Get the free Inflatable Rental InsuranceInsurance for Party Rentals

Get, Create, Make and Sign inflatable rental insuranceinsurance for

How to edit inflatable rental insuranceinsurance for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out inflatable rental insuranceinsurance for

How to fill out inflatable rental insuranceinsurance for

Who needs inflatable rental insuranceinsurance for?

Understanding inflatable rental insurance

Understanding inflatable rental insurance

Inflatable rental insurance is a specialized coverage designed to protect businesses that rent out inflatable equipment, such as bounce houses, slides, and obstacle courses. This insurance provides coverage for various risks associated with rental operations, including property damage and bodily injury. With the increasing popularity of inflatable rentals for parties and events, understanding the nuances of inflatable rental insurance is crucial for business owners.

The importance of this insurance extends beyond mere protection. It safeguards a rental business against potential financial pitfalls arising from accidents or equipment failures. The coverage options typically range from general liability to property damage coverage, allowing rental businesses to tailor their policy to meet their unique needs.

Benefits of inflatable rental insurance

Inflatable rental insurance offers numerous benefits that can significantly impact the stability and credibility of a rental business. One of the foremost advantages is the protection it provides against liability claims. This shield can protect business assets and personal savings from legal claims that may arise from accidents during rental events.

Additionally, this insurance covers damages and injuries that occur due to equipment malfunctions or accidents, ensuring that the business is not financially burdened by unexpected incidents. With proper coverage, businesses can enhance their credibility with clients, reassuring them that they prioritize safety. This peace of mind during events enables rental businesses to focus on providing a memorable experience without the constant worry of potential liabilities.

Key components of inflatable rental insurance policies

Understanding the key components of inflatable rental insurance policies is vital for ensuring comprehensive coverage. One of the fundamental components is general liability insurance, which protects against claims of bodily injury and property damage. This coverage is essential for addressing incidents that may occur during a rental event, such as a patron getting injured while using the inflatable.

Another critical component is property damage coverage, which compensates for losses relating to the physical rental equipment. Event cancellation insurance can cover lost revenue due to unforeseen cancellations, while medical payments coverage facilitates quick medical reimbursements after an injury, regardless of fault. Additionally, many policies offer additional insured endorsements, allowing clients to be named on the policy, further enhancing trust and security.

