Get the free Form 472S - Sellers Claim for Sales or Use Tax Refund or Credit

Get, Create, Make and Sign form 472s - sellers

Editing form 472s - sellers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 472s - sellers

How to fill out form 472s - sellers

Who needs form 472s - sellers?

Form 472S - Seller's Form: A Comprehensive Guide

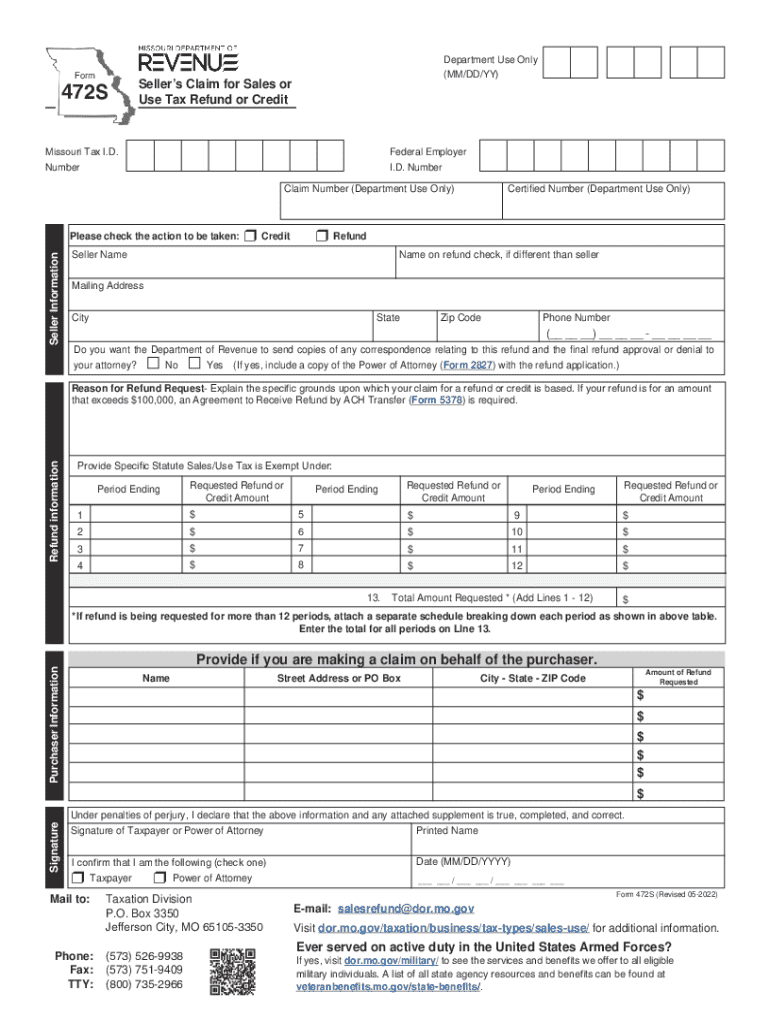

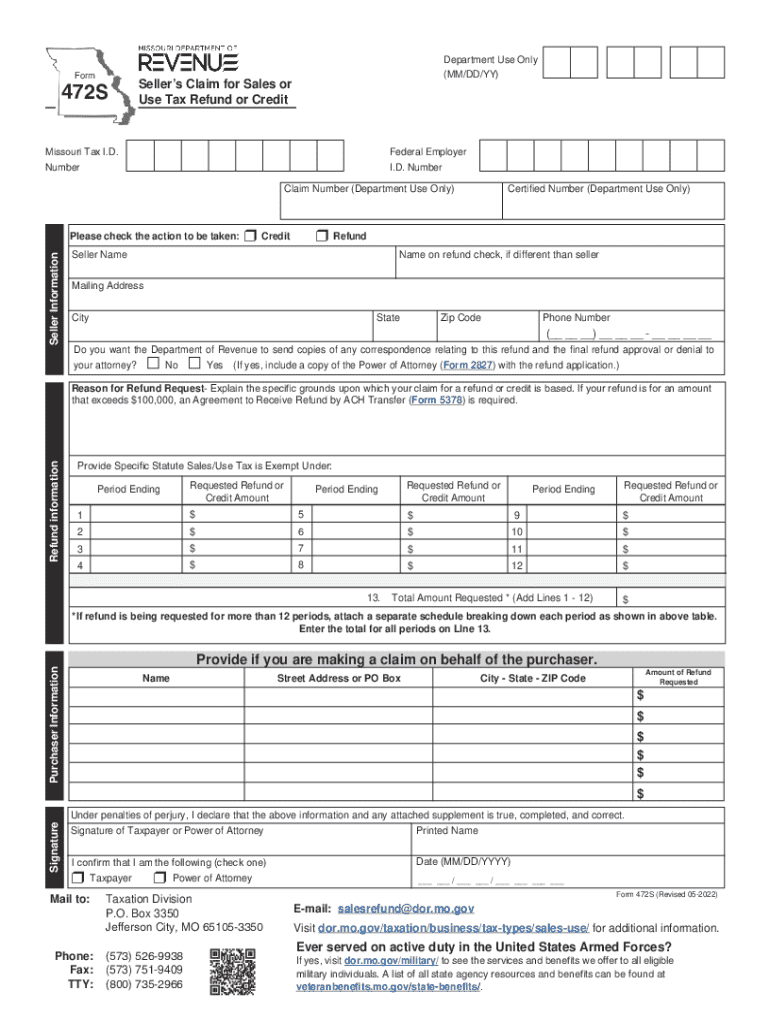

Overview of Form 472S

Form 472S, commonly known as the Seller's Form, is a crucial document utilized in Missouri for claiming refunds or credits for sales or use tax. This form serves to formalize requests from sellers who believe they have overpaid tax on their transactions, enabling them to reclaim any excess taxed amounts efficiently.

