Get the free Part 1: Defining the Health Problem In Week 1, your task is ...

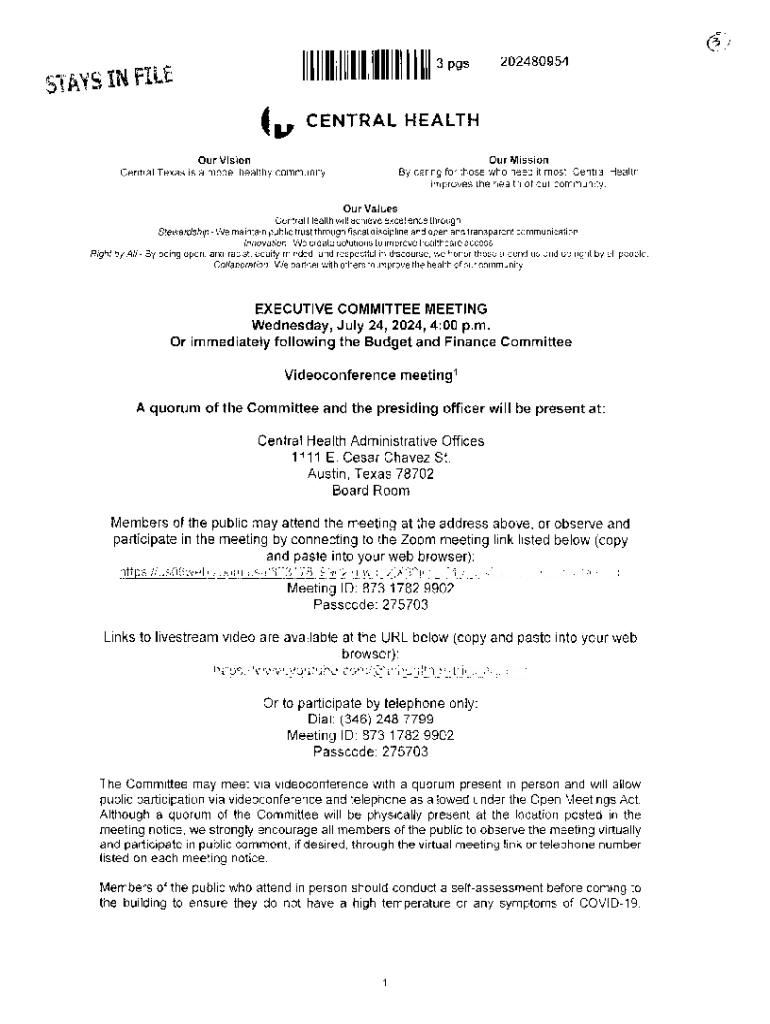

Get, Create, Make and Sign part 1 defining form

Editing part 1 defining form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part 1 defining form

How to fill out part 1 defining form

Who needs part 1 defining form?

Part 1 Defining Form: A Comprehensive Guide

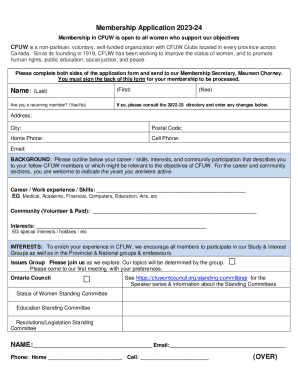

Overview of part 1 defining form

The Part 1 Defining Form serves as a foundational document required in various regulatory frameworks, ensuring organizations and individuals submit accurate and consistent information. Its primary purpose is to capture essential data that meets the requirements set forth by regulatory agencies, thereby fostering transparency and compliance. This form plays a pivotal role in mitigating risk and fostering reliability in reporting across different sectors.

The importance of the Part 1 Defining Form cannot be overstated, as inaccurate submissions can lead to legal ramifications or non-compliance with institutional guidelines. By clearly specifying requirements, it streamlines the overall process and helps maintain integrity in organizational reporting.

Key users of the form

The Part 1 Defining Form is required by a wide array of users, ranging from individuals to organizations involved in various regulated activities. For individuals, anyone seeking to provide accurate information for regulatory compliance—be it for finance, healthcare, or other industries—must fill this form out.

For organizations, teams working on compliance, legal submissions, or regulatory reporting often utilize this form. Common scenarios include finance departments preparing financial disclosures, compliance teams assessing risks, and legal counsel ensuring adherence to guidelines.

Structure of the part 1 form

The Part 1 Form is structured to facilitate ease of use and comprehension. It generally comprises several sections, each designated to collect specific types of information necessary for regulatory submissions.

By breaking down the sections, users can more easily navigate and complete the form without missing vital information.

Item-by-item overview

Item 1: Identification information

The first section requests identification information, including the name of the individual or organization submitting the form, their contact details, and unique identifiers such as a Social Security number or Tax ID. Complete and accurate entries in this section are crucial since they establish the legitimacy and authority of the submission, affecting how it is processed.

Item 2: Financial information summary

Item 2 requires a brief overview of the organization’s financial status, allowing regulatory bodies to assess the applicant’s solvency and risk. Include information such as assets, liabilities, and revenue streams. This summary gives a snapshot that guides further inquiries or audits.

