Get the free MW507M 2025 Exemption from Maryland Withholding Tax ...

Get, Create, Make and Sign mw507m 2025 exemption from

How to edit mw507m 2025 exemption from online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mw507m 2025 exemption from

How to fill out mw507m 2025 exemption from

Who needs mw507m 2025 exemption from?

MW507M 2025 Exemption from Form: A Comprehensive Guide

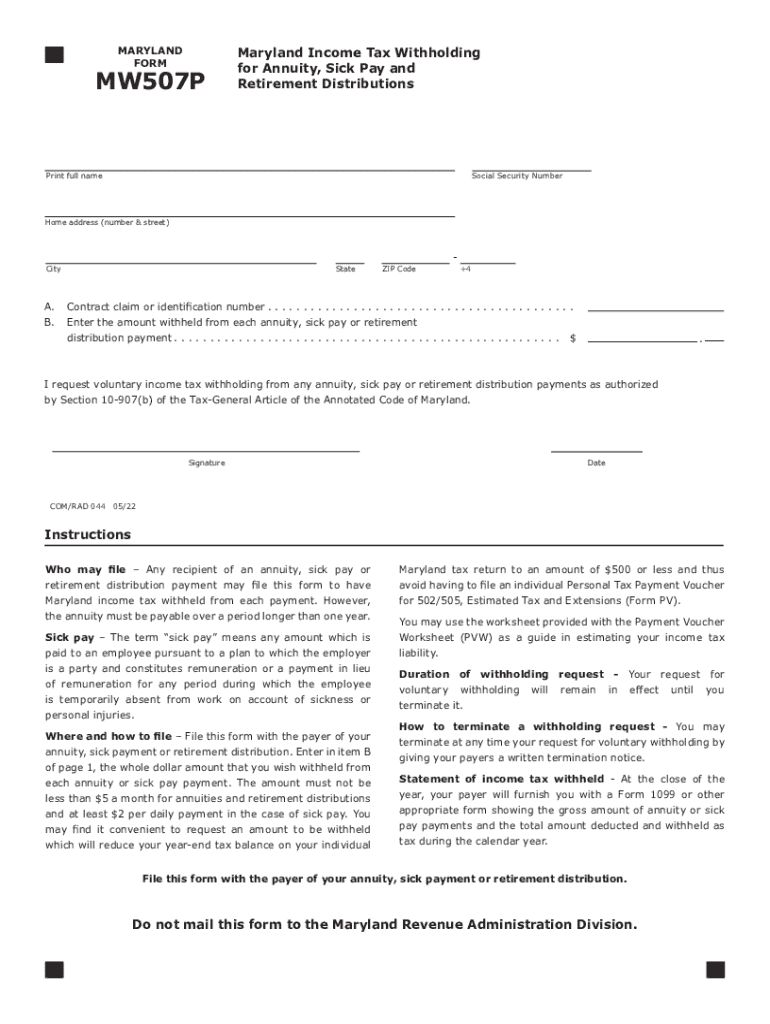

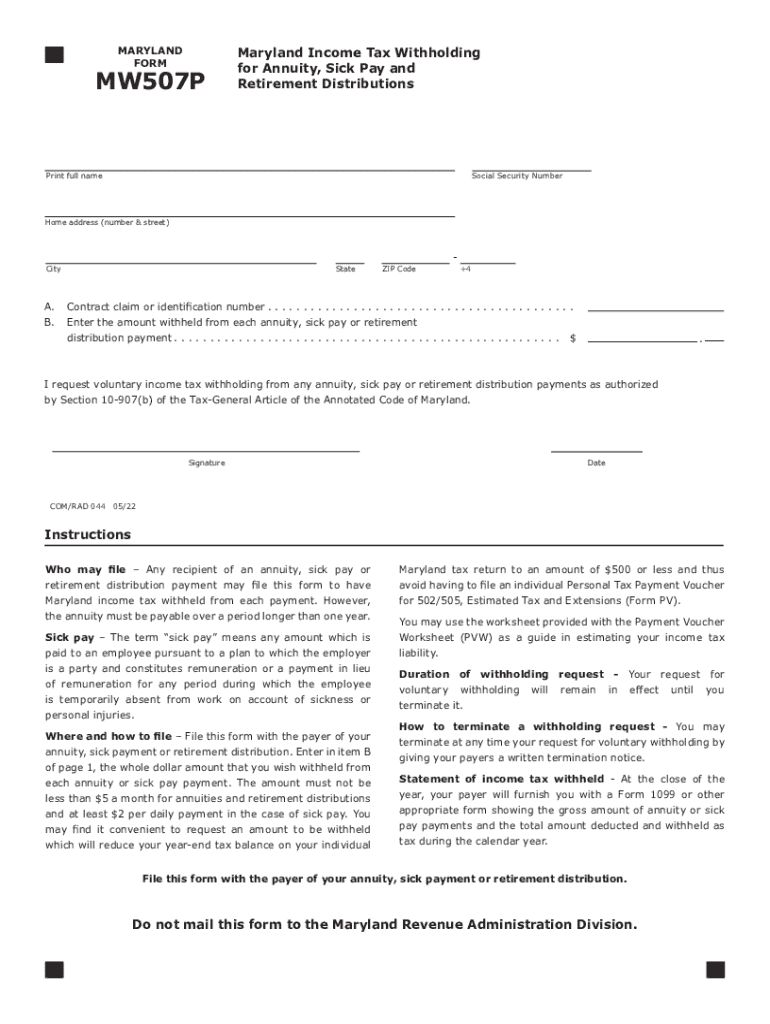

Overview of the MW507M exemption form

The MW507M exemption form is a crucial document for Maryland taxpayers who seek to claim exemption from state income tax withholding on their wages. This form allows eligible individuals to avoid excessive tax withholding, enabling them to keep more of their earnings throughout the year. With the introduction of the 2025 exemption rules, understanding its implications has become increasingly important for residents.

The 2025 exemption specifically addresses changes in tax legislation that can affect both individual tax liabilities and employer practices. For instance, changes in income thresholds, dependent allowances, and deductions could significantly impact a taxpayer's requirement to withhold state taxes. Individuals must remain informed about these changes to maximize their financial planning.

Compared to previous years, the 2025 MW507M exemption sees key modifications designed to streamline processes and provide better support for Maryland taxpayers. These updates include adjustments in eligibility criteria and enhanced guidelines on the exemption application process, reflecting ongoing efforts to simplify compliance and improve efficiency.

Who should use the MW507M form

Understanding who should utilize the MW507M form is pivotal in ensuring proper tax compliance. The form is primarily designed for individuals who anticipate owing no Maryland income tax or who are exempt from withholding. The eligibility criteria include various life circumstances that can affect tax situations.

By identifying the right circumstances to apply for the exemption, taxpayers can reduce their tax burden while ensuring they comply with Maryland's tax laws.

Step-by-step guide to completing the MW507M

Filling out the MW507M exemption form correctly is essential in securing the exemption. Here is a detailed, step-by-step guide to ensure you complete the form accurately.

