Comprehensive Guide to Model State Coerced Debt Form

Understanding model state coerced debt

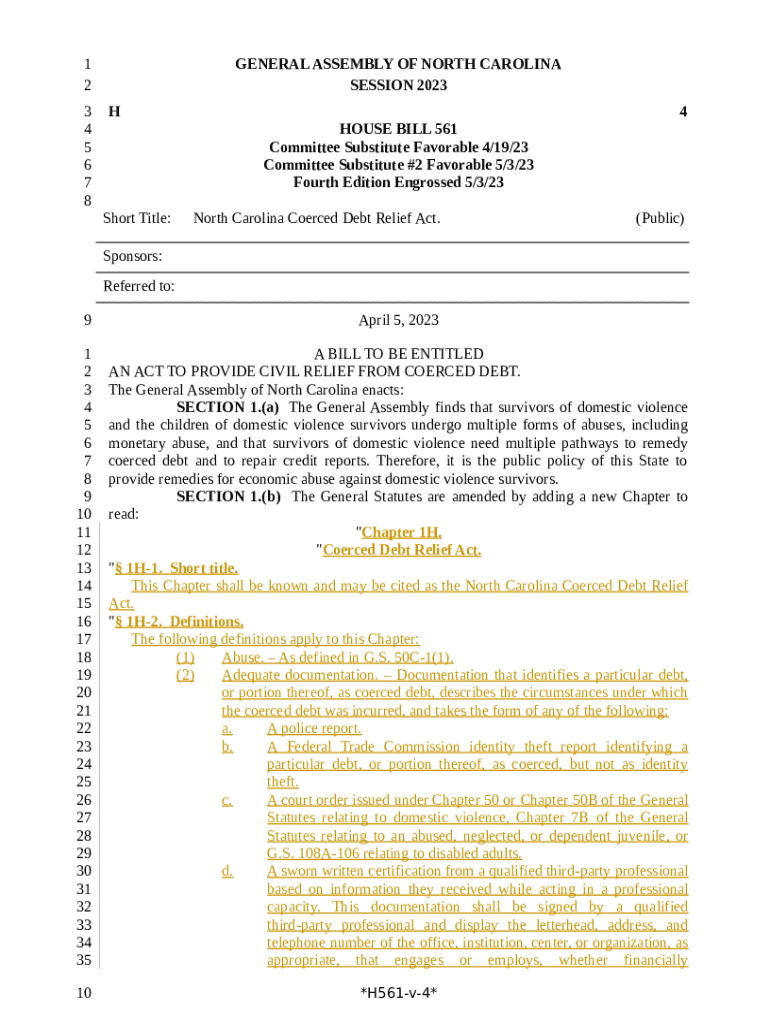

Coerced debt refers to financial obligations that are imposed on individuals under duress, often resulting in disadvantageous terms for the borrower. This can occur in various contexts, including payday loans or other high-interest loans where borrowers might not fully understand the implications of their agreements. To combat the potential abuse related to such debts, many states have developed model laws outlining the necessary forms to document coerced debt agreements clearly.

The importance of coerced debt forms cannot be overstated; they serve not only as legal safeguards for both borrowers and lenders but also ensure that all agreements are transparently documented, reducing the likelihood of disputes. The model state coerced debt form acts as a standardized template that must meet specific legal requirements outlined by state laws, ensuring both parties are adequately informed and protected.

Features of the model state coerced debt form

The model state coerced debt form comprises several key components designed to provide clarity and legal protection. One essential feature is the identification section, which includes metadata such as creditor and debtor information. This ensures accurate attribution of the agreement and helps in tracking obligations.

Further, sections detailing payment terms and conditions are crucial. This part outlines how much is owed, the interest rate, payment schedule, and consequences of default, ensuring all parties understand their responsibilities. Additionally, the language used in these forms often contains legal jargon, which may require careful consideration by those filling them out to avoid misunderstandings.

Required metadata: Criminally important for tracking debt obligations.

Sections outlining payment terms: Clarity on amounts owed and deadlines.