The significance of Form 472S lies in its ability to facilitate the Seller's Claim for Sales or Use Tax Refund or Credit, which directly affects the cash flow and operational sustainability of a business. By ensuring that sellers can effectively recover due refunds, Missouri fosters a more supportive environment for local commerce.

Sellers can capitalize on several key benefits when utilizing this form. These include streamlined tax processes, improved financial management through timely refunds, and enhanced compliance with state regulations. Sellers might find themselves in need of this form during tax season or when discrepancies arise in their sales tax calculations, prompting the necessity to reclaim funds.

Understanding the eligibility criteria

Eligibility to file Form 472S is typically extended to both individual sellers and businesses operating in Missouri. Individual entrepreneurs and smaller vendors must also meet specific conditions to ensure valid claims, while larger businesses often navigate more complex qualifications based on the scale of their operations.

Common conditions under which claims can be made include proof of over-collected tax amounts during sales transactions or instances of returned goods that resulted in tax implications. Sellers need to understand circumstances such as non-taxable sales and the effect of exempt status on their eligibility, as these can significantly influence their right to contest tax charges.

Detailed instructions for completing Form 472S

Completing Form 472S accurately is vital for a smooth refund process. Begin by gathering all necessary information, including your personal or business details, sales information, and the specific reasons for your refund claim.

The form consists of several sections that require careful attention. Each section should be filled as follows: - Personal/Business Information: Fill in your name, address, and tax identification number. - Sales Information: Provide details about the sales transactions, including dates, amounts, and the nature of the sales. - Reason for Refund/Claim: Clearly state why you believe a refund is due—be as detailed and honest as possible.

While filling out your claim, avoid common mistakes like miscalculating tax amounts, omitting information, or submitting without supporting documents. Double-check your entries for accuracy and completeness.

Document preparation and supporting materials

To accompany Form 472S, you must prepare several important documents to support your claim. This typically includes: - Sales receipts and invoices substantiating the transactions in question. - Previous tax filings illustrating past payments and adjustments.

Using pdfFiller tools can streamline the preparation process, allowing easy editing and compliance with state regulations. Ensure all documents are properly formatted and legible to prevent delays in processing.

eSigning and submitting your form

Once Form 472S is completed and accompanied by the necessary documents, the next step involves signing and submission. pdfFiller provides a convenient way to electronically sign the form, ensuring it maintains legal compliance.

Submission options are flexible, supporting both online submissions and traditional mail-in methods. For online submissions, ensure you have a stable internet connection, and follow the prompts accordingly. Keeping track of your submission status can alleviate uncertainties during the waiting process.

Common questions and troubleshooting

Frequently asked questions regarding Form 472S often include concerns about claim denials and the processing timeline for refunds. If a claim is denied, it’s crucial to review the reasons provided by the tax authority, allowing you to make necessary adjustments or appeal the decision.

Typically, the processing of refunds can take several weeks, depending on the volume of claims received by the state. Utilizing support options available through pdfFiller can help users navigate these issues, ensuring they have the assistance they need at every step.

Interactive tools for enhanced documentation

pdfFiller offers robust interactive features specifically designed to assist in the management of Form 472S. Users can edit forms with ease and collaborate with team members on shared documents, leading to successful submissions.

Integrations with cloud storage solutions also allow for seamless access to your documents from anywhere. Utilizing these tools can minimize errors, simplify collaboration, and streamline your overall documentation process.

Related forms and documentation

In addition to Form 472S, there are several other forms related to sales or use tax claims. These can vary by state, so understanding their relationships is crucial for effective tax management.

Quick access to similar forms in various states also helps sellers ensure compliance across jurisdictions. Familiarity with how Form 472S interacts with other finance-related documents can lead to more informed business practices.

Legal and compliance considerations

Understanding the legal landscape surrounding Form 472S is essential for anyone involved in sales tax transactions in Missouri. Key regulations govern how and when this form should be used to maintain compliance with state laws.

Moreover, additional compliance measures should be observed when preparing claims. Maintaining accurate records and submitting honest claims ensures a smoother review process and reduces the risk of penalties for inaccuracies.

Testimonials and user experiences

Success stories from users of pdfFiller showcase how individuals and businesses have effectively managed their forms using the platform. Those who have navigated the complexities of Form 472S report significant time savings and improved accuracy in their submissions.

Feedback emphasizes ease of use for document preparation and the reassurance of deploying a reliable process for tax claims. Real-world applications demonstrate the transformative impact of leveraging pdfFiller on business operations.

Connect and engage with pdfFiller community

To stay informed about updates regarding Form 472S and related topics, connecting with the pdfFiller community through various platforms is highly beneficial. User engagement can provide insights on improvements and new features that enhance document management experiences.

Opportunities for community interaction are also present through forums, webinars, and social media channels where users can exchange tips and success stories, fostering a collaborative learning environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 472s - sellers in Chrome?

How do I edit form 472s - sellers straight from my smartphone?

Can I edit form 472s - sellers on an iOS device?

What is form 472s - sellers?

Who is required to file form 472s - sellers?

How to fill out form 472s - sellers?

What is the purpose of form 472s - sellers?

What information must be reported on form 472s - sellers?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.