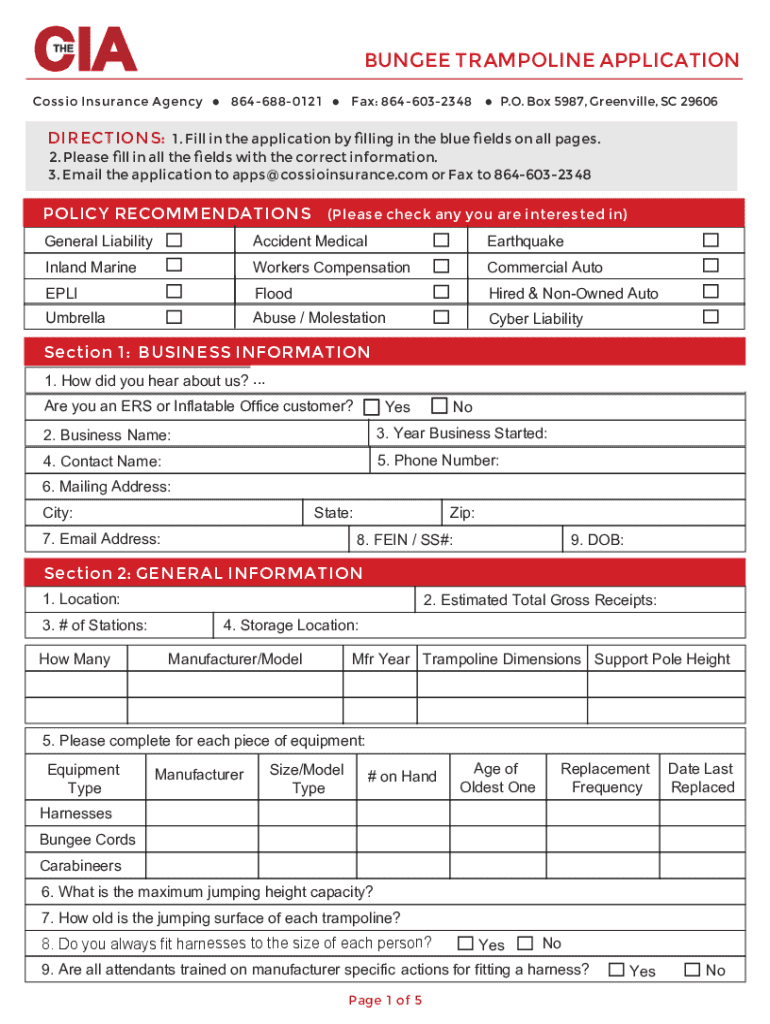

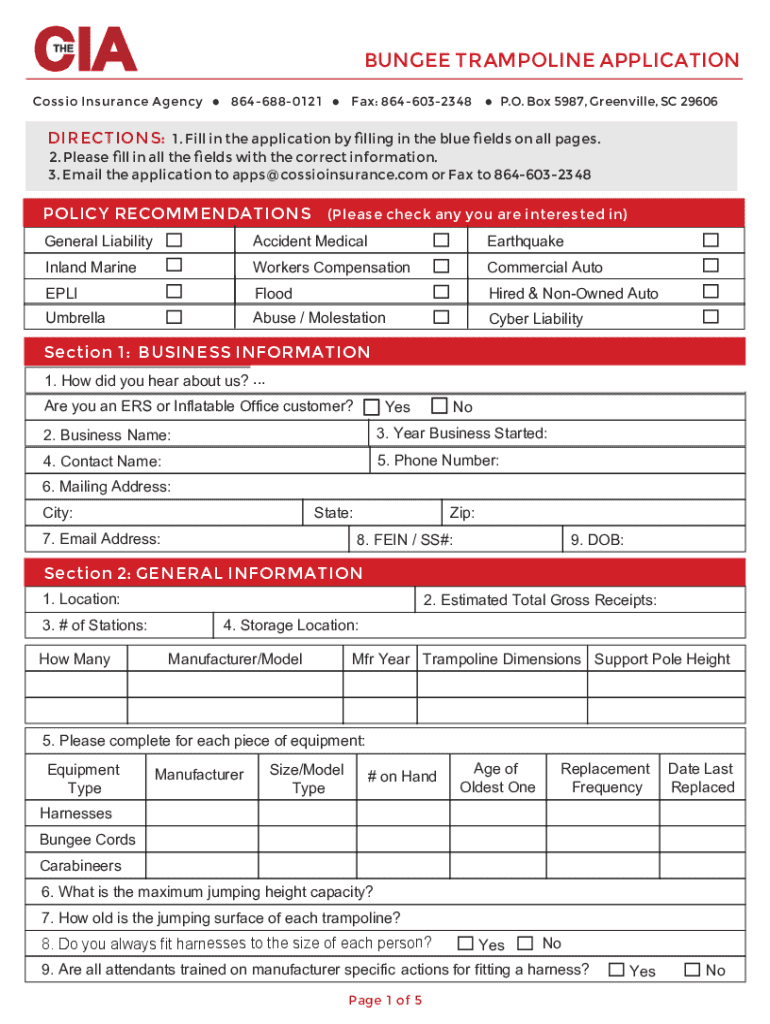

How to apply for inflatable insurance

Applying for inflatable rental insurance involves a straightforward process if approached correctly. Start with gathering necessary information about your business, such as the types of inflatables you offer, rental frequency, and any past claims history. Afterward, choose the right policy options that best suit your business's unique requirements.

Next, submit your application through the chosen insurer's platform. Be sure to read and understand the terms outlined in your policy, then review and sign the documents. Common mistakes to avoid include underestimating the type of coverage needed or failing to disclose relevant information about your operations, which can lead to complications when filing a claim.

Estimating costs for inflatable rental insurance

Estimating the costs of inflatable rental insurance can be complex as premiums are influenced by multiple factors. The type of equipment rented plays a significant role; for example, larger inflatable structures often incur higher premiums. Frequency of rentals also affects costs; businesses renting out equipment regularly might find better rates than those who rent sporadically.

Geographic location is another important factor, as certain areas may have higher risks associated with weather or venue conditions. On average, policies can range dramatically based on these factors, often falling between $500 to $2,500 annually. To secure competitive quotes, consider approaching multiple insurers, comparing offers, and inquiring about discounts for safety training or package deals.

Comparing inflatable insurance providers

When selecting an inflatable rental insurance provider, it's essential to compare different insurers based on specific criteria. Key considerations include the level of coverage offered, premium costs, and customer service reputation. Renowned providers often provide in-depth insight into their policies, making it easier for businesses to determine the best fit.

Additionally, personal experiences and testimonials from other rental businesses can offer valuable insights. Checking reviews and ratings can help gauge the claims process's ease and overall customer satisfaction with a potential insurer, ensuring that you make an informed decision.

Safety practices for inflatable rentals

Implementing robust safety practices is paramount for minimizing liabilities associated with inflatable rentals. Regular equipment inspections should be conducted before and after each rental to ensure that all inflatables are in good condition. Additionally, training staff on proper operational procedures ensures that everyone involved in the rental process understands their responsibilities.

