Get the free INDUSTRIAL EQUIPMENT CAPITAL

Get, Create, Make and Sign industrial equipment capital

Editing industrial equipment capital online

Uncompromising security for your PDF editing and eSignature needs

How to fill out industrial equipment capital

How to fill out industrial equipment capital

Who needs industrial equipment capital?

Understanding Industrial Equipment Capital Forms: A Comprehensive Guide

Understanding industrial equipment capital forms

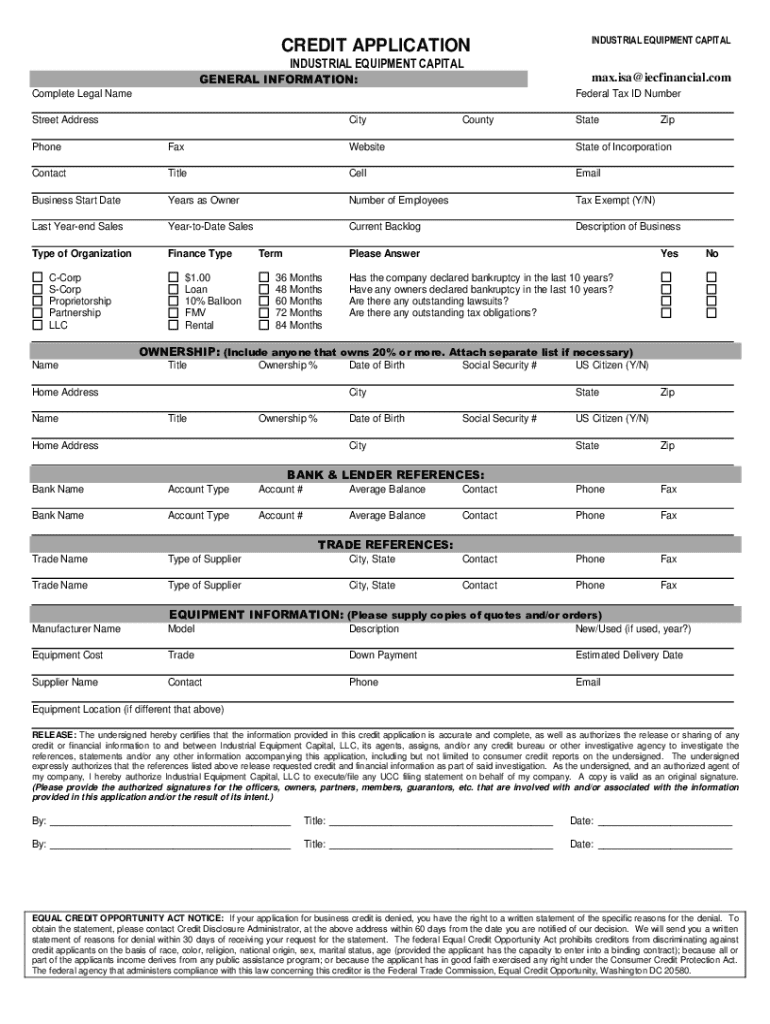

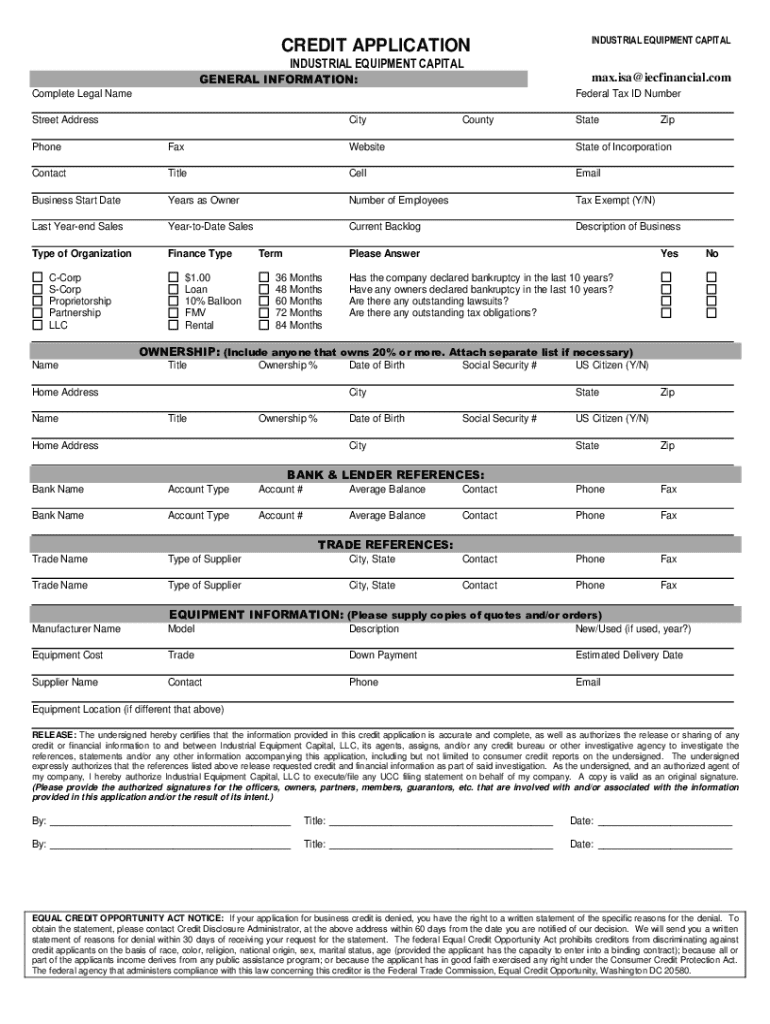

An industrial equipment capital form is a crucial document used by businesses to outline the financial aspects of acquiring machinery and equipment. The primary purpose of this form is to facilitate decision-making regarding whether to lease or purchase equipment, impacting a company's balance sheet and cash flow. This document plays a fundamental role in business operations, helping ensure financial accountability and compliance, while also guiding management strategies concerning capital investments.

Understanding how to effectively utilize industrial equipment capital forms is vital for any organization involved in capital-intensive industries. It serves as a formal request to either acquire or finance equipment, signaling to stakeholders the financial implications of such decisions. In sum, these forms are essential tools for financial management, risk assessment, and resource allocation.

Key components of the capital form

A well-structured industrial equipment capital form includes essential fields and data that facilitate smooth processing and approval. Key components typically include:

Types of industrial equipment capital forms

When dealing with industrial equipment, businesses often face a choice between leasing and purchasing capital forms, each offering distinct financial implications. For instance, leasing typically involves lower upfront costs and flexible terms, making it appealing for companies aiming to conserve cash and avoid substantial initial outlays. However, this may lead to higher long-term costs and a lack of ownership benefits.

