Stewart Title Insurance Company Form: A Comprehensive Guide

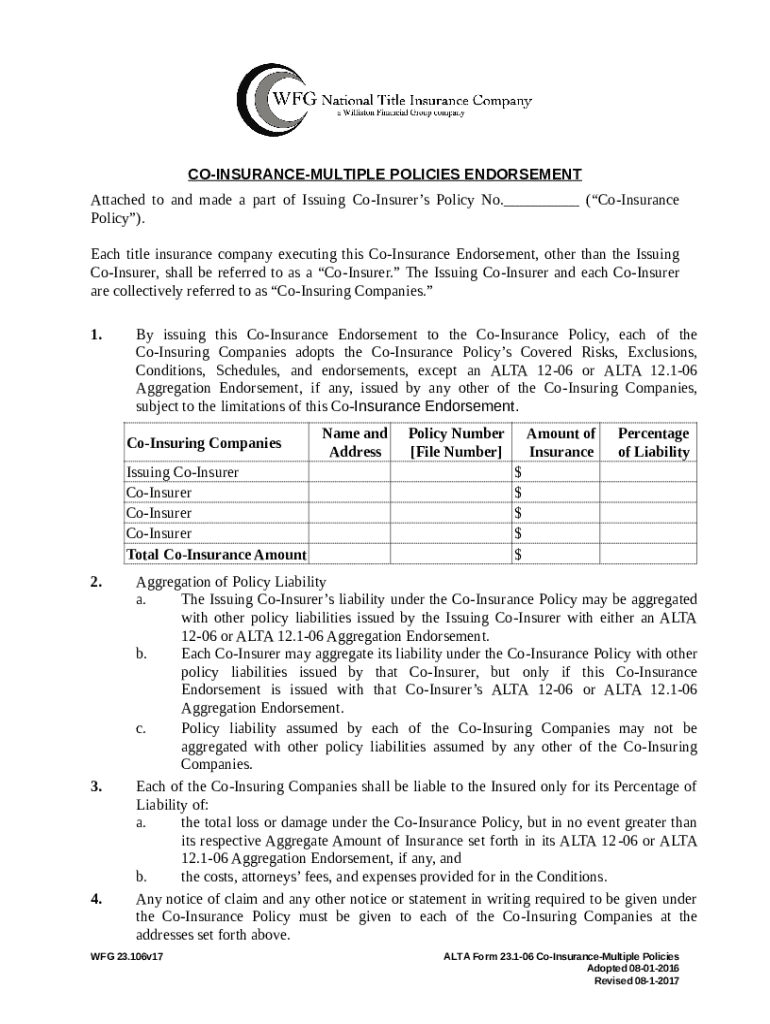

Understanding title insurance

Title insurance is a vital aspect of real estate transactions, designed to protect buyers and lenders against potential losses arising from disputes related to property titles. It operates as a safeguard, ensuring that the ownership of a property is legitimate and free from liens, claims, or other encumbrances that could jeopardize the buyer's or lender's investment.

The significance of title insurance cannot be overstated, especially in complex real estate dealings. Whether purchasing a home, investment property, or commercial asset, having title insurance fosters confidence by mitigating the risk of unexpected legal issues relating to the title after the purchase.

Types of title insurance

Two primary types of title insurance coverage exist: owner's title insurance and lender's title insurance. Owner's title insurance protects the property owner’s interest by covering potential losses due to title defects, while lender's title insurance, required by lenders, safeguards the lender’s investment in the property until the mortgage is paid off. Each type offers unique coverage details, including potential claims that can arise from fraud, undisclosed heirs, or errors in public records.

Overview of Stewart Title Insurance Company

Stewart Title Company has established itself as a leading provider of title insurance and related services in the United States. Founded in 1893, the company boasts a rich history and a sound reputation for delivering exceptional title solutions. Stewart Title’s network encompasses thousands of agents, facilitating transactions across various real estate sectors, including residential, commercial, and industrial markets.

The services offered by Stewart Title extend beyond providing insurance policies. They include a range of customer-oriented solutions such as escrow, closing services, and technology-driven resources, helping clients navigate the often-complex world of real estate transactions.

Key benefits of choosing Stewart Title

Choosing Stewart Title comes with numerous benefits. Their dedicated customer support team is equipped to assist clients throughout the title process, answering questions and addressing concerns promptly. Additionally, Stewart Title leverages innovative technology and resources that streamline the documentation process, making it easier for clients to manage their title insurance needs.