Legal jargon: Essential for legal binding but may be complex.

Filling out the model state coerced debt form

Filling out the model state coerced debt form can seem daunting, but breaking it down into manageable steps can simplify the process significantly. The first step involves gathering all necessary information, including personal identification, financial documentation, and the specifics of the loan or debt agreement.

Next, access the form on pdfFiller, which offers a user-friendly interface for document management. Following this, you will edit the form fields using pdfFiller's comprehensive editing tools to ensure every detail is correct. After filling out the form, take time to review it for accuracy, checking for spelling errors, missing information, or incorrect figures.

Gather necessary information: Ensure all personal data and documentation is available.

Access the form on pdfFiller: Utilize the platform to obtain the correct version of the form.

Edit form fields using pdfFiller's tools: Make necessary corrections or additions.

Review the filled form for accuracy: Double-check for completeness and clarity.

Editing and managing the model state coerced debt form

Using pdfFiller's editing tools can greatly enhance your ability to manage the model state coerced debt form efficiently. With features such as text editing, adding notes, and document annotations, users can modify the form to precisely fit their circumstances or to add additional comments for clarification.

Moreover, collaboration features allow teams to work together on the form seamlessly. Users can leave comments and utilize the track changes feature, ensuring that everyone involved can easily see modifications made by others, fostering a transparent and effective review process.

Signing the model state coerced debt form

Signing the model state coerced debt form can be done electronically, which is both efficient and legally binding. Understanding electronic signature solutions is crucial, as they vary by platform and may entail different identification verification measures, but overall, they are recognized by law just as traditional handwritten signatures.

Using pdfFiller for eSigning not only streamlines the process but also provides secure signing options that protect sensitive personal and financial information while ensuring that your signed form is stored safely.

Electronic signature solutions: Research legal recognition of eSignatures.

Sign the form using pdfFiller securely: Ensure confidentiality during signing.

Best practices for document security: Understand methods for protecting shared, signed documents.

Managing the coerced debt form after completion

Once your model state coerced debt form is completed, proper management of the document is essential. Storing it securely in the cloud via pdfFiller allows for easy access anywhere and anytime, ensuring you have the document readily available when required.

Moreover, tracking changes and maintaining version control on the document is vital. Keeping records of different iterations of the form helps to clarify its history and ensures that all modifications are documented, which can be crucial in case of disputes or questions regarding the debt.

Storing forms in the cloud: Benefits for easy access and security.

Accessing forms anywhere, anytime: Ensuring flexibility in document management.

Tracking changes and version control: Importance of maintaining accurate records.

Frequently asked questions

Clarifying common concerns can significantly help users in navigating the complexities of coerced debt forms. For instance, if errors are discovered post-signature, it is essential to know the steps to amend the document or revise the agreement to reflect accurate information.

Additionally, as circumstances change, it might be necessary to update the form. Understanding how to make these adjustments legally and efficiently can often prevent future complications in repayment arrangements.

What to do if errors are found after signing?: Steps to correct signed documents.

How to update the form if circumstances change?: Guidelines for modifying agreements.

Legal resources: When to consult legal advice regarding coerced debts.

Support and assistance

Getting help through pdfFiller is straightforward. The platform provides various customer support options, including tutorials and guides specifically for the model state coerced debt form, which can assist users in navigating its features effectively.

Moreover, engaging with community forums can offer shared experiences and advice from others who have dealt with similar situations, enriching your understanding of best practices when working with coerced debt forms.

Overview of customer support options: Availability of help when needed.

How to access tutorials and guides specific to this form: Maximizing the platform's potential.

Engaging with forums or groups: Community input can provide valuable insights.

Summary of key takeaways

In summary, understanding the model state coerced debt form is crucial for anyone involved in debt agreements. This comprehensive guide outlines essential elements and processes, reinforcing the importance of using a platform like pdfFiller for drafting and managing such documents.

By utilizing pdfFiller's tools, individuals and teams can streamline their document management processes, ensuring accuracy and compliance with the law surrounding coerced debt agreements.