Conversely, purchasing equipment might entail higher initial expenditures but could ultimately result in greater asset control and potential tax benefits associated with ownership. Companies need to carefully consider their operational needs versus financial capacities to choose the suitable option for their specific contexts.

Forms for different equipment categories

Different categories of industrial equipment, such as heavy machinery, construction equipment, and manufacturing tools, might require unique forms tailored to their respective needs. Heavy machinery capital forms typically emphasize operational safety and compliance, while construction equipment forms focus on project timelines and flexibility for rapid deployment.

Manufacturing tools, on the other hand, often require detailed specifications to align with production goals. Ensuring that the capital form is appropriately structured for the equipment category can facilitate smoother approval and integration into business operations.

The capital form process flow

Completing an industrial equipment capital form is a systematic process that requires attention to detail. Follow these steps for effective completion:

Common mistakes to avoid when filling out these forms include inaccuracies in data entry and omitted information, which can delay approval and lead to financial miscalculations. Additionally, choosing the wrong form type can complicate the process significantly.

Utilizing pdfFiller for your capital form needs

pdfFiller is a powerful tool that enhances the process of managing your industrial equipment capital form. With its seamless document editing and e-signing capabilities, users can easily interact with forms to make necessary changes without hassle. The platform’s interface allows for interactive edits that streamline data input, significantly reducing time spent on paperwork.

