Get the free New Mortgage/Refinance

Get, Create, Make and Sign new mortgagerefinance

Editing new mortgagerefinance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new mortgagerefinance

How to fill out new mortgagerefinance

Who needs new mortgagerefinance?

New Mortgage Refinance Form: A How-to Guide

Understanding mortgage refinancing

Mortgage refinancing is the process of obtaining a new mortgage to replace the original one, often to secure better terms or features. The purpose of refinancing can vary from person to person, but fundamentally, it aims to save money over the loan’s lifecycle or to change its structure to better fit an individual’s financial goals.

Benefits of refinancing your mortgage

Homeowners may consider refinancing for several compelling reasons. One of the primary benefits includes lowering monthly payments, providing immediate relief to someone's budget. Another major reason is the potential for reducing interest rates, which can save thousands over the life of a loan. Additionally, refinancing can allow homeowners to tap into their home’s equity to fund major expenses, like educational fees or home improvements.

When to consider refinancing

Deciding when to refinance can hinge on various factors, reflecting individual financial situations. Key indicators that refinancing may be beneficial include a significant drop in interest rates compared to what you’re currently paying or a rise in your credit score, which can qualify you for better loan conditions. Homeowners often seek refinancing because they want to lower their financial burden or transition from an adjustable-rate mortgage to a more predictable fixed-rate mortgage.

Common reasons homeowners refinance

Common motivations behind refinancing include lowering a financial burden through reduced payments, switching to a fixed-rate mortgage from a variable-rate loan, or obtaining funds for home improvements. Evaluating refinancing goals before proceeding ensures that the homeowner's long-term strategy aligns with immediate financial needs.

