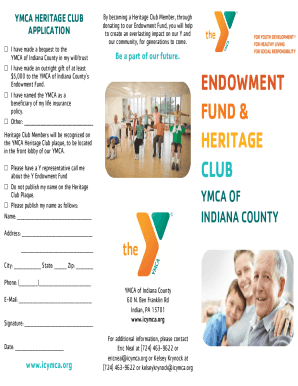

Get the free Omnibus Participating Private Trust Agreement - Regolith

Get, Create, Make and Sign omnibus participating private trust

Editing omnibus participating private trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out omnibus participating private trust

How to fill out omnibus participating private trust

Who needs omnibus participating private trust?

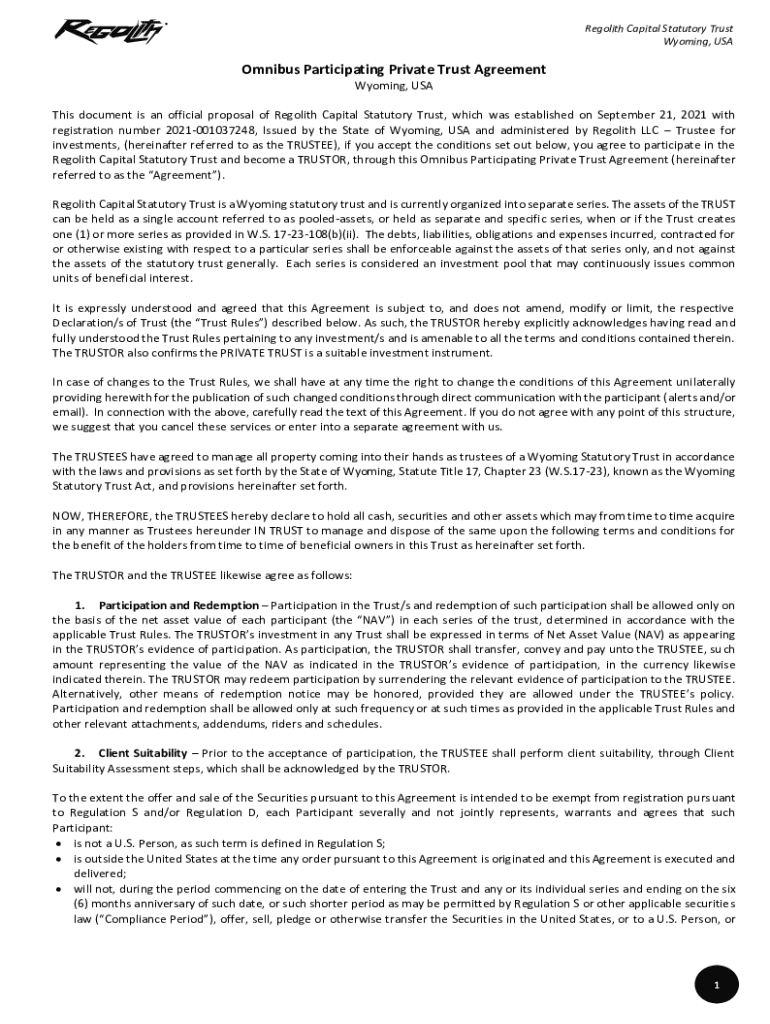

Understanding the Omnibus Participating Private Trust Form

Understanding the omnibus participating private trust form

The omnibus participating private trust form is an essential document used to manage multiple interests consolidated into a single entity. This often-used structure allows multiple participants to pool their resources while ensuring individual interests are preserved. Its significance lies in providing a streamlined mechanism for managing trust assets, enabling participants to collaborate effectively in investment strategies or asset management.

Its unique features differentiate it from other trust forms, as it combines collective investment with fiduciary responsibilities pertinent to each participant. This adaptability is evident when comparing it with conventional private trusts, which may not accommodate multiple participants effectively.

Importance of the omnibus participating private trust form

The roles and responsibilities outlined in the omnibus participating private trust form are crucial for maintaining trust integrity. Participants typically include trustees, who oversee the trust's management, individuals investing in the trust, and beneficiaries receiving trust benefits. Each of these roles carries fiduciary duties, demanding a high level of professionalism and commitment.

