Get the free BHBT TTEE HENDERSON CHARITABLE TRUST

Get, Create, Make and Sign bhbt ttee henderson charitable

Editing bhbt ttee henderson charitable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bhbt ttee henderson charitable

How to fill out bhbt ttee henderson charitable

Who needs bhbt ttee henderson charitable?

A Comprehensive Guide to the BHBT TTEE Henderson Charitable Form

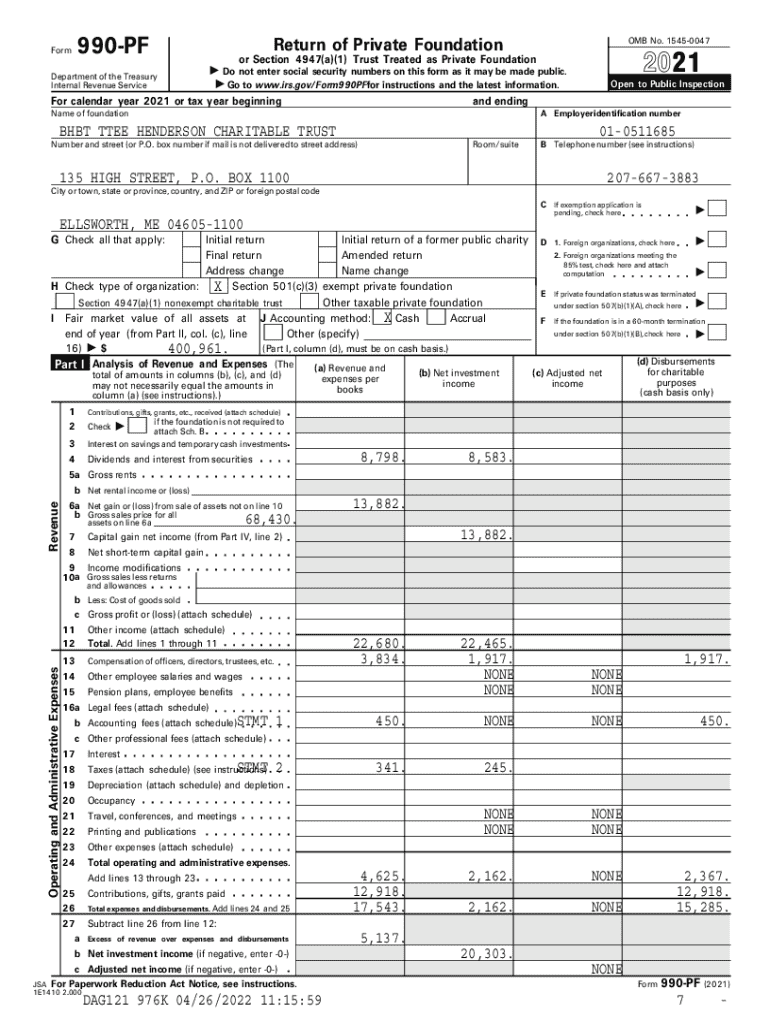

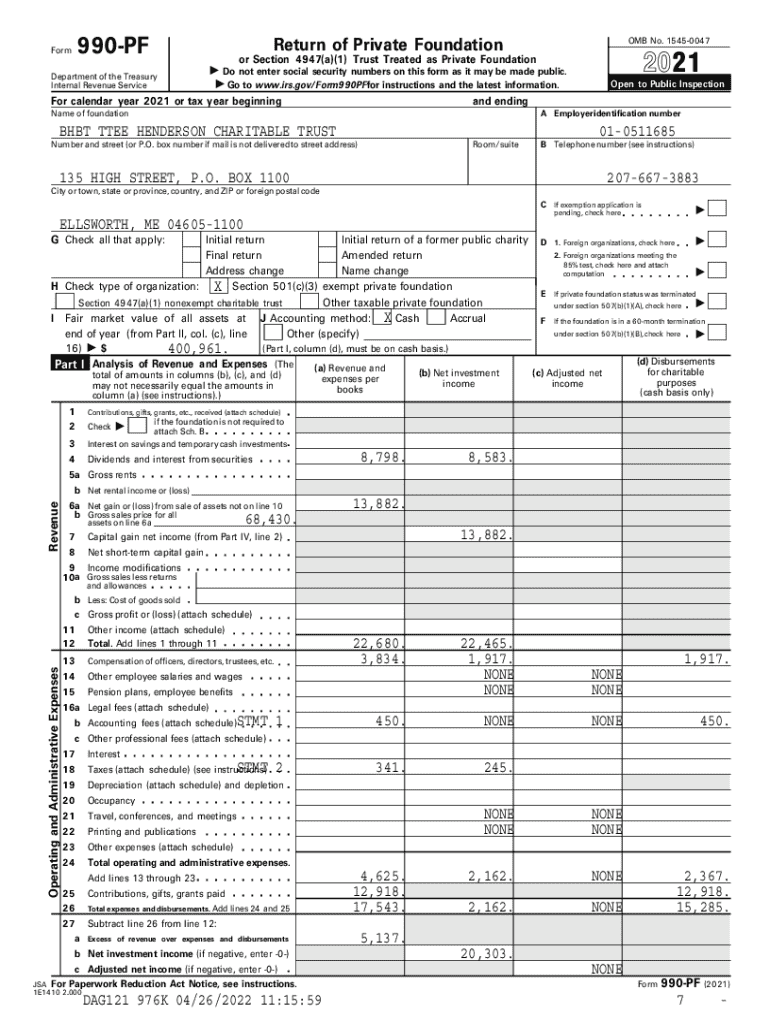

Understanding the BHBT TTEE Henderson Charitable Form

The BHBT TTEE Henderson Charitable Form is a critical document designed for individuals and organizations aiming to formalize their charitable intentions. This form serves as a declaration of commitment to altruistic activities that benefit the community. Completing it accurately ensures that your charitable efforts can be recognized and that you comply with relevant tax regulations. It enhances transparency and accountability in charitable transactions.

Proper completion of the BHBT TTEE Henderson Charitable Form is essential, affecting not only your compliance with legal requirements but also the potential for securing financial contributions and resources. Clarity and precision in your entries provide a clearer picture of your charitable goals and intentions.

Who requires this form?

This form is primarily required by individuals and organizations looking to establish or maintain charitable trusts. This includes non-profit organizations, foundations, and even individual philanthropists seeking to direct their assets towards charitable causes. It is pertinent for those who want to ensure compliance with tax regulations regarding charitable contributions.

Eligibility for using this form varies, as individuals filing on their own behalf may have different requirements compared to organizations applying for tax-exempt status. Understanding these nuances is vital for correct submission.

Detailed breakdown of the form sections

The BHBT TTEE Henderson Charitable Form consists of specific sections that require detailed input. First, personal and organizational information must be completed accurately. This includes not only names and contact information but also organizational structure and registration details for entities. A common pitfall here is failing to update contact information or misrepresenting the structure of the organization.

