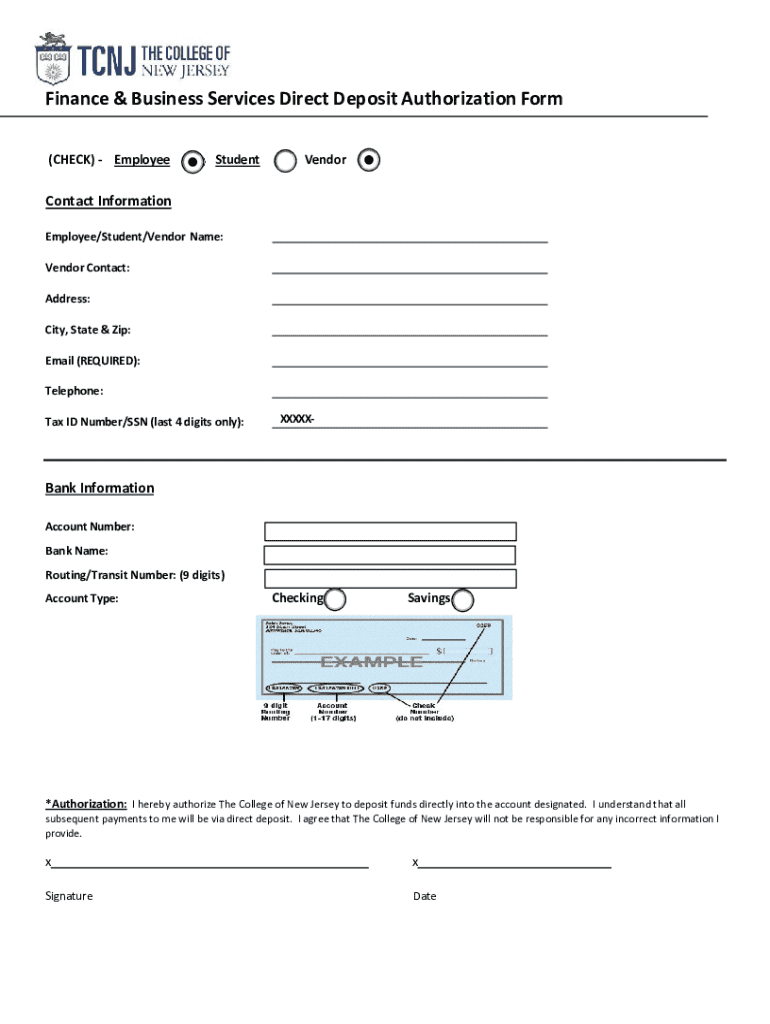

Get the free Finance & Business Services Direct Deposit Authorization Form - treasurer tcnj

Get, Create, Make and Sign finance business services direct

How to edit finance business services direct online

Uncompromising security for your PDF editing and eSignature needs

How to fill out finance business services direct

How to fill out finance business services direct

Who needs finance business services direct?

A Comprehensive Guide to Finance Business Services Direct Forms

Understanding finance business services

Finance business services encompass a wide range of functions that support the financial operations of businesses. These services are crucial for managing day-to-day financial transactions, ensuring compliance with regulations, and enabling strategic planning. Within this framework, document management plays a pivotal role, as effective handling of financial documents facilitates smoother operations and reduces errors.

Efficient document management is important not only for accuracy but also for compliance and accountability in financial reporting. Over the years, the structure and requirements for financial forms have evolved, adapting to both regulatory demands and technological advancements. Therefore, having a solid grasp of the types of forms used in the finance sector is essential for business owners and financial professionals alike.

The role of direct forms in business finance

Direct forms are document templates that allow users to input specific information required for various finance-related processes. They come in different types, including application forms and submission forms, each designed to streamline a particular aspect of finance management. By using these forms, businesses can ensure their documentation is standardized, reducing the potential for errors that might arise from inconsistent formats.

The benefits of utilizing direct forms extend beyond just standardization. They significantly enhance operational efficiency, allowing teams to save time through predefined structures, automated data entry, and easy submission capabilities. The result is a more organized approach to financial documentation, which can improve overall team productivity.

Overview of the direct form process

Creating and submitting a direct form involves several key steps to ensure accuracy and compliance. The first step is identifying the correct form type based on the specific financial requirement, whether it’s an application for funding, an expense report, or any other financial document. Each form has unique information fields that need to be completed.

After identifying the form, pre-filling the information fields is the next step. This is where care must be taken; inputting incorrect information can lead to delays or issues with processing. Verification of required documents is also crucial; ensuring that all necessary attachments accompany the form prevents unnecessary back-and-forth communication with finance teams.

Common mistakes to avoid during this process include submitting forms without all required information or failing to check for clarity and accuracy in the inputted data. Make sure to double-check all forms before finalizing submissions.

How to access and use direct forms on pdfFiller

Accessing and using direct forms within the pdfFiller platform is straightforward and user-friendly. Start by navigating to the pdfFiller interface where you can find a variety of templates tailored for different finance business services. Once you select the appropriate template, you can begin filling it out according to your needs.

Filling out forms on pdfFiller can be broken down into a few simple steps. First, select a template that corresponds to the type of form you need. Next, customize the document by adding relevant details and information. After editing the document, you can easily incorporate eSignatures to authorize or finalize the form, creating a seamless transition from preparation to submission.

Once completed, you can save and store your documents securely within the pdfFiller platform, allowing for easy retrieval and management of your financial records.

Interactive tools available on pdfFiller

pdfFiller is equipped with numerous interactive tools designed to enhance document creation and management. One notable feature is its document editing functionality, enabling users to modify text, images, and even signatures effortlessly. This versatility is particularly useful when making revisions or updates to financial documents without having to create new versions from scratch.

