Get the free Use Tax and Individual Use Tax

Get, Create, Make and Sign use tax and individual

Editing use tax and individual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out use tax and individual

How to fill out use tax and individual

Who needs use tax and individual?

Understanding Use Tax and Individual Forms: A Comprehensive Guide

Understanding use tax

Use tax is a state tax imposed on the purchase of goods or services that are not subject to sales tax in the state where they are used, consumed, or stored. This commonly occurs when items are purchased from out-of-state retailers that do not collect sales tax at the point of sale. While sales tax is paid upfront at the time of purchase, use tax is an obligation that consumers need to self-report and remit to their respective state tax authorities.

Compliance with use tax regulations is crucial. Many states require individuals to report use tax to ensure a level playing field for local businesses that are subject to sales tax. Understanding and fulfilling this obligation helps avoid potential penalties and interest that can arise from non-compliance. It's essential for individuals to realize that ignorance of these laws is not an excusable reason for failure to pay use tax.

Common scenarios for use tax application

Several scenarios can trigger use tax obligations for individuals. One of the most prevalent cases happens when items are purchased online from out-of-state retailers that do not charge sales tax. Another common situation arises when individuals buy goods while physically in another state, ensuring the purchase is subject to the use tax back in their home state. Additionally, personal use of items that were purchased for business expenses can also be liable for use tax.

There are some exemptions when it comes to use tax. Common items not subject to this tax include groceries, prescription medications, and certain educational materials, depending on state-specific laws. Understanding what items are exempt can help individuals minimize their use tax liability.

Calculating your use tax obligation

To effectively calculate your use tax obligations, you first need to determine the tax rate applicable in your area. Tax rates differ significantly from state to state, and even within states, local jurisdictions may impose additional taxes. A quick search on your state's department of revenue website will provide the exact rate you need.

For example, if you purchased a $200 item online and your state's use tax rate is 6%, your use tax obligations would amount to $12. Calculators are available online to help expedite this process. Additionally, it is vital to keep all receipts and invoices from your purchases. These documents not only substantiate your obligations but also simplify the reporting process during tax filing.

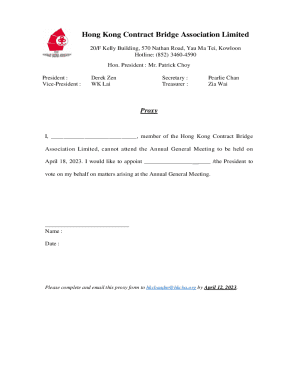

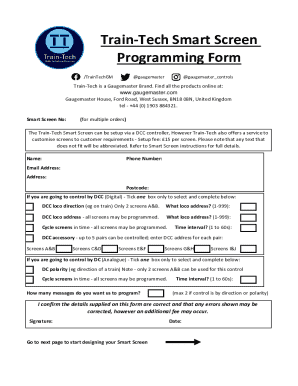

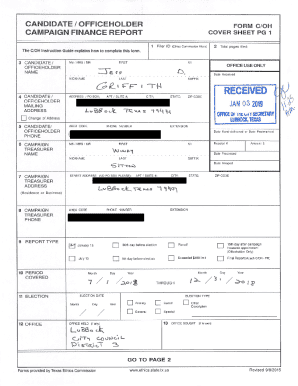

Filing your individual use tax form

Filing your use tax can be made simple by correctly filling out the appropriate individual use tax forms. Each state has its own forms; for example, states like California and New York provide specific tax forms for residents to report use tax. It is crucial to start with the proper documentation to avoid any delays.

The filing process generally involves several key steps. First, gather personal information which typically includes your name, address, and taxpayer identification number. Next, you'll need to report all taxable purchases. Many states also provide guidance on how to itemize these purchases, making it easier for you to fill out the required sections correctly. For visual learners, examining a sample completed form can be beneficial.

