Get the free Section 125 Cafeteria Plan Data Form

Get, Create, Make and Sign section 125 cafeteria plan

Editing section 125 cafeteria plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out section 125 cafeteria plan

How to fill out section 125 cafeteria plan

Who needs section 125 cafeteria plan?

Section 125 cafeteria plan form - How-to guide

Understanding the section 125 cafeteria plan

A Section 125 cafeteria plan is a flexible benefits plan that allows employees to choose from a variety of pre-tax benefit options. This type of plan is especially beneficial for both employers and employees, as it enhances employee satisfaction while providing significant tax savings. With the proper implementation of a cafeteria plan, decision-making regarding benefits becomes a collaborative and strategic process.

Various benefits can be incorporated into a Section 125 plan. Common ones include health insurance options, flexible spending accounts (FSAs), and dependent care assistance. While the benefits can be customized to fit the workforce, misconceptions about cafeteria plans exist. Some assume they complicate tax filings or are infeasible for small businesses, but this isn’t the case.

Determining eligibility for a section 125 plan

Not all businesses can implement a Section 125 cafeteria plan. To qualify, an employer must be a corporation, partnership, or sole proprietorship offering at least one taxable benefit. Furthermore, considering employee eligibility is crucial as it affects the plan’s overall effectiveness. Employers should consider aspects such as hours worked or employee classification.

Understanding the enrollment periods, including annual open enrollment and special enrollment due to qualifying life events, is essential for keeping your cafeteria plan compliant and effective.

Setting up your section 125 cafeteria plan

Establishing a cafeteria plan involves several structured steps. First, it’s vital to select a qualified plan administrator who can manage daily operations and compliance. Next, drafting the plan document is crucial, as this document outlines the benefits offered and the terms of the plan. Following these steps ensures a systematic approach to implementation.

Navigating IRS regulations and compliance requirements is also a vital part of setting up your cafeteria plan. The IRS has established guidelines that all cafeteria plans must follow, ensuring that any changes or implementations align with federal laws. It is advisable to consult with legal experts during the drafting process to avoid pitfalls.

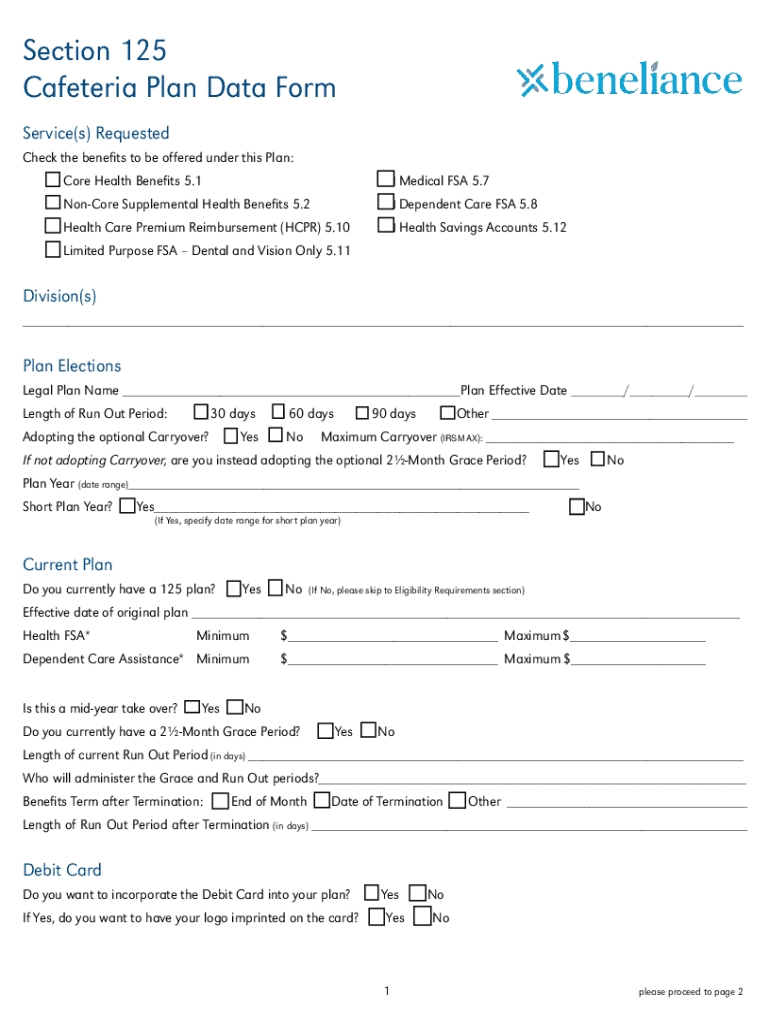

Completing the section 125 cafeteria plan form

Filling out the section 125 cafeteria plan form accurately is essential for successful enrollment in the plan. The form typically requires detailed information about the employer, employees, and selected benefits. Begin with basic employer information, then provide details relevant to each employee's selections.

Quick tips for editing and signing your cafeteria plan form can be invaluable. Utilizing tools like pdfFiller can provide an efficient way to manage this process, ensuring the form is electronically signed and stored securely. Common pitfalls include forgetting to sign the form or miscalculating contributions, which can lead to discrepancies.

Managing your section 125 cafeteria plan

The ongoing administration of a Section 125 cafeteria plan requires diligent record-keeping and effective employee communication strategies. Employers must maintain records of employee enrollments, benefits selections, and any changes made throughout the plan year to ensure compliance with IRS regulations.

Handling changes to the cafeteria plan also requires a structured approach. Procedures for plan amendments, clarifying how changes will impact employees, and addressing questions promptly can enhance the overall effectiveness of the cafeteria plan.

Frequently asked questions about section 125 plans

Despite the value of Section 125 cafeteria plans, questions persist among employees and employers alike. Addressing these inquiries can provide clarity and enhance participation. For instance, many individuals wonder what exactly Section 125 means as indicated on their paychecks; it signifies the tax-free benefits provided by the cafeteria plan. Additionally, there is some confusion about which benefits are excluded from Section 125, including certain fringe benefits like transportation and parking benefits.

Understanding these common questions can lead to better engagement from employees regarding their benefits and overall satisfaction with the cafeteria plan.

Interactive tools and resources

To facilitate the creation and management of Section 125 cafeteria plans, various interactive tools and resources are available. Tools like pdfFiller provide users with an interactive form for creating their cafeteria plan documents, making the initial steps easier and more organized.

These resources simplify the administrative burden, allowing businesses to implement cafeteria plans efficiently and effectively.

Conclusion: Empower your business with section 125 cafeteria plans

Utilizing a Section 125 cafeteria plan not only elevates employee satisfaction but also promotes significant tax advantages for both employees and employers. Implementing such a plan may seem daunting at first, but tools like pdfFiller streamline the document management process, ensuring smooth operations and administrative efficiency.

By embracing comprehensive administration solutions, businesses empower their workforce with bespoke benefit choices, enhancing overall employee morale and engagement. Ultimately, the strategic implementation of a Section 125 cafeteria plan can be a pivotal factor in optimizing human resource management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out section 125 cafeteria plan using my mobile device?

How do I complete section 125 cafeteria plan on an iOS device?

How do I edit section 125 cafeteria plan on an Android device?

What is section 125 cafeteria plan?

Who is required to file section 125 cafeteria plan?

How to fill out section 125 cafeteria plan?

What is the purpose of section 125 cafeteria plan?

What information must be reported on section 125 cafeteria plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.