Banking Services Request for Form: A Comprehensive Guide

Understanding banking services requests

A banking services request is a formal appeal made by customers to their financial institutions, outlining specific banking services they wish to obtain. Requests can range from account management services to applying for loans, mortgages, or investment options. Accurate submission is crucial, as incomplete or erroneous forms can lead to delays in service provisioning or, worse, rejection.

The importance of accurate request submission cannot be overstated. Banks rely on precise information to process requests efficiently, ensuring compliance with regulatory standards and internal policies. Common types of banking services requests include applications for new accounts, requests for statement copies, and loan applications.

Overview of the request for banking services form

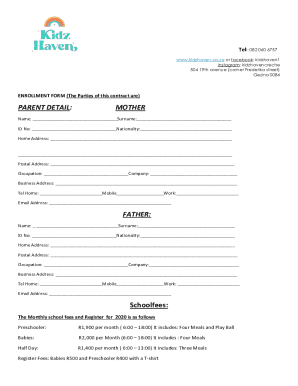

The request for banking services form serves as the primary tool for customers to communicate their needs to banks. Its purpose is to clearly outline customer requests, ensuring financial institutions can process them in a timely and efficient manner. This form is essential for maintaining clear lines of communication between customers and financial institutions, facilitating a smooth transaction process.

Typically, this form is used by individuals or businesses looking to open accounts, apply for loans, or request additional services like investment accounts or financial planning assistance. Key features of the request for banking services form include predefined sections for personal information, service selection, and banking details, enabling streamlined processing.

Steps to access the banking services request form

Accessing the banking services request form on the pdfFiller platform is a straightforward process. Begin by creating an account, which provides you with access to a wide range of documents and templates tailored for your banking needs. After account creation, log in to your pdfFiller account.

To locate the banking services request form, utilize the search functionality on the platform. Simply enter 'Banking Services Request Form' into the search bar, and the system will show you relevant options for immediate access.

Create a user account on pdfFiller.

Search for 'Banking Services Request Form'.

Detailed instructions for completing the banking services request form

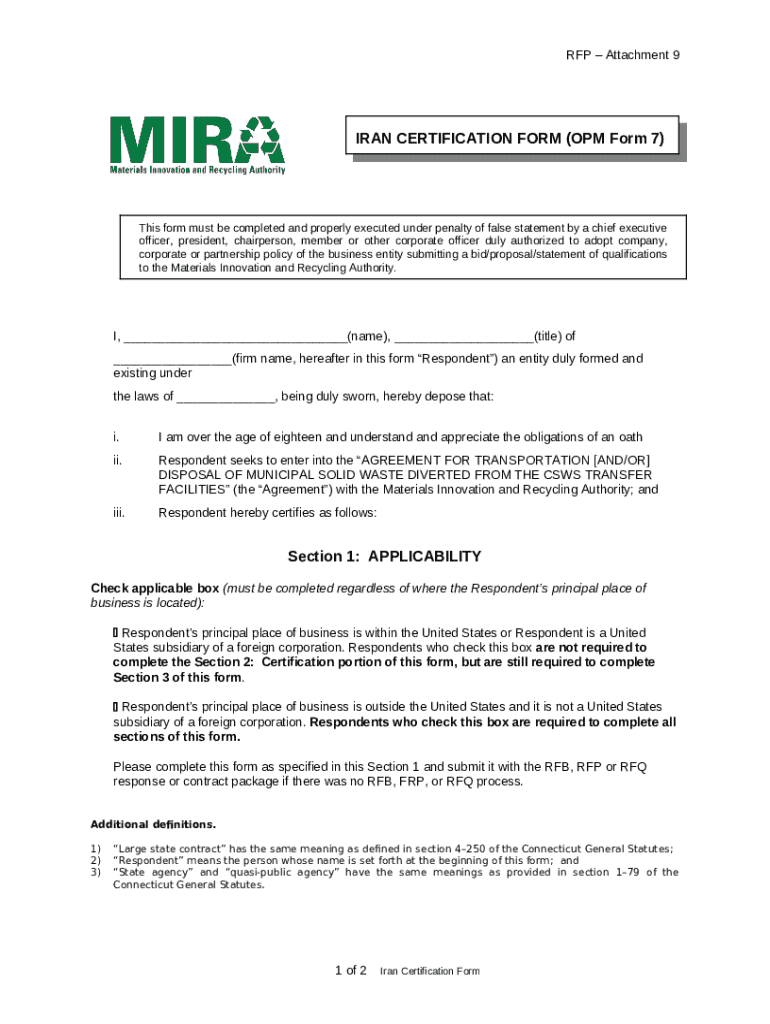

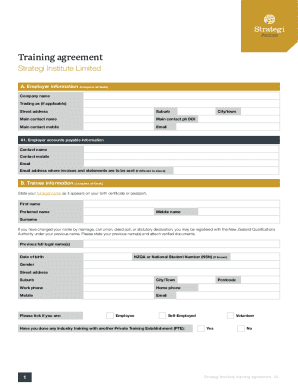

Completing the banking services request form effectively involves a few simple, yet critical steps. The first section generally requests personal information including your name, address, phone number, and email address. Be sure to provide accurate and up-to-date information to avoid delays in processing.