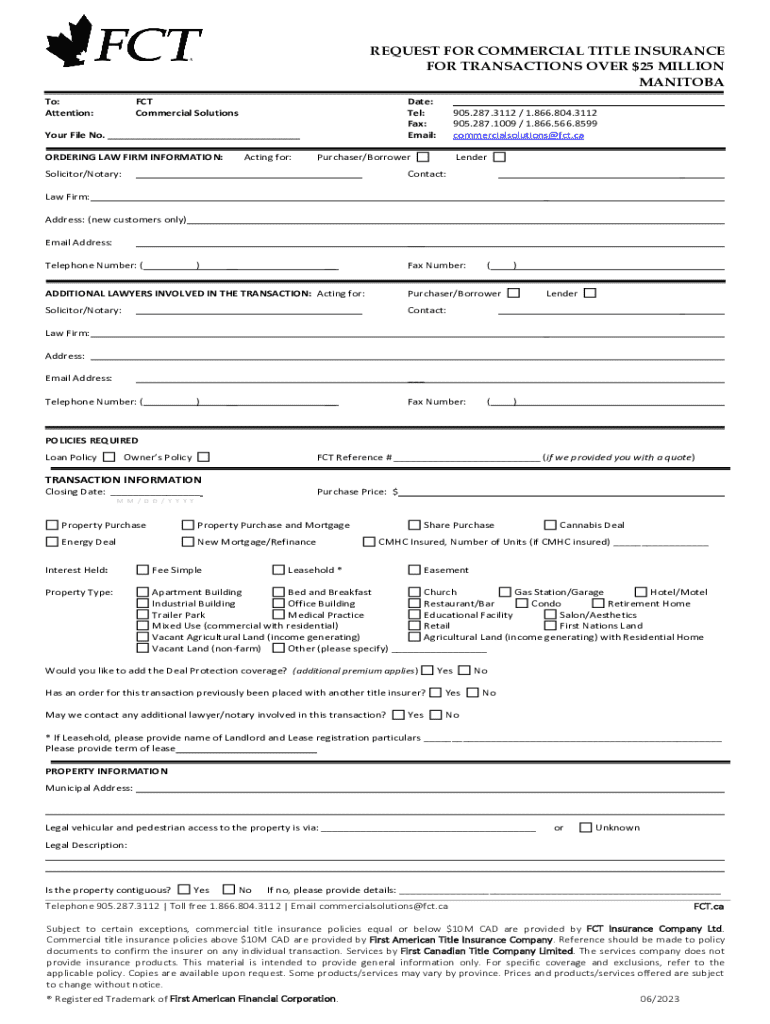

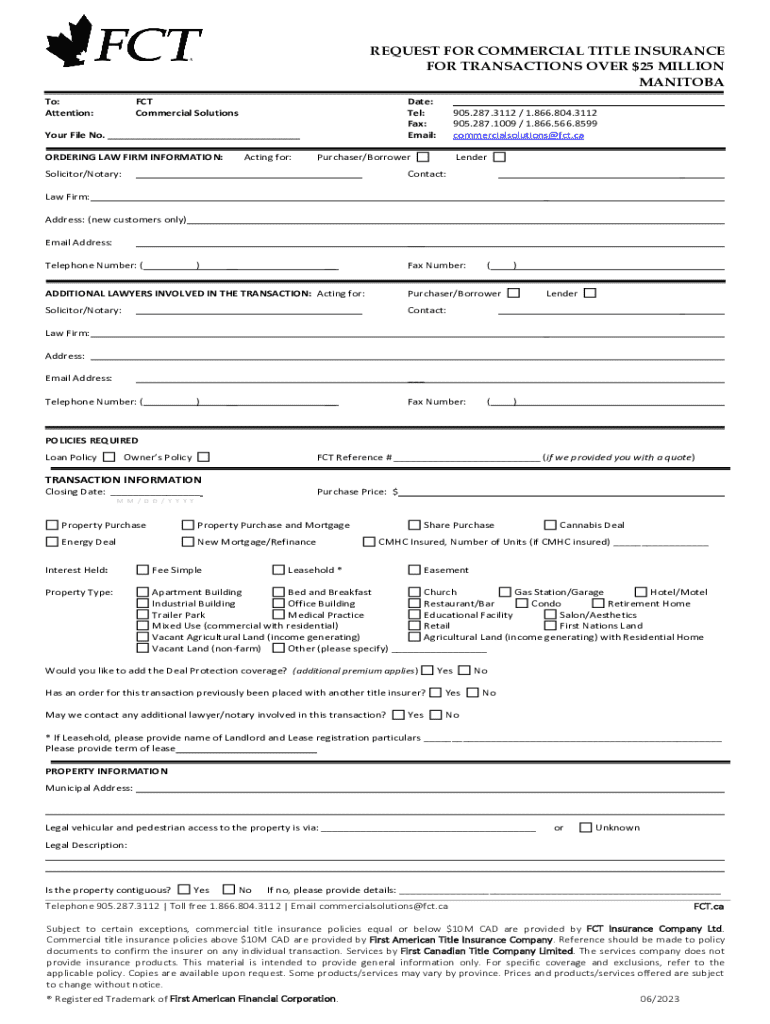

Types of mortgage refinance forms

The refinancing process requires several forms, namely the Loan Estimate Form and the Closing Disclosure Form. These documents provide crucial information regarding the loan amount, interest rates, monthly payments, and closing costs related to refinancing.

Overview of different forms required

The Loan Estimate Form offers borrowers insight into their loan's costs and terms within three business days of applying. Meanwhile, the Closing Disclosure Form details final terms of the loan, ensuring everything agreed upon is clearly documented.

Step-by-step guide to completing the new mortgage refinance form

Completing the new mortgage refinance forms can seem daunting, but breaking down the process can simplify it considerably. First, gather the necessary documents such as proof of income—pay stubs, tax returns, and bank statements—as well as obtaining your credit report, and detailing your current mortgage specifics. Having these documents job-ready facilitates smoother and faster processing.

Completing the Loan Estimate Form

When filling out the Loan Estimate Form, take time to break down each section. Key details include your loan type, the loan amount, interest rates, and projected monthly payments. Additionally, be meticulous in entering any potentially applicable fees associated with the loan, as this information significantly impacts your understanding of total costs.

Filling out the Closing Disclosure Form

When handling the Closing Disclosure Form, focus on the key areas such as loan terms, projected payments, and closing costs. Understanding fees associated with the closing, such as origination fees and prepaid items, prepares you for the funds required at closing, ensuring there are no surprises during the refinancing process.

Tips for a successful refinance process

To ensure a successful refinancing process, respond promptly to any underwriting requests from your lender, as timely communication is crucial. Keep an eye out for common pitfalls such as overlooking hidden fees or assuming all terms are final after the Loan Estimate Form. Collaborating closely with your mortgage consultant is pivotal, as they can help clarify complexities and streamline your application.

Understanding the timeline and expectations

Having realistic expectations regarding the timeline can significantly enhance the refinancing experience. Generally, the process takes around 30 to 45 days, depending on various factors including lender efficiencies and market conditions. Understanding these timelines aids in planning any necessary adjustments in your budget.

Additional document requirements

In addition to the primary forms, a comprehensive mortgage refinance document checklist can help ensure nothing is overlooked. Key documents typically include proof of income, employment verification, tax returns, and recent bank statements.

Important disclosures to keep in mind

Lenders are required to provide a range of disclosures during the refinancing process. Pay close attention to important items such as your right to cancel the loan and the lender's responsibilities regarding your mortgage. Knowing these details can empower you during negotiations and decision-making.

FAQs regarding additional documentation

Common FAQs regarding documentation often center around what’s necessary based on the type of mortgage you're pursuing, lender stipulations, and timing for obtaining these documents. Ensure you have clarity on these questions to effectively navigate the refinance landscape.

Using pdfFiller for your mortgage refinance needs

Utilizing pdfFiller can streamline your document management processes when it comes to mortgage refinancing. As a cloud-based platform, it allows users to access documents from anywhere, significantly improving convenience and efficiency.

Benefits of using pdfFiller for document management

With pdfFiller, editing forms, eSigning, and collaborating are more seamless than ever. The platform's interactive tools guide users in filling out forms properly while providing robust options for team collaborations, making it an ideal choice for both individual users and teams managing refinancing processes.

Post-refinance steps and considerations

Once refinancing is finalized, it’s critical to adjust your budget accordingly. This might involve recalibrating your payment schedules or reallocating funds initially intended for higher payments toward other financial goals.

Long-term considerations to keep in mind

Long-term considerations following refinancing include monitoring interest rates regularly for future refinancing opportunities and understanding how market changes may impact your mortgage in the long run. Maintaining communication with your lender can also ensure you're aware of potential options before they become critical.

Success stories and testimonials

Real-life experience often illustrates the impact of well-executed refinancing strategies. Many homeowners have shared their successful refinancing journeys, noting decreased monthly payments and accessible funds for home improvements or debt reduction. Engaging with industry experts can also lend credible insights into leveraging refinancing effectively.

Frequently asked questions about mortgage refinancing

When considering refinancing, homeowners should ask their lenders crucial questions: What are the total costs associated with refinancing? How do the interest rates compare to current market rates? Understanding expected costs and knowing the terms of loans can significantly impact the decision-making process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new mortgagerefinance directly from Gmail?

How do I edit new mortgagerefinance in Chrome?

How do I complete new mortgagerefinance on an iOS device?

What is new mortgagerefinance?

Who is required to file new mortgagerefinance?

How to fill out new mortgagerefinance?

What is the purpose of new mortgagerefinance?

What information must be reported on new mortgagerefinance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.