Methods of payment for use tax

Paying your use tax can be done through various options. One method is incorporating the use tax payment into your state income tax return. This is a convenient way to handle both responsibilities simultaneously. Alternatively, state tax authorities often provide options for making direct payments via their websites.

When opting for online payments, it's crucial to familiarize yourself with the setup. Many authorities have user-friendly navigation assisting you throughout the process. Moreover, adhering to payment deadlines is fundamental to avoid incurring penalties or late fees. By keeping track of these due dates, you will minimize any added stress during tax season.

Dealing with errors and corrections

Mistakes happen, and it’s essential to know how to amend your use tax form when needed. Most states provide a straightforward amendment process which often involves completing a new form or attaching an explanation to your filed form. Check your state's guidelines for specific instructions.

Being aware of the penalties for late or incorrect submissions can help you navigate your tax obligations more carefully. If you find yourself unsure or overwhelmed, seeking professional assistance from tax advisors or accountants can save time and reduce stress considerably.

Keeping track of use tax for future purchases

Keeping organized records is fundamental for managing your use tax obligations effectively. You should develop a system to retain receipts and invoices related to taxable purchases. Investing in documents management tools, such as pdfFiller, can greatly enhance your ability to track, document, and manage your tax forms efficiently.

Using cloud-based platforms for storing your documents provides the flexibility to access the information from anywhere. Additionally, these platforms often include tools to help users complete and manage their forms—helping you remain organized and prepared for tax filing.

Frequently asked questions (FAQs)

Navigating use tax can lead to numerous questions. For instance, what happens if you don’t pay use tax? Generally, tax authorities can impose penalties, late fees, and interest on unpaid taxes. Another common question is whether you can claim a refund for overpaid use tax. The answer varies by state, but most allow refunds under specific conditions. It’s essential to consult state guidelines for particular scenarios.

Some individuals inquire about state-specific differences in use tax regulations. Each state has unique rules, so checking local legislation is crucial. Lastly, how can pdfFiller enhance your use tax filing experience? The platform simplifies document management, allowing you to create, edit, and share forms effortlessly.

Resources and tools for simplifying the use tax process

Several resources are available to streamline the use tax process. Interactive tools, including tax calculating software, can provide accurate estimations of your obligations. pdfFiller offers various tools for document management, simplifying the process of filling and submitting forms. Additionally, state tax authority websites offer direct downloads of necessary forms and resources.

For those looking for practical assistance, tutorials on using pdfFiller effectively can enhance your understanding of how to create and manage your necessary documents. Utilizing budgeting tools online can also help keep your finances on track as you plan for any tax obligations.

Use tax experience testimonials

User testimonials often provide insight into the practical applications of navigating use tax. Many have shared positive experiences with ease of filing and correction of errors using online platforms. Additionally, case studies show how users successfully placed their trust in innovative document management solutions like pdfFiller, enhancing their overall tax filing experience and increasing compliance.

Such case studies exemplify how streamlined document processes can alleviate stress during tax season and prevent commonly made errors. Feedback from users consistently highlights the intuitive layout and convenience of online filing, allowing individuals to focus on what matters most.

Stay informed: legislative changes and updates

Tax regulations can change frequently, making it vital for individuals to stay informed about updates to use tax laws. Recent changes may affect exemptions, tax rates, or filing requirements in your state. Participation in upcoming webinars or workshops can also provide valuable insights into navigating these changes while ensuring compliance, helping individuals stay ahead and well-prepared for tax demands.

To maintain compliance, subscribing to state tax authority newsletters or alerts can be another way to receive timely information. Keeping abreast with these updates ensures that you understand your responsibilities as a taxpayer and avoid any unexpected surprises.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit use tax and individual from Google Drive?

How do I complete use tax and individual on an iOS device?

How do I complete use tax and individual on an Android device?

What is use tax and individual?

Who is required to file use tax and individual?

How to fill out use tax and individual?

What is the purpose of use tax and individual?

What information must be reported on use tax and individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.