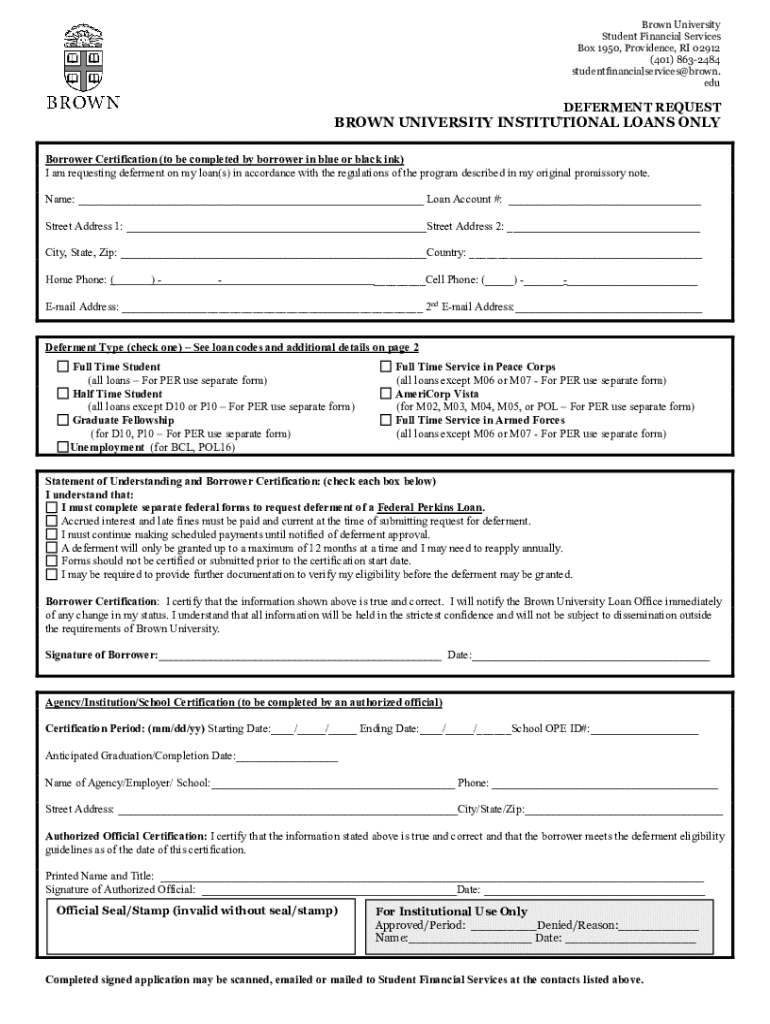

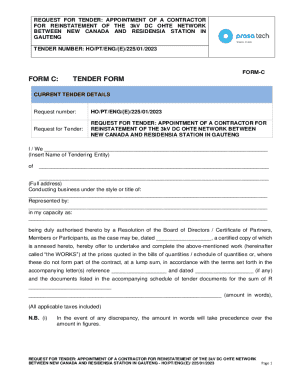

Get the free Borrower Certification (to be completed by borrower in blue or black ink)

Get, Create, Make and Sign borrower certification to be

Editing borrower certification to be online

Uncompromising security for your PDF editing and eSignature needs

How to fill out borrower certification to be

How to fill out borrower certification to be

Who needs borrower certification to be?

