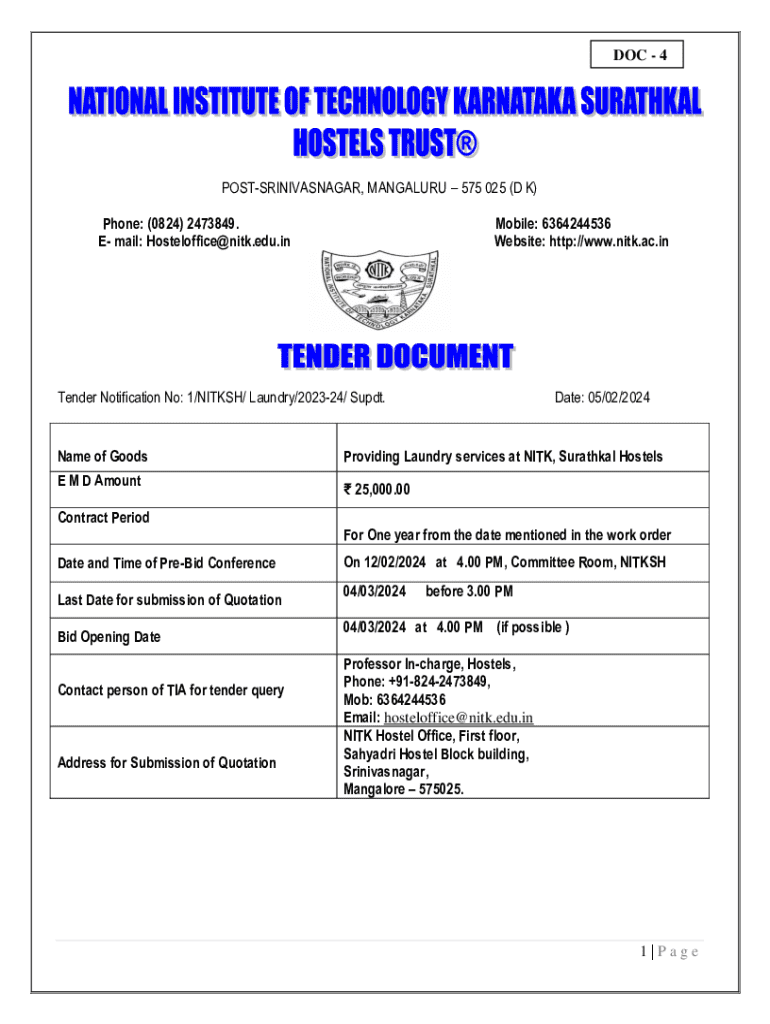

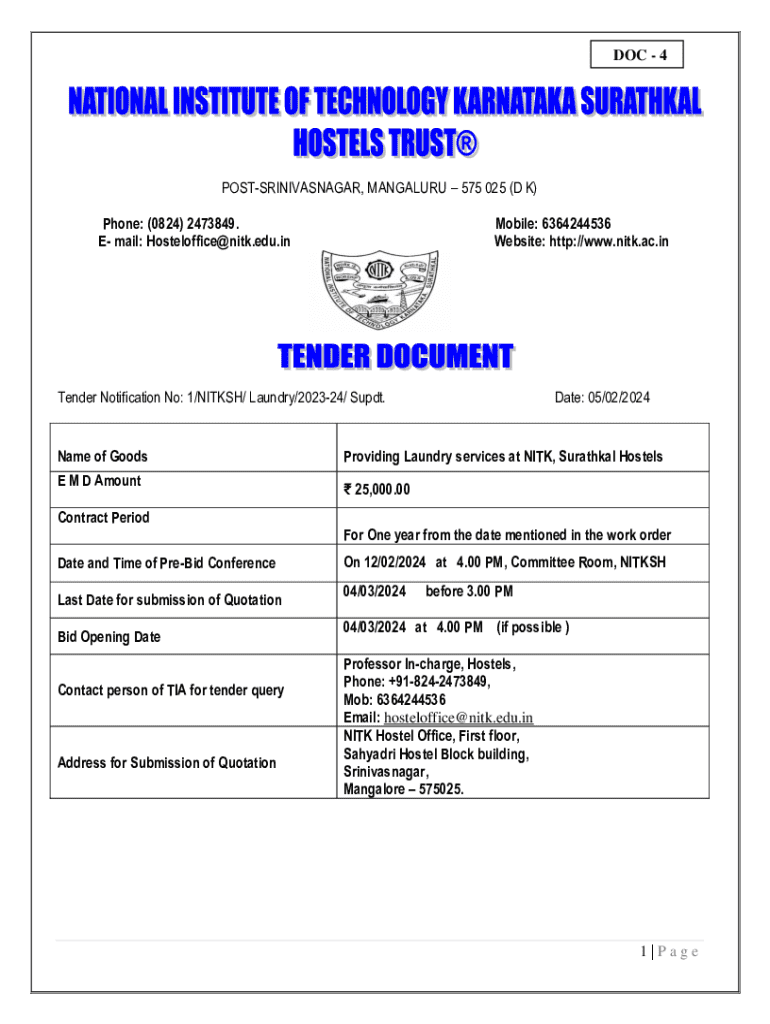

Get the free E M D Amount

Get, Create, Make and Sign e m d amount

How to edit e m d amount online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e m d amount

How to fill out e m d amount

Who needs e m d amount?

A Comprehensive Guide to the EMD Amount Form

Understanding EMD (Earnest Money Deposit)

An Earnest Money Deposit (EMD) plays a critical role in various transactions, primarily signifying a buyer's good faith in executing a purchase agreement. Essentially, the EMD acts as an assurance to the seller that the buyer is serious about the transaction and intends to follow through with their commitment. This form is often used in real estate transactions and competitive bidding situations, where a substantial value is at stake.

The importance of an EMD cannot be overstated—it not only indicates to sellers that buyers are genuine but also helps to mitigate risks associated with defaults and fraudulent activities. From tenders in government contracts to property purchases, EMDs are pivotal in securing trust and transparency in various domains.

Overview of the EMD Amount Form

The EMD Amount Form serves a clear purpose—it formalizes the deposit made by a buyer and outlines the terms and conditions associated with it. By filling out this form, a buyer provides essential details that the seller or bidding agency will rely on for processing the transaction securely. This form typically includes crucial sections such as the buy or bid amount, EMD percentage, and payment details.

Key sections to expect in an EMD form are: the buyer's information, transaction details that specify the nature of the agreement, specifics about the EMD (such as the amount and percentage), and terms related to refundability and forfeiture, which protect both parties involved in the transaction.

Specifications of the EMD Amount

Understanding how the EMD amount is calculated can save buyers from financial pitfalls. The EMD amount largely depends on the type of transaction and is often expressed as a percentage of the total purchase or bid price. In real estate, typical EMD percentages might range from 1% to 5% of the home price, while in tender situations, the percentage could be dictated by the governing regulations or project norms.