Adhering to the legal and regulatory framework surrounding these trusts is imperative. Understanding relevant laws, such as the Uniform Trust Code, helps participants and trustees comply with applicable standards and protects against liability.

Step-by-step guide to filling out the omnibus participating private trust form

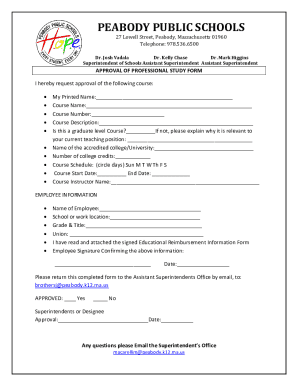

Preparation is vital when completing the omnibus participating private trust form. Before starting, gather essential documents, including identification, trust agreements, and details concerning trust assets and participants. This groundwork ensures that the information entered is accurate and complete, thereby streamlining the completion process.

Once prepared, fill out the form by addressing specific sections in this order: Trustee information, Participant details, Trust assets declaration, Terms and conditions, and Signature fields. Accuracy in the 'Trustee Information' section is crucial, as it identifies the individual responsible for managing trust assets and ensuring compliance with trust obligations.

Common mistakes such as inaccurate participant details, unclear terms, and missing signatures can create complications. Take careful measures to prevent omissions and misunderstandings by double-checking all entries.

Editing and managing your omnibus participating private trust form

Digital document management has become simpler and more effective with tools like pdfFiller. This platform allows users to create, edit, and store the omnibus participating private trust form securely. With features such as collaboration and version control, pdfFiller enhances the trust management experience, especially when multiple stakeholders are involved.

Maintaining best practices while managing trust documents involves regular organization, updates, and audits. Scheduled reviews of the trust contents ensure compliance with changing regulations and participant needs, protecting the trust from potential legal issues.

Signing the form: essential considerations

The process of signing the omnibus participating private trust form requires careful attention to eSignature options. eSignatures are legally valid in most jurisdictions, offering convenience without sacrificing security. To ensure a reliable signing process, implement security measures such as two-factor authentication and secure platforms.

Collaboration with stakeholders is fundamental during the signing phase. Inviting participants to contribute and ensuring they understand the terms of the trust fosters trust and transparency, while efficient tracking guarantees that all required parties finalize their input.

Ongoing management of the trust

The ongoing management of the omnibus participating private trust requires periodic reviews and adjustments. These reviews ascertain that the trust continues to meet participants' needs and remains compliant with evolving legal standards. Early identification of issues or discrepancies is essential to avoid complications that could arise later.

Changes in circumstances often necessitate amendments to the trust. Whether adding new beneficiaries or modifying existing participant roles, ensuring the trust adapts to these changes maintains its relevance and effectiveness. Consulting professional advisors, such as estate planners or trust attorneys, can provide crucial insights and recommendations for managing the trust's structure efficiently.

Future of the omnibus participating private trust form

The landscape of trust management is continuously evolving, influenced by trends and innovations that reshape the way trusts are structured. New legal practices are emerging to comply with contemporary needs, while technology plays a significant role in simplifying and enhancing trust administration.

Digital assets are increasingly integrated into trust formation, necessitating new approaches to ensure proper management and distribution. Understanding the implications of these assets will be critical for future trust participants who aim to safeguard their interests while adapting to technological advancements.

Interactive tools and resources

Utilizing interactive features on pdfFiller enhances the experience of managing the omnibus participating private trust form. The platform offers a variety of templates aimed specifically at trust documentation, making it simple to adapt documents to fit unique needs.

The enhanced user experience available through pdfFiller not only simplifies documentation but also equips users with modern document management capabilities.

Frequently asked questions (FAQs)

Addressing common concerns regarding the omnibus participating private trust form can provide valuable insights. Some frequent queries include inquiries about the complexities of managing multiple participants, the significance of compliance with regulations, and the responsibilities attributed to trustees.

Providing clear answers to these questions can demystify the process for those interested in using this valuable trust structure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit omnibus participating private trust from Google Drive?

How do I edit omnibus participating private trust on an Android device?

How do I complete omnibus participating private trust on an Android device?

What is omnibus participating private trust?

Who is required to file omnibus participating private trust?

How to fill out omnibus participating private trust?

What is the purpose of omnibus participating private trust?

What information must be reported on omnibus participating private trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.