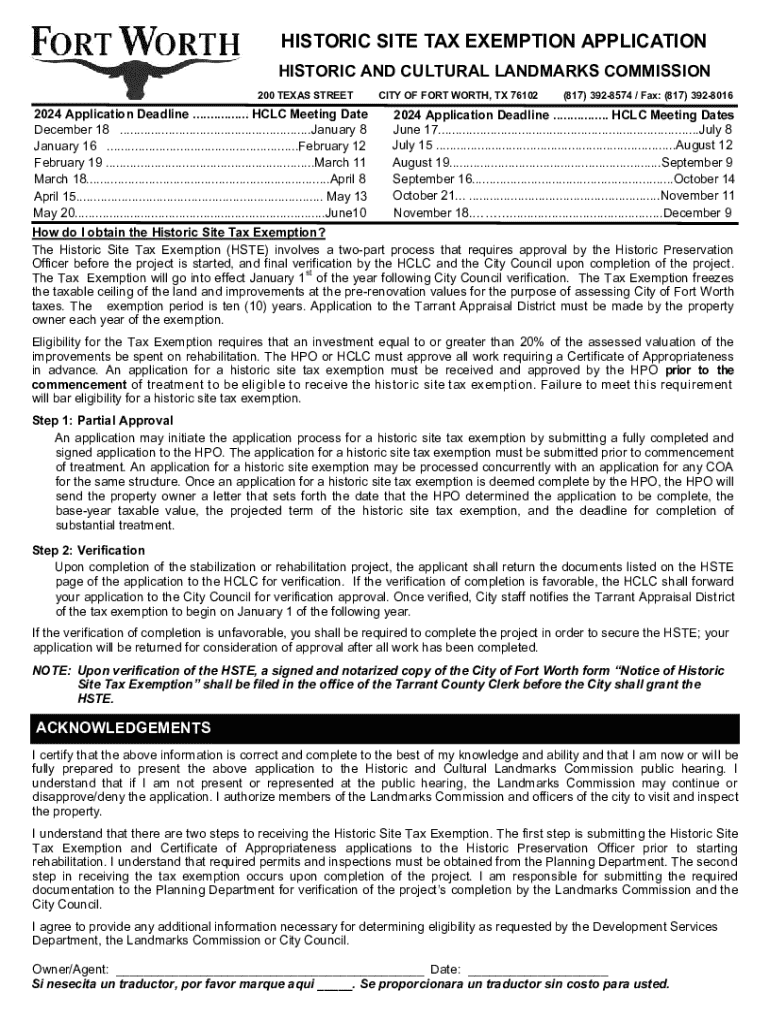

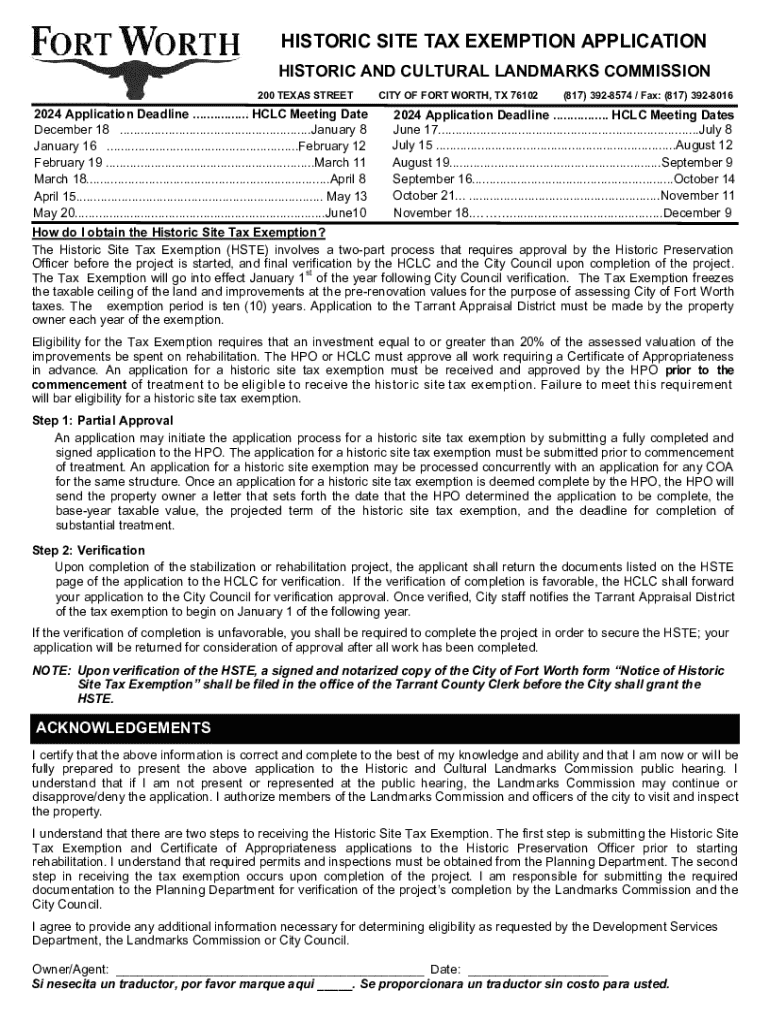

Get the free HISTORIC SITE TAX EXEMPTION APPLICATION

Get, Create, Make and Sign historic site tax exemption

How to edit historic site tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out historic site tax exemption

How to fill out historic site tax exemption

Who needs historic site tax exemption?

