Get the free Student Loan Deferment for Cancer Patients

Get, Create, Make and Sign student loan deferment for

Editing student loan deferment for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out student loan deferment for

How to fill out student loan deferment for

Who needs student loan deferment for?

A Comprehensive Guide to Student Loan Deferment for Form

Understanding student loan deferment

Student loan deferment is a crucial option for borrowers facing financial difficulties. It allows individuals to temporarily pause their loan payments without incurring additional financial penalties. Deferment can provide much-needed relief during challenging times, such as enrollment in school, economic hardship, or military service.

Eligibility for deferment typically includes federal student loans like Direct Subsidized and Unsubsidized Loans, Grad PLUS Loans, and certain private loans. While each type of loan may have specific criteria, understanding the general terms can help borrowers navigate their options effectively.

How does student loan deferment work?

The deferment process begins with submitting a formal request to your loan servicer. This request should clearly state your reasons for seeking deferment and provide relevant documentation. Understanding the key terms and conditions associated with deferment is essential, as borrowers must be aware of any interest accrual and time limits.

Most deferments last between six months to three years, depending on the circumstances. It's important to note that while federal subsidized loans may not accrue interest during deferment, unsubsidized loans will continue to accumulate interest.

Difference between deferment and forbearance

Deferment and forbearance are often mistaken for one another; however, there are distinct differences between them. Deferment allows for a temporary delay in loan payments without accruing interest on subsidized loans, while forbearance permits the postponement of payments but typically results in accumulating interest regardless of the loan type.

Choosing between the two options depends on your situation. If you're able to qualify for a deferment due to specific circumstances such as returning to school or economic hardship, it’s advantageous. However, if you do not meet those criteria but are still in need of a break from payments, forbearance can be a solution, albeit one that may cost more in the long run.

Eligibility for student loan deferment

Eligibility for deferment varies based on the type of loans held. Federal loan borrowers generally have more options compared to private loan borrowers. For federal loans, specific criteria must be met to qualify, such as maintaining at least six credit hours in an eligible academic program or undergoing economic hardship.

Special circumstances also apply. For example, active duty military members may qualify for deferment while deployed, and certain rehabilitation programs may provide exemptions for borrowers.

