Get the free Rage Room Insurance Application

Get, Create, Make and Sign rage room insurance application

How to edit rage room insurance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rage room insurance application

How to fill out rage room insurance application

Who needs rage room insurance application?

Everything You Need to Know About the Rage Room Insurance Application Form

Overview of rage room insurance

Rage room insurance is a specialized type of business insurance designed to protect rage room operators from the unique risks associated with providing a space for people to vent their frustrations through physical destruction. These hazards can include injury to participants, property damage, and potential legal claims arising from customer accidents. Securing adequate insurance is critical for rage room operators, as it ensures business continuity and sustains consumer trust in a business that inherently comes with peril.

For rage room operators, having insurance is not just a regulatory requirement but also a safeguard against unforeseen incidents that could lead to financial loss or reputational damage. This coverage allows entrepreneurs to focus on delivering unique, exhilarating experiences without the constant worry of the financial implications of an accident occurring on their premises.

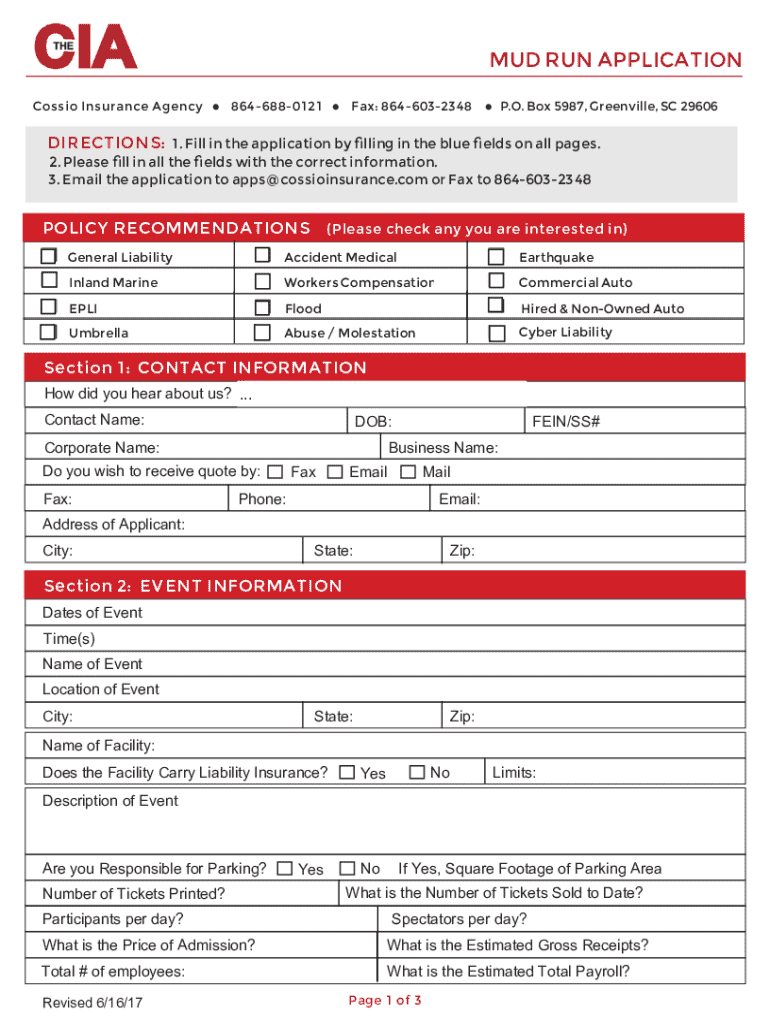

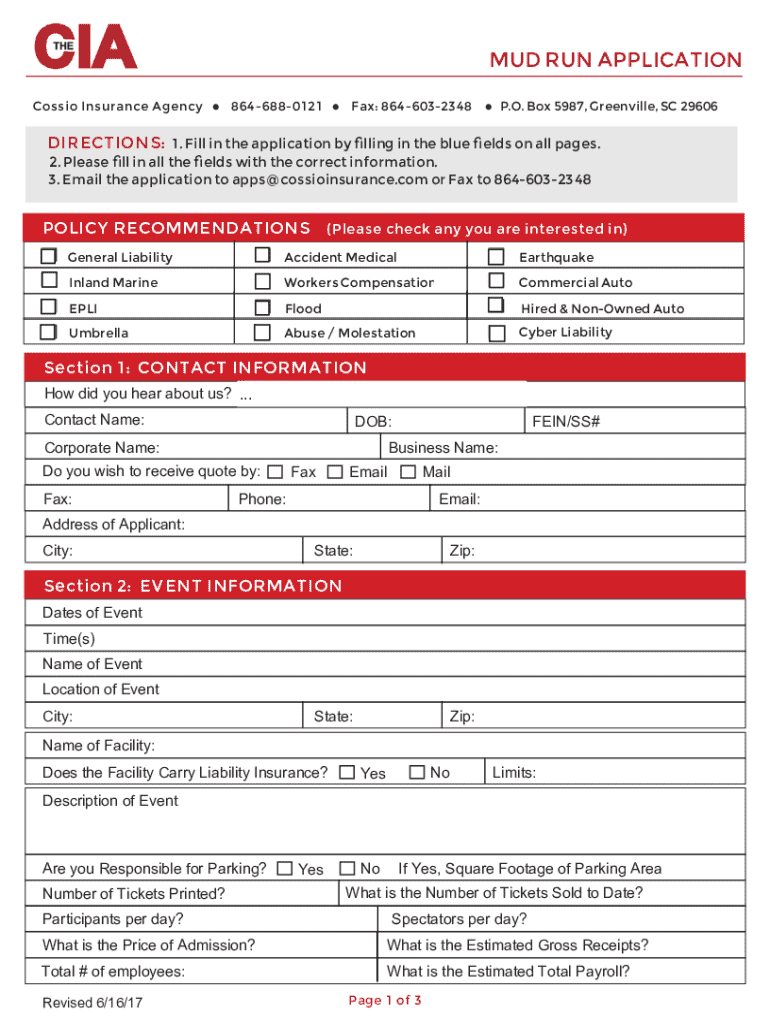

Understanding the rage room insurance application form

The rage room insurance application form serves as the primary means through which operators request insurance coverage tailored to their specific business needs. This form enables insurance companies to evaluate the risks associated with the rage room, allowing them to provide appropriate coverage options. It typically collects essential information about the business, such as location, business model, estimated foot traffic, and safety measures in place.

When utilizing tools like pdfFiller for the application process, operators can streamline their form submissions, ensuring accuracy and subsequently speeding up the approval process. pdfFiller allows users to fill out, edit, and sign documents from anywhere, which is particularly advantageous for busy entrepreneurs who need to manage paperwork efficiently.

Types of coverage typically included

When applying for rage room insurance, several types of coverage are typically included to mitigate various risks. The following are the most common types of insurance coverage relevant to rage room operators:

Special considerations for rage room businesses

Rage rooms present unique risks that may not be prevalent in traditional business settings. Customizing insurance coverage to fit these needs is essential. Risks such as flying debris, equipment malfunction, and potential personal injury claims necessitate careful risk assessments. Operators must consider the safety measures implemented, the frequency and types of events held, and the demographic of participants when determining insurance requirements.

It’s wise to engage with an insurance professional who specializes in this field to ensure that coverage is tailored to the unique aspects of your rage room. This professional will assist you in evaluating your exposure to risk and help you make informed decisions regarding the type and amount of coverage needed for your specific scenario.

Filling out the rage room insurance application form

Completing the rage room insurance application form requires careful attention to detail. Here is a step-by-step guide to simplify the process:

To ensure a smooth application process, avoid common pitfalls such as leaving sections blank or skipping over required documents. Always double-check your entries and utilize the feedback options provided by pdfFiller to enhance overall clarity and submission quality.

Cost factors for rage room insurance

