Get the free 2023 State Tax Rate Submission.xlsx

Get, Create, Make and Sign 2023 state tax rate

How to edit 2023 state tax rate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 state tax rate

How to fill out 2023 state tax rate

Who needs 2023 state tax rate?

Navigating Your 2023 State Tax Rate Form: A Comprehensive Guide

Understanding state tax rates

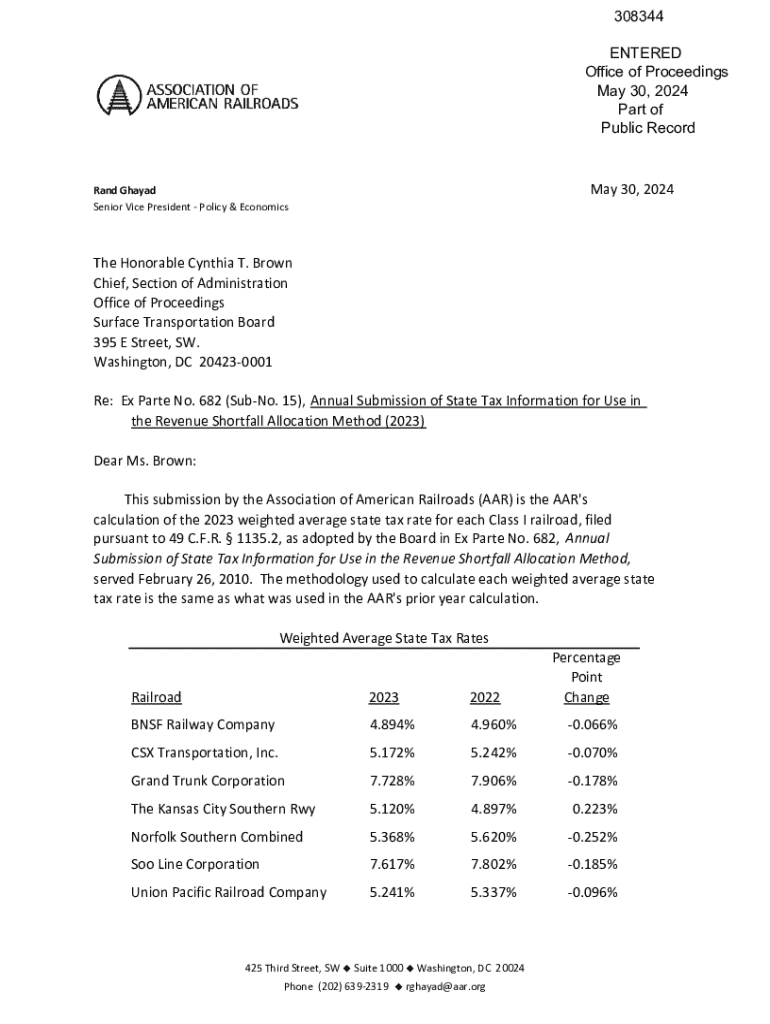

State tax rates can vary significantly from one state to another, affecting how much tax individuals and businesses owe. Each state has the autonomy to set its tax rates and regulations. Knowing your state tax rate is critical, not just for compliance but also for effective financial planning. Understanding these rates can empower you to make informed decisions about your income, potential deductions, and future investments.

For individuals, state tax rates are crucial as they directly affect take-home pay, savings, and overall financial health. Furthermore, different tax brackets within each state may impact how much you owe as your income changes. This means that staying updated on state tax rates, especially in 2023, can lead to significant financial advantages.

2023 state individual income tax rates and brackets

In 2023, individual income tax rates across the United States present a patchwork of brackets that reflect diverse state policies. For instance, while states like California and New Jersey showcase some of the highest tax rates, others like Florida and Texas impose no state income tax at all. Understanding these brackets is important for maximizing tax efficiency.

Income thresholds determining these rates can differ widely, hinging on personal circumstances such as filing status and eligible deductions. Residents in higher tax states may face marginal rates exceeding 10%, while those in no-income-tax states benefit from considerable savings, allowing for better financial development.

State tax forms overview

State tax forms can be categorized into several types including income tax forms, property tax forms, and sales tax forms. Understanding which form you need is essential to ensure compliance and avoid issues with state tax authorities. For instance, if you're filing your individual income tax, you'll need to focus on your specific state’s income tax form, which may differ in design and requirements dramatically from that of your neighbor's state.

