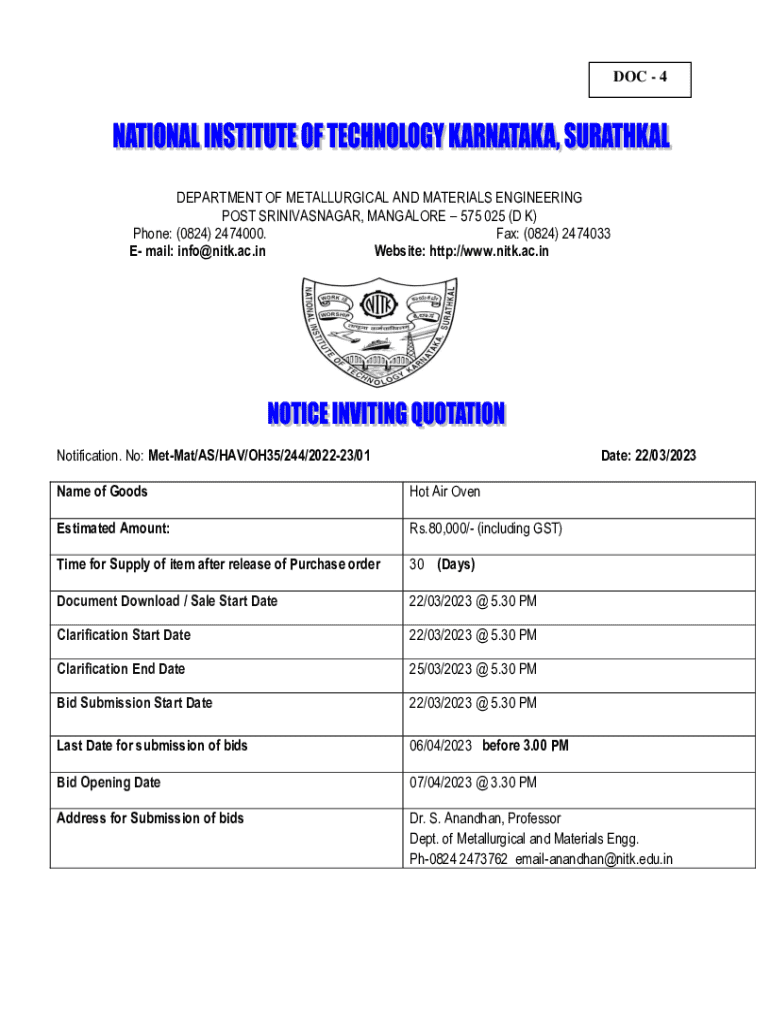

Get the free 80,000/- (including GST)

Get, Create, Make and Sign 80000- including gst

How to edit 80000- including gst online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 80000- including gst

How to fill out 80000- including gst

Who needs 80000- including gst?

Essential Guide to the 80000- Including GST Form

Understanding the concept of GST

Goods and Services Tax (GST) is a unified tax structure in India that replaced multiple indirect taxes such as sales tax, service tax, and value-added tax (VAT). Initiated on July 1, 2017, GST simplifies the tax process by subsuming various levies into a single tax system. The central aim of GST is to improve compliance and enhance the ease of doing business.

GST compliance is crucial for businesses as it affects pricing, cash flow management, and tax obligations. A lack of compliance can result in penalties, hindering a business's growth and reputation. Understanding the GST framework is essential for all entrepreneurs, especially in a rapidly evolving regulatory landscape.

The 80000- including GST form: Key details

The 80000- including GST form is a crucial document for reporting income while accounting for GST. Businesses or individuals engaged in taxable services or goods must complete this form to ensure compliance with GST regulations. It serves as a declaration of the total income including applicable GST, allowing tax authorities to assess liabilities accurately.

Any business that provides goods or services taxable under GST needs to fill out this form. This obligation includes individual freelancers and any organization whose turnover meets the prescribed threshold. Accuracy in this form is essential as discrepancies can lead to audits, penalties, or delayed processing of claims.

Step-by-step guide on filling the 80000- including GST form

Step 1: Gathering necessary information

To fill out the 80000- including GST form accurately, gather all relevant business documentation. This includes your GST registration number, invoices, and previous tax filings. Ensuring a complete collection of financial data enhances the accuracy of your submission, minimizing the risk of errors.

Step 2: Understanding the sections of the form

The form typically consists of sections detailing revenue, GST collected, and deductions if applicable. Familiarize yourself with each segment to reduce mistakes. Common pitfalls include misinterpretation of terms and incorrect figures that can lead to significant consequences.

Step 3: Calculating the total amount including GST

Calculating GST is a straightforward process. Use the formula: Total Amount = Net Amount + (Net Amount × GST Rate). For example, if a product is priced at ₹80,000 and the GST rate is 18%, the calculation will be: ₹80,000 + (₹80,000 × 0.18) = ₹94,400.

