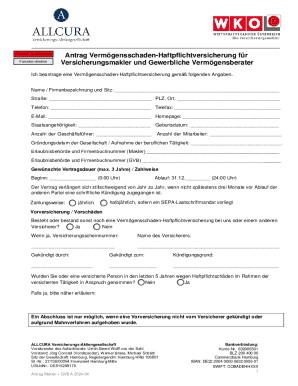

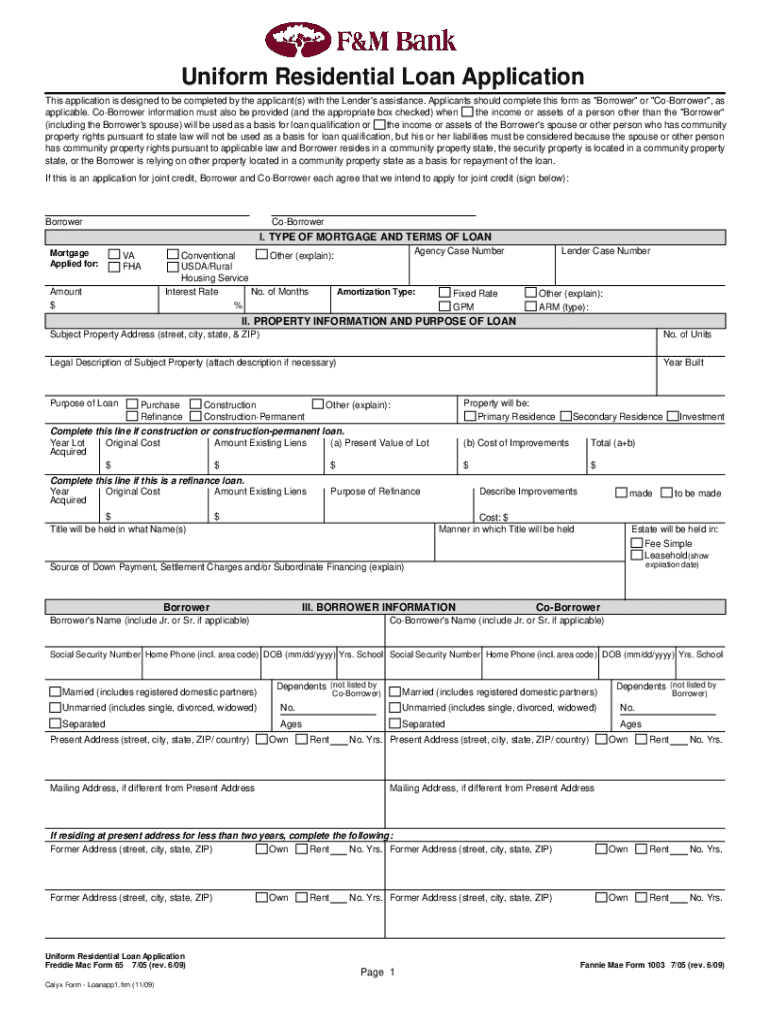

Overview of the HUD 41551 Mortgage Credit Form

The HUD 41551 Mortgage Credit Form is an essential document in the mortgage application process aimed at assessing a borrower’s creditworthiness. This form plays a fundamental role in evaluating the financial stability and eligibility of individuals seeking to secure a home loan. Lenders utilize the information compiled in this form to make informed decisions about approving or denying mortgage applications.

Accurate credit assessments through this form help streamline the mortgage process, ensuring that borrowers are fit for the loans they are applying for. By utilizing the HUD 41551, both borrowers and lenders can benefit; borrowers can have a clearer picture of their financial standing while lenders minimize the risk associated with lending.

Understanding the components of the HUD 41551 form

The HUD 41551 form is divided into specific sections, each designed to capture vital data that contribute to a robust credit assessment. Broadly, the form includes sections that gather personal details, income and employment information, credit history assessments, and existing debts. Understanding these components is crucial for accurate completion and enhances the likelihood of loan approval.

Each section serves a specific function and provides lenders with the necessary insights to make a well-informed decision regarding a mortgage application. An accurate portrayal of these components is crucial in determining the eligibility of the borrower.

Step-by-step instructions for completing the HUD 41551 form

Completing the HUD 41551 form can be a straightforward process if you follow these structured steps. Start by gathering all necessary documentation as this will ensure efficient completion of the form.

By systematically following these steps, borrowers can ensure they accurately complete the HUD 41551 Mortgage Credit Form, thereby enhancing their prospects for mortgage approval.

Common mistakes to avoid when using the HUD 41551 form

Even a minor error on the HUD 41551 form can delay the mortgage approval process or even result in denial. Common mistakes often include incorrect personal information, miscalculation of income or debts, and failure to include necessary documentation.

Each of these errors significantly impacts the mortgage application process. By recognizing these potential pitfalls and staying vigilant, borrowers can mitigate inaccuracies that could hinder their application.

Tools and resources for completing the HUD 41551 form

Utilizing tools like pdfFiller can significantly streamline the process of completing the HUD 41551 form. This platform allows users to fill out forms digitally, ensuring that all details are correctly entered without the hassle of paper documentation.

By incorporating these tools, borrowers can fill out the HUD 41551 form with greater confidence and accuracy, ultimately aiming for a favorable outcome on their mortgage applications.

Frequently asked questions (FAQs) about the HUD 41551 form

Navigating the HUD 41551 form can raise various questions. Here are some of the most frequently asked to help clarify any uncertainties.

Having clear answers to these questions equips borrowers with the knowledge needed to navigate the HUD 41551 form efficiently.

The role of collaboration in completing the HUD 41551 form

Completing the HUD 41551 form isn't just a solo effort; effective collaboration can often lead to more accurate submissions. Borrowers may need assistance from others, such as family members, lenders, or financial advisors.

By leveraging collaboration through tools like pdfFiller, teams can enhance their efficiency and ensure that all submissions meet lender expectations.

Next steps after completing the HUD 41551 form

After diligently filling out the HUD 41551 form, the next steps involve submission and preparing for the lender's review process. It’s imperative to follow the instructions set forth by the lender regarding how and where to submit the completed form.

By being prepared for these next steps, borrowers can ensure an efficient process while applying for mortgage loans using the HUD 41551 form.

Case studies: Successful use of the HUD 41551 form

Real-life examples showcase the impact of well-completed HUD 41551 forms on mortgage approvals. Many borrowers have shared their success stories stemming from an organized approach to filling out the form.

These case studies illustrate the significance of accuracy, preparation, and team effort in leveraging the HUD 41551 form for successful mortgage lending.

Staying organized and informed

Effective management of mortgage-related documentation ensures preparedness for any stage in the mortgage application process. Keeping personal records organized will facilitate smoother interactions with lenders.

Staying organized and educated via the right tools will empower you as a mortgage applicant, providing clarity during the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find hud 41551 mortgage credit?

How do I edit hud 41551 mortgage credit in Chrome?

How do I complete hud 41551 mortgage credit on an Android device?

What is hud 41551 mortgage credit?

Who is required to file hud 41551 mortgage credit?

How to fill out hud 41551 mortgage credit?

What is the purpose of hud 41551 mortgage credit?

What information must be reported on hud 41551 mortgage credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.