Get the free Credit Card Authorization Form - Inn On The Harbour

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - A Comprehensive How-to Guide

Understanding credit card authorization forms

A credit card authorization form is a document that allows a merchant to charge a customer’s credit card for a specific amount, either one-time or on a recurring basis. This form serves as a written consent from the cardholder, showing they authorize payment to be deducted directly from their credit card. Such authorization is crucial, especially in industries where payment processing occurs without the card physically present, like in online transactions or subscriptions.

The importance of these forms lies in reducing fraud risk and ensuring both parties are protected during financial exchanges. For the merchant, having a properly filled-out credit card authorization form can safeguard against chargebacks and provides a layer of verification during payment processing. Common use cases include e-commerce transactions, subscription services, hotel bookings, and event registrations.

Benefits of using a credit card authorization form

Utilizing a credit card authorization form presents multiple benefits that can significantly enhance transaction safety and business efficiency. First and foremost, it helps prevent chargeback abuse, wherein customers fraudulently dispute legitimate charges, resulting in lost revenue for businesses. By obtaining explicit authorization, merchants can provide proof of consent in case of disputes.

Next, credit card authorization forms enhance security in transactions. They ensure that only the authorized person can permit charges, which is particularly critical in remote sales where physical verification isn’t possible. Additionally, such forms offer legal protections for sellers; if a transaction is disputed, having a signed authorization can strengthen the seller's case. Lastly, these forms also streamline payment processes, allowing for more efficient management of recurring payments or one-time transactions, leading to a smoother customer experience.

Components of a credit card authorization form

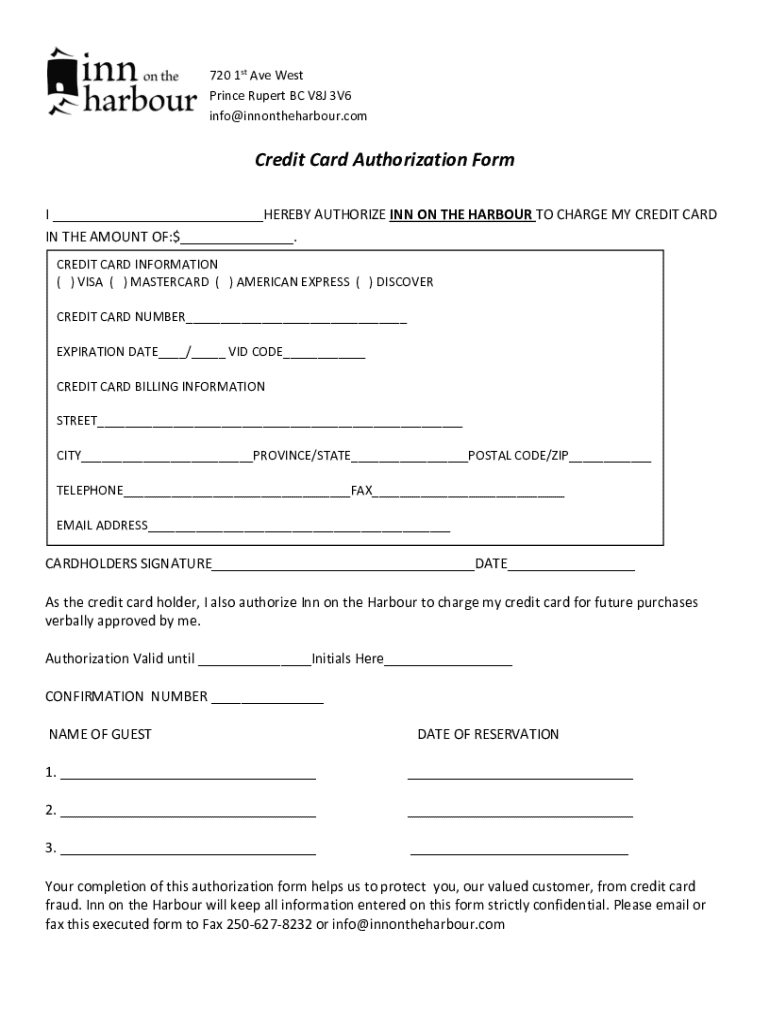

A well-structured credit card authorization form typically includes several key components, which provide essential information to authorize the transaction accurately. These components include the cardholder’s name, credit card number, expiry date, and CVV, as well as the billing address linked to the card. Crucially, the form will also specify the authorization amount and the date the authorization is granted.