Step 4: Signing and submitting the form

After completing the form, you'll need to sign it. E-signing through platforms like pdfFiller simplifies this process. Ensure you follow the submission protocols, whether electronically or in paper form, to comply with legal requirements.

Interactive tools to enhance your filing experience

Tools like pdfFiller offer unique functionalities for efficient document management. Users can create, edit, and collaborate on documents seamlessly in a cloud environment. Interactive templates specifically designed for the 80000- including GST form expedite the completion process, allowing faster and error-free submissions.

Taking advantage of collaborative features within pdfFiller also enhances compliance for teams. Multiple users can work simultaneously on a form, ensuring everyone has input before finalizing, which reduces the risk of mistakes often seen in traditional document handling.

GST rates applicable in India

Understanding current GST rates is essential when filling out the 80000- including GST form. As of now, GST is categorized into various slabs: 0%, 5%, 12%, 18%, and 28%. Each category impacts pricing differently, making it crucial for businesses to identify the correct rate applicable to their goods or services.

For instance, if a business provides a service that falls under the 18% GST bracket, they must include this in the total calculation. Staying updated on any changes in these rates is equally important to ensure ongoing compliance and correct filing.

Common mistakes to avoid when filling the form

Common errors while filling the 80000- including GST form include computation mistakes, wrong GST rates, and omission of necessary information. Double-checking figures, ensuring correct GST application, and reviewing metrics before submission can save significant time and mitigate penalties.

Understanding GST calculation with an example

To understand GST calculation more clearly, consider a scenario where a service is offered for ₹80,000 with an 18% GST rate. The computation would be: GST = Net Amount × GST Rate = ₹80,000 × 0.18 = ₹14,400. Consequently, the total amount, including GST, will be ₹80,000 + ₹14,400 = ₹94,400. This understanding is vital for accurately filling the form.

Breaking it down stepwise provides clarity and ensures users are aware of where their figures come from, eliminating confusion for users who may struggle with tax calculations.

The role of pdfFiller in managing GST documentation

pdfFiller serves as an essential tool in managing GST-related documents seamlessly. It allows users to create and edit documents online, track changes, and securely store files in the cloud. This process not only helps ensure compliance but also boosts productivity through quicker document creation and management.

Having a central cloud-based solution for document creation and filing alleviates the stress of managing numerous tax documents manually. Additionally, it allows businesses to maintain a comprehensive archive of their records for future reference.

Frequently asked questions (FAQs)

The 80000- including GST form can raise several questions for users. Common queries include whether freelancers need to complete it, potential penalties for errors, and submission deadlines. Users often seek clarification on whether to aggregate multiple invoices under one form.

Enhancing business efficiency through effective document management

Implementing tools like pdfFiller can streamline your GST documentation processes significantly. Businesses can improve overall operational efficiency by enhancing their filing systems, allowing team members to focus on core tasks rather than paperwork. Efficient management fosters a more organized work environment and increases productivity.

Case studies show that organizations leveraging document management systems have reported faster approvals and enhanced communication across departments, reflecting the importance of efficient document handling in modern business practices.

Additional insights on GST compliance and management

Updates surrounding GST regulations continually evolve, underlining the need for businesses to stay informed about changes that may affect the 80000- including GST form. Regularly reviewing compliance strategies and keeping abreast of new guidelines are best practices that ensure a business remains compliant while also strategically positioned to respond to regulatory shifts.

User stories and testimonials

Many individuals and teams have transformed their GST documentation processes by using pdfFiller. User feedback highlights the ease of editing and collaborating on documents, which has led to a decrease in errors and streamlined approvals.

Testimonials reflect how businesses save time in their filing and documentation procedures, noting increases in productivity and the peace of mind that comes from improved compliance.

Interactive features of pdfFiller

pdfFiller offers advanced features such as document security, version control, and accessibility options including mobile capabilities. This ensures that documents remain protected and can be accessed anywhere, empowering users to manage their GST forms efficiently.

These features cater to diverse user needs, whether operating solo or as part of a team. By providing secure, accessible tools, pdfFiller stands as a versatile solution for anyone dealing with GST documentation.

Connect with support and resources

For further assistance regarding GST or the 80000- including GST form, reach out to pdfFiller support for expert guidance. Their team is equipped to handle queries regarding document management and compliance, linking you to relevant resources quickly.

Utilizing these available resources can empower you to tackle any GST-related challenges and maintain strong compliance as your business evolves.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 80000- including gst electronically in Chrome?

How do I edit 80000- including gst straight from my smartphone?

How do I edit 80000- including gst on an Android device?

What is 80000- including gst?

Who is required to file 80000- including gst?

How to fill out 80000- including gst?

What is the purpose of 80000- including gst?

What information must be reported on 80000- including gst?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.