Get the free MERS IRA (Individual Retirement Account) Application

Get, Create, Make and Sign mers ira individual retirement

How to edit mers ira individual retirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mers ira individual retirement

How to fill out mers ira individual retirement

Who needs mers ira individual retirement?

MERS IRA Individual Retirement Form: A Comprehensive Guide

Overview of MERS IRA

The Municipal Employees' Retirement System (MERS) serves as a crucial resource for public sector employees, providing a structured retirement savings vehicle tailored to their needs. The MERS IRA specifically allows individuals to save for retirement independently, ensuring financial security after their service. These individual retirement accounts (IRAs) represent a cornerstone in retirement planning, fostering a savings culture among municipal workers.

IRAs play a significant role in diversifying retirement portfolios. For individuals employed by municipalities, understanding the parameters of MERS IRA is essential, as it combines the benefits of tax-advantaged growth with personalized control over investments. With growing awareness about retirement readiness, this system empowers employees to take proactive steps in managing their financial futures.

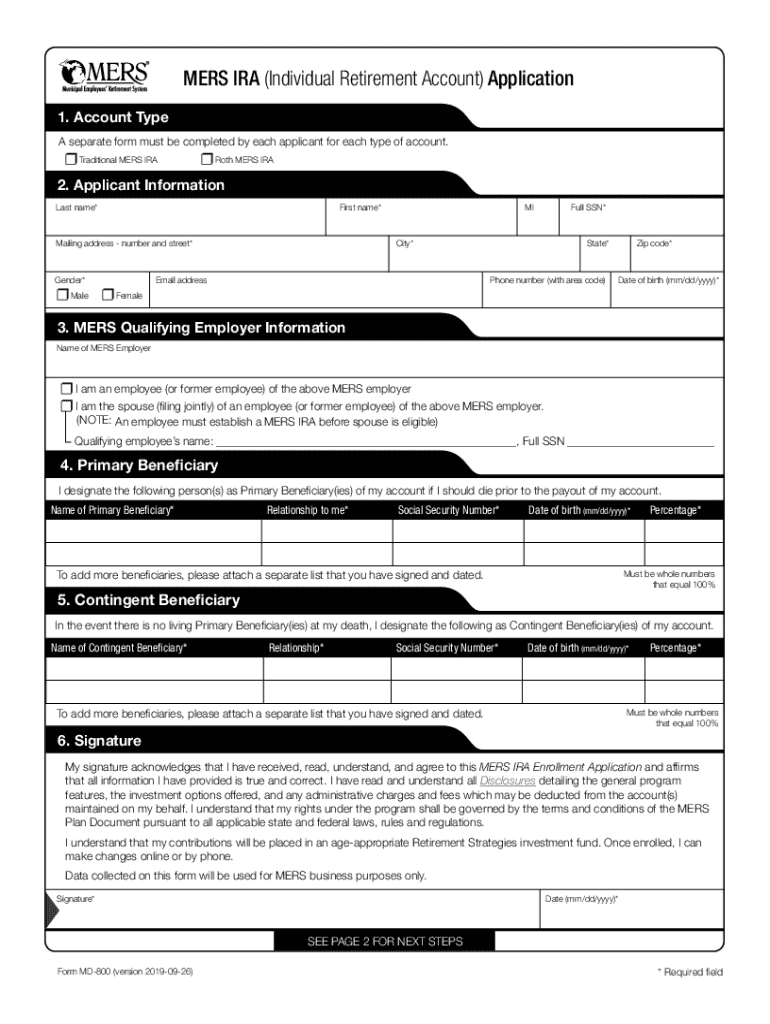

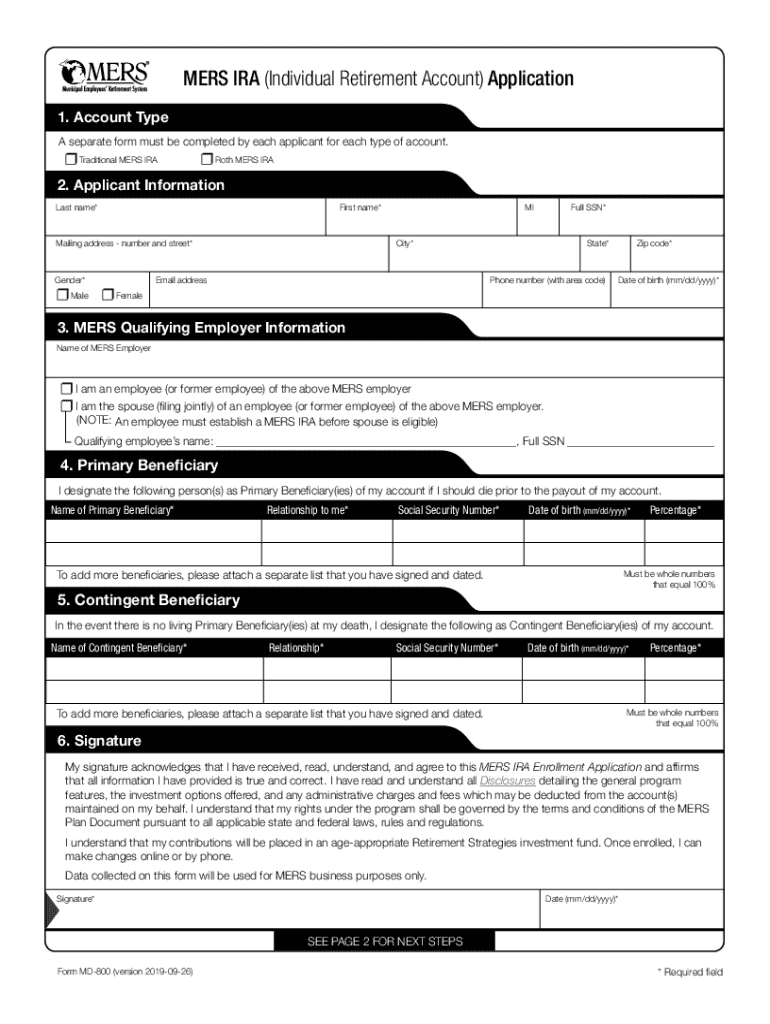

Understanding the MERS IRA Individual Retirement Form

The MERS IRA Individual Retirement Form is a pivotal document for those wishing to establish a personal IRA under the MERS framework. This form captures essential personal and financial information necessary for setting up the retirement account. Each entry on the form must be accurate, as inaccuracies can lead to delays or complications during the retirement planning process.

The form typically requires details such as personal identification, income statements, and retirement goals. Completing this form accurately is crucial not just for the immediate setup of the IRA but also for compliance with tax regulations and future contributions. It acts as a foundational step in securing an efficient retirement strategy.

How to Access the MERS IRA Form

Accessing the MERS IRA Individual Retirement Form can easily be accomplished through pdfFiller's user-friendly interface. Follow these simple steps to locate the necessary document:

The MERS IRA form is available in multiple formats, including PDF and online forms, catering to user preferences and ease of access.

Filling Out the MERS IRA Individual Retirement Form

Meticulously filling out the MERS IRA Individual Retirement Form is essential for setting up your account correctly. The form is divided into several sections that require specific details:

Personal Information Section

The personal information section requests essential details such as your full name, contact information, and employment history. Accuracy here ensures effective communication and processing.

Financial Information Section

In the financial information section, you are required to input your income and savings details. It is crucial to provide up-to-date figures, as they significantly influence your eligible contribution limits. Additionally, be aware of potential tax implications associated with your choices.

Selection of Retirement Options

You will also need to indicate your preferred retirement option, choosing between a traditional IRA or a Roth IRA. Each has different tax implications and benefits, which should be carefully considered based on your financial situation.

Signature and Date Requirements

Finally, do not forget to complete the signature and date requirements. E-signatures are accepted, which streamlines the process but must be done before any processing of your form can occur.

Editing and Managing Your MERS IRA Form