Variations of credit card authorization forms cater to different needs. For instance, one-time authorization forms are used for singular transactions, while recurring payment authorization forms are tailored for subscription services or memberships. Group or event authorization forms allow multiple participants to authorize payments for shared expenses, making it particularly useful in scenarios like event registrations or group travel bookings.

Step-by-step guide to completing a credit card authorization form

Best practices for sellers using credit card authorization forms

Sellers should recognize when it is appropriate to use a credit card authorization form, such as for events or recurring payments that require upfront consent. Storing signed authorization forms safely is also essential; they should be kept in a secure location to protect customer data, in compliance with data protection regulations. Understanding legal obligations regarding authorizations is critical. Sellers must ensure that their forms comply with industry standards, particularly concerning the handling and storage of sensitive cardholder data.

Regular training for staff on the proper handling of credit card authorization forms can further enhance security and compliance, minimizing risks associated with mishandling these sensitive documents. Moreover, developing a clear policy regarding the use and storage of these forms helps maintain consistency and protects the integrity of the seller's operations.

Common concerns and FAQs about credit card authorization forms

A prevalent question is whether businesses are legally obligated to use a credit card authorization form. While not always required by law, it is strongly recommended to protect against disputes and fraud. Another common concern is the omission of a space for the CVV. Some businesses may choose not to include it for various reasons, including security practices or to reduce the risk of storing sensitive information.

When it comes to storage and management, signed forms should be retained securely and destroyed after their purpose has been fulfilled. In cases of disputes or chargebacks, having the signed forms on hand provides necessary support to address the issue. Businesses must establish clear protocols for managing these documents to ensure compliance with payment processing regulations.

Advanced insights: Role of technology in authorization processes

Technology is transforming the landscape of payment authorizations. For instance, artificial intelligence can play a pivotal role in enhancing fraud detection and prevention. Algorithms can analyze transaction history, user patterns, and anomaly detection to flag potentially fraudulent activities before they escalate. Similarly, ensuring PCI compliance is vital in payment authorizations; merchants must adhere to established standards to protect cardholder data and maintain customer trust.

Additionally, examples of digital credit card authorization solutions demonstrate the shift towards streamlined processes. Many businesses are now adopting secure online platforms that facilitate digital signing and storage of authorization forms, reducing manual errors and improving customer experience. These innovative approaches not only support compliance but also enhance efficiency in transaction management.

Template downloads and tools

pdfFiller offers downloadable credit card authorization form templates that users can customize according to their specific needs. These templates feature pre-filled fields for easy completion and can be edited directly within the pdfFiller platform. Interactive tools are also available for editing and managing authorizations efficiently.

To cater to various business scenarios, tips for customizing credit card authorization forms include ensuring that forms meet relevant compliance requirements and clearly outlining the terms of payment. Users can add their branding and specific legal language as necessary, enhancing the professionalism and legitimacy of the forms they use.

FAQs: Addressing your questions

Understanding common queries concerning credit card authorizations helps both buyers and sellers navigate this critical aspect of financial transactions. From inquiries regarding the necessity of forms to how to address common issues, exploring these FAQs can provide clarity on what to expect when engaging in credit card transactions.

Merchants can benefit significantly from knowing how to rectify problems related to credit card processing and authorization. Having a solid grasp of both the technical and legal implications of credit card authorizations aids in establishing a robust framework for secure payments, ultimately fostering customer trust and business integrity.

Related topics to explore

Delving deeper into payment processing methods can provide valuable insights into various systems shaping the industry today. Exploring how to protect a business from fraud is paramount for merchants navigating the complexities of digital transactions, ensuring they stay ahead of potential threats. Furthermore, understanding the role of customer authorization within the realm of e-commerce can facilitate more effective transaction management and customer relationship building.

Each of these areas offers further opportunities for education, allowing individuals and teams to enhance their understanding and application of secure payment practices, making the credit card authorization form an indispensable tool in today’s transactional landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card authorization form online?

Can I create an electronic signature for the credit card authorization form in Chrome?

Can I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.