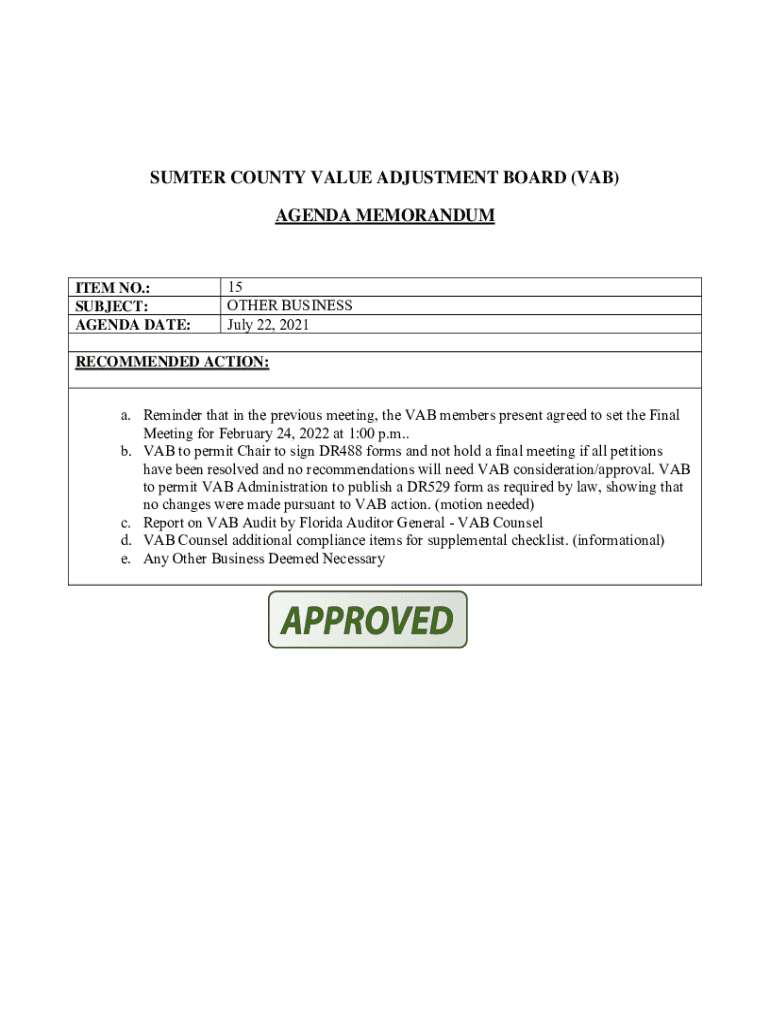

Get the free Value Adjustment BoardSumter County, FL

Get, Create, Make and Sign value adjustment boardsumter county

Editing value adjustment boardsumter county online

Uncompromising security for your PDF editing and eSignature needs

How to fill out value adjustment boardsumter county

How to fill out value adjustment boardsumter county

Who needs value adjustment boardsumter county?

Value Adjustment Board in Sumter County: A Comprehensive Guide to the Form Process

Understanding Value Adjustment Boards in Sumter County

Value Adjustment Boards (VAB) serve a pivotal role in ensuring fairness in property tax assessments in Sumter County. These boards are established by law to provide a mechanism for property owners to appeal against property valuation decisions made by local property appraisers. The main purpose of VAB is to guarantee that property tax assessments are accurate and just, allowing property owners an opportunity to rectify disparities in valuations.

In Sumter County, the VAB conducts hearings where property owners can present their cases, bringing transparency to the tax process. Their importance cannot be overstated: inaccuracies in property taxation can lead to significant financial burdens. Understanding how VAB operates within Sumter is crucial for anyone looking to contest their property tax valuation.

Overview of the Value Adjustment Board Process

The process of appealing through the Value Adjustment Board in Sumter County involves several key steps. It begins with the filing of a formal application, which must be carefully completed and submitted by a specific deadline, typically within 25 days after the property tax assessment notice is mailed.

