Get the free Non-Tax Filing Statement -Student - 2024-2025. ...

Get, Create, Make and Sign non-tax filing statement -student

How to edit non-tax filing statement -student online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-tax filing statement -student

How to fill out non-tax filing statement -student

Who needs non-tax filing statement -student?

Understanding the Non-Tax Filing Statement - Student Form

. Understanding the Non-Tax Filing Statement - Student Form

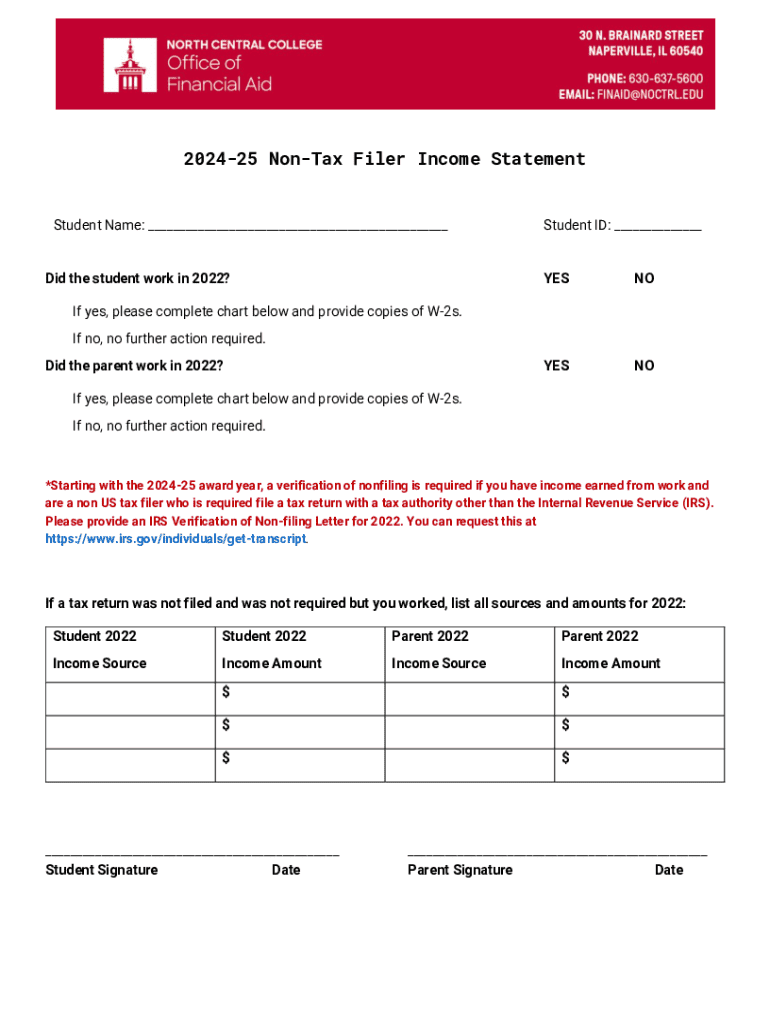

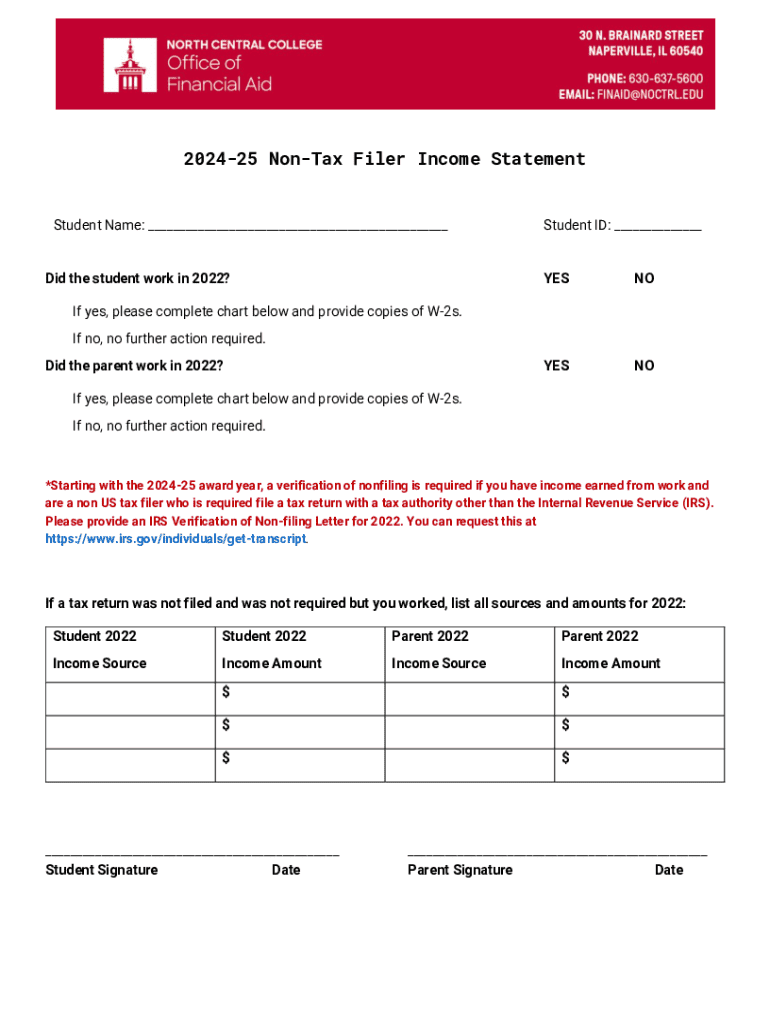

A non-tax filing statement is an essential form that students may need to complete to report their financial situation when they have not filed a federal or state tax return. This document is crucial in educational contexts, especially for students applying for financial aid.