Item 3: Advisory services and goals

In this section, users outline any advisory services they require or provide. Defining clear goals associated with these services sets the expectations for both the applicant and the regulatory body, helping to safeguard against conflicts.

Item 4: Disclosures and conflicts of interest

Addressing disclosures and potential conflicts of interest mitigates compliance risks. Users must declare any circumstances that could impair objectivity, ensuring full transparency throughout the process.

Item 5: Signature and certification

The final section emphasizes the importance of an accurate signature. Validation through a signature certifies that the information provided is accurate and truthful. Incorrect placement here could lead to severe consequences for the credibility of the form.

Common challenges and solutions

Individuals often face misunderstandings regarding the required information in the Part 1 Defining Form. Misreading or misinterpreting sections can lead to mistakes that delay processing. Common pitfalls include omitting necessary financial disclosures or failing to sign the form properly.

To overcome these challenges, users should thoroughly read the instructions accompanying the form before filling it out. Furthermore, utilizing pdfFiller's interactive tools can facilitate clarity, as users can obtain explanations of each section simply by hovering over the field.

Technical hazards, such as difficulties with submitting PDF documents or electronic signatures, are prevalent. Users should ensure they are using up-to-date software compatible with current submission processes.

Best practices for accurate completion include maintaining organized records, using templates to guide the structure, and reviewing entries before submission. Additionally, pdfFiller's resources, including tutorials and FAQs, offer relevant guidance for users to refer to as they complete their forms.

Interactive tools for filling out part 1 form

pdfFiller provides several editing features that enhance the user experience when completing a Part 1 Defining Form. These include tools for formatting text, adding annotations, and inserting dates, making it easier for users to customize the document to their needs.

To eSign the Part 1 Form securely, follow these steps: first, navigate to the eSign tool within pdfFiller, select the form, and specify the signer’s details. After placement, ensure that the signature is clear and matches the individual’s name for legal validity.

Collaboration features within pdfFiller facilitate teamwork, allowing users to share the form within their teams to gather inputs efficiently. Team members can add their contributions in real-time, streamlining the completion process.

Utilizing cloud-based storage offers a seamless method for managing forms. It allows users to access documents from any device, ensuring that even on the go, changes and responses can be made promptly.

Regulatory and compliance implications

Submitting the Part 1 Defining Form accurately is essential not only for regulatory compliance but also to avoid legal repercussions. Mistakes in the form can lead to fines, penalties, or even criminal prosecution in cases of severe negligence.

Users should stay informed about updates and changes in regulatory requirements to maintain compliance. Regulatory bodies may amend mandates on a periodic basis, so subscribing to relevant newsletters or monitoring government sites is advisable.

Additionally, long-term management of submitted forms is critical for organizational compliance. Following best practices for record retention helps organizations respond effectively to audits, ensuring they have the documentation required for any regulatory inquiries.

Frequently asked questions (faqs)

What if lose my form?

If you lose your form, consult your local regulatory body for instructions on how to obtain a replacement. They may provide guidance on re-submission and confirmations.

Can revise a submitted form?

Revisions are typically accepted, but follow the specific process outlined by the regulatory body where the form was submitted. Some allow amendments, while others may require a new submission.

How long is the form valid after submission?

The validity period of the Part 1 Defining Form often hinges on the specific regulations governing your industry. Generally, it remains valid until there’s a significant change in the data provided or until re-submission is mandated by the regulatory body.

Case studies: successful form filings

Real-world examples

Various individuals and organizations have navigated the complexities of the Part 1 Defining Form successfully. For example, a mid-sized healthcare company streamlined its compliance by implementing a rigorous review system before form submission, enhancing their chances of approval.

Lessons learned

Key takeaways from successful form filings often emphasize the need for thoroughness, attention to detail, and utilizing available resources like pdfFiller to facilitate the process. Adopting a systematic approach ensures that forms are completed correctly and submitted on time.

Terminology and glossary

Key terms explained

Familiarizing oneself with the terminology associated with the Part 1 Defining Form is crucial for accurate completion. Basic terms, such as 'disclosures' and 'conflicts of interest,' carry significant relevance and impact the submission process.

Acronyms and their meanings

Recognizing common acronyms related to regulatory compliance, such as IRS (Internal Revenue Service) or SEC (Securities and Exchange Commission), can streamline your understanding of the form requirements.

Final checks before submission

Review checklist

Before finalizing your Part 1 Defining Form, review it against the checklist below to ensure accuracy:

Common errors to avoid

Users should be conscious of common errors such as incorrect data entry, lack of attached supporting documents, and neglecting to observe submission deadlines. Each error could potentially delay processing and result in non-compliance.

Additional support

Contacting support through pdfFiller

To resolve any uncertainties regarding the Part 1 Defining Form, users can easily reach out for support through pdfFiller. The support team offers guidance and can address specific queries related to form completion and submission processes.

Community forums and knowledge base

Engaging with other users through community forums can provide additional tips and strategies for completing the Part 1 Defining Form. The knowledge base also contains valuable articles that can further aid in addressing issues encountered during the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my part 1 defining form in Gmail?

How can I get part 1 defining form?

How do I fill out part 1 defining form on an Android device?

What is part 1 defining form?

Who is required to file part 1 defining form?

How to fill out part 1 defining form?

What is the purpose of part 1 defining form?

What information must be reported on part 1 defining form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.