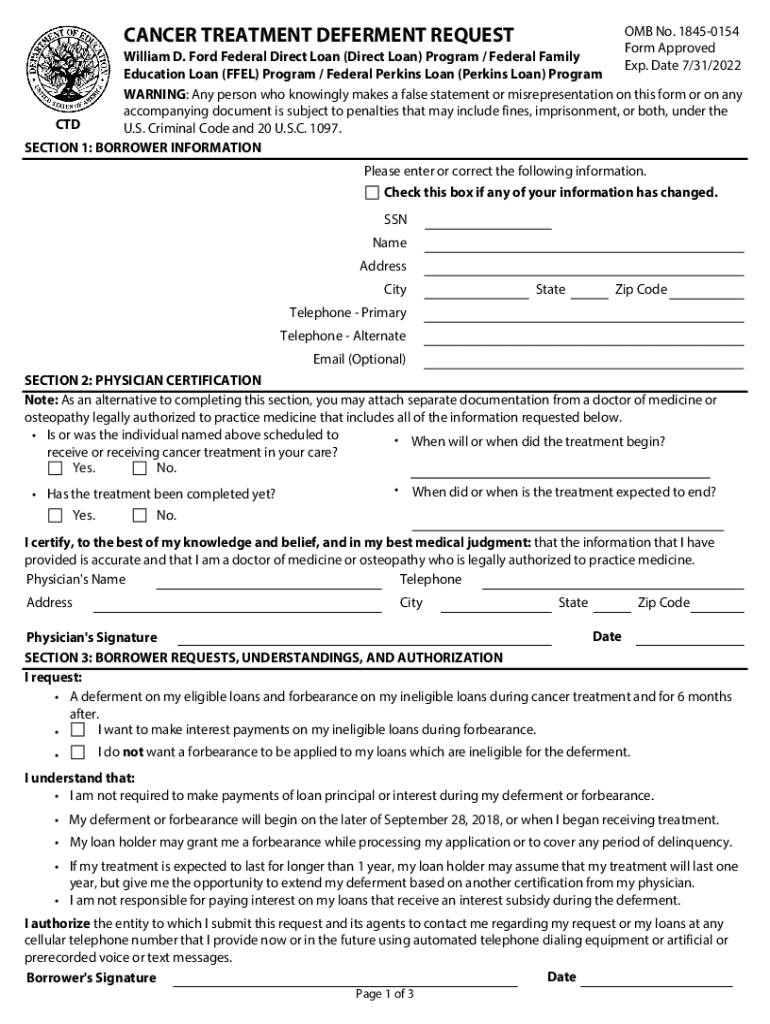

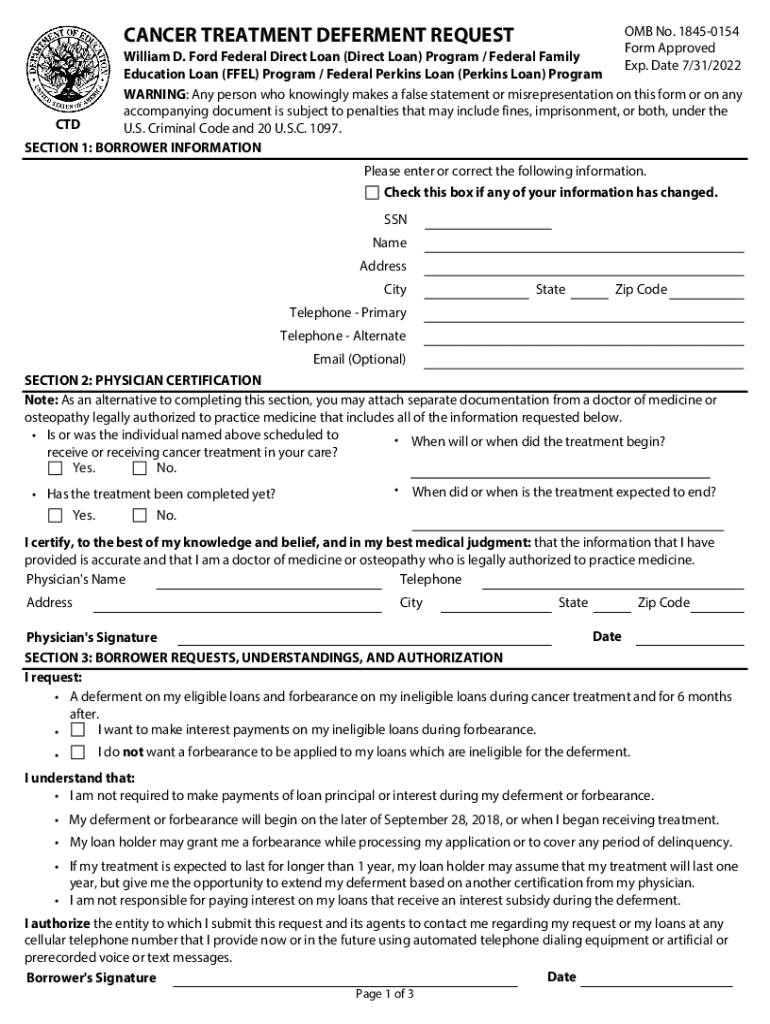

How to request student loan deferment

To request deferment, borrowers must start by gathering the necessary information and documentation. This usually includes personal data, such as Social Security number and loan details, along with any documentation supporting the deferment request, like enrollment verification or proof of economic hardship.

The next step is to complete the deferment form. Accessing the deferment request form through your loan servicer’s website is straightforward, but it’s essential to fill it out accurately to avoid delays. Each section should be completed with care, and applicants should review the instructions thoroughly.

Submitting the deferment request

When it comes to submitting the deferment request, borrowers have a few options: online submission, faxing the form, or mailing it directly to the loan servicer. It’s vital to adhere to any deadlines set by the servicer to ensure timely processing of your request.

Once submitted, borrowers should keep an eye on their email or loan account for confirmation of the deferment status. If approval is granted, borrowers may be required to follow up with additional steps, especially if documentation needs to be updated.

Managing student loan deferment

During the deferment period, borrowers are relieved from the obligation of making monthly payments; however, understanding how deferment influences your loans is crucial. For subsidized loans, interest will not accrue, but it’s essential to monitor the balance of any unsubsidized loans, as those will continue to accumulate interest throughout the deferment.

Additionally, borrowers should be aware that deferment does not usually impact credit scores negatively, but consistent communication with loan servicers about the loan status is advisable to ensure ongoing support through the deferment.

Ending deferment and next steps

Deferment may last a few months to several years, according to the type of deferment granted. Once it concludes, borrowers must transition into repayment. Staying informed about when deferment ends is essential to avoid lapsing into delinquency or default.

Preparation is key; borrowers should explore options that will best fit their financial situation, whether that’s income-driven repayment, extended repayment plans, or making extra payments to minimize interest over time.

FAQs about student loan deferment

Borrowers often have several questions regarding student loan deferment. One common concern is whether deferment affects credit scores; typically, it does not negatively impact credit unless payments are missed outside of deferment periods.

Questions about the possibility of multiple deferments arise frequently—borrowers should understand the limits and conditions on how often edits can be made. If a request for deferment is denied, it's essential to communicate clearly with the loan servicer to understand the reasoning and explore alternative options.

Helpful tips and best practices

Staying informed throughout the deferment process is essential. Use the servicer’s portal to regularly check your deferment status and ensure that all documentation remains current. Building a relationship with your loan servicer can provide additional support and resources as needed.

Resources are also available for aiding in managing student loans effectively, including financial literacy tools and budget planners. Engaging with the community can offer further understanding and support for similar experiences.

Interactive tools and resources

Utilizing platforms like pdfFiller makes managing your student loan deferment forms easier. From editing and signing PDF documents to collaborative features enabling shared access, pdfFiller provides everything needed to complete your deferment forms efficiently.

Access the deferment form from any device, allowing flexibility and convenience. Additional tools provided on the platform can assist with budgeting for repayment or calculating monthly payments using various online calculators.

Staying informed on deferment and student loans

The landscape of student loans and deferments is continually evolving, making it crucial for borrowers to stay informed. Following updates in loan regulations and government programs can significantly impact financial planning and repayment options.

Educational resources such as articles and webinars are often available to provide deeper insights into managing your loans effectively. Keeping abreast of these can prevent potential pitfalls and empower efficient financial decision-making.

Share your experience

Encouraging user engagement through platforms allows borrowers to share experiences and strategies related to student loan deferment. Experiences can help create a supportive community while offering much-needed help to those in similar situations.

Input from diverse borrower perspectives enriches discussions and fosters connections, making it easier to navigate the complexities of student loans. This collaborative approach paves the way for enhanced understanding and ultimately better decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit student loan deferment for in Chrome?

Can I create an electronic signature for signing my student loan deferment for in Gmail?

How do I edit student loan deferment for straight from my smartphone?

What is student loan deferment for?

Who is required to file student loan deferment for?

How to fill out student loan deferment for?

What is the purpose of student loan deferment for?

What information must be reported on student loan deferment for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.