The primary purpose of the non-tax filing statement is to verify the income and household situation of students who cannot provide tax returns. Schools, particularly those participating in federal financial aid programs, utilize this statement to determine eligibility for grants and scholarships.

One key difference between a non-tax filing statement and a tax filing statement is that the former caters specifically to students or individuals who do not meet the income threshold for tax filing. In contrast, a tax filing statement is used by individuals who earn income above the specified limits and must report it to the IRS.

. Who Needs a Non-Tax Filing Statement?

Students who do not earn enough income to require tax filings typically need to complete this statement. Eligibility criteria may vary, but generally, it includes guidelines set by federal and state financial aid programs.

Situations that may require submission of a non-tax filing statement include applying for financial aid at colleges or universities, particularly for students who are considered dependents or who fit the low-income definition established by the government.

. Detailed Overview of the Form

The non-tax filing statement typically consists of several key sections, each capturing essential information. Students will need to provide their identifying information, income details, and household information.

The first section requires identifying information, including names, addresses, and Social Security numbers. Next, students must report any income received during the tax year, such as wages, scholarships, or other support. Lastly, the household section collects information about the number of people living in the same house and their respective financial statuses.

Common terms used in the statement may include Adjusted Gross Income (AGI), which represents the total income minus specific deductions, and household size, indicating the number of individuals who contribute to and depend on the financial resources of the household.

Frequently asked questions often arise regarding the completion and necessity of the form, including who qualifies as a dependent and how to accurately report household income.

. How to Fill Out the Non-Tax Filing Statement - Student Form

Filling out the non-tax filing statement requires careful attention to detail. Start by gathering necessary documents, such as income statements and any financial aid correspondence that supports your application for financial aid.

Next, begin completing each section of the form. Be thorough with your personal and income information, and ensure that your household details reflect your current living situation accurately. After finishing, review all information to ensure its accuracy and completeness before submission.

Special considerations may apply for non-United States citizens or for students working multiple jobs. Ensure you understand the definitions of income based on your status and how to report it accurately.

. Tips and Best Practices for Submitting the Form

When submitting the non-tax filing statement, it's essential to choose the right method. Some institutions allow for online submissions, which can be convenient and quick. For mail-in options, properly prepare your envelope, ensuring that it reaches the designated office timely.

Tracking your submission is also crucial. Maintain records and contact points for confirmation, and inquire about expected response times to manage your financial planning effectively.

If you submit physically, consider tracking your mail or requesting a delivery receipt. Understanding the submission timeline can help reduce anxiety about the application process.

. Interactive Tools and Resources on pdfFiller

pdfFiller provides users with several tools to make the completion of the non-tax filing statement easier. One helpful feature allows users to fill out forms online, making it accessible from anywhere.

To enhance accessibility, pdfFiller offers templates for consistent submissions, along with eSigning features that allow for secure document signing without the need for paper.

Through collaboration tools, students can share forms with advisors and receive real-time feedback, streamlining the process of completing their non-tax filing statement.

. Navigating challenges and common pitfalls

Common errors in the completion of the non-tax filing statement often arise from missing information or mismatched income reports. Identifying these potential pitfalls before submitting your form can help avoid delays in processing.

If issues do arise, knowing how to seek help can save time. Contacting support resources provided by your educational institution or the platform you used for submission is crucial. Transparently explaining your situation can lead to faster resolutions.

In cases where challenges persist, exploring alternative submission methods might be necessary. Keep open lines of communication with administrative offices to facilitate a smooth resolution.

. Additional forms and related documents

In conjunction with the non-tax filing statement, students may need to familiarize themselves with other vital documents such as the Federal Application for Financial Student Aid (FAFSA) and potential verification documents. Understanding these forms ensures a comprehensive approach when applying for financial aid.

Gathering and understanding these forms can streamline the financial aid application process, making it more manageable for students.

. Language assistance and support

For non-English speakers, there are numerous resources available to assist in navigating the non-tax filing statement and related documents. Schools often provide language assistance services, and pdfFiller has helpful tools for multilingual support.

Students should not hesitate to reach out to their institution's support services for further clarification and assistance with language-specific concerns.

. Engaging with the community

Participating in forums and discussion groups can be incredibly beneficial for students navigating the non-tax filing statement process. Engaging with peers and professionals allows for shared experiences and best practices.

As students exchange tips and insights, they can build a more robust understanding of the submission process and explore practical solutions to common issues. Utilizing these community resources can ultimately ease anxiety and improve the financial aid application experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-tax filing statement -student in Gmail?

How can I edit non-tax filing statement -student on a smartphone?

Can I edit non-tax filing statement -student on an iOS device?

What is non-tax filing statement -student?

Who is required to file non-tax filing statement -student?

How to fill out non-tax filing statement -student?

What is the purpose of non-tax filing statement -student?

What information must be reported on non-tax filing statement -student?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.