Get the free PAGE 199 OF

Get, Create, Make and Sign page 199 of

Editing page 199 of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out page 199 of

How to fill out page 199 of

Who needs page 199 of?

Mastering Page 199 of Form: Your Comprehensive Guide

Overview of page 199: Understanding its importance

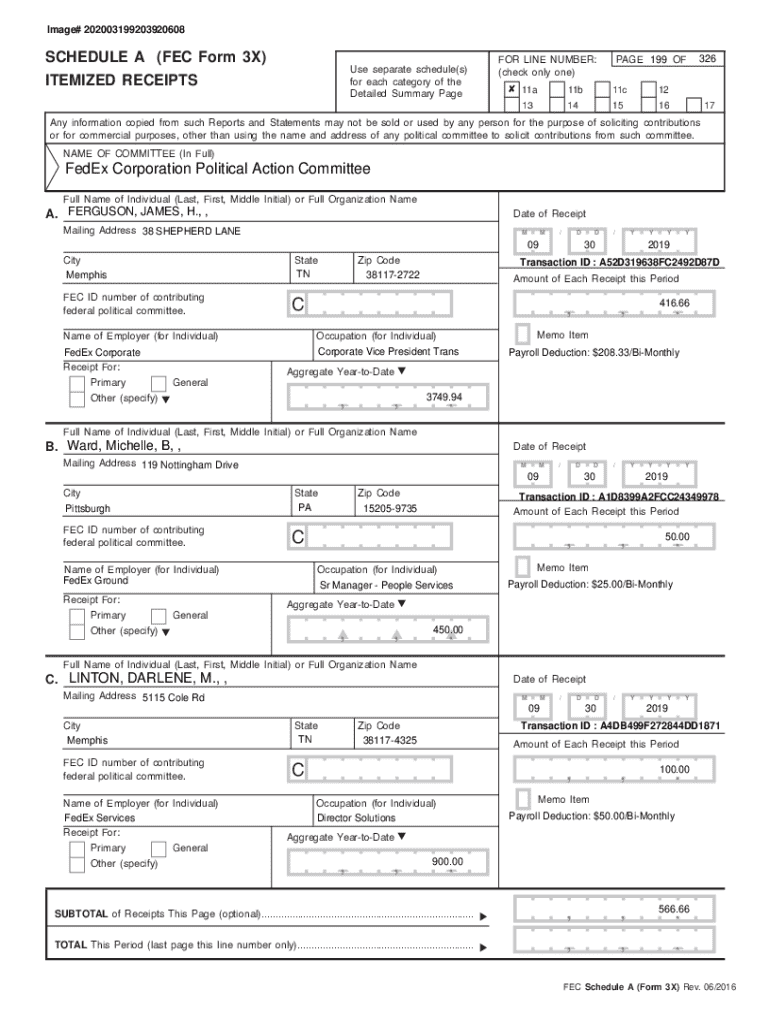

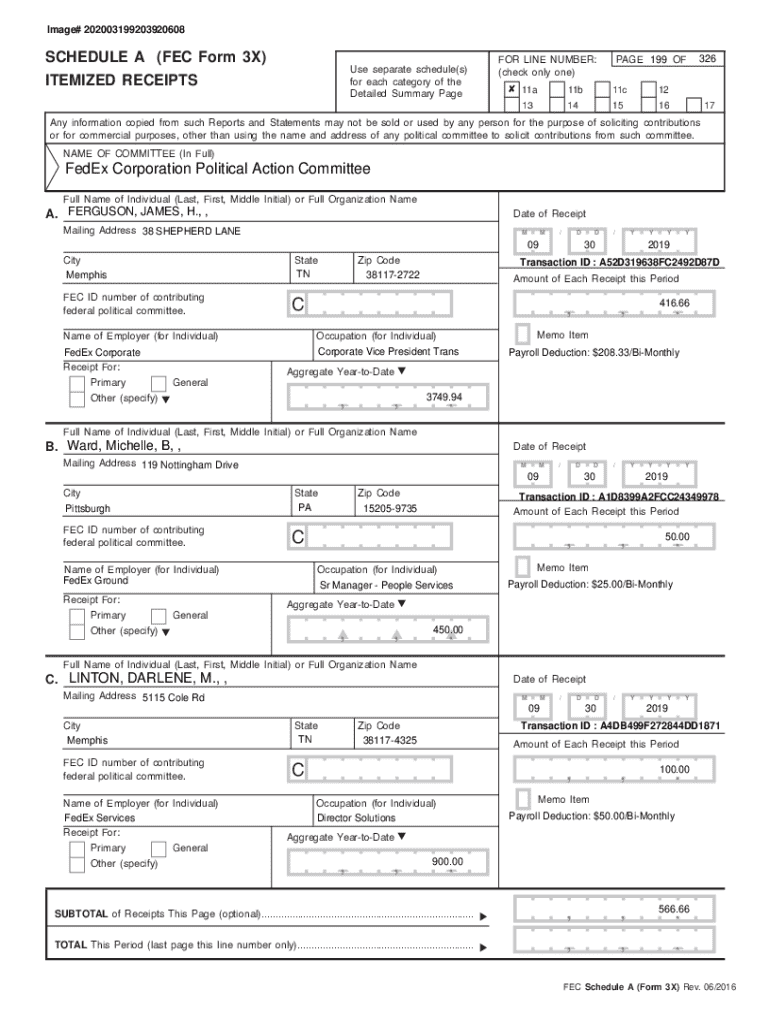

Page 199 of form plays a critical role in various document processes, often serving as a pivotal element within larger paperwork that individuals and teams encounter. Its significance lies in how it consolidates essential information and ensures compliance with regulatory requirements.

The page typically contains vital sections that document personal and financial details, making it a cornerstone for applications, declarations, and audits. Understanding what makes Page 199 stand out can streamline your filling process.

How to navigate page 199 effectively

Navigating Page 199 effectively requires understanding its structure. Key sections usually include personal information, financial data, and relevant disclosures. Each section contributes to the overall assessment, making it essential to complete them accurately.

For instance, the personal information section collects data critical for identity verification, while financial data offers insights into the applicant's fiscal situation. Familiarity with these sections boosts your efficiency and reduces the chances of error.

Step-by-step instructions for filling out page 199

Before diving into filling out Page 199, it's crucial to prepare adequately. Gather all necessary documents—such as identification and financial statements—that provide the required information. This not only eases the form completion process but also ensures you have everything at hand to avoid delays.

When filling out Page 199, start with personal information, following through financial data, and concluding with certifications and signatures. Each section demands precise entries: Double-check your personal details for correctness and make sure financial inputs align with supporting documents.

Editing and customizing page 199

One of the remarkable features of utilizing pdfFiller is the ability to edit and customize Page 199. Users can modify pre-filled information, enabling them to correct any mistakes or add pertinent entries based on their individual circumstances.

Make use of templates for document consistency, which not only enhances your form's appearance but also standardizes the data collection, ensuring that no crucial detail is overlooked. Highlighting important sections can also be beneficial, especially in lengthy forms, as it draws the reviewer’s focus to critical information.

Collaborating on page 199 with teams

Effective teamwork is crucial when completing Page 199, especially in larger organizations or collaborative environments. Leverage cloud-based collaboration tools integrated within pdfFiller to facilitate real-time editing and feedback among team members. This synchronizes efforts and reduces the risk of conflicting information.