Key factors influencing the EMD amount include the industry standards associated with different transactions and any stipulations set forth by the seller or bidding agency. In competitive environments, the EMD acts as both a signal of seriousness and a financial commitment, reinforcing the buyer’s intention to proceed.

Detailed breakdown of EMD percentage calculation

Calculating the EMD percentage is a straightforward yet impactful process. For instance, if a property is priced at $400,000 and the agreed EMD percentage is 3%, the calculation would be simple: $400,000 x 0.03 = $12,000. Understanding this calculation not only helps in budgeting but also clarifies the financial commitment expected when entering a transaction.

To ensure accuracy, follow this step-by-step methodology: First, ascertain the total price of the transaction. Next, identify the percentage required by the seller or governing body. Finally, execute the multiplication to arrive at the EMD amount. Common mistakes include miscalculating the percentage or neglecting to refer to the specific guidelines pertinent to the transaction type.

Steps to complete the EMD form

Completing the EMD form requires preparation and accuracy. Before filling it out, gather necessary documentation such as a valid ID, evidence of the transaction, and any previously agreed terms that might influence the EMD. Furthermore, ensure that all personal details are correct and comprehensive, minimizing mistakes that could lead to delays.

When filling out the EMD form, key parameters include your personal information, transaction details, EMD amount, and payment method. Pay close attention to the specific requirements laid out by the seller or governing body to ensure compliance. Noteworthy points include double-checking for typographical errors and ensuring all sections are completely filled out before submission.

Modes of payment for EMD

Several acceptable payment methods for EMDs exist, offering flexibility to buyers. Common modes include bank transfers, certified checks, and even credit card transactions in some cases. Each payment method comes with its own set of advantages—bank transfers are often quicker, while checks might provide added security.

