Get the free Dental or Vision COBRA Election Form (Federal).docx

Get, Create, Make and Sign dental or vision cobra

How to edit dental or vision cobra online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dental or vision cobra

How to fill out dental or vision cobra

Who needs dental or vision cobra?

Understanding the dental or vision COBRA form: A comprehensive guide

Understanding COBRA and its importance for dental and vision coverage

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a significant piece of legislation that allows employees and their families to maintain health coverage after experiencing a qualifying event. This act is particularly critical for ensuring the continuity of dental and vision insurance, which can often be overlooked during transitions such as job loss or reduction in hours.

COBRA can be the bridge between employer-sponsored insurance and finding alternative coverage, allowing individuals to preserve their healthcare options. Maintaining dental and vision benefits can be vital not just for wellness, but for managing costs related to unexpected emergencies and regular check-ups.

COBRA eligibility requirements

To qualify for COBRA coverage, specific events must occur. These qualifying events typically include job loss, reduced work hours, or even changes in the household such as divorce or the death of the covered employee. Understanding these events is critical because they dictate who is eligible for maintaining their health coverage, including dental and vision benefits.

Coverage under COBRA can last for up to 18 months for employees who experience job loss or a reduction in hours. In some cases, such as disability, coverage may extend up to 29 months. It's crucial for individuals to know how long they can retain their plans, as this will influence their choices regarding healthcare during this period.

Can keep my dental and vision insurance while on COBRA?

When an individual opts for COBRA, they can generally continue their existing dental and vision insurance plans. This is particularly advantageous as it ensures that patients can continue their treatments without interruption, provided they adhere to the required stipulations and timelines.

However, it's important to note that certain conditions apply. Individuals should check with their employer or the plan administrator to confirm the terms of coverage during the COBRA period, addressing essential aspects such as network restrictions or changes in premiums.

