Get the free IRS Form 990 Filing Due Date 2025

Get, Create, Make and Sign irs form 990 filing

Editing irs form 990 filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 990 filing

How to fill out irs form 990 filing

Who needs irs form 990 filing?

Comprehensive Guide to IRS Form 990 Filing Form

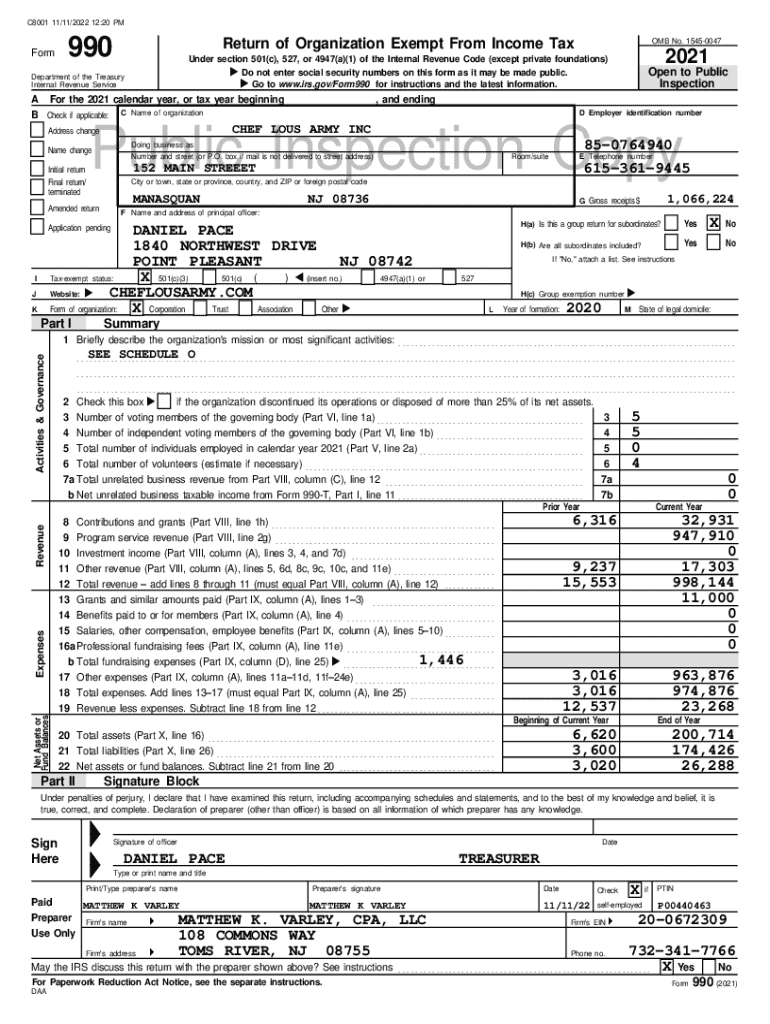

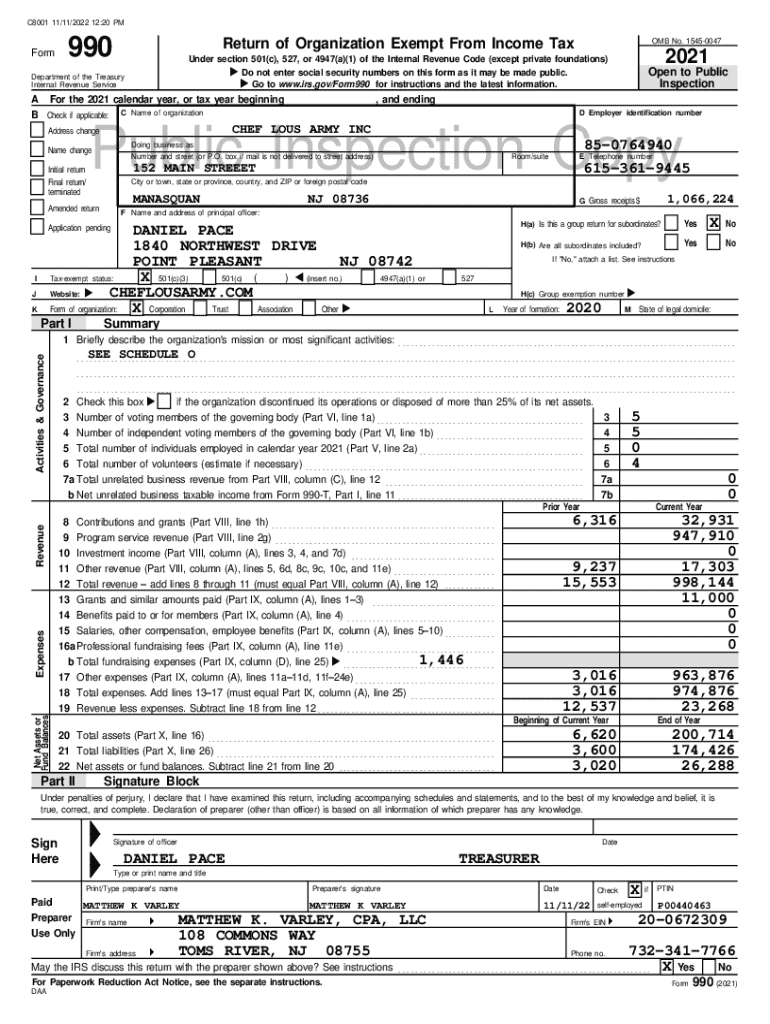

Overview of IRS Form 990

IRS Form 990 is a crucial filing requirement for tax-exempt organizations, such as nonprofits. This informational return provides detailed insights into the organization’s mission, programs, and finances. The purpose of Form 990 is to promote transparency and accountability among nonprofits, ensuring they operate in the public's interest.