To efficiently select the required state tax form, taxpayers can utilize online tools that guide them based on their state of residence and tax situation. These interactive tools can significantly simplify the process, directing users to the relevant forms they need to complete for their specific circumstances.

Step-by-step guide to completing the 2023 state tax rate form

Filling out your 2023 state tax rate form requires a systematic approach to avoid errors and ensure comprehensive reporting. Start by gathering personal information, including social security numbers and addresses, along with details of all income sources. It’s essential to not overlook possible deductions and credits applicable to your situation, as these can significantly reduce your tax burden.

Once you have all necessary information, begin filling out the form section by section. It is crucial to read guidelines carefully and input information accurately. Avoiding common mistakes, such as miscalculating income or failing to claim eligible credits, can save time and prevent potential audits.

Edits and electronic signatures

With the rise of digital documentation, utilizing tools like pdfFiller can streamline the process of editing your tax forms. pdfFiller offers versatile editing tools that allow users to make necessary changes, collaborate with others, and add electronic signatures seamlessly. These modern conveniences are crucial for individuals and teams looking to manage their tax compliance efficiently.

Collaboration features are especially valuable for teams that may need to review documents collectively. With pdfFiller, members can provide input on tax forms without compromising security or the integrity of the documents. This collaborative environment can simplify the tax preparation process significantly.

Submitting your 2023 state tax rate form

Once your 2023 state tax rate form is complete, the next step is submission. Depending on your state, there may be multiple options for submitting your form, such as online platforms, through the mail, or even in-person at a tax office. Understanding your state’s specific submission process is critical to ensure timely compliance.

It's important to be aware of submission deadlines as failing to meet them may result in penalties. After submission, tracking your submission status is advisable to confirm that it has been received and is being processed correctly.

Managing state tax documentation

Proper management of tax documentation is essential for a smooth filing process. Keeping tax-related documents organized will not only help during tax season but will also prepare you for any audits. Utilize tools like pdfFiller to store and manage your documents effectively in the cloud.

With pdfFiller's document organization features, users can maintain a clutter-free digital workspace that encompasses all necessary forms and records, ensuring that nothing gets lost in the shuffle. This effort also aids in staying prepared for future tax cycles.

Frequently asked questions (FAQs)

Filling out state tax forms often leads to common queries. One such query includes how to address mistakes post-filing. It’s vital to know that if you discover an error after submission, you can typically file an amended return to correct any inaccuracies. Additionally, using tools like pdfFiller can simplify the management and real-time editing of your tax forms.

Another common issue relates to the challenges faced when determining which forms are necessary. These can usually be resolved using the interactive tools provided on pdfFiller that guide you based on state-specific criteria, ensuring a worry-free filing process.

Latest updates on state tax policies for 2023

Keeping abreast of the latest changes in state tax policies is crucial for an informed filing process. In 2023, various states have updated their tax laws, which could affect both tax rates and the forms you need to fill out. Some states may introduce new deductions, while others might alter tax brackets or phases out certain tax credits.

Staying informed about these changes often involves following government announcements or subscribing to tax news from reliable resources. Adopting a proactive approach to these updates ensures you are always equipped with the most accurate and beneficial information.

Interactive resources and tools

When preparing to fill out your 2023 state tax rate form, leveraging interactive resources can greatly enhance your experience. Utilizing tools like tax rate comparison tools can help you gauge your potential tax implications and make informed financial decisions. Moreover, the template library at pdfFiller provides a range of state tax forms tailored to suit the individual preferences of users.

These resources not only ease the preparation process, but they also encourage efficient document management through templates that are easy to navigate. For personalized assistance, consider scheduling a consultation with tax professionals who can guide you through complex situations and offer tailored advice.

Engaging with state tax updates

Engagement with tax policy updates is vital for anyone navigating the financial landscape effectively. This means subscribing to newsletters, utilizing financial blogs, and following reliable tax-related resources can align your knowledge with the latest state tax developments. Being proactive about engaging with these updates enables taxpayers to optimize their financial strategies and stay compliant.

Particularly, pdfFiller has committed to keeping its user base informed about legislative changes to tax forms and state tax policies. Being subscribed to such updates provides a core advantage in anticipating tax season requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2023 state tax rate without leaving Google Drive?

How can I get 2023 state tax rate?

Can I create an electronic signature for signing my 2023 state tax rate in Gmail?

What is 2023 state tax rate?

Who is required to file 2023 state tax rate?

How to fill out 2023 state tax rate?

What is the purpose of 2023 state tax rate?

What information must be reported on 2023 state tax rate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.