Once you have filled out the MERS IRA Individual Retirement Form, utilizing pdfFiller's editing tools can enhance your experience further. The platform provides features to highlight, comment, and fill in various sections easily. If you need to make any changes, these tools simplify the adjustment process.

Additionally, pdfFiller offers saving and version management functionality, allowing users to keep track of different iterations of the form. This is especially helpful for individuals who may need to revisit their entries or update information as circumstances change.

Electronic signature process

The electronic signature process for the MERS IRA form through pdfFiller is straightforward and secure. Follow this guide to complete your signature electronically:

Security measures for e-signatures via pdfFiller include encryption and secure server handling, ensuring the confidentiality of your information. The advantages of e-signing include enhanced efficiency and reduced processing delays, making it an ideal choice for busy professionals.

Submitting Your MERS IRA Individual Retirement Form

Once your MERS IRA Individual Retirement Form is completed and signed, it’s time to submit it. Methods of submission can vary; here's how you can proceed:

To monitor your submission's status, pdfFiller offers tracking features that keep you informed of the progress of your application. Typically, processing times may vary depending on demand, but it's essential to expect a turnaround of several weeks for full processing.

Frequently asked questions (FAQs)

Navigating the MERS IRA Individual Retirement Form process may prompt various questions. Here are some frequently asked questions and their answers:

Additional information on MERS IRA plans

MERS offers various IRA plans tailored to different employment circumstances and goals. Here’s a breakdown of the two main types of plans available for individuals:

Understanding these different plans is crucial for public employees as it helps them decide which route aligns best with their long-term retirement goals and risk tolerance.

Resources for MERS IRA participants

For MERS IRA participants looking to enhance their retirement planning, several resources can be beneficial. pdfFiller offers valuable links to relevant retirement resources and guides that can further assist in understanding retirement options.

Additionally, community forums and social media groups allow individuals to share experiences and advice regarding their MERS IRA plans. If further assistance is needed, MERS support provides dedicated customer service to address inquiries.

Tips for successful IRA management

To effectively manage your MERS IRA, consistent monitoring and proactive engagement are key. Here are some best practices to consider:

By implementing these strategies, you can ensure sustained growth in your retirement account and a better trajectory towards your financial independence in retirement.

Additional features of pdfFiller relevant to MERS IRA

pdfFiller not only facilitates the filling and signing of the MERS IRA Individual Retirement Form but also offers additional features that enhance document management, collaboration, and accessibility.

For teams managing shared retirement documents, collaboration tools offered by pdfFiller streamline workflow, enabling multiple users to comment and edit simultaneously. Furthermore, being a cloud-based platform, users can access their retirement documents from anywhere, ensuring that managing retirement plans remains efficient and flexible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in mers ira individual retirement?

How can I edit mers ira individual retirement on a smartphone?

How do I fill out the mers ira individual retirement form on my smartphone?

What is mers ira individual retirement?

Who is required to file mers ira individual retirement?

How to fill out mers ira individual retirement?

What is the purpose of mers ira individual retirement?

What information must be reported on mers ira individual retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.