For nonprofits and tax-exempt organizations, filing Form 990 is essential as it serves as a public record that stakeholders can review. It not only demonstrates compliance with federal regulations but also informs donors about how their contributions are utilized. By analyzing Form 990, potential funders can assess the organization’s financial health and program effectiveness.

Key deadlines for filing Form 990 vary based on the fiscal year-end of the organization but generally fall on the 15th day of the fifth month following the end of the tax year. Extensions can be granted, but timely filing is essential to maintain tax-exempt status.

Understanding the structure of Form 990

Navigating through the structure of Form 990 is vital for accurate reporting. The form comprises several major sections, each designed to capture unique aspects of an organization's operations.

Key sections include:

Each section plays a significant role in illustrating the organization's overall financial health and community impact, crucial for maintaining donor trust and compliance.

Detailed step-by-step guide to filing Form 990

Filing Form 990 requires careful preparation and attention to detail. Here’s a step-by-step guide to navigate the process successfully.

A. Collecting necessary information

Start by gathering all relevant financial records necessary for the accurate completion of Form 990. This includes balance sheets, income statements, and detailed reports on program expenses and revenue.

It's essential to document program service accomplishments effectively, highlighting the impact of your organization’s activities. Additionally, ensuring that governance policies, such as conflict of interest policies, are well documented is critical for compliance.

B. Step 1: Completing basic information

Begin by filling out the identifying information section. This includes the organization’s name, address, and Employer Identification Number (EIN). Selecting the correct version of Form 990 is crucial — whether it’s 990, 990-EZ, or 990-N, based on your organization’s size and financial activity.

. Step 2: Reporting on programs and revenue

Accurately describing your organization's programs and activities is vital. Clearly outline the objectives, target audiences, and results achieved. When it comes to reporting revenue, disclose all sources including donations, grants, and any unrelated business income, ensuring that all financial transactions are transparent.

. Step 3: Governance and management reporting

Governance reporting includes outlining your organization’s policies and procedures. Be prepared to disclose executive compensation and ensure that board oversight is clearly defined, as this reflects your commitment to transparency.

E. Step 4: Financial statements preparation

Preparing the financial statements is one of the most critical steps. Ensure that you provide a clear articulation of your organization’s assets, liabilities, and net assets. Additionally, preparing a Statement of Functional Expenses is necessary to categorize expenditures.

F. Step 5: Reviewing and validating your form

Once completed, review your Form 990 thoroughly to avoid common pitfalls. Implement error-checking through tools such as pdfFiller’s interactive features to ensure accuracy and compliance with IRS standards before submission.

Filing methods: Online vs. paper submissions

Choosing between online and paper submission for Form 990 is a crucial decision for nonprofits. Online filing through IRS e-File offers several advantages, including faster processing times and real-time feedback.

Using pdfFiller, you can streamline your online submission process, ensuring all necessary documents are accurately filled and easily shared. While some may prefer traditional paper submissions, they often entail longer processing times and higher risks of delays or errors.

Understanding post-filing requirements

Nonprofits must maintain comprehensive records even after filing Form 990. Recordkeeping ensures that you have all necessary documentation accessible for any IRS inquiries, which could include additional information clarification or audits.

Maintaining transparency with the public is equally important. This entails making Form 990 accessible and providing updates on how funds are utilized, which helps build trust with your donors and stakeholders.

Interactive tools and resources on pdfFiller

pdfFiller enhances the process of managing your Form 990 filing through an array of interactive tools and resources. With features designed for seamless document management, users can easily edit, sign, and collaborate on their filings.

Utilizing pdfFiller not only streamlines the editing process, but also provides security through eSignature capabilities, ensuring that every submitted document is authentic and compliant.

Frequently asked questions (FAQs)

Best practices for future compliance

Year-round preparation can ease the burden of Form 990 filings. Establish a robust internal schedule for financial reviews to ensure all records are kept up to date and reflect accurate data.

Regular updates and reviews of governance policies are crucial for compliance. Collaborating with financial advisors and consultants can provide additional oversight and improve best practices within your organization.

Client testimonials and success stories

Many nonprofits have successfully navigated the complexities of Form 990 filing with aid from pdfFiller’s tools. Case studies highlight how organizations improved their filing processes, achieving timely submissions with enhanced accuracy.

Testimonials from various nonprofits underline the efficiency gained through streamlined document management and collaboration features, proving the platform’s value in maintaining compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irs form 990 filing to be eSigned by others?

How do I complete irs form 990 filing on an iOS device?

How do I complete irs form 990 filing on an Android device?

What is irs form 990 filing?

Who is required to file irs form 990 filing?

How to fill out irs form 990 filing?

What is the purpose of irs form 990 filing?

What information must be reported on irs form 990 filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.