Collaboration is key in finance, and pdfFiller facilitates this through its sharing capabilities. Users can share documents with team members easily, allowing for real-time comments and suggestions to improve edits before final submissions. Additionally, tracking document status allows businesses to monitor the submission and approval processes, ensuring everyone is aligned and informed.

Filling out specific finance business service forms

When it comes to finance business services, specific forms like tax forms and expense reimbursement forms are critical for maintaining accurate financial records. For tax forms, various types exist, each catering to distinct reporting requirements, such as income tax returns, property tax reports, and sales tax declarations.

Completing tax forms requires careful attention to detail, ensuring all figures and documentation are precise to avoid audits or penalties. Moreover, expense reimbursement forms also have unique requirements for submission, emphasizing the need for clear guidelines regarding receipts and necessary documentation to support claims.

Frequently requested finance forms

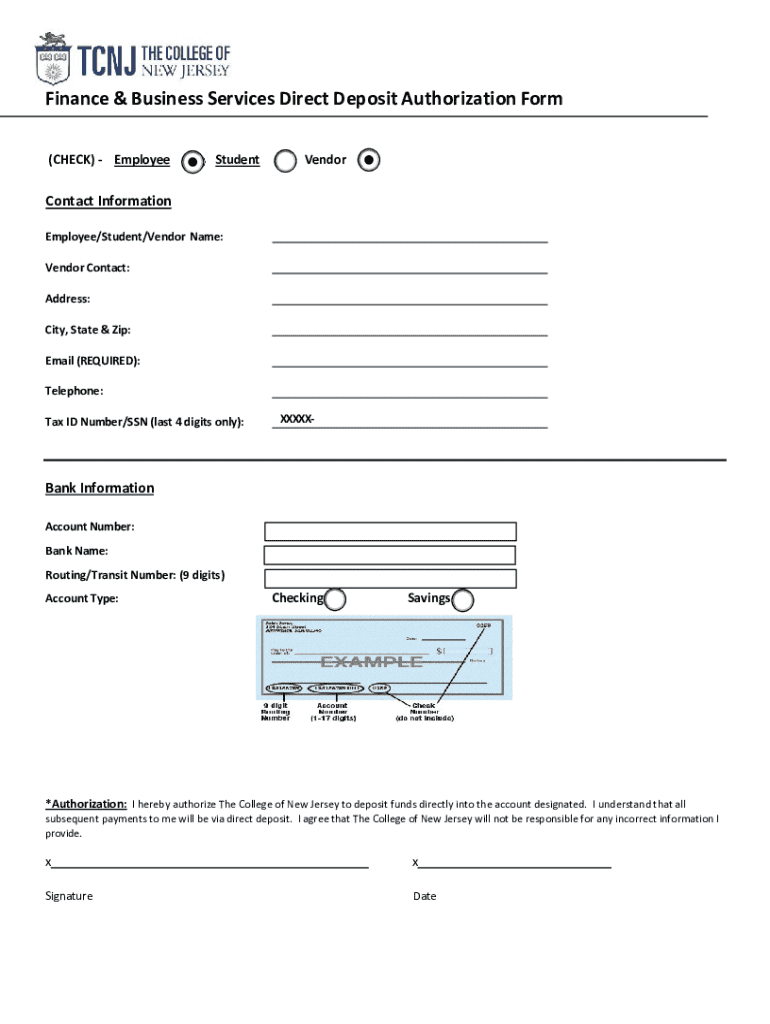

In the realm of finance business services, certain forms are requested more frequently than others. Popular forms among businesses include direct deposit sign-up forms, budget transfer forms, and expense transfer forms. Each of these documents plays a role in enhancing the financial transaction process, promoting efficient operations and better cash flow management.

Beyond just having access to these forms, understanding common questions around their usage can lead to better compliance and user satisfaction. For instance, individuals often have queries regarding compliance with internal policies or regulatory requirements when filling out these financial forms.

Best practices for managing financial documents

Managing financial documents requires a level of organization and security to safeguard sensitive information. Implementing robust security measures when handling financial documents is paramount. This can include encrypting files, using secure access credentials, and limiting document viewership to essential personnel only.

In addition to security, organizing document storage, especially in the cloud, can streamline access and retrieval. Regular updates and maintenance of financial forms ensure that information is always current, minimizing complications associated with outdated documents.

Troubleshooting common issues

Even with well-structured processes, issues can occur when filling out finance business services direct forms. Common submission errors often stem from incomplete information or mismatches in documentation. To overcome these hurdles, having thorough checklists can guide users in ensuring completeness and correctness before submission.

When discrepancies arise in submitted documents, it’s essential to resolve them systematically. Reach out to any relevant department in your organization and clarify what needs to be amended. Finally, if challenges persist, don't hesitate to contact pdfFiller support for assistance in navigating and resolving issues.

Importance of staying updated with financial services forms

The financial landscape is constantly evolving, and so are the forms required to maintain compliance. It's vital for businesses to stay updated on any regular changes to finance forms, as failing to do so can lead to regulatory non-compliance and potential penalties.

Adapting to regulatory changes is crucial; this not only encompasses understanding new forms but also embracing technological innovations that may alter how documents are processed and managed. Continuous learning through available resources will empower teams to remain aligned with best practices in finance document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my finance business services direct in Gmail?

Can I edit finance business services direct on an iOS device?

How do I fill out finance business services direct on an Android device?

What is finance business services direct?

Who is required to file finance business services direct?

How to fill out finance business services direct?

What is the purpose of finance business services direct?

What information must be reported on finance business services direct?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.