Get the free 0001959173-24-000125. Form 144 filed on 2024-01-04

Get, Create, Make and Sign 0001959173-24-000125 form 144 filed

Editing 0001959173-24-000125 form 144 filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0001959173-24-000125 form 144 filed

How to fill out 0001959173-24-000125 form 144 filed

Who needs 0001959173-24-000125 form 144 filed?

Understanding the 0001959173-24-000125 Form 144 Filed Form

Overview of Form 144

Form 144 is a critical document within the securities realm, primarily used by insiders of public companies to report proposed sales of unregistered securities. This form serves as a notice to the Securities and Exchange Commission (SEC) and acts as an alert regarding potential sales which could influence the market.

The purpose of Form 144 is to ensure transparency and compliance with securities laws, safeguarding the integrity of the market and providing investors with insight into the selling activities of major shareholders. When insiders plan to sell their shares, filing this form is not just a regulatory requirement—it's also a transparent practice that informs investors about the insiders' intentions.

Key sections of Form 144

Form 144 consists of several key sections, each requiring specific information that must be filled in accurately. This is not just a formality; each section plays a crucial role in ensuring the form's compliance and clarity.

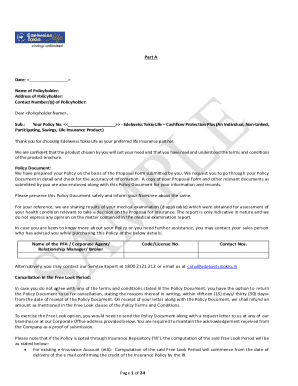

Filer information

It's essential to provide complete and accurate details of the filer, whether an individual or a corporate entity. This includes the name, address, and relationship to the issuer, which establishes the credibility of the filing. Accurate information helps to verify the filer’s identity and ensures compliance with SEC regulations.

Issuer information

The issuer information section identifies the company whose stock the filer is reporting on. This includes the issuer's name, address, and unique identifier (like CIK). Accuracy in this section is paramount as it relates directly to the company affected by the transactions.

Securities information

Here, individuals must detail the type and amount of securities to be sold. Proper reporting of security details, including the price and proposed sale dates, is necessary to establish the transaction's genuine intentions. Clear descriptors help in analyzing market movements related to insider sales.

Specifics of securities to be sold

When reporting security amounts on Form 144, the guidance stipulates that you're required to disclose the total quantity of securities intended for sale. This encompasses all securities being disposed of, which ensures that investors have a clear insight into how much stock is available for public trading.

Indicating proposed sale dates is another critical aspect of this section. These dates provide a timeline that helps analysts and investors gauge market activities and potential effects on stock prices. Highlighting these details ensures a well-documented account of transactions, fostering greater market reliability.

Recent sales and information disclosure

Within Form 144, filers must disclose securities sold in the past three months. This disclosure serves as a record of the filer's recent sales and confirms the extent of their selling activity.By providing this information, filers enhance the transparency of their actions, lessening the chances of market manipulation perceptions.

Collecting detailed data regarding recent sales also plays a vital role during the examination process for the SEC. Noting this information indicates that the filer is operating honestly and ethically. Additionally, this section includes remarks and signatures—where accurate documentation must coincide with the filed information. Ensuring the right signatory completes this section is essential to validate your submission.

Managing the form submission process

Filing Form 144 involves several important stages: the preparation stage, the completion stage, and the review stage. Each stage brings its unique requirements, ensuring that the form is accurately filled out, compliant with regulations, and ready for submission.

Preparation stage

During the preparation stage, gathering necessary documentation is key. This includes all relevant information about previous transactions and the specific details of the securities to be sold. It is advisable to meticulously organize documents and notes to streamline the completion process.

Completion stage

In this stage, focus on detailed instructions for each section of the form. Carefully fill in filer and issuer information, ensuring accuracy as outlined previously. In this way, you can avoid errors that might raise flags during the SEC's review.

Review stage

Finally, a thorough review of your completed form is crucial. Go through each field and ensure no sections are left blank. Verify that all numerical figures are correct and that the signatory has included a valid signature. Best practices at this stage may include using a checklist to ensure every aspect of the form aligns with the requirements.

Submission contact information

Knowing where and how to submit Form 144 is pivotal for compliance. Filers typically submit the form directly to the SEC, either through electronic submission systems or by mail. Ensure you have the right address, and if using mail, confirm adequate postage and delivery methods to maintain compliance.

Understanding submission deadlines is equally important, as timely filing can avoid penalties or potential legal issues. Familiarize yourself with the typical time frames—generally within 90 days of the sale—required by the SEC to stay compliant and effectively manage your filings.

Compliance and legal considerations

Accuracy and honesty while filling out Form 144 cannot be overstressed. Any discrepancies or misstatements within the form could have serious consequences. Under 18 U.S.C. 1001, such misrepresentations are subject to criminal liability, emphasizing the need for keen attention to detail.

To ensure compliance with SEC regulations, it's paramount to cross-verify all information with existing records. Moreover, maintain an archive of past filings, as tailored compliance practices can save time and streamline the submission process in future instances.

Key features of using pdfFiller for Form 144

Utilizing pdfFiller simplifies the process of managing Form 144. The platform offers interactive tools that facilitate document management, meaning filers can swiftly navigate through forms without hassle.

Interactive tools for document management

With its user-friendly interface, pdfFiller streamlines navigation through complex forms. This is ideal for individuals or teams needing efficient solutions—providing insights and resources to manage their documents throughout the filing process.

Collaboration features

pdfFiller's collaboration capabilities allow team members to work together seamlessly on Form 144, enabling efficient completion and accuracy assurance. Real-time comments and suggestions can lead to more thorough reviews and faster turnaround times.

eSignature capabilities

Digital signature features are particularly useful for validating submitted documents. Securely signing documents digitally enhances the overall efficiency of the filing process, eliminating the need for physical signatures.

Cloud-based access

Finally, pdfFiller’s cloud-based access means forms can be accessed anytime, anywhere, which is perfect for busy professionals. Filers can manage their documentation in real-time, ensuring that no deadlines are missed and every form is filed correctly.

Troubleshooting common Form 144 issues

When working with Form 144, errors can lead to compliance complications. Common errors often involve omitted information, inaccuracies in financial reporting, or incomplete signature sections. Identifying these early can prevent delays or penalties.

To resolve issues effectively, maintaining a checklist can aid in ensuring no details are overlooked. Additionally, grasping FAQs about Form 144 and utilizing resources such as pdfFiller's support portal can provide quick answers and enhance your filing experience.

About pdfFiller

pdfFiller is committed to providing an all-in-one document management solution, empowering users to easily edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. Our mission is to streamline your document management experience, making tedious filing processes more accessible and efficient.

Testimonials from satisfied users highlight the effectiveness of our platform, showcasing successful interactions and productivity enhancements. We also offer additional services, like templates and digital storage, designed to meet the diverse needs of our users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 0001959173-24-000125 form 144 filed for eSignature?

How do I edit 0001959173-24-000125 form 144 filed online?

How can I edit 0001959173-24-000125 form 144 filed on a smartphone?

What is 0001959173-24-000125 form 144 filed?

Who is required to file 0001959173-24-000125 form 144 filed?

How to fill out 0001959173-24-000125 form 144 filed?

What is the purpose of 0001959173-24-000125 form 144 filed?

What information must be reported on 0001959173-24-000125 form 144 filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.