Borrower Certification to Be Form: A Comprehensive Guide

Borrower certification to be: Understanding the essentials

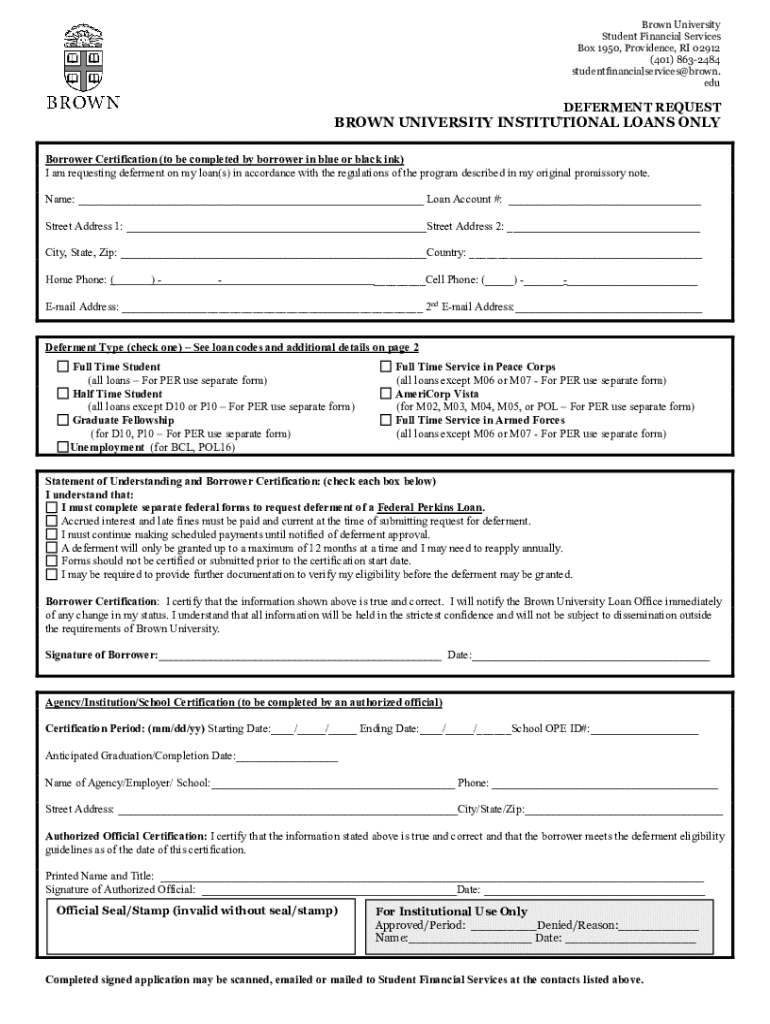

Borrower certification is a crucial component of the loan application process. It serves as a formal declaration by the borrower, affirming their intentions regarding the loan, confirming their understanding of the terms, and providing essential personal and financial information. The borrower certification to be form specifically outlines the particulars required from the borrower to facilitate the underwriting process, ultimately aiding lenders in assessing the borrower's eligibility.

The importance of borrower certification cannot be overstated; it serves as a safeguard for both lenders and borrowers by ensuring transparency and accuracy. Additionally, this form is required at various stages of the loan process, depending on the type of mortgage or loan being sought. Understanding when to use the borrower certification form is vital for smooth loan processing.

Key elements of the borrower certification form

The borrower certification to be form includes several essential components that collect critical information about the borrower. Each section is designed to capture specific details necessary for lenders to evaluate the request effectively. The key elements typically include personal information, financial information, and loan specifics.

Personal information usually entails the borrower's full name, Social Security number, and contact details. Financial information, on the other hand, addresses aspects such as employment details and sources of income. Finally, the loan specifics encapsulate the type of loan being requested, the loan amount, and the property address associated with the loan.

Step-by-step guide to completing the borrower certification form

Completing the borrower certification to be form accurately is imperative to avoid complications later in the loan process. Here’s a step-by-step guide to help you navigate this essential task.

Common mistakes to avoid

Mistakes on the borrower certification form can lead to significant delays in the loan approval process. It’s essential to be aware of common pitfalls. One prevalent issue is incomplete information. Providing insufficient details can result in the lender requesting additional documentation, which could slow down the approval timeline.

Another common error arises from misreported income. It’s crucial to represent your financial situation accurately to avoid complications. Lastly, neglecting to include required signatures can render your form invalid, requiring you to start the submission process anew.

Editing and signing your borrower certification

Utilizing tools from pdfFiller can simplify the editing and signing process of your borrower certification to be form. With pdfFiller, you can easily edit your document, filling in necessary fields or correcting any identified errors.

The step-by-step process for electronically signing the document is also straightforward. Once your form is filled out, you can add your signature using electronic tools, ensuring that all parties involved can also sign rapidly and efficiently.

Managing your borrower certification document with pdfFiller

pdfFiller offers a suite of features for managing your borrower certification to be form, ensuring you have flexibility and control over your documentation. One significant advantage is cloud storage, allowing you to access your documents from anywhere at any time, a major benefit for busy individuals and teams.

Additional features include version control and sharing options, enabling you to keep track of document changes and collaborate with lenders or stakeholders efficiently. By leveraging these tools, you can streamline your loan process and ensure all required documentation is readily accessible.

Frequently asked questions (FAQs) about borrower certification

As you prepare to complete your borrower certification to be form, you might encounter a few questions that require clarification. Here are some common questions along with their answers.

Additional support for borrower certification

Accessing additional support during your completion of the borrower certification to be form is common. pdfFiller provides various resources to assist users, including tutorials and video guides for document management.

Moreover, the platform offers customer support where users can get tailored assistance, along with community forums where individuals can seek help and offer advice based on their experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in borrower certification to be without leaving Chrome?

How do I fill out borrower certification to be using my mobile device?

How do I complete borrower certification to be on an iOS device?

What is borrower certification to be?

Who is required to file borrower certification to be?

How to fill out borrower certification to be?

What is the purpose of borrower certification to be?

What information must be reported on borrower certification to be?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.