The Stewart Title Insurance Company form: An in-depth review

The Stewart Title Insurance Company Form is an essential document in the realm of title insurance. It serves as a formal request for coverage and aids in the establishment of the buyer's legal rights to the property. Understanding why this form is necessary can facilitate smoother transactions and prevent future legal complications.

The situations that necessitate the Stewart Title Insurance Company Form vary from property purchases, refinancing, to when transferring ownership. In each instance, having a correctly filled out form can enhance the overall reliability of the transaction.

Interactive features of the form

Thanks to platforms like pdfFiller, completing the Stewart Title Insurance Company Form has never been easier. pdfFiller provides various interactive features that aid users in efficiently filling out the form. Users can edit text fields, drag and drop elements, and utilize collaboration tools, enabling multiple stakeholders to provide input and feedback seamlessly.

Step-by-step guide to completing the Stewart Title Insurance Company form

Completing the Stewart Title Insurance Company Form requires attention to detail and an understanding of the information required. Below are essential steps to ensure accuracy in the completion process.

Initial preparations

Before filling out the form, gather all required documents, including the deed, property description, and any prior title insurance policies. Familiarizing yourself with the terminology used in the form is crucial; this will enhance your understanding of what information is needed and will facilitate a clearer filling process.

Detailed instructions for each section

Property Information: This includes the property's legal description and address. It is critical to provide accurate details to prevent any discrepancies.

Buyer/Seller Information: Fill in essential information for all parties involved in the transaction, including names and contact details.

Title Insurance Details: This section requires you to choose the appropriate title insurance coverage, which will depend on whether you are the buyer or lender.

Editing, e-signing, and managing your form

With pdfFiller, editing the Stewart Title Insurance Company Form is user-friendly. After filling out the form, e-signature tools allow you to sign electronically. This not only saves time but also ensures that the document is encrypted and secure. Once completed, users can save, share, or print documents directly from the platform.

Frequently asked questions about Stewart Title and the insurance form

The form addresses coverage for both owner's and lender's insurance, outlining the protections available against potential title defects.

Processing times can vary but typically take a few days once submitted, depending on the complexity of the transaction and the efficiency of document submission.

If a mistake is identified, users can return to pdfFiller, edit the form, and update the necessary sections before re-submission.

It's essential to ensure that all sections of the form are thoroughly completed and that necessary supporting documents are attached.

Yes, the Stewart Title Insurance Company Form is applicable for both residential and commercial property transactions.

Troubleshooting common issues with the Stewart Title Insurance Company form

Users may encounter technical issues while filling out the Stewart Title Insurance Company Form. Common problems may include difficulties in uploading documents or navigating the pdfFiller platform.

To resolve these issues, ensure your browser is updated and that you are utilizing a compatible device. If issues persist, reaching out to pdfFiller's dedicated support team can provide further assistance.

Understanding approval delays

Approval delays may occur if the submitted information is incomplete or ambiguous. Factors affecting validation can include missing signatures or non-compliance with specific submission requirements. Ensuring all required fields are properly filled can help mitigate these delays.

Contacting Stewart Title for additional support

For further assistance with the Stewart Title Insurance Company Form, reaching out to customer service is recommended. Stewart Title offers multiple channels for communication including phone, email, and online chat.

Preparing your queries in advance can facilitate faster response times. Be clear about your issues or questions, and have your documents ready to share if needed.

Innovations in title insurance solutions by Stewart Title

Stewart Title is at the forefront of integrating digital solutions into the title insurance landscape. The company is continually evolving to embrace technological advances, aiming to enhance user experience.

Their commitment to digitization translates into tools that simplify title searches and streamline transactions. This forward-thinking approach ensures that clients have access to cutting-edge resources, significantly enhancing the overall process of acquiring title insurance.

The role of technology in enhancing user experience

Specific technology tools offered by Stewart Title include intuitive online platforms for document processing, e-signature capabilities, and customer service chatbots. These innovations not only empower clients to manage their title insurance needs from anywhere but also eliminate possible inaccuracies through automated checks.

Conclusion on the Stewart Title Insurance Company form and its importance in real estate transactions

Completing the Stewart Title Insurance Company Form correctly is crucial in ensuring a smooth and legally compliant real estate transaction. This form plays a pivotal role in protecting both buyers and lenders by establishing clear ownership rights and coverage. Careful attention to detail while completing this document can greatly reduce potential disputes and challenges down the road, solidifying its importance in any property-related dealings.