Get the free MORTALITY INSURANCE APPLICATION - Debbie Treadwell ...

Get, Create, Make and Sign mortality insurance application

Editing mortality insurance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortality insurance application

How to fill out mortality insurance application

Who needs mortality insurance application?

Understanding the Mortality Insurance Application Form: A Comprehensive Guide

Understanding mortality insurance

Mortality insurance, commonly referred to as life insurance, protects individuals and their families against the financial burden of premature death. It provides a monetary benefit to beneficiaries upon the insured's death, thereby ensuring financial stability during uncertain times. The significance of mortality insurance lies in its ability to aid in personal and financial planning, addressing potential debts, loss of income, and funeral expenses.

As part of comprehensive financial planning, having mortality insurance allows individuals to secure their loved one's future, ensuring they can maintain their lifestyle even after the primary wage earner is gone. Despite this, many people hesitate to purchase it due to misconceptions or a lack of understanding about the various types available.

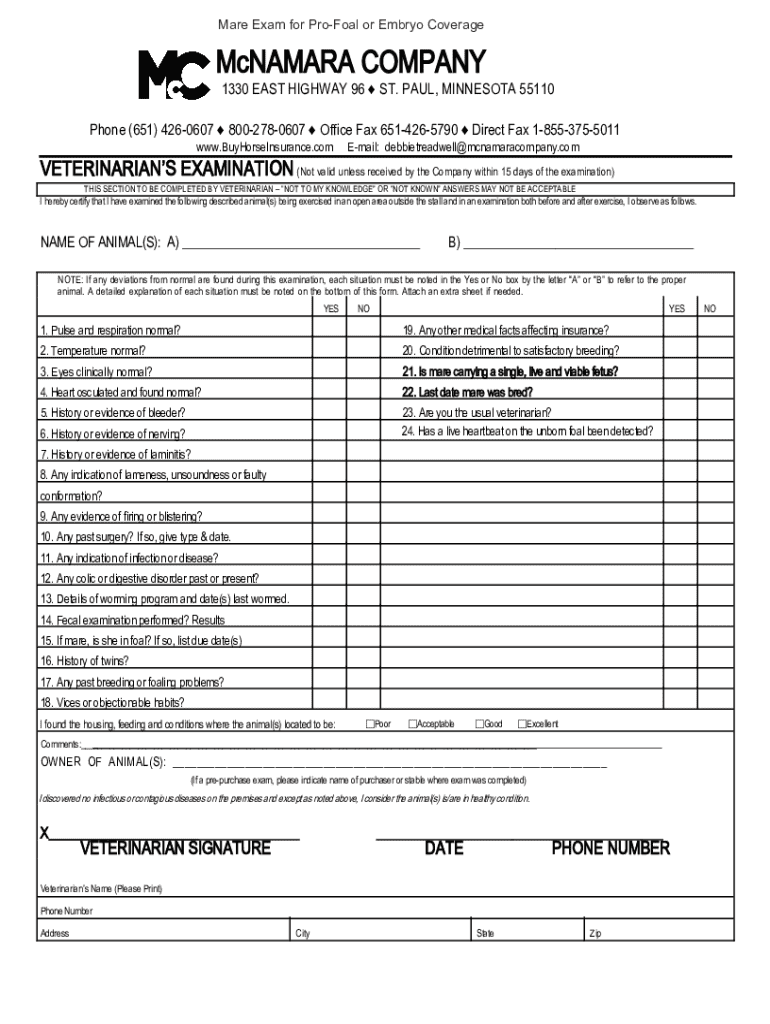

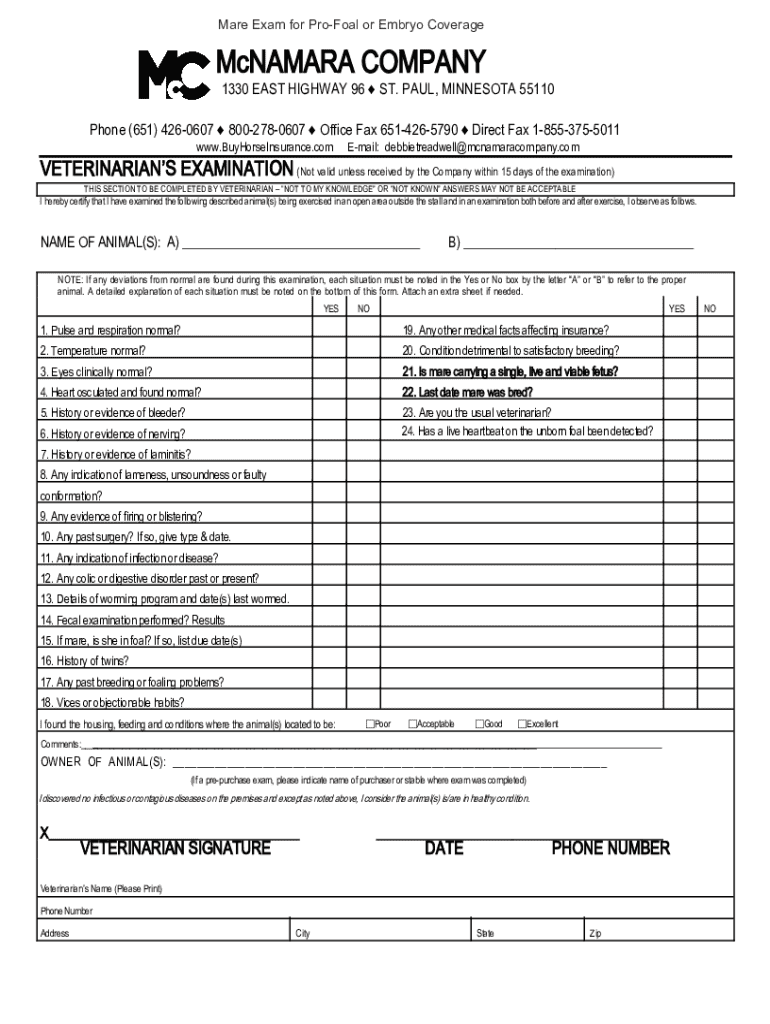

Purpose of the mortality insurance application form

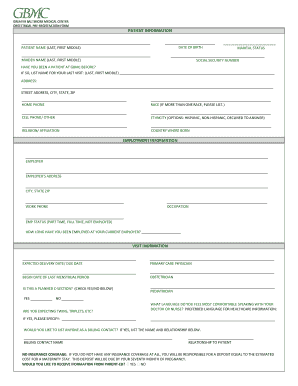

The mortality insurance application form serves a critical role in the insurance process. It collects vital information that enables companies to assess risk and determine premium costs. Ensuring accurate and complete information greatly impacts the policy approval process, influencing how quickly an application is reviewed and whether coverage is granted.

When it comes to the information gathered, the form typically requires details such as personal identification information, comprehensive health history, and pertinent lifestyle factors. This data is essential for underwriting purposes and determines eligibility for specific coverage and premiums.

Step-by-step guide to filling out the mortality insurance application form

Filling out your mortality insurance application form requires meticulous attention to detail. To begin the process, gather all necessary documents and information, which will not only streamline your application process but also steer clear of future complications.

Step 1 is to gather required documents, which typically include identification documents like a driver's license or passport, health records, and any previous insurance policies. This preparation pays off as it helps in navigating the form with confidence.

Next, in Step 2, focus on completing the personal information section. Take your time ensuring that all data is entered accurately; this includes verifying your name, address, and contact details. Common pitfalls at this stage include typos or outdated information, which can lead to delays.

Step 3 is about disclosing your health history. It’s crucial to be transparent regarding your health status to avoid potential consequences. For instance, failing to accurately report a pre-existing condition could lead to denial of benefits when they are most needed.

