Understanding the Business Rates Hardship Relief Form

Breadcrumb navigation

Home > Business Rates > Hardship Relief

Help available for business rates

Business owners facing economic difficulties can access various support services designed to alleviate the burden of business rates. These services include government grants, local council assistance, and financial advice organizations. Understanding these resources can be the first step towards securing necessary relief.

Key resources include local council websites, the Gov.uk site for national support measures, and business support helplines. Acting quickly and utilizing these resources effectively can significantly enhance your chances of receiving relief.

Local council assistance for business rate queries.

Gov.uk for comprehensive government support details.

Business support helplines available for guidance.

For specific instructions and detailed insights into business rates hardship relief, be sure to explore local economic development departments or representatives that can offer tailored advice.

What is business rates hardship relief?

Business rates hardship relief is a financial assistance program designed to support businesses experiencing significant financial challenges. This relief aims to reduce the business rates liability for eligible firms, allowing them to sustain operations and potentially avoid closure during difficult times.

The importance of this relief can hardly be overstated, particularly for small businesses and startups that often operate on thin margins. The legal framework governing hardship relief typically falls under the Local Government Finance Act, giving local authorities the discretion to provide assistance based on individual circumstances.

Understanding 'crisis' and 'exceptional circumstances'

In a business context, a 'crisis' refers to an unforeseen event that drastically disrupts regular operations, such as a natural disaster, economic downturn, or a global pandemic. Exceptional circumstances may include, but are not limited to, significant drops in revenues, loss of key clients, or critical supply chain interruptions.

These situations can incapacitate businesses, leading to layoffs, reduced hours, or even total shutdowns. Recognizing these crises is essential as they form the basis for applications for business rates hardship relief.

Economic downturns impacting sales.

Natural disasters disrupting operations.

Supply chain issues causing product shortages.

Eligibility criteria for hardship relief

Not every business qualifies for hardship relief; understanding the eligibility criteria is crucial. Generally, businesses located in commercial properties are eligible, although specific circumstances might affect this eligibility positively or negatively.

A detailed eligibility checklist includes considerations for business size, structure, and key financial performance indicators, such as annual turnover, number of employees, and cash flow viability.

Type of property: Must be a commercial property or business premises.

Business size: Small and medium businesses are favored.

Financial performance indicators: Need to demonstrate adverse financial conditions.