The cost of rage room insurance can vary greatly depending on several factors that influence premium rates. Understanding these cost determinants can aid in budgeting and planning for your business insurance needs. Key elements include:

Comparing different insurance providers and securing multiple quotes can help you navigate these costs effectively, ensuring you find the right coverage at the most competitive rates.

Advanced coverage options

In addition to standard coverage, several advanced options can enhance protection for your rage room business. These include:

Exploring these advanced options can provide peace of mind and protect your revenue streams from various potential threats in the ever-evolving business landscape.

Assessing your coverage needs

Determining adequate coverage for your rage room necessitates a thorough assessment of various factors. Consider the following when evaluating your insurance needs:

Evaluation tools and resources can assist in quickly assessing your coverage needs, enabling you to create a comprehensive insurance package tailored to your business.

FAQs about rage room insurance

As you navigate the rage room insurance landscape, several frequently asked questions can help clarify common concerns around the insurance application process. Here are some of the most common inquiries:

Additional tips for managing rage room insurance

Successfully managing your rage room insurance involves ongoing diligence and engagement with both your insurance provider and your operational framework. Regularly reviewing and updating your coverage can ensure it remains adequate as your business evolves. Furthermore, training your staff in safety protocols effectively minimizes accidents and claims.

Accurate record-keeping is another critical area; maintaining orderly documentation facilitates smoother claims processing when issues arise. Ensuring that both safety logs and incident reports are detailed and up-to-date not only supports claims but creates accountability within your operation.

Using pdfFiller for streamlined management

pdfFiller stands out as an invaluable tool for managing rage room insurance forms and documents. The platform offers numerous advantages, including easy PDF editing, collaboration features, and eSignature capabilities, all of which streamline the application process. Users can fill in information directly, which reduces errors and enhances clarity. Once completed, forms can be electronically signed and submitted without the need for physical paperwork.

The real-time collaboration capabilities allow teams to work together, providing feedback and making changes instantaneously, which is perfect for busy operators looking to ensure every detail is correctly addressed before a final submission. Features such as auto-save and document tracking further enhance the efficiency of the process.

Wrapping up the insurance application process

Completing the rage room insurance application process involves a blend of thorough documentation and proactive communication. The importance of gathering all necessary supporting documents can't be overstated, as poor documentation can lead to delays or misunderstandings.

After submitting the application, maintaining an open line of communication with your insurance provider is vital to stay informed about coverage options and any additional requirements. Ensure you follow up post-submission to address any queries promptly, facilitating a smoother overall process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit rage room insurance application from Google Drive?

How do I execute rage room insurance application online?

Can I edit rage room insurance application on an Android device?

What is rage room insurance application?

Who is required to file rage room insurance application?

How to fill out rage room insurance application?

What is the purpose of rage room insurance application?

What information must be reported on rage room insurance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.