Providing clear instructions for users, such as age limits and maximum capacity signs, can significantly reduce the risk of accidents. Various resources for safety training and guidelines can be found through inflatable manufacturers and local regulatory bodies, enabling rental businesses to enhance their operational safety.

FAQs about inflatable rental insurance

Many rental business owners have questions regarding inflatable rental insurance. One common query is whether insurance is mandatory for inflatable rentals. While it may not be legally required in all jurisdictions, it's a wise investment to protect against potential liabilities. Coverage needs can differ based on the type of inflatables; for instance, water slides may require different coverage than dry inflatables.

Handling claims after an incident involves promptly notifying your insurer and documenting the scene. Coverage can also vary based on the rental environment—indoor versus outdoor rentals might necessitate different considerations. Lastly, understanding potential outcomes if a customer gets injured can help businesses navigate the complexities of rental operations.

Additional coverages to consider

Beyond standard inflatable rental insurance, businesses should consider additional coverages to bolster protection. Workers' compensation insurance is vital for businesses with employees, as it covers medical expenses stemming from work-related injuries. Cyber liability coverage might also be necessary, especially for businesses that manage sensitive customer information online.

Moreover, transportation insurance for equipment can protect rentals during transit to and from events. Considering these additional coverages ensures that a rental business is comprehensively protected against a range of risks, providing a safety net that extends beyond standard liability.

Regulatory considerations for inflatable rental businesses

Understanding local regulations regarding inflatable rentals is crucial for compliance and liability protection. Different states or municipalities may have specific laws governing inflatable usage, which can directly impact operational procedures. Familiarizing yourself with these regulations can avoid legal complications and penalties.

Compliance not only protects the business but also enhances reputation and reliability in the market. There are numerous resources available, including state websites and local business associations, which provide guidance on understanding both state and local laws relevant to inflatable rental businesses.

Finding the right insurance agent

Choosing an insurance agent specializing in rental insurance can greatly simplify the coverage process. Begin by looking for agents with experience in the inflatable rental industry; their expertise is invaluable in navigating the unique risks associated with your business. When evaluating potential agents, ask questions about their understanding of your industry and the types of coverage they recommend.

The role of an insurance agent extends beyond merely selling policies; they can also help tailor your insurance needs specific to your operation, ensuring proper coverage is in place and aiding in claim navigation when needed. Establishing a strong relationship with your insurance agent can provide a solid foundation for your business's risk management strategy.

Real-life case studies

Examining real-life case studies highlights the importance of inflatable rental insurance in critical situations. Success stories abound where businesses were saved from financial ruin following accidents during events due to having robust insurance coverage. These narratives illustrate the best practices surrounding risk management and assurance that safety is prioritized.

Conversely, anecdotes of incidents that lacked sufficient insurance underscore the severe consequences of neglecting coverage. Such cases underline the necessity for adequate insurance measures within the inflatable rental business. Understanding these examples furthers awareness of potential risks and informs best practices for those in the industry.

Interactive tools for managing insurance

Utilizing technology can significantly enhance the management of insurance documents and processes. Platforms like pdfFiller allow users to document their insurance policies, edit and sign insurance documents online, and effectively manage claims from anywhere. This capability simplifies the process of tracking and organizing vital insurance information.

By leveraging cloud solutions, rental businesses can ensure that they have access to their insurance documents whenever necessary, leading to more agile decision-making processes during rental events. Managing all documentation in a single, efficient space reflects modern operational needs, providing a seamless experience in handling inflatable rental insurance.

Tailored insurance solutions for event businesses

Event businesses often require unique insurance solutions, particularly when it comes to inflatable rentals. Tailoring insurance packages that take into account the specific nature of the event, duration, and customer demographics can maximize coverage effectiveness. A one-size-fits-all policy often fails to meet the diverse needs found within the event space.

Consulting with insurance professionals can help craft custom insurance packages that address general liability while providing coverage for specific risks associated with differing events, ensuring broad protection with minimum gaps.

Ready to explore inflatable rental insurance?

Navigating the complexities of inflatable rental insurance is made simpler with platforms like pdfFiller. This solution empowers users to streamline their document management process, providing tools that make it easy to create, edit, sign, and manage essential insurance forms. By embracing these innovative tools, rental business owners can focus on what truly matters—creating memorable experiences, assured by robust protection.

With comprehensive support and readily available resources, business owners can harness the power of well-structured document management and insurance oversight, fully equipped to tackle the exciting challenges of the inflatable rental industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in inflatable rental insuranceinsurance for?

How do I edit inflatable rental insuranceinsurance for on an iOS device?

How do I edit inflatable rental insuranceinsurance for on an Android device?

What is inflatable rental insurance for?

Who is required to file inflatable rental insurance?

How to fill out inflatable rental insurance?

What is the purpose of inflatable rental insurance?

What information must be reported on inflatable rental insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.