Managing permissions is vital when multiple users are involved in the document. Ensure that you establish appropriate access levels so that everyone can contribute without risk of unauthorized changes, maintaining the document's integrity throughout the process.

Signing the completed page 199

Once Page 199 is filled, the signing process is crucial. pdfFiller offers various electronic signing methods, ensuring that all parties involved can authenticate the document efficiently and securely. An electronic signature is legally binding, replicating the importance of a handwritten one while providing added convenience.

Best practices emphasize that all signatories need to be verified to prevent any disputes later on. This can include ensuring that the representatives signing on behalf of an organization have the authority to do so, keeping the document's authenticity intact.

Managing your document post-submission

After submitting Page 199, maintaining a structured approach to document management is paramount. Utilize tracking methods to monitor the status of your submissions, ensuring that you can follow up if necessary. With pdfFiller, you can save and store completed documents securely within the cloud, mitigating the risks of loss or damage.

Addressing feedback or requests for changes is crucial. Be proactive, responding promptly and adjusting your document as required to meet the expectations of the recipients. This not only reflects professionalism but also fosters positive relationships with stakeholders.

Frequently asked questions about page 199

Common queries regarding Page 199 often arise around mistakes made during the process. If an error occurs, carefully evaluate the section in question, and identify whether correction is possible without submitting a new form. Additionally, electronic filing can introduce unique challenges - understanding these is paramount for a smooth submission.

Resources for assistance can alleviate confusion. Consulting with experts, or utilizing help sections within pdfFiller, can guide users navigating any complex issues that arise.

Additional considerations and tips

When dealing with Page 199, be cognizant of any potential tax implications that filling out this form may have. Ensuring compliance can help prevent unnecessary penalties associated with errors or omissions.

Utilizing available resources for guidance can clarify complex areas of the form, further boosting your confidence when navigating the completion of the document.

Related topics relevant to page 199

Understanding Page 199 holistically involves recognizing its relation to other forms that may be required in conjunction. Familiarizing yourself with complementary forms can ease the overall filing process.

pdfFiller provides an array of tax and filing resources, giving users access to various forms that aid in creating a streamlined documentation experience – from preparation to submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the page 199 of in Gmail?

How do I fill out the page 199 of form on my smartphone?

How do I fill out page 199 of on an Android device?

What is page 199 of?

Who is required to file page 199 of?

How to fill out page 199 of?

What is the purpose of page 199 of?

What information must be reported on page 199 of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.