A common pitfall is miscalculating withholding amounts, so careful review is advised to avoid mistakes that could require correction later on.

Submitting the MW507M exemption form

Once you have completed the MW507M form, it's important to understand how and where to submit it. This section outlines the submission methods and what you can expect once your form is filed.

Expect processing timeframes ranging from a few days to several weeks, dependent on the volume of submissions. You will receive notifications regarding the status of your application and any actions you may need to take.

Managing your MW507M exemption status

Post-submission, it's vital to know how to manage your MW507M exemption status effectively. This could involve checking your exemption status and making updates as needed.

Frequently asked questions (FAQs) about the MW507M

As with any tax-related process, many questions arise concerning the MW507M form. Here are some frequently asked questions.

Tools and resources for MW507M forms

Finding the right tools can enhance your experience when filling out the MW507M form. There are multiple resources available to assist you.

Additional considerations for employers

Employers have specific responsibilities concerning the MW507M forms and must ensure compliance with state regulations.

Moreover, employers should provide clear communication to employees regarding the benefits and implications of filing the MW507M form.

Future updates and changes to consider

Staying aware of future changes is critical as tax laws can vary year to year, and the MW507M form may undergo revisions.

Community insights and shared experiences

Hearing from others who have navigated the MW507M exemption form process can provide invaluable information and encourage best practices.

Leveraging pdfFiller for smooth document management

Utilizing pdfFiller can enhance your experience while managing MW507M forms, empowering users to edit PDFs, eSign, and collaborate with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mw507m 2025 exemption from from Google Drive?

Can I sign the mw507m 2025 exemption from electronically in Chrome?

Can I edit mw507m 2025 exemption from on an Android device?

What is mw507m 2025 exemption from?

Who is required to file mw507m 2025 exemption from?

How to fill out mw507m 2025 exemption from?

What is the purpose of mw507m 2025 exemption from?

What information must be reported on mw507m 2025 exemption from?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.