Get the free 7F rev

Get, Create, Make and Sign 7f rev

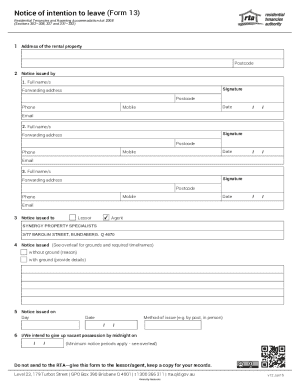

Editing 7f rev online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 7f rev

How to fill out 7f rev

Who needs 7f rev?

7f Rev Form: A Comprehensive How-To Guide

Understanding the 7f Rev Form

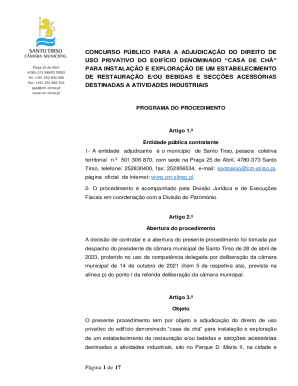

The 7f Rev Form is a crucial document often utilized in specific sectors such as taxation and finance. It serves as a declaration or acknowledgment that is essential in various transactions, allowing for a standardized way to collect necessary information.

This form plays an important role for professionals dealing with financial disclosures or tax filings. By understanding the 7f Rev Form, individuals and businesses can ensure they comply with relevant regulations and keep their financial documentation in order.

Who should use the 7f Rev Form?

The 7f Rev Form is particularly relevant for tax professionals, finance teams, and small business owners. Those involved within tax preparation, financial accounting, or regulatory compliance will find this form particularly useful.

For example, a small business owner preparing their annual tax return may need to utilize this form to report their financials accurately. Similarly, accountants managing multiple clients' tax affairs can find it beneficial for ensuring consistent information presentation.

Accessing the 7f Rev Form

Finding the 7f Rev Form is straightforward, particularly through official channels and document management platforms like pdfFiller. Users can download the latest version directly from government websites or access it through online document management systems for convenience.

Utilizing pdfFiller ensures you have the most up-to-date version of the 7f Rev Form, complete with the latest updates that might not be reflected on older PDF documents circulating in the industry.

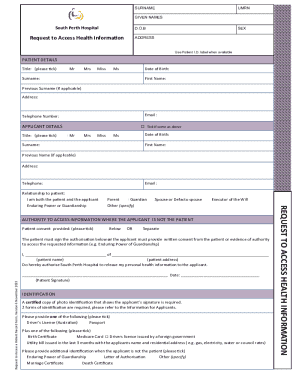

Filling out the 7f Rev Form

Completing the 7f Rev Form effectively can prevent delays in processing. Each section requires attention to detail, ensuring accuracy in provided information. Steps to fill out the form include reviewing the sections carefully, entering data accurately, and seeking clarification if needed.

It's advisable to utilize interactive features like those available on pdfFiller. The platform allows pre-filling data from previous forms, which can significantly reduce errors and streamline the process.

Editing the 7f Rev Form

Editing your 7f Rev Form can be done easily using pdfFiller’s intuitive tools. If you've made a mistake or need to update information post-submission, the platform allows users to edit documents collaboratively, ensuring efficient workflows.

To edit your form, simply upload it to pdfFiller, make the necessary adjustments, and use the review features to guarantee data accuracy before finalizing it.

Signing the 7f Rev Form

E-signing the 7f Rev Form through pdfFiller adds convenience and efficiency to document processing. Electronic signatures are legally recognized, making them a reliable alternative to handwritten signatures.

To eSign, you simply need to follow the platform's straightforward steps to add your digital signature, ensuring that the necessary legal considerations are met.

Managing your 7f Rev Form

Once the 7f Rev Form is filled out, effective document management becomes essential. Utilizing cloud storage solutions such as pdfFiller not only secures your documents but also allows easy retrieval and organization.

Best practices include categorizing forms, using labeled folders, and employing search functions to navigate efficiently between documents.

Troubleshooting common issues with the 7f Rev Form

Common errors when filling out the 7f Rev Form often stem from misreading instructions or incorrect data entry. Awareness of these frequent mistakes can lead to smoother document processing and fewer delays.

If you encounter technical issues while using pdfFiller, the platform offers robust support tools that can assist in resolving issues quickly, ensuring you can focus on your main tasks.

Alternative forms and options

While the 7f Rev Form serves a specific purpose, other related forms might be relevant depending on your needs, such as forms for different financial disclosures or tax documents. Exploring alternatives can provide added context or fulfill specific requirements.

pdfFiller offers a vast array of templates and document creation solutions that cater to various needs, empowering users to choose the right form for their situation.

Best practices for using the 7f Rev Form effectively

Maximizing efficiency with the 7f Rev Form involves strategic approaches to document management and collaboration. Utilize the features in pdfFiller not only for filling out forms but also for streamlining teamwork. Efficient practices can save time and minimize errors.

Collaboration tips include keeping all stakeholders informed through shared access and tracked changes, allowing for real-time updates and feedback.

Frequently asked questions (FAQs)

Understanding the 7f Rev Form may evoke several questions. Common queries often relate to the required information, submission deadlines, or best practices for completion. Addressing these common concerns can further clarify the practical usage of the form.

Additionally, user feedback can provide insight into specific scenarios where the form is applied, helping to refine the guidance provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 7f rev directly from Gmail?

Can I sign the 7f rev electronically in Chrome?

How do I complete 7f rev on an Android device?

What is 7f rev?

Who is required to file 7f rev?

How to fill out 7f rev?

What is the purpose of 7f rev?

What information must be reported on 7f rev?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.