Application process for hardship relief

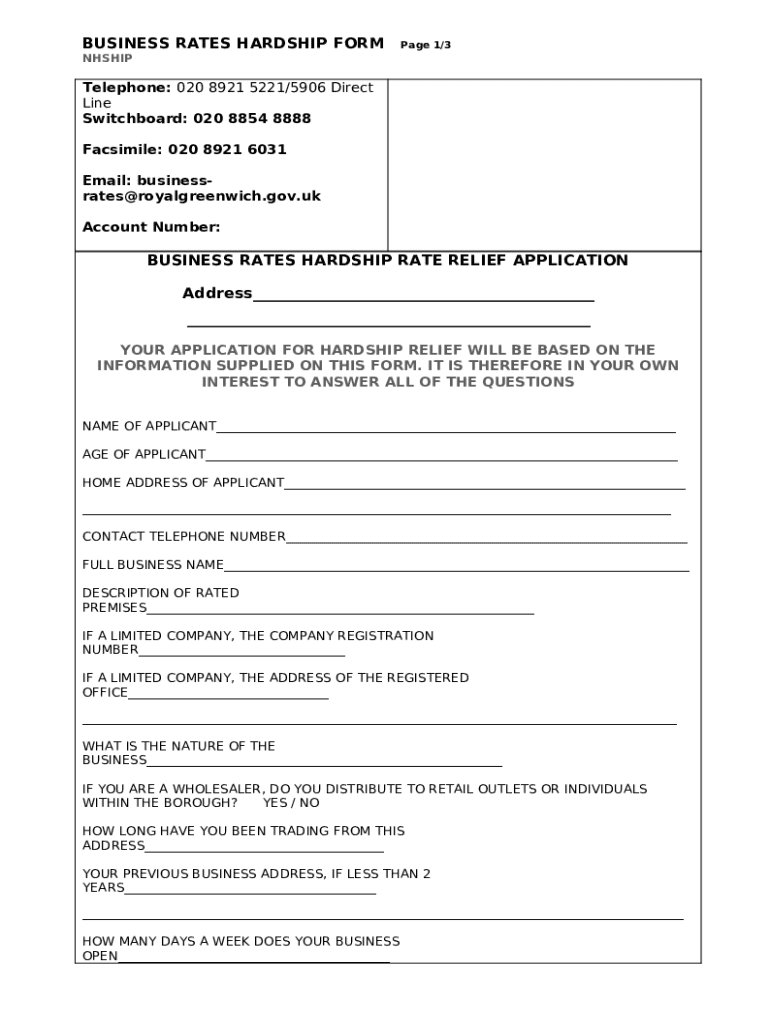

The application process for the business rates hardship relief form requires careful attention to detail to maximize your chance of approval. Start by gathering the necessary documentation, which usually includes financial statements, business plans, and proof of property occupancy.

Filling out the business rates hardship relief form accurately is crucial. Ensure all sections are completed, and provide clear, concise information regarding your business’s financial status. Once completed, submit your application to your local council.

Gather relevant documentation.

Fill out the business rates hardship relief form carefully.

Submit your application to your local council.

Avoiding common mistakes such as incomplete forms, providing incorrect documentation, and failing to clearly outline your financial situation can significantly increase your application’s chance of approval.

What to expect after submission

After submitting your application for business rates hardship relief, it can take several weeks for local authorities to process. During this time, clear communication is essential. You will likely receive updates from your local council, informing you of the status of your application.

If your application is successful, you will receive a notification that outlines the specific relief granted. Conversely, if denied, authorities are obliged to provide reasons for the rejection, giving you insight into terms of the decision.

Ongoing payment obligations

It’s important to understand your responsibilities concerning ongoing payments after applying for business rates hardship relief. While relief may reduce payments due, regular payments on the remaining balance might still be required.

Clarifying these obligations is crucial, as is financial planning during the relief period. Many successful applicants find budgeting strategies helpful to navigate their financial commitments during this transition period.

Review potential revisions to your rates post-approval.

Continue making payments as instructed by local authorities.

Engage in proactive financial planning during the relief period.

Disputing a decision: next steps

If the decision on your application for business rates hardship relief is unfavorable, you have the right to challenge it. The appeal process typically involves submitting a formal request for reconsideration to your local council, providing any new evidence or documentation supporting your case.

The timeline for appeals can vary, but it generally takes several weeks to receive a response. Helpful resources for dispute resolution can include local business advisory services and legal consultation to ensure you present a strong case.

Prepare a formal request for reconsideration.

Provide new evidence or documentation as required.

Seek resources for dispute assistance, like legal advice.

Further information on hardship relief

For more information about business rates hardship relief, engaging with your local council can provide specific guidelines and contact details. They can direct you toward key resources and necessary legislation relevant to your appeal or inquiry. Understanding local policies can help ensure compliance and awareness of your rights and options.

Links to relevant legislation can often be found on government websites. Additionally, accessing templates and additional forms can aid in ensuring your submissions are compliant and comprehensive.

Apply for discounts, exemptions, and relief

Various financial supports are available beyond hardship relief. Businesses may also be eligible for discounts or exemptions based on factors like location or property use. Exploring these avenues can provide further financial aid.

To access other relief programs, business owners should refer to local council resources and Gov.uk for detailed guidance on various forms and applications available. Specific forms/templates for these options are also accessible through pdfFiller, simplifying the document management process.

Download the business rates hardship relief application form

To begin your application for business rates hardship relief, you can download the necessary form directly from your local council’s website or through pdfFiller. This platform not only provides the form but also offers user-friendly features that allow for editing and e-signing.

After downloading, carefully review the application requirements, fill in all necessary information, and follow the submission instructions. Engaging in best practices such as reviewing your application with a peer can enhance accuracy and ensure compliance with local regulations.

Download the application form from local council or pdfFiller.

Review application requirements thoroughly before filling out.

Submit your completed application as per council guidelines.