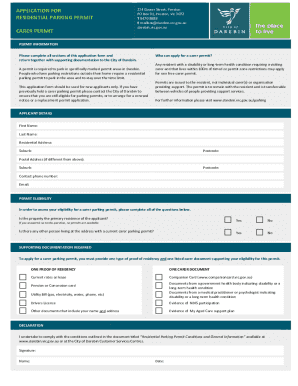

Get the free Tax Rate Worksheet

Get, Create, Make and Sign tax rate worksheet

Editing tax rate worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax rate worksheet

How to fill out tax rate worksheet

Who needs tax rate worksheet?

Understanding the Tax Rate Worksheet Form: A Comprehensive Guide

Overview of the tax rate worksheet form

The tax rate worksheet form plays a crucial role in simplifying the complex landscape of tax filings. This form is designed to help individuals and teams calculate their tax obligations based on various income categories and applicable deductions. By laying out the necessary information in a structured manner, it provides clarity and precision in tax calculations, which can often be overwhelming.

Incorporating the tax rate worksheet into your tax preparation process benefits you significantly. Using a digital solution like pdfFiller allows for easy access and efficient management of these forms. Users can edit, sign, and collaborate seamlessly, helping ensure that all necessary documents are correctly completed and submitted on time.

Getting started with the tax rate worksheet form

To get started with the tax rate worksheet form on pdfFiller, you need to visit their website and access the form from their extensive library. The process is user-friendly and designed to save time, whether you're a novice or an experienced tax filer.

Here’s a step-by-step guide on how to access and use the worksheet effectively:

pdfFiller offers editing tools, eSignature capabilities, and collaboration options that enhance your overall user experience, making tax preparation easier than ever.

Detailed breakdown of the tax rate calculation process

Understanding the components of the tax rate worksheet is essential for accurate calculations. The worksheet is structured into key categories, each playing an integral role in determining tax liability.

These key components include:

To illustrate how to utilize the worksheet for calculations, let’s walk through an example:

Filling out the tax rate worksheet form

Filling out the tax rate worksheet form accurately is critical for an optimal filing experience. Each section of the form requires specific information, beginning with your personal details and culminating in your final tax calculation.

Here's a comprehensive guide to each section of the form:

Common mistakes to avoid include misreporting income, overlooking deductions, or failing to check the latest tax brackets. Double-checking your entries can prevent penalties down the line.

Keeping track of tax year changes

With tax laws evolving from year to year, it’s important to stay updated on rate changes. Between 2021 and 2024, significant changes in tax brackets and rates have occurred, impacting many taxpayers.

Using the latest tax rate worksheet ensures compliance with current regulations and may help maximize your returns. pdfFiller provides users access to the most up-to-date versions of forms, ensuring that you're never filling out obsolete information.

Frequently asked questions (FAQs)

Addressing common queries related to the tax rate worksheet can facilitate a smoother experience. Here are some frequently asked questions:

Troubleshooting common issues

When it comes to tax filings, mistakes can lead to lengthy resolutions. Common errors in tax rate calculations include misapplying deductions or failing to account for all income sources.

To mitigate these issues, pdfFiller offers various resources, including tutorials and guides. Furthermore, if you find that mistakes were made, pdfFiller's tools allow you to easily redo calculations and correct any errors directly within the platform.

Utilizing additional tools on pdfFiller

pdfFiller does not only provide access to the tax rate worksheet. Integrating the worksheet with other financial documents can create a cohesive strategy for tax preparation.

Here are some additional functionalities available on pdfFiller:

Tax rate worksheet for specific situations

Tax situations can vary greatly between businesses and individuals. When filling out the tax rate worksheet, it’s crucial to recognize these variations.

For instance, freelancers and contractors may need to account for additional aspects such as self-employment taxes. Meanwhile, businesses must consider operational expenses that may influence their tax filings. Be mindful of specific tax rate worksheets that pertain to state requirements, as these often differ from federal guidelines.

Staying informed on tax updates

Remaining informed on tax developments is crucial for maximizing your potential returns. Subscribing for updates through pdfFiller allows you to keep abreast of changes in tax laws, new deductions, and updated rates.

Continuous learning is key in navigating the complex tax landscape. Various resources, including news articles and newsletters, can help ensure compliance while preparing you for future trends in tax management, enabling you to face tax season with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax rate worksheet online?

How can I edit tax rate worksheet on a smartphone?

Can I edit tax rate worksheet on an Android device?

What is tax rate worksheet?

Who is required to file tax rate worksheet?

How to fill out tax rate worksheet?

What is the purpose of tax rate worksheet?

What information must be reported on tax rate worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.