Financial information requirements

Financial disclosure is another significant section where clarity is crucial. Applicants must report all sources of income and assets relevant to their charitable purpose. This means including details about donations received, grants, and any other financial support. An overlooked aspect often leads to compliance issues or potential audits.

To guide you through reporting, compile financial statements that reflect both past earnings and projections for future income. Items to focus on include:

Charitable purpose declaration

Articulating the charitable intent is essential in this form. Applicants should clearly state the specific charitable activities they are engaged in or plan to undertake. Phrases that convey direct benefits to the community or specific groups will strengthen the application.

Examples of acceptable statements include:

Compliance and regulatory considerations

Compliance with local and national laws is critical when filling out the BHBT TTEE Henderson Charitable Form. Laws governing charitable organizations can be extensive, requiring adherence to specific regulations to qualify for tax-exempt status. Key regulations may include IRS guidelines for charities, annual reporting requirements, and truth-in-advertising laws.

Failing to meet these guidelines can result in penalties or, worse, disqualification from receiving donations. Always stay updated on these laws, as they can evolve.

Preparing to fill out the BHBT TTEE Henderson charitable form

Preparation is key to a successful submission. Before starting with the BHBT TTEE Henderson Charitable Form, gather all necessary documentation. This includes financial statements, organizational bylaws, and prior tax filings. Having everything in order will streamline the process.

Here’s a quick list of required documents:

Tips for organizing paperwork include creating a designated folder for electronic documents and ensuring all files are up-to-date and easily accessible.

Using interactive tools for form completion

Leveraging technology can significantly simplify the process of completing the BHBT TTEE Henderson Charitable Form. Tools such as pdfFiller allow users to fill, sign, and manage documents from a single cloud-based platform. With interactive features, applicants can easily collaborate with team members to finalize their submissions.

