Get the free Marriage tax allowancetransferring your personal ...

Get, Create, Make and Sign marriage tax allowancetransferring your

How to edit marriage tax allowancetransferring your online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marriage tax allowancetransferring your

How to fill out marriage tax allowancetransferring your

Who needs marriage tax allowancetransferring your?

Marriage Tax Allowance - Transferring Your Form

Understanding marriage allowance

Marriage allowance is a tax benefit that allows one spouse to transfer a portion of their personal allowance to the other, potentially reducing the couple's overall tax bill. The personal allowance is the amount of income not taxed by the government, and for many couples, one partner earns more than the other, making this allowance transfer beneficial.

To be eligible for marriage allowance, couples must be married or in a civil partnership, and one partner must earn less than the personal allowance threshold while the other earns more. This imbalance creates an opportunity for tax savings through the transfer of unused allowance.

The importance of utilizing marriage allowance lies in its financial benefits. For couples with a significant earnings disparity, transferring this allowance can reduce the higher earner's tax liability, leading to potential savings that can be reinvested in family needs or savings.

The process of transferring your marriage allowance

Transferring your marriage allowance is a straightforward process, but certain circumstances may warrant the action. For instance, a couple undergoing a significant life change, such as a new job or a shift in income, may find it advantageous to revisit their allowance transfer.

Here are the key steps involved in transferring your marriage allowance:

Effect on your tax code

Once the marriage allowance is transferred, it directly impacts your tax code. The higher earner will see an adjustment reflecting the newly transferred allowance, which may offer a more favorable tax code leading to reduced tax payments.

When preparing future tax returns, it's essential to consider this transfer as it will change the amounts declared. Notably, individuals should be cautious of common mistakes such as failing to report the allowance on tax returns or misunderstanding its effect on overall tax liability.

Real-life scenarios: benefits of transferring marriage allowance

Practical applications of marriage allowance can be illustrated through various scenarios, demonstrating its effectiveness in tax savings. For instance, consider a married couple where one partner earns significantly less than the other—transferring the marriage allowance in such cases can optimize their tax savings.

For example, in a case study where one spouse earns £18,000, and the other earns £50,000, the higher earner can benefit from the lower earner's unused personal allowance, directly translating to additional savings on their annual tax payments.

These scenarios underscore the importance of regularly reviewing one's tax situation and making informed decisions regarding marriage allowance transfers.

Frequently asked questions (FAQs)

When navigating marriage tax allowance, it’s common to have questions. Here are some of the frequently asked queries:

Need help with your marriage allowance?

Navigating tax documents can be daunting, but tools like pdfFiller can simplify the process. With a cloud-based platform, pdfFiller empowers users to edit, sign, and manage their documents effortlessly, ensuring that you can access your marriage allowance forms anywhere.

Additionally, professional guidance is often beneficial, especially in complex tax situations. With expert advice, individuals can identify how to maximize their allowance effectively and avoid potential pitfalls.

Stay updated

Staying informed about tax updates is crucial for effective financial planning. Subscribing to monthly newsletters can provide valuable insights on any changes to tax policies that may affect your marriage allowance.

pdfFiller also offers a range of resources and articles to help you navigate marriage allowance and other tax-related topics, ensuring you are well-equipped with the knowledge needed to optimize your taxes.

Conclusion

Understanding and utilizing your marriage tax allowance can significantly impact your financial situation. By actively transferring your allowance and monitoring your tax position, couples can effectively optimize their savings and ensure financial stability in their marriage.

With the right tools and information, like those provided by pdfFiller, taking action to transfer your allowance will lead to substantial savings and a better understanding of your overall tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my marriage tax allowancetransferring your in Gmail?

How do I make edits in marriage tax allowancetransferring your without leaving Chrome?

How do I complete marriage tax allowancetransferring your on an iOS device?