In recent years, electronic payment systems have gained popularity due to their convenience and efficiency. Utilizing platforms like pdfFiller allows you to submit EMD payments securely, ensuring that your financial commitment is processed quickly and effectively, without unnecessary delays.

Implications of EMD: Why it matters

The implications of the EMD stretch well beyond straightforward transactional security. Primarily, it ensures serious participation from bidders, deterring frivolous or unserious offers that could stall the bidding process. By holding an EMD, sellers can screen out uncommitted buyers, saving both time and money on failed negotiations.

In addition, the EMD serves as a protective measure against defaults and fraudulent activities, reinforcing trust in the transaction process. Moreover, it promotes fair competition among bidders—since everyone has to commit a portion of their financial resources—ensuring that the best offers reflect genuine interest and capability.

Refund and forfeiture of EMD

Understanding the conditions under which an EMD is refundable is crucial for buyers. Typically, EMDs are refundable if the transaction falls through due to specific contingencies detailed in the purchase or bidding agreement, such as failed inspections or financing issues. To claim a refund, a buyer must follow a defined process that often includes submitting a request and accompanying documentation.

On the flip side, EMDs may be forfeited under certain conditions, commonly if a buyer defaults or fails to comply with the agreement terms. Examples include failing to adhere to deadlines or not following through with the purchase after successful bidding. To avoid losing your EMD, stay informed of all obligations and maintain clear communication with the selling party throughout the process.

Exemptions from EMD

In specific scenarios, some entities or transactions might be exempt from providing an EMD. Government agencies often have exemptions due to differing regulations, as do non-profit organizations engaging in public service projects. Recognizing when exemptions apply requires an understanding of the guidelines set forth by regulatory bodies.

To secure an EMD exemption, necessary documentation must be presented, including proof of non-profit status or a letter from an authorized agency outlining the exemption rationale. Familiarizing yourself with these requirements can save time and effort during the application process.

Challenges and considerations related to EMD

Navigating the EMD process can present various challenges, particularly if compliance requirements are not fully understood. Common issues include wrongful forfeiture due to miscommunication and failing to meet deadlines. For buyers, being well-informed about the terms can alleviate these risks.

It is essential to adopt best practices for overcoming EMD-related challenges. Maintaining organized documentation, clearly communicating with stakeholders, and reviewing all agreement terms can significantly improve your chances of a smooth transaction. Additionally, leveraging tools like pdfFiller can greatly enhance compliance by providing structured templates and electronic submission options.

Utilizing pdfFiller for EMD management

pdfFiller is a powerful tool for simplifying the EMD form process. With features designed to assist users in completing forms effectively, pdfFiller offers capabilities such as electronic signatures, document sharing, and collaboration tools. This eases the burden of completing required paperwork, allowing users to focus on their transactions.

Moreover, the advantages of utilizing a cloud-based platform like pdfFiller for managing EMD documents are substantial. Users can access, edit, and store documents from anywhere, streamlining the entire process and ensuring that all documentation complies with current regulations—ideal for individuals and teams seeking seamless document creation solutions.

FAQs about EMD amount form

Several common queries arise regarding the EMD process, including how to determine the amount, what documentation is required, and the percentage typically expected. Furthermore, clarifications about misconceptions, such as the belief that all EMDs are non-refundable, are essential for potential buyers.

Understanding these intricacies can enhance a buyer's confidence and ability to navigate transactions. Providing a streamlined FAQ section on platforms like pdfFiller ensures users have easy access to vital information, helping to clarify concerns and promoting more efficient processes.

Final remarks on the EMD amount form

Handling the EMD amount form with care is essential, as it plays a pivotal role in securing a successful transaction. Each step, from calculating the EMD amount to filling out the form accurately, is crucial for a smooth process. Leveraging tools such as pdfFiller enhances the user experience, streamlining documentation and ensuring compliance.

By being informed and prepared, buyers and participants can navigate the EMD landscape with confidence, ultimately facilitating more secure and efficient transactions across various sectors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit e m d amount from Google Drive?

How do I complete e m d amount on an iOS device?

How do I edit e m d amount on an Android device?

What is e m d amount?

Who is required to file e m d amount?

How to fill out e m d amount?

What is the purpose of e m d amount?

What information must be reported on e m d amount?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.