Get the free Revenue Department, 2135 Rimrock Rd, Madison, WI ...

Get, Create, Make and Sign revenue department 2135 rimrock

How to edit revenue department 2135 rimrock online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revenue department 2135 rimrock

How to fill out revenue department 2135 rimrock

Who needs revenue department 2135 rimrock?

Comprehensive Guide to the Revenue Department 2135 Rimrock Form

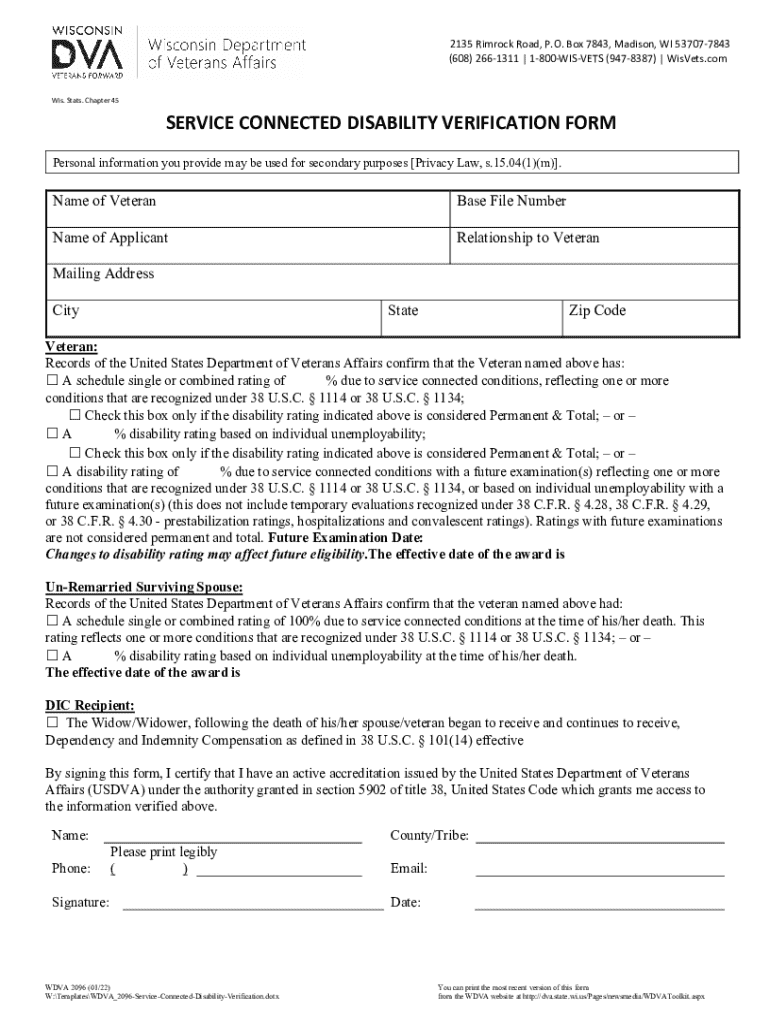

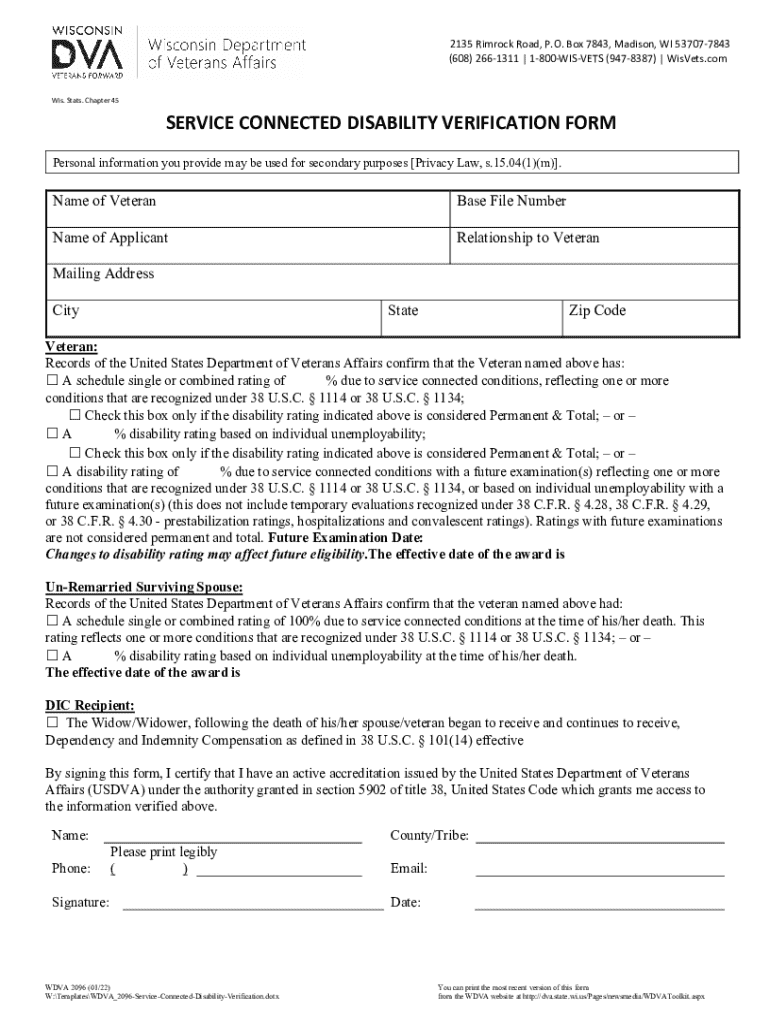

Overview of the Revenue Department 2135 Rimrock Form

The Revenue Department 2135 Rimrock Form serves a vital purpose in tax-related processes, specifically aimed at individuals and teams who need to report their financial status. This form is primarily used to declare assets, income details, and other pertinent financial information that is necessary for accurate tax calculations. The significance of this form lies in its role in ensuring compliance with tax regulations, preventing audits, and mitigating any potential fines. Understanding the filing requirements and deadlines is crucial, as late submissions can lead to penalties.