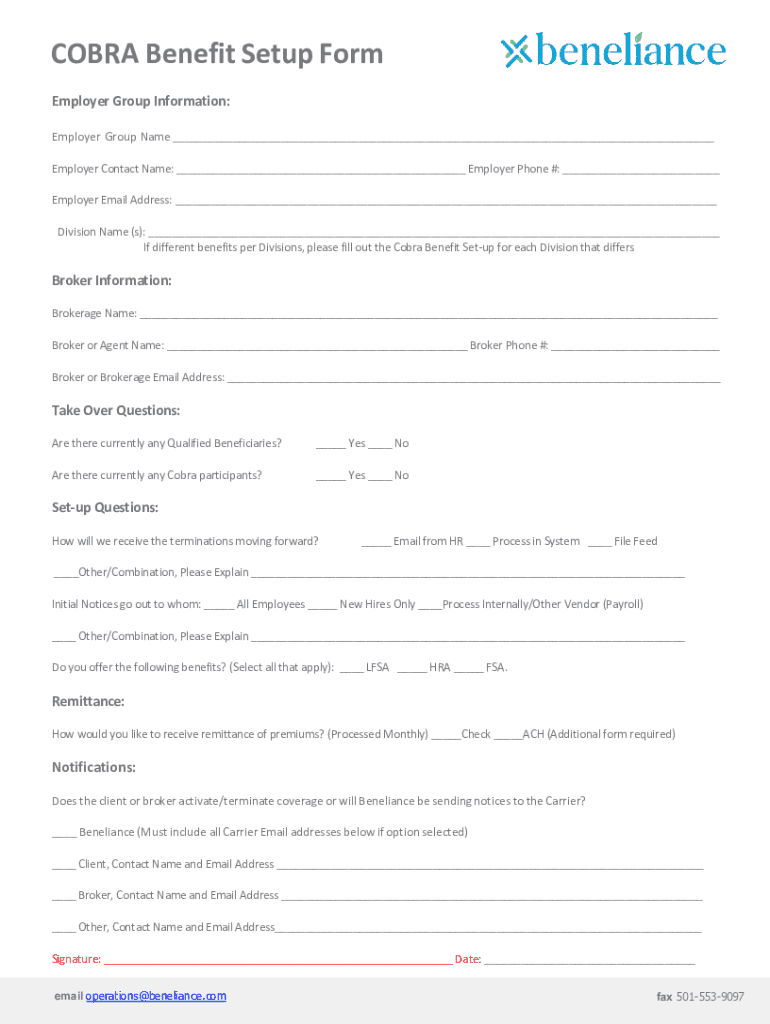

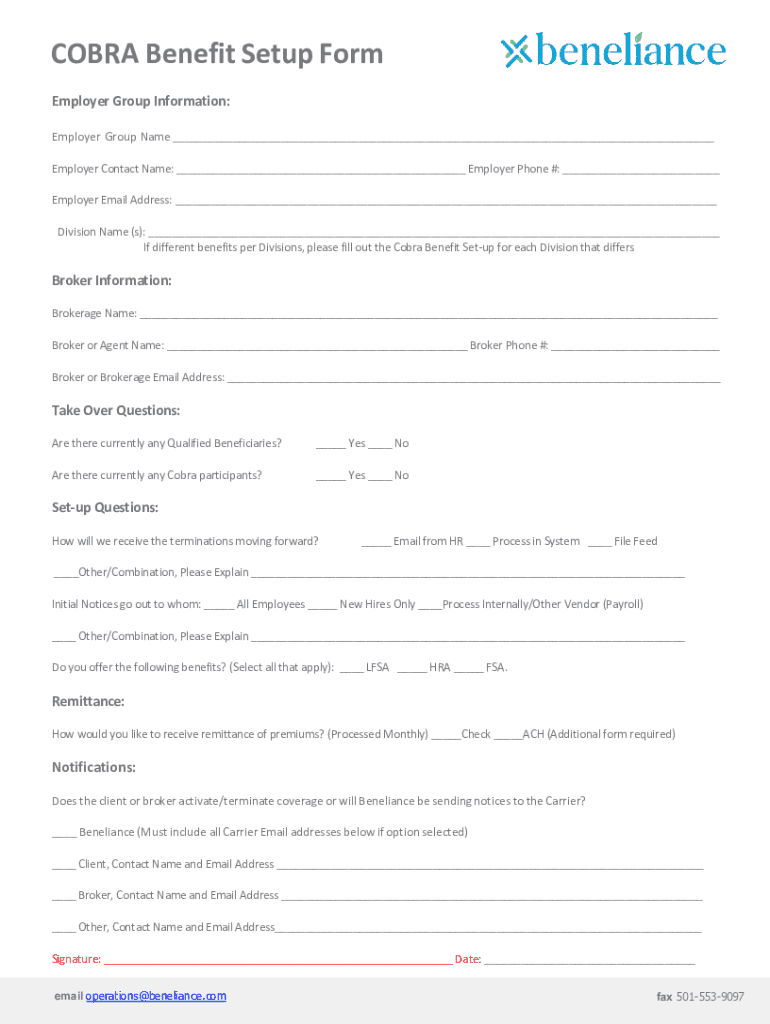

Navigating the dental and vision COBRA form

Completing the COBRA form for dental and vision plans can be daunting, but a clear understanding of its structure can simplify the process. This form typically requires essential information about the applicant, the existing insurance plans, and the preferred coverage options.

Key sections of the COBRA form usually include personal details, coverage selection, and acknowledgment of terms. To ensure accurate filling, one must focus on providing comprehensive yet precise information.

Step-by-step instructions for completing the form

Completing the COBRA form involves several vital steps. First, gather necessary documents including previous insurance details, personal identification info, and any notifications regarding COBRA eligibility. This preparation will make the form-filling process smoother.

Next, fill in the personal information section accurately. Provide your full name, address, and contact information, ensuring there are no typographical errors. Selecting your desired coverage options comes next; this may include choosing between dental, vision, or both. Lastly, read and acknowledge any terms and conditions carefully to ensure compliance with enrollment deadlines.

Managing your COBRA enrollment

Choosing the right start date for your COBRA coverage can significantly impact your healthcare experience. Ideally, select a date that bridges the gap between your previous insurance coverage and the new COBRA plan. Factors such as monthly premiums and the effective coverage duration should be carefully considered when making this decision.

Making modifications to your existing coverage is another aspect of COBRA management. Individuals should be aware of potential deadlines for changes, as delays can lead to lost benefits or increased out-of-pocket expenses.

Common issues and questions regarding COBRA dental and vision plans

Navigating COBRA can introduce common queries, including whether COBRA resets the annual cap for dental insurance. Typically, the annual limit remains consistent, meaning any unused limits from the previous plan do not reset with COBRA. This understanding highlights the importance of thorough documentation and awareness of your previous benefits.

Another frequent concern involves dependents' insurance coverage. Eligible dependents are entitled to COBRA coverage under the same conditions as the primary insured. However, differences in coverage levels can occur, necessitating communication with insurance providers for clarity.

Additional knowledge on COBRA

It is essential to maintain comprehensive coverage during transitional periods. Lapses in insurance can pose significant financial risks and health implications. Therefore, timely application for COBRA can safeguard against gaps in healthcare access.

For many, the transition from COBRA to other insurance options can be daunting. Explore alternatives such as the marketplace, employer-sponsored insurance, or specific dental and vision plans that may better suit your needs moving forward.

Interactive tools and resources

Utilizing online tools can significantly simplify navigating COBRA. A COBRA coverage calculator can help estimate potential costs associated with maintaining your dental and vision coverage. This foresight can assist in budgeting and understanding financial implications during your coverage period.

Additionally, addressing common concerns through an FAQs section can provide immediate clarification on pressing issues regarding the COBRA dental and vision forms. For further assistance, reaching out to support teams equipped to handle questions can facilitate smoother management of your enrollments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my dental or vision cobra in Gmail?

How can I edit dental or vision cobra on a smartphone?

How do I fill out the dental or vision cobra form on my smartphone?

What is dental or vision cobra?

Who is required to file dental or vision cobra?

How to fill out dental or vision cobra?

What is the purpose of dental or vision cobra?

What information must be reported on dental or vision cobra?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.