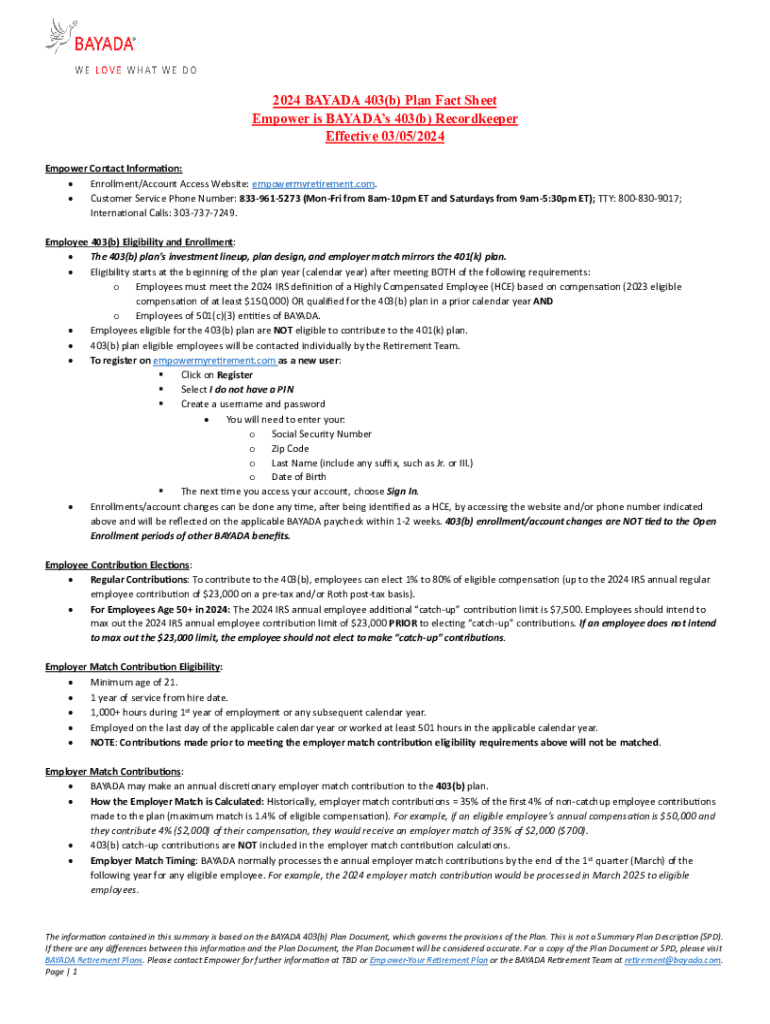

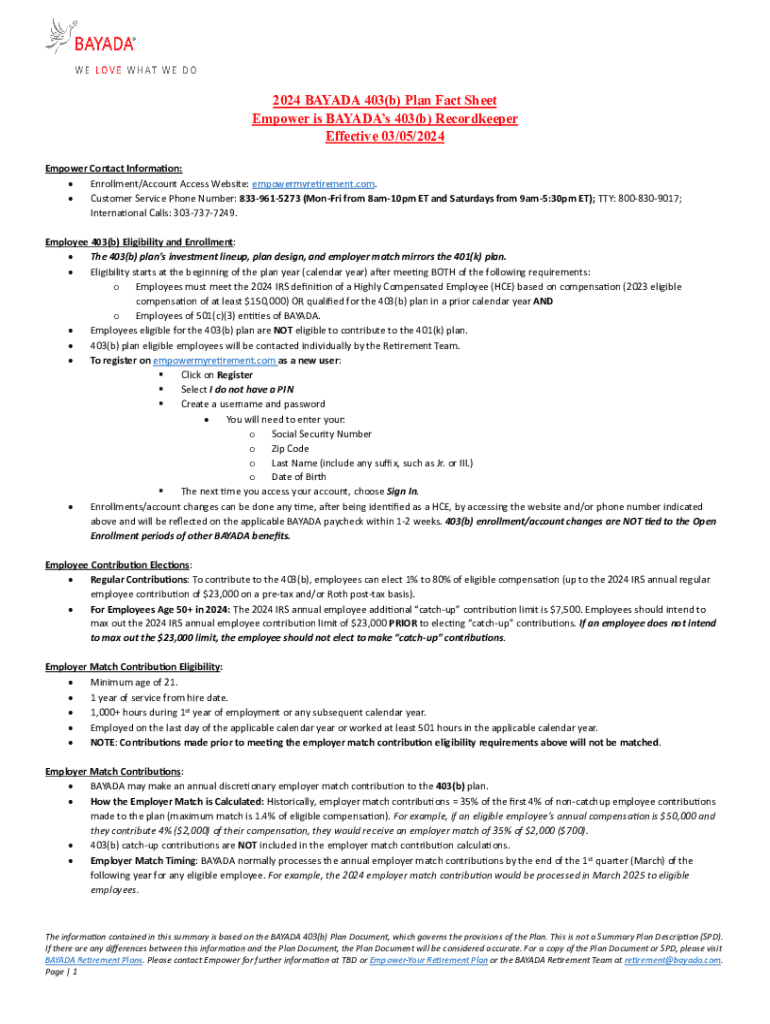

Get the free 2024 BAYADA 403(b) Plan Fact Sheet

Get, Create, Make and Sign 2024 bayada 403b plan

How to edit 2024 bayada 403b plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 bayada 403b plan

How to fill out 2024 bayada 403b plan

Who needs 2024 bayada 403b plan?