Moving on to Step 4, specify your beneficiary details. Select someone who will have the financial know-how to manage your policy proceeds. This could be a spouse or trusted family member; keep in mind the implications of using minors as beneficiaries.

Finally, in Step 5, thoroughly review your application. Double-check for any errors or incomplete sections. This is a crucial step as inaccuracies can lead to rejection or delayed processing of your application.

Editing and managing your mortality insurance application form

Once your application is submitted, you may find the need to edit or manage the document due to changes in your circumstances or new information. This is where a tool like pdfFiller becomes invaluable for users. With pdfFiller, you can easily edit your PDF documents, ensuring accuracy and completeness.

One key feature allows you to edit PDFs, making necessary adjustments without starting over. For further convenience, pdfFiller also allows you to track changes made to your document, providing a clear history of modifications.

Collaborating with families or financial advisors can enhance your application process. pdfFiller enables users to invite others to review your application, making it a collaborative effort and decreasing the likelihood of overlooking vital details. Comments and notes can be effectively utilized to provide context or questions about particular sections.

Signing and submitting your mortality insurance application

The final step in your mortality insurance application process is signing and submitting the form. Utilizing e-signing tools provided by pdfFiller simplifies this process significantly. Electronic signatures are legally binding and have become increasingly accepted by insurance providers, streamlining the finalization of your application.

To effectively sign your document electronically, follow a step-by-step process within the pdfFiller platform, adding your signature where required. After signing, it’s essential to proceed with the submission process. You can submit your application directly through pdfFiller, which provides options tailored to your needs and makes tracking your submission status straightforward.

FAQs about mortality insurance application forms

Navigating the process of applying for mortality insurance can raise numerous questions or concerns. Common queries often revolve around the frequency of application delays and the potential reasons behind them. Delays can stem from incomplete information, complexities in health history, or discrepancies found during underwriting. It's crucial to keep communication open with your insurance provider for updates.

Additionally, applicants wonder what happens if their information changes during the application process, such as a new diagnosis or change in beneficiary. It is advisable to notify your insurance provider immediately of such changes, as these can significantly impact your coverage.

Additional tips for a successful application process

Understanding underwriting processes is pivotal when filling out a mortality insurance application form. Underwriters use the information provided to assess risk factors and determine the insurance premium. Familiarizing yourself with what underwriters look for can greatly increase your chances of approval.

Recognizing and avoiding common mistakes can also prove beneficial. Misunderstandings about health questions or the importance of full disclosure can lead to rejection. Always take the time to read the questions carefully and provide comprehensive answers.

Moreover, staying informed on policy changes can impact the effectiveness of your coverage. Insurance companies regularly update their policies; being proactive in understanding these changes can enhance your overall policy management experience.

Further assistance with mortality insurance applications

Accessing resources for filling out your mortality insurance application form is essential. Platforms like pdfFiller offer various templates and forms specifically designed to make the application process more manageable. Utilizing these templates can save time and reduce errors while filling out your application.

In addition to templates, customer support is available for immediate help. If you encounter difficulties or have questions about completing your application, pdfFiller's support team can provide the assistance you need.

Consulting with an insurance advisor can offer personalized insights. Professionals can guide you through the complexities of mortality insurance, ensuring you select options that align with your financial goals and specific needs.

Interactive tools to enhance application experience

To simplify the application process, pdfFiller integrates a variety of interactive tools designed to enhance the user experience. These features include document sharing and collaboration options, enabling applicants to seek input from family or advisors easily.

Smart tool integrations assist users in preparing their applications thoroughly. For instance, auto-fill options can streamline data entry based on previous documents, significantly reducing time and effort involved in filling out the mortality insurance application form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortality insurance application for eSignature?

Can I create an eSignature for the mortality insurance application in Gmail?

How do I fill out the mortality insurance application form on my smartphone?

What is mortality insurance application?

Who is required to file mortality insurance application?

How to fill out mortality insurance application?

What is the purpose of mortality insurance application?

What information must be reported on mortality insurance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.