Following the submission, the board reviews the application, leading to a hearing where evidence can be presented. Each of these steps plays a vital role in ensuring a systematic approach to property valuation disputes. Here's a detailed breakdown of each stage:

Typically, this entire process can span several weeks, depending on the volume of applications and the scheduling of hearings.

Essential forms and documentation

Successfully navigating the Value Adjustment Board process in Sumter County requires specific forms and supporting documentation. Some essential forms include the Application Form for Value Adjustment and a detailed Supporting Documentation Checklist to substantiate your appeal.

These documents are integral to the process, ensuring your appeal is considered comprehensive and well-supported. You can easily access and download these forms from pdfFiller, a platform that streamlines document management and completion.

Filling out the Value Adjustment Board form

Completing the Value Adjustment Board form accurately is essential for the success of your appeal. Each section of the application requires careful attention to detail. Here is a breakdown of the critical sections of the form:

Tips for ensuring accuracy and completeness include double-checking your figures, ensuring all information is current, and submitting all required documentation together.

Editing and managing your Value Adjustment Board form

Utilizing pdfFiller's editing tools can significantly enhance your experience while completing the Value Adjustment Board form. The platform allows you to make immediate adjustments and corrections, ensuring that your form is accurate before submission.

Once your form is complete, pdfFiller provides options to save and store your documents securely in the cloud. This feature makes it easy to access your completed forms whenever needed. Moreover, collaboration is made simple; you can share your forms with others, allowing for reviews or input from advisors or family members.

eSigning the Value Adjustment Board form

The eSigning process for the Value Adjustment Board form streamlines the submission and adds a layer of convenience. In Florida, eSignatures hold legal validity, providing assurance that your signed documents are recognized by authorities.

Here's a step-by-step guide to eSigning your Value Adjustment Board form using pdfFiller:

Following these steps ensures your form is signed quickly and efficiently, ready for submission.

FAQs about the Value Adjustment Board process

Navigating the value adjustment board process can be challenging, so it's common for property owners to have questions. Some frequently asked questions include: What happens if my application is denied? Can I appeal again? What evidence is most compelling?

Clarifying misconceptions about the VAB is equally important. For instance, many believe that the process is lengthy and convoluted, but when properly approached, it can be quite straightforward. A robust resource for further information is the Sumter County VAB’s official website, where prospective applicants can find answers to many common inquiries.

Additional services offered by pdfFiller

pdfFiller goes beyond just handling value adjustment board forms. The platform offers a variety of services for streamlining other administrative processes, from tax forms to contracts.

Integration with other tools and platforms can enhance productivity, while dedicated customer support options are available to assist users with any inquiries about the platform, ensuring a seamless experience.

Success stories from Sumter County residents

Many residents of Sumter County have successfully navigated the VAB process, resulting in fairer property tax assessments. Testimonials often highlight the effectiveness of presenting thorough evidence and staying persistent during the process.

Case studies reveal that timely appeals and comprehensive documentation notably increase the chance of favorable outcomes. These success stories serve not only as inspiration but also as a testament to the importance of understanding the VAB process.

Quick links for further assistance

For those looking to access the Value Adjustment Board process resources quickly, a few useful links include:

Connecting with other resources

It's important to recognize the various entities involved in local property tax management. Related departments such as the County Finance Office, Property Appraisers, and Tax Collector Offices all play a role in the overall taxation framework.

Links to additional resources, such as forms designed specifically for agricultural or classified-use property, can further assist property owners in navigating their responsibilities and rights.

Unique features of pdfFiller’s platform

What sets pdfFiller apart is its cloud-based advantages for document management. This platform allows users to edit and manage their documents effortlessly, ensuring that all necessary forms are easily accessible from anywhere.

The seamless user experience caters to individuals and teams, while robust security measures provide peace of mind that your sensitive documents are handled appropriately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete value adjustment boardsumter county online?

How do I edit value adjustment boardsumter county online?

How do I edit value adjustment boardsumter county on an iOS device?

What is value adjustment board Sumter County?

Who is required to file value adjustment board Sumter County?

How to fill out value adjustment board Sumter County?

What is the purpose of value adjustment board Sumter County?

What information must be reported on value adjustment board Sumter County?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.