2024 Bayada 403b Plan Form: A Complete Guide for Employees

Understanding the 2024 Bayada 403b plan

The Bayada 403b plan represents a vital financial tool for employees in the nonprofit sectors, particularly for those working at Bayada. A 403b plan is a retirement savings plan offered by public schools and certain tax-exempt organizations, allowing employees to save for retirement through payroll deductions. The significance of this plan lies in its tax advantages and its contribution options tailored for nonprofit employees. While similar to a 401k plan often found in the corporate sector, the 403b plan offers unique features that can be more beneficial for its participants.

Choosing Bayada's 403b plan provides employees with specific advantages. For starters, it includes personalized investment options that cater to the diverse financial goals of Bayada employees. This plan additionally boasts competitive vendor options for investment vehicles, making it a compelling choice for long-term savings. Understanding how this plan aligns with personal financial goals is essential for maximizing retirement savings.

Key components of the 2024 Bayada 403b plan form

The 2024 Bayada 403b plan form is structured to simplify the enrollment process. Key sections of the form include personal information requirements, contribution selection processes, and beneficiary details. Each section is designed to capture critical information that determines how your contributions will be managed and your beneficiary designation, which affects who receives your assets in the event of your passing.

When navigating the contribution limits for 2024, it’s vital to know the IRS establishes both standard limits and catch-up contribution options. For employees under 50 years of age, the maximum contribution limit for a 403b plan remains at $22,500, while those age 50 and above can contribute an additional $7,500 as a catch-up. Understanding these limits plays a crucial role in retirement planning, ensuring you're making the most out of your contributions.

Step-by-step guide to filling out the 2024 Bayada 403b plan form

Accessing the 2024 Bayada 403b plan form is straightforward. Employees can locate and download the form directly from pdfFiller. Ensure that you choose the most updated version to avoid any issues when submitting your application. The platform provides intuitive navigation making the download process quick and hassle-free.

When you begin filling out the form, it’s crucial to pay attention to detail. Start with your personal information, ensuring accuracy as this data forms the basis of your account. The next step involves selecting your contribution amount — carefully consider your financial situation and retirement goals here. Finally, designating beneficiaries is a critical step to ensure that your funds will be directed where intended after your passing. Always review your filled form at least twice for errors before submission.

Tips for editing and managing your 403b plan form

Utilizing pdfFiller's tools for editing enhances the experience of managing your 403b plan form. Features include drag-and-drop filling, adding signatures, and real-time collaboration that allow you to seamlessly complete and correct the form without hassle. These tools can significantly streamline the process, making it easier to develop a well-documented and accurate submission.

Security is paramount when dealing with financial documents. pdfFiller offers secure electronic signature options, ensuring that your submission is both valid and protected. Managing the confidentiality of your financial information is critical, so make use of password protection or other security features offered by the platform to ensure your records remain safe.

Frequently asked questions about the 2024 Bayada 403b plan

A common concern among employees is what happens to contributions if they leave Bayada. Generally, the funds remain in the 403b plan, and the employee can either maintain the account, roll it over into another qualified retirement account, or withdraw based on designated provisions. Staying informed about these options will empower employees to make the best decisions concerning their finances.

Tracking and managing contributions is simple with the resources provided by Bayada. Employees can access their accounts online to monitor their growth, contributions, and investment performances. Should you need assistance, Bayada’s Human Resources department is available for guidance, ensuring employees have direct access to support.

Keeping records of your 403b plan

Maintaining documentation is crucial for managing your 403b retirement plan effectively. It's recommended to keep records such as annual statements, beneficiary designations, and any communications relating to your contributions. Storing these documents securely ensures you can reference them easily and maintain up-to-date records.

Using pdfFiller for consistent record-keeping is an effective strategy. The advantage of a cloud-based solution allows employees to easily access their documents from any location. Integration with other financial software or services can streamline record management, ensuring you have comprehensive dashboards to understand your financial health better.

Conclusion: Empower yourself with the Bayada 403b plan

In summary, the 2024 Bayada 403b plan form is a powerful instrument that encourages retirement savings. Engaging actively with this plan means harnessing its benefits for financial stability in later years. Utilize the available tools, like those found on pdfFiller, to enhance the ease of use and efficiency in managing your account.

Proactive management of your finances is essential. Set reminders for regular review sessions and contributions to your 403b plan. Staying informed about changes and updates in the plan will keep you on track toward a secure retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2024 bayada 403b plan?

Can I sign the 2024 bayada 403b plan electronically in Chrome?

How do I edit 2024 bayada 403b plan on an iOS device?

What is 2024 bayada 403b plan?

Who is required to file 2024 bayada 403b plan?

How to fill out 2024 bayada 403b plan?

What is the purpose of 2024 bayada 403b plan?

What information must be reported on 2024 bayada 403b plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.