Understanding the Dice Supplemental Application Policy Form

Overview of the Dice Supplemental Application

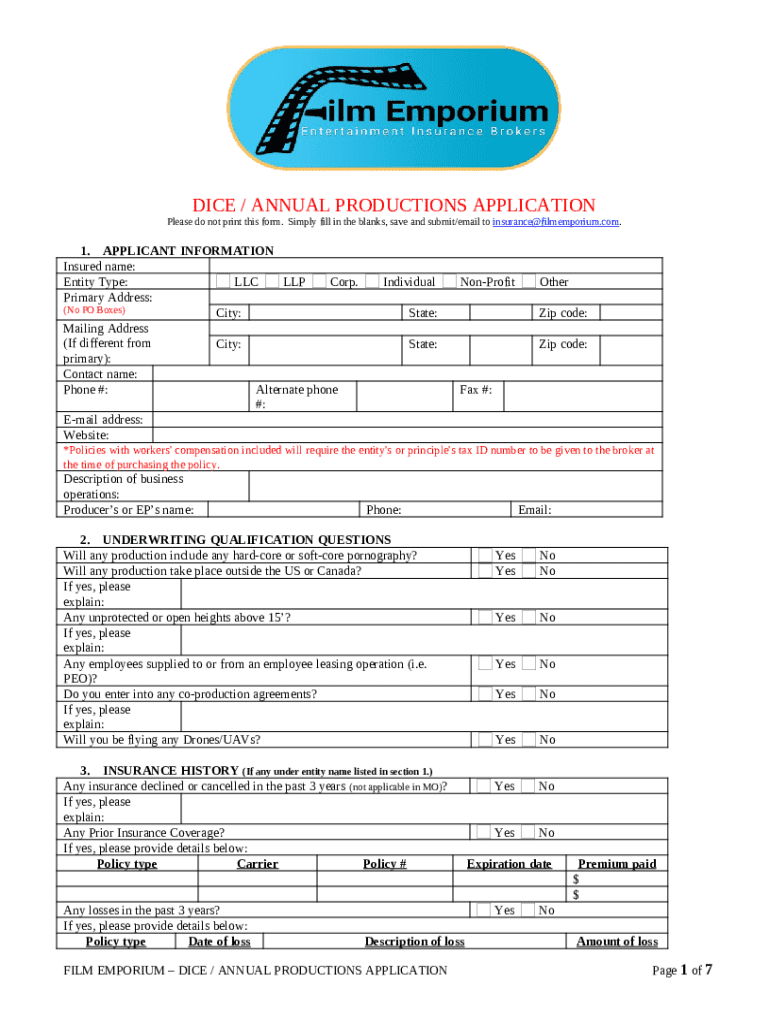

The Dice Supplemental Application Policy Form is an essential document utilized by individuals and businesses seeking insurance coverage that extends beyond standard policies. This form plays a significant role in detailing additional coverage options tailored to specific needs, ensuring that applicants receive comprehensive protection. Typically, this form is used in various insurance sectors including health, auto, and property, allowing users to articulate the nuances of their coverage requirements.

In many cases, the information provided in the Dice Supplemental Application influences underwriting decisions, rates, and the overall policy structure. Understanding how to effectively complete this form can be the difference between receiving adequate insurance coverage and facing unforeseen gaps in protection.

Key information required

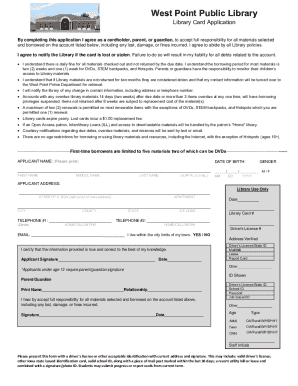

Completing the Dice Supplemental Application requires thorough attention to detail. The form generally asks for key personal information such as the applicant's name, contact details, date of birth, and address. Additionally, applicants are often required to provide information regarding their business or employment situation, including industry type, years in business, and gross revenue.

Moreover, the policy details section is equally important. This includes specifying the type of additional coverage being requested, which could cover everything from expanded liability to specific risks unique to the applicant. Accurately filling out these sections ensures that the insurance provider has a clear picture of what is needed, preventing any miscommunications that might affect coverage.

Understanding coverage types

When completing the Dice Supplemental Application, a clear understanding of the various coverage types available is crucial. Policies may cover a range of areas such as professional liability, general liability, or cyber insurance, each addressing different risks associated with individuals or businesses. Knowing these coverage types not only aids applicants in selecting the right ones but also impacts the application's overall acceptance.

For example, if an applicant is in the medical field, additional coverage for malpractice may be essential, whereas a tech startup might prioritize cyber liability protection. The relationship between the types of coverage selected and the details provided in the application can significantly affect the underwriter's decision and the premium costs.

Step 1: Gathering essential documents

Before beginning the application process, it's vital to gather essential documents that will aid in filling out the Dice Supplemental Application accurately. The following items should be prepared in advance:

Identification documents such as driver's license or passport.

Proof of income or financial statements to support coverage needs.

Existing insurance policies to reference current coverage.

Business licenses and any relevant permits, if applicable.

Any documentation related to previous claims or incidents.

Step 2: Filling out the application

With the necessary documents organized, the next step is to fill out the Dice Supplemental Application itself. Start by carefully entering personal information in the designated fields, ensuring that each entry is accurate and up-to-date. Errors in personal details can lead to processing delays or even denial of coverage.