Collaboration features allow for sharing forms with team members, enabling real-time feedback and adjustments. This ensures all stakeholders remain informed and can contribute to the finalization of critical equipment financial decisions.

Moreover, pdfFiller’s cloud-based storage solutions make accessing forms convenient and secure. Users can retrieve documents from any location, facilitating remote work and team collaboration, crucial for today's dynamic business environment.

Capital equipment financing and management

Understanding the financing options available for capital equipment is essential for businesses deciding how to proceed with acquisitions. Capital leases, operating leases, and loans offer varying terms and implications that should align with a company’s long-term financial strategy. Capital leases allow businesses to retain equipment on their balance sheet, while operating leases are typically treated as operating expenses, which can enhance cash flow.

Decision-makers need to assess their financial situation carefully, taking into account factors such as the expected lifespan of the equipment, potential usage rates, and available budget. Understanding the depreciation schedule and associated tax benefits is equally critical, as these can have far-reaching implications for a company's overall financial health.

Compliance and documentation

Compliance with regulatory requirements is paramount when dealing with industrial equipment capital forms. Businesses must ensure they maintain accurate records and submit appropriate documentation to satisfy legal stipulations. Without proper documentation, companies risk penalties and operational inefficiencies that can arise from non-compliance.

Staying updated with regulatory changes is crucial for successful management of industrial equipment. pdfFiller can assist businesses in maintaining compliance by providing features that ensure that forms are kept current and accessible, helping organizations to avoid lapses in adherence to industry standards.

Troubleshooting common issues

Organizations may encounter various challenges related to industrial equipment capital forms, such as difficulty accessing forms or issues with editing and document management. To address these challenges, businesses should familiarize themselves with the functionalities of tools like pdfFiller. Understanding how to effectively use the platform can minimize frustration and enhance productivity.

Additionally, seeking help from resources such as pdfFiller customer support or online forums can provide valuable solutions and insights. Peer experiences can enrich understanding and offer practical tips for navigating form-related issues.

Long-term management of industrial equipment

Effective long-term management of industrial equipment involves best practices for tracking and maintenance. Sporting an effective asset tracking system allows companies to monitor equipment usage, maintenance schedules, and the lifecycle of each asset. Regular maintenance documentation not only aids in preserving operational efficiencies but also contributes to extending the lifespan of equipment.

Utilizing technology tools, such as pdfFiller, showcases significant advantages in managing documentation. Accessing forms and maintenance logs from the cloud ensures ongoing management is not only effective but also efficient, simplifying the processes involved in keeping equipment in optimal condition.

Enhancing your document management strategy

Integrating capital forms into your business workflow is essential for improving operational efficiency. Streamlining onboarding and procurement processes allows companies to adapt quickly to changes in manufacturing demands while facilitating smoother transitions during equipment onboarding. Establishing regular review cycles for form updates ensures that documentation remains relevant and accurate, contributing to informed decision-making.

Leveraging analytics derived from capital forms provides businesses with insights that can inform future financial decisions. By identifying trends in equipment usage and evaluating financing strategies, organizations position themselves to make proactive decisions that enhance profitability and operational effectiveness.

Case studies and success stories

Examining real-world case studies highlights the efficiency achieved through sound management of industrial equipment capital forms. Many organizations using pdfFiller have noted a significant reduction in time spent on documentation processes, enabling them to focus on core business activities while ensuring compliance and transparency in equipment management.

Testimonials from these companies showcase the positive impact of streamlined document solutions, illustrating how effective utilization of capital form management tools translates into operational success and enhanced financial control.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the industrial equipment capital in Gmail?

How do I edit industrial equipment capital straight from my smartphone?

How do I fill out industrial equipment capital using my mobile device?

What is industrial equipment capital?

Who is required to file industrial equipment capital?

How to fill out industrial equipment capital?

What is the purpose of industrial equipment capital?

What information must be reported on industrial equipment capital?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.