Key benefits of using pdfFiller include:

Step-by-step guide to filling out the form

When it’s time to fill out the BHBT TTEE Henderson Charitable Form, start by accessing pdfFiller. Here’s how to get started:

As you fill out each section, ensure that you provide detailed and accurate information. Going section by section helps mitigate the risk of leaving important details out.

Filling out each section

Each section of the BHBT TTEE Henderson Charitable Form demands careful attention. From basic information to specific declarations of purpose and financial details, your input must reflect both compliance with regulations and the genuine nature of your philanthropic intentions. Here’s how to address each section effectively:

Reviewing your completed form

After filling in the necessary information, review the completed form meticulously. Proofreading is not just a final step; it's a critical part of the process to avoid mistakes and omissions that could delay or jeopardize your application.

Best practices for proofreading include:

eSigning and submitting your form

Once you're satisfied with the completion of your BHBT TTEE Henderson Charitable Form, the next step is to finalize it through eSigning. An eSignature is a modern, secure method of signing documents electronically, eliminating the need for printing and scanning.

The eSigning process typically involves:

Legality and security measures surrounding eSignatures are robust, making it an acceptable alternative to traditional signatures.

Submission options

After your form is signed, it’s time to submit it. The submission process can vary widely based on the regulations in your jurisdiction. Typically, forms can be submitted electronically through the relevant authority’s online portal or via traditional mail.

Confirmation of submission steps should involve receiving a receipt or confirmation email, thereby providing proof that your BHBT TTEE Henderson Charitable Form was successfully submitted.

Managing your charitable form

Management of your BHBT TTEE Henderson Charitable Form doesn't end at submission. Following up on the status of your submission is equally important. Typically, organizations can track submission statuses through the respective regulatory websites or by contacting their offices directly.

Key points for managing your form include:

Updates and revisions

In the event that you need to make changes to your submission, it’s crucial to understand the process for updates and revisions. Depending on the governing body, revisions may need to be formally submitted or could be managed informally through a contact at the organization.

Using pdfFiller can simplify the process of revising your document considerably, allowing you to make necessary changes and prepare a new submission efficiently.

Common mistakes and how to avoid them

When dealing with the BHBT TTEE Henderson Charitable Form, certain mistakes are frequent, especially among first-time filers. Many individuals find themselves missing crucial details, using outdated templates, or misunderstanding the requirements. An understanding of these common pitfalls can greatly enhance your chances of a smooth submission.

FAQs related to the BHBT TTEE Henderson charitable form

Frequently asked questions concerning the BHBT TTEE Henderson Charitable Form often center around restrictions on fund usage and the potential impact of inaccurate reporting. To clarify common concerns, it's helpful to engage with forums or communities where charitable activities are discussed.

Additional tips include:

Case studies and examples

Practical examples offer valuable insight into how the BHBT TTEE Henderson Charitable Form can be effectively utilized. Many successful applicants have tailored their submissions to reflect unique charitable missions, showcasing how specific details improve their chances for approval.

One notable success story involved a small non-profit that focused on youth mentorship. By detailing their objectives clearly and showing past financial accountability, they secured funding that positively impacted their community. Lessons learned from such instances reveal the importance of clarity and specificity.

Analyzing a sample completed form

Walking through a filled-out BHBT TTEE Henderson Charitable Form can highlight important aspects of clarity and comprehension. Applicants can annotate key areas of their forms, emphasizing the sections where they made distinguished contributions or highlighted organizational impact.

Final thoughts on the BHBT TTEE Henderson charitable form

Completing the BHBT TTEE Henderson Charitable Form can feel daunting at first, especially for first-time filers. However, with the right guide and resources, confidence can be built throughout the process.

Engagement with community support through forums and platforms like pdfFiller can provide valuable insights. Sharing experiences not only builds a network of understanding but can empower others who wish to embark on their charitable journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the bhbt ttee henderson charitable electronically in Chrome?

How do I fill out the bhbt ttee henderson charitable form on my smartphone?

How do I complete bhbt ttee henderson charitable on an iOS device?

What is bhbt ttee henderson charitable?

Who is required to file bhbt ttee henderson charitable?

How to fill out bhbt ttee henderson charitable?

What is the purpose of bhbt ttee henderson charitable?

What information must be reported on bhbt ttee henderson charitable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.