Next, proceed to fill out the sections pertaining to coverage types. Be as specific as possible when describing additional insurance needs. For instance, if selecting coverage for specific events or locations, provide detailed descriptions. Utilize the space provided to clarify any special circumstances or requests that may help the underwriter in their assessment.

Step 3: Reviewing your application

One of the most critical phases in completing the Dice Supplemental Application is the review process. Double-checking every entry ensures all information is accurate and complete. Pay special attention to fields that could be prone to common errors, such as transposed numbers or omitted details.

Additionally, scrutinize the policy details to ensure they reflect your requirements. Errors discovered post-submission can result in longer processing times or incorrect coverage being assigned. Prioritizing this review step not only demonstrates diligence but also paves the way for a smoother application process.

Utilizing digital tools for enhanced efficiency

Using digital tools can significantly streamline the Dice Supplemental Application process. One such tool is pdfFiller, which allows users to edit PDFs, fill out forms, and even eSign documents in a user-friendly interface. The benefits of using pdfFiller include increased efficiency, as users can easily manage all documents from a single cloud-based platform, accessible anytime and anywhere.

Additionally, pdfFiller facilitates document sharing and collaboration, making it invaluable for teams. Whether multiple team members need to input data or an agent is assisting in the process, everyone can collaborate in real-time, enhancing productivity and accuracy.

Collaborative features of pdfFiller

Collaboration during the application process can be improved significantly by using pdfFiller. This platform enables users to invite team members or insurance agents to review and edit the Dice Supplemental Application. The built-in comment tools enhance communication, allowing users to discuss specific entries or request clarifications directly on the document.

Moreover, this collaborative feature not only improves team efficiency but also reduces errors. By enabling discussions directly within the document, users can rectify misunderstandings before submission, ensuring that the application accurately reflects the desired coverage.

Frequently asked questions

Addressing common queries about the Dice Supplemental Application can help demystify the process for many applicants. Understanding the factors that influence the approval of the application is crucial. Applicants often wonder about the frequency of supplemental applications or the documentation that must accompany them.

Some common questions include the need for additional paperwork for specific coverage types and how long one can expect the approval process to take. Generally, it can take anywhere from a few days to several weeks, depending on the complexity of the application and the insurance provider’s process.

Understanding approval timelines

Approval timelines for the Dice Supplemental Application vary widely based on several factors. These can include the insurer's workload, the completeness of the submitted application, and specific risk assessments related to the coverage requested. Generally, applicants should anticipate a waiting period and prepare accordingly.

To improve the chances of a swift approval, applicants can ensure that all information is complete and documented correctly. Moreover, following up with the insurer after submission can provide updates and potentially expedite the process.

Form customization options

One of the standout features of pdfFiller is the ability to customize the Dice Supplemental Application Form. Users can modify the form to suit specific needs, whether it's adding sections for additional information, adjusting formatting, or integrating company branding. This level of customization ensures that each application can be tailored to reflect the unique requirements of the individual or business.

Customizable fields also allow applicants to streamline the application process, making it easier to navigate and fill out, ultimately saving time and improving accuracy.

Editable templates

Using editable templates for the Dice Supplemental Application can significantly enhance the application experience. pdfFiller provides users with a variety of customizable templates, allowing for quick adjustments based on individual needs while maintaining compliance with industry standards.

These templates not only save time but also ensure that all necessary fields are present. Users can focus on inputting information rather than formatting, allowing for a more efficient completion process.

E-signature integration

E-signature integration within pdfFiller plays a crucial role in the submission process for the Dice Supplemental Application. Utilizing e-signatures not only expedites the signing of documents but also provides added security and verification of the signer's identity. This modern approach alleviates the need for printing and manual signatures, which can be cumbersome and time-consuming.

By implementing e-signatures, users can ensure that their applications are processed efficiently, while also benefiting from a paperless workflow that enhances sustainability and reduces overhead costs.

Tracking your application status

Once the Dice Supplemental Application is submitted, keeping track of its status becomes essential. pdfFiller offers tools that allow users to monitor their application's progress. Regular follow-ups with the insurance provider can also help ensure that the application is moving through the approval processes as expected.

Whether it’s through software notifications or personal inquiries, understanding where your application stands can make it easier to plan for the next steps in your coverage journey.

Storing important documents safely

Managing your completed application along with all supporting documents is vital for future reference. pdfFiller provides a secure platform for storing these documents, ensuring they are easily accessible yet protected from unauthorized access.

Best practices for effective document management include organizing files in clearly labeled folders and using naming conventions for easy retrieval. Moreover, regularly backing up documents ensures that important information is safeguarded against data loss.

The importance of accurate reporting in applications

The details provided in the Dice Supplemental Application can significantly impact the success of obtaining appropriate coverage. Accuracy in reporting ensures that all information is reflective of actual conditions, reducing the risk of policy disputes later on. Misrepresentations can lead to denied claims or cancelled policies, so it is crucial that applicants approach this task with diligence and honesty.

Sustaining a culture of accurate reporting not only aids in the application process but also fosters better relationships with insurers who can rely on the information provided. Moving forward, keeping documents up to date becomes essential to ensure future coverage renewals or adding additional protections when necessary.

Future considerations

As circumstances change, so too should the information provided in applications. Future considerations should include regularly reassessing coverage to align with evolving business or personal circumstances. Keeping documentation current, especially before renewal periods, ensures seamless transitions and adequate protection.

Additionally, conducting reviews of coverage and discussing changes with insurance agents can further enhance the adequacy of obtained policies, minimizing gaps in coverage or unnecessary costs.