A Comprehensive Guide to the Historic Site Tax Exemption Form

Understanding historic site tax exemption

The historic site tax exemption is a financial incentive aimed at promoting the preservation of historically significant sites. It allows property owners to receive tax relief for maintaining and improving their heritage properties, ultimately benefiting the community by preserving culture and history.

For property owners, this exemption not only reduces their tax burden but also can enhance the value of their properties through well-maintained historical features. It encourages investment in preserving architectural integrity, which in turn enhances tourism and local pride.

Historical context

The concept of preserving historic sites in the United States traces back to the early 20th century, with notable efforts like the establishment of the National Historic Preservation Act in 1966. This landmark legislation underscored the importance of protecting buildings that embody our nation's heritage.

Over time, various tax incentive programs emerged as tools for local governments to encourage preservation efforts. The evolution of these laws reflects changing attitudes toward heritage conservation, recognizing its importance beyond mere architecture—it's about preserving stories and identities.

Eligibility criteria

The eligibility for the historic site tax exemption varies based on property type and local laws. Generally, homeowners, non-profits, and commercial properties may apply, provided they meet specific criteria.

Individual homeowners must own a property that is either designated as a historic site or listed in the National Register of Historic Places. For non-profits and commercial entities, the property should not only be significant architecturally, but also adhere to local and state preservation standards.

The application process

Completing the historic site tax exemption form involves a systematic approach. Begin by gathering necessary documentation which may include property deeds, historical records, and any prior preservation assessments. This foundational work is essential for a successful application.

Carefully fill out the application form, focusing on key sections such as property description, historical significance, and financial information related to the property. Each detail contributes to the reviewer's understanding of your property's value.

Avoid common mistakes such as incomplete documentation, incorrect property classifications, and submitting after deadlines to ensure a smoother application process.

Supporting documents needed

When preparing your application for the historic site tax exemption, a checklist of supporting documents is crucial. Typical requirements include architectural blueprints, photographs highlighting historical features, and letters of support from local preservation organizations.

Organizing your submission systematically enhances clarity. Digital file management is recommended; keeping documents categorized and high-quality scans can vastly improve the evaluation process.

Fees and associated costs

Understanding the cost structure is essential when applying for the historic site tax exemption. Application fees vary by jurisdiction, but you can expect certain basic fees, which may cover processing and inspection costs.

Additionally, exploring potential financial assistance such as grants can provide funding for necessary preservation work. These grants often support improvements that maintain a property’s historical character, offering further incentives beyond tax exemptions.

Inspection and approval process

What happens after your submission? Generally, an inspection will follow, formed around an established timeline for review. Reviewers will assess the application against specific local guidelines to ensure compliance with preservation standards.

Inspectors look for architectural integrity, adherence to documented historical features, and other elements that contribute to the property’s historical significance. Knowing what to expect during this phase can help streamline the process.

Frequently asked questions (FAQs)

Applications can be complex, leading to many frequently asked questions. For instance, what should you do if your application is denied? Most regions allow for an appeals process or resubmission with additional documentation. Communication with local authorities is essential.

Another common concern revolves around property modifications after being granted an exemption. Changes may impact your exemption status, so it’s important to consult guidelines before undertaking substantial alterations.

Utilizing pdfFiller for your application

Choosing pdfFiller to manage your historic site tax exemption application streamlines the process. With powerful editing and collaboration tools, users can easily create, fill out, and submit their forms from a single cloud-based platform.

Using pdfFiller also ensures secure e-signature functionality and efficient cloud storage, enhancing both accessibility and collaboration. These features allow users to manage their documentation easily, and track their application status in real time.

Tips for successful submission

Navigating the application process successfully requires a well thought out approach. Keep communication lines open with local authorities to receive guidance and ensure all details are correct. Consulting with preservation experts can provide valuable insights, ensuring your application stands out.

Moreover, staying updated on any policy changes regarding tax exemptions is crucial. Engaging with reputable publications and joining preservation associations can be beneficial for continuous education and network building.

Contact information for local preservation offices

Reaching out for assistance is often the final key in ensuring a successful historic site tax exemption application. Local preservation offices typically provide invaluable resources, including guidance on the application process and eligibility criteria.

Contact information for local governments can often be found on city or county websites. Additionally, hotlines dedicated to historic preservation can potentially offer immediate assistance or direct your queries to the appropriate department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete historic site tax exemption online?

How can I fill out historic site tax exemption on an iOS device?

How do I fill out historic site tax exemption on an Android device?

What is historic site tax exemption?

Who is required to file historic site tax exemption?

How to fill out historic site tax exemption?

What is the purpose of historic site tax exemption?

What information must be reported on historic site tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.