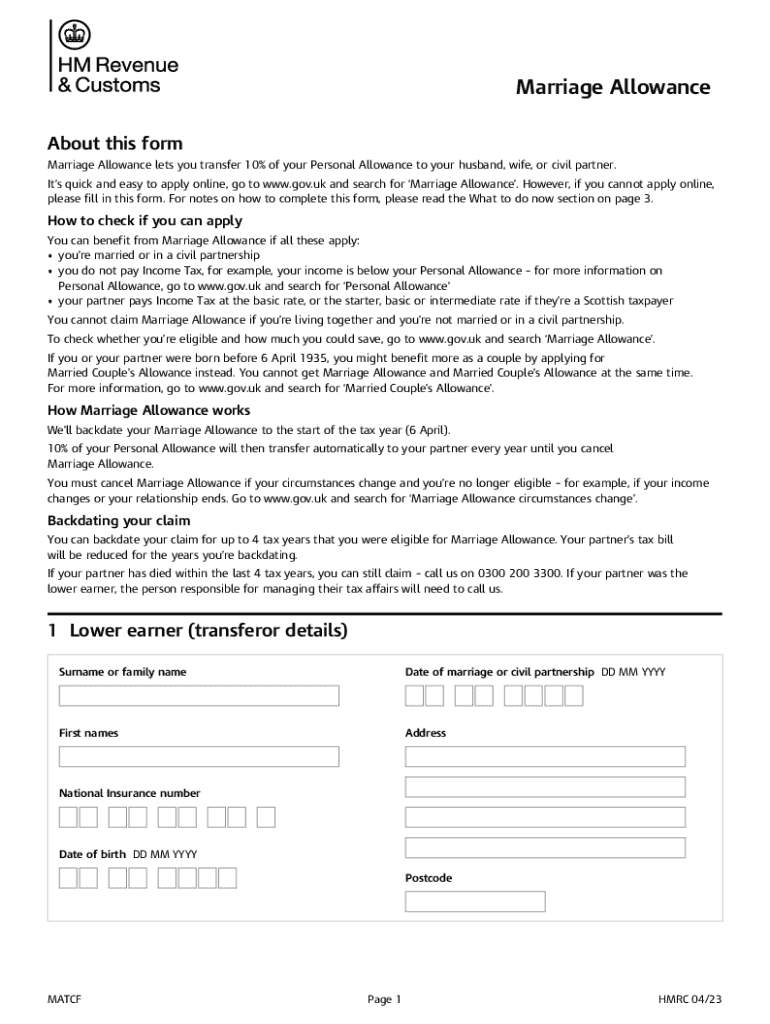

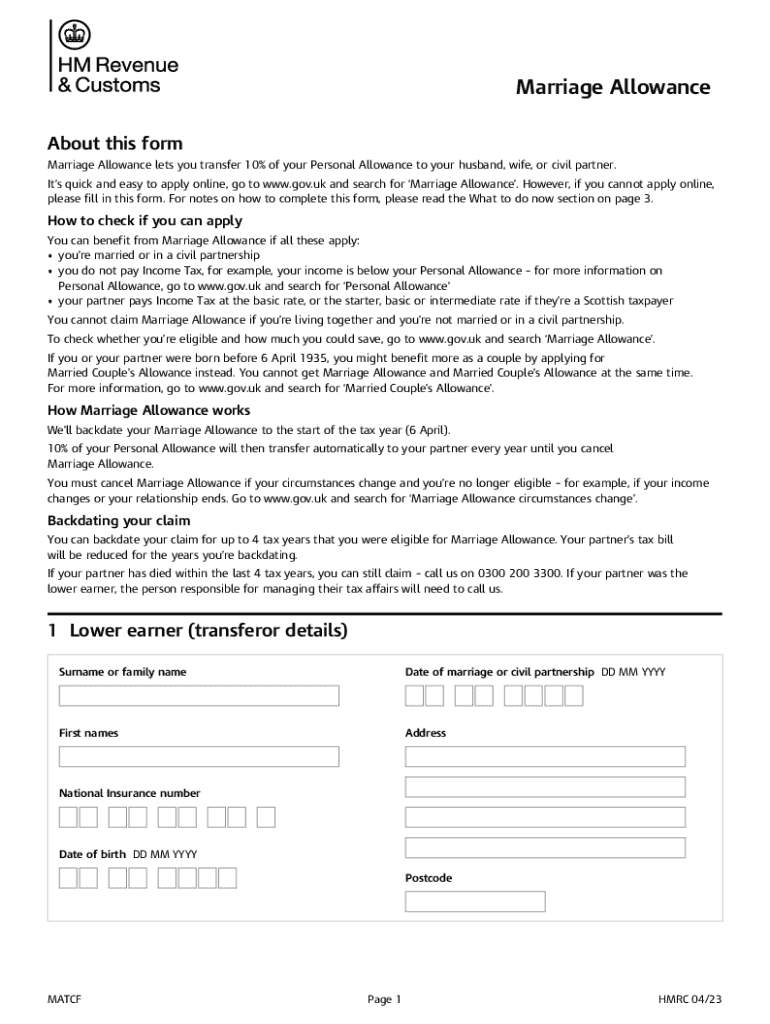

What is marriage tax allowance transferring your?

Who is required to file marriage tax allowance transferring your?

How to fill out marriage tax allowance transferring your?

What is the purpose of marriage tax allowance transferring your?

What information must be reported on marriage tax allowance transferring your?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.