Next, the banking details section requires information related to your current accounts, including account numbers and types. Following this, clearly indicate your desired service selection, whether it's opening a new account, applying for a loan, or requesting specific banking services. Accuracy is key, as many submissions encounter issues due to minor errors in these details.

Fill in your personal information accurately.

Provide correct banking details related to your accounts.

Clearly indicate the services you wish to request.

Editing and customizing your request form

Once you have accessed the banking services request form on pdfFiller, you can utilize its editing tools to customize the document as needed. This includes adding or removing sections, adjusting information, and ensuring that your request is tailored specifically to your needs.

Additionally, pdfFiller offers various formatting options to enhance clarity. You can change text size, style, and include any necessary annotations to clarify your requests further. Collaboration is also possible, allowing team members to review or edit the form before final submission.

Use pdfFiller’s editing tools to customize your form.

Adjust formatting options for clarity.

Collaborate with team members on the document.

Signing your banking services request form

Signing the banking services request form can be seamlessly done using pdfFiller's electronic signature tool. This feature allows you to add a legally binding signature directly onto the document, simplifying the submission process. Should multiple approvals be necessary, pdfFiller enables you to set a signing order to facilitate timely approvals.

Using the electronic signature tool is user-friendly; simply follow the prompts to sign the document electronically. This removes the necessity for printing and scanning, making the process not only efficient but also eco-friendly.

Utilize pdfFiller’s electronic signature tool for easy signing.

Set signing order for multiple approvers if needed.

Follow prompts to complete your electronic signature.

Submitting your request form

Once your banking services request form is complete and signed, the next step is submission. pdfFiller provides multiple submission methods including online submission via the platform itself or the option to download and mail a physical copy to your bank.

Tracking your submission is also vital. Many banks send notifications or updates regarding the status of your request, allowing you to stay informed about the processing time and any additional information that may be required.

Submit your request online via pdfFiller.

Alternatively, download and mail your form to your bank.

Track your submission status through notifications from your bank.

Frequently asked questions (FAQs)

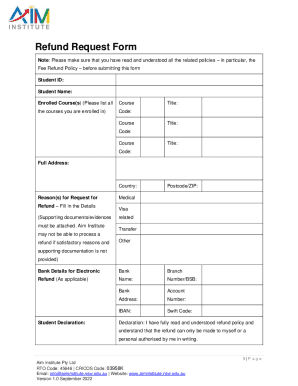

Several common inquiries arise regarding the banking services request form. One of the frequent questions is what steps to take if a submission is rejected. In such cases, it is advisable to reach out directly to your bank's customer service for clarification and guidance on adjustments needed for resubmission.

Another important query relates to making corrections after submission. If you realize errors post-submission, promptly contact your bank to discuss the possibility of correcting the details before processing begins, as each institution has its own policies regarding amendments.

Reach out to your bank's customer service if your submission is rejected.

Promptly correct any errors by contacting the bank after submission.

Be aware of specific banking policies related to form submissions.

Tools and features for enhanced document management

pdfFiller excels not just in form creation but also in document management, offering users cloud storage benefits that ensure your documents are securely stored and easily accessible from anywhere. This is particularly advantageous for professionals managing multiple banking requests or for teams collaborating on financial documentation.

Additionally, pdfFiller provides document sharing options, allowing users to send files to clients or collaborators directly from the platform. Interactive tools also enhance workflow efficiency, ensuring that users can manage and retrieve documents with minimal effort.

Advantages of robust cloud storage for document security.

Option to share documents directly through pdfFiller.

Utilize interactive tools for efficient document management.

Real-world applications of the banking services request form

Real-world applications of the banking services request form highlight its integral role in financial transactions. For instance, a small business may submit a request for credit line modification, showcasing the direct impact of accurate submissions on operational capabilities. Moreover, testimonials from users emphasize the positive experiences they've had while utilizing pdfFiller to manage their banking requests efficiently.

One case study revealed how a marketing firm successfully leveraged pdfFiller's tools to streamline their banking needs, resulting in quicker approvals and enhanced cooperation between team members, which underscored the advantages of having an organized approach to document management.

Staying updated with financial regulations and banking services

Understanding the importance of keeping informed about financial regulations is essential for both individuals and businesses. The banking landscape is continually evolving; staying updated on these changes can significantly impact how you manage your banking services requests. Engaging with reliable resources that provide regular updates on banking services and trends is advisable.

Subscribing to financial news platforms and following expert blogs can help you stay ahead of the curve. Moreover, many banks offer newsletters and updates regarding new services, regulatory changes, and financial advice tailored to your needs.

Engaging with the community

Engaging with the banking services community can provide numerous benefits. Opportunities for feedback on banking services and forms are often provided by financial institutions, which can drive improvements and adaptations in their service offerings. Additionally, connecting with financial advisors or experts through platforms like pdfFiller can enrich your understanding and ability to navigate banking requests.

Such interactions not only enhance knowledge but can also lead to better personal finance management strategies, allowing you to optimize the services and information you receive from your banking institution.