Key features of the 2135 Rimrock Form

The 2135 Rimrock Form is designed with a user-friendly format, making it accessible for a variety of users, from individuals to dedicated finance teams. It includes sections that clearly highlight crucial information, guiding users through the documentation process with ease. Furthermore, comparative analysis shows that while similar forms may exist, the 2135 Rimrock Form stands out for its specificity and focused requirements, ensuring that all essential aspects of financial reporting are thoroughly addressed.

Step-by-step instructions for completing the 2135 Rimrock Form

To ensure a smooth filing experience, completing the 2135 Rimrock Form can be broken down into three crucial steps.

Step 1: Initial preparation

Before beginning the form, gather the required information and documentation to streamline the process. This includes identification details, previous tax returns, and accurate data on assets and income. It’s also advisable to create a checklist of required documents to avoid any omissions.

Step 2: Filling out the form

Begin by filling in your personal information accurately. This includes your full name, address, and social security number. Next, move on to asset declarations, ensuring that all assets are listed and valued correctly. Finally, input your income details; this section may require extensive documentation, such as W-2s or 1099 forms, to substantiate your earnings.

Be aware of common pitfalls, such as misreporting income or omitting assets, as these can lead to complications during processing.

Step 3: Reviewing your entry

Once the form is filled out, review your entries meticulously. Double-check to ensure that all information is accurate, complete and in alignment with supporting documents. Utilize a personalized checklist of items to review, such as verifying identification numbers and ensuring that all sections are filled.

Interactive tools to assist you

Utilizing pdfFiller's interactive features can empower users to fill out the 2135 Rimrock Form seamlessly. With tools for real-time collaboration, users can work together efficiently, ensuring that all parties involved have the most current information at their fingertips. The integration of eSigning capabilities allows for rapid turnaround, ensuring that the form is submitted in a timely manner. For users to visualize this process better, example screenshots of these tools in action would emphasize the efficiency, ease, and collaborative aspect of using pdfFiller.

Managing the 2135 Rimrock Form after submission

After submitting the 2135 Rimrock Form, tracking your form’s status becomes essential. Understanding how to navigate the response process allows for better management of future submissions. Users should be aware of options available for corrections or resubmissions if any mistakes occurred. Furthermore, knowing the typical processing timelines and outcomes can help mitigate anxiety associated with awaiting feedback from the Revenue Department.

Common questions and troubleshooting

Many users may have similar queries regarding the 2135 Rimrock Form. Some frequently asked questions include clarifications on submission methods, processing timelines, and information about troubleshooting common errors faced during completion. For personalized assistance, the Revenue Department contact information is readily available, ensuring users can receive the help they need promptly.

Benefits of using pdfFiller for the 2135 Rimrock Form

Adopting pdfFiller for your 2135 Rimrock Form provides numerous advantages. The seamless integration of editing and signing features allows you to manage your documents effectively from a single platform. Since pdfFiller is cloud-based, users can access their forms and collaborate remotely – a vital benefit for teams working from different locations. Additionally, pdfFiller incorporates robust security and compliance features, significantly mitigating risks associated with handling sensitive personal information.

Real user testimonials and success stories

User experiences with pdfFiller demonstrate its impact on document management. Users have highlighted the application's efficiency, ease of use, and the organized layout that saves time during tax preparation. Personal anecdotes reflect how pdfFiller has streamlined workflows, reduced errors during submission, and enhanced collaborative efforts within teams handling the 2135 Rimrock Form.

Future updates and changes to the 2135 Rimrock Form

Staying informed about updates or changes can greatly assist users in remaining compliant. Recent revisions to the 2135 Rimrock Form reflect evolving tax regulations which may require attention. Anticipating changes in the upcoming tax year is crucial for those who regularly use this form, as adjustments may alter requirements or encourage amended reporting. pdfFiller ensures that users can stay ahead of these changes by providing timely updates and resources for evolving document requirements.

Conclusion regarding the 2135 Rimrock Form experience

Successfully navigating the 2135 Rimrock Form is critical for accurate financial reporting and compliance. By leveraging pdfFiller, users can streamline the entire process of filling out, editing, and managing their forms with ease. Comprehensive guidance, interactive tools, and a seamless experience make pdfFiller the preferred choice among individuals and teams handling essential documentation like the 2135 Rimrock Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in revenue department 2135 rimrock without leaving Chrome?

Can I sign the revenue department 2135 rimrock electronically in Chrome?

How do I fill out revenue department 2135 rimrock on an Android device?

What is revenue department 2135 rimrock?

Who is required to file revenue department 2135 rimrock?

How to fill out revenue department 2135 rimrock?

What is the purpose of revenue department 2135 rimrock?